Zhuang Zhuoran has been at the helm of Flying Pigs for four years. Are the tough days over?

![]() 11/18 2024

11/18 2024

![]() 525

525

This is the most competitive Double 11 online travel sale in recent years.

"I sincerely recommend frequent travelers to stock up on air tickets during Double 11." "Just buy the hit list, closed eyes version! Please keep it!" "Show the trips you want to stock up on. Huabei's 80,000 is enough..."

Last year, Ctrip barely participated in Double 11, and Flying Pigs only started on October 24. This year, it started as early as October 14. Various merchant platforms have increased their investment in the Double 11 shopping season, starting promotional activities early, collaborating with over 100 global travel brands to offer subsidies totaling hundreds of millions of yuan, helping consumers stock up on travel products with price discounts in advance, with the longest validity period extending to May Day next year.

As a result, travel-related stockpiling lists have dominated various social media platforms.

Among the topics of stockpiling hotels and flexible flights, Flying Pigs has made a strong impression.

The Kaiyuan Hotel's nationwide exchangeable 3-night package starts at 333 yuan per night; Jinjiang and BTG Home Inns offer nationwide exchangeable packages starting at 99 yuan per night; the round-trip ticket card for two in All Nippon Airways' economy class starts at 3,240 yuan, including taxes; the ski and stay package at Wanda International Resort in Changbaishan costs 1,499 yuan, with additional benefits such as free airport transfers, etc. Well-known domestic and international travel brands are all over Flying Pigs' promotional venues.

One travel industry insider lamented, "If there's one last push in the last quarter of 2024, Flying Pigs will be the hope of everyone."

According to data released by Flying Pigs, at midnight on November 12, the 2024 Flying Pigs Double 11 "Global Travel Festival" concluded. Compared to last year, the transaction volume of Double 11 products increased by double digits, the number of transacting users increased by 40%, and the transaction volume of pre-booked products increased by nearly 90%.

Currently, among the disclosures, Flying Pigs is the only platform that has shown double-digit growth in both overall transaction volume and user numbers. Amidst widespread complaints of "aesthetic fatigue" towards Double 11, the travel industry's Double 11 has exhibited a distinct market trend, which is truly rare.

Consumer spending is sluggish, and travel is a typical non-essential category. The middle class, the main consumer group, is more discerning than before, seeking both "cost-effectiveness" and "value for money". At the same time, market competition is fiercer, with established OTAs and new players like Douyin, Kuaishou, and Xiaohongshu each showcasing their unique strengths.

Flying Pigs, which plays the role of a latecomer in the old competitive landscape, has stumbled through the fierce competition but has gradually shown signs of composure.

In early 2023, the travel industry began to recover from its low point and gradually regain its vitality.

According to data released by the Ministry of Culture and Tourism, in the first three quarters of this year, the number of domestic tourist trips reached 4.237 billion, an increase of 563 million from the same period last year, representing a year-on-year growth of 15.3% and recovering to 92.17% of the same period in 2019.

The total expenditure of domestic tourists has also increased significantly. In the first three quarters of this year, the total expenditure of domestic tourists reached 4.35 trillion yuan, an increase of 660 billion yuan over the previous year, representing a year-on-year growth of 17.9%.

Standing at the cusp of the travel recovery, many OTA platforms have also seen a surge in related orders.

During this year's National Day holiday, Ctrip's average daily order volume for outbound and inbound travel exceeded that of 2019, setting a new record. Flying Pigs' outbound travel bookings continued to grow rapidly on top of last year's strong rebound, with bookings increasing by over 50% year-on-year. Tongcheng Travel's international flight and hotel bookings also showed a significant increase.

It can be said that in the highly competitive consumer market, travel has become one of the best-performing growth sectors.

More and more players are eyeing this pie.

On the one hand, mainstream OTAs such as Meituan, Tongcheng, Ctrip, and Flying Pigs, after surviving the pandemic, are "fighting their own battles" and racing against each other.

The sinking market has become one of the most fiercely contested battlegrounds.

Relying on its local lifestyle service resources, Meituan is accelerating its layout in the surrounding and short-haul travel markets. Tongcheng Travel has always focused on "digging into the sinking market". In addition to intensifying its layout in lower-tier cities, it is also seeking new growth through expanding its ecosystem with mobile phone manufacturers and short video platforms, exploring new increments from the supply chain and traffic inlets.

The outbound travel market targeting high-income groups is also heating up. Ctrip has long invested and acquired travel ecosystems such as platforms, hotels, and air tickets, continuously strengthening its competitiveness in the outbound travel market. Although Flying Pigs started late, it has mastered the tricks favored by young people. With cheap air tickets and various small group tours, day tours, and tickets not available on other platforms, it has accumulated a good reputation among users.

Beyond mainstream OTA platforms, content platforms such as Douyin, Kuaishou, and Xiaohongshu are accelerating their layout in the travel sector, aiming to erode more market share through the "content + traffic" strategy.

From Zibo's barbecue becoming a nationwide hit to Harbin's fascination with small southern potatoes and Tianshui's spicy hot pot driving tourism in Gansu, these three content platforms are not only creating phenomenal travel IPs but also competing to launch hotel and travel businesses, attracting supplier resources.

The momentum of "Douyin, Kuaishou, and Xiaohongshu" is undeniably strong. However, as latecomers, they have not yet surpassed mainstream OTA platforms that have accumulated extensive hotel and attraction resources, either in scale or in investment ROI.

Therefore, facing the new changes in the travel market, OTAs are also more likely to score well in the competition.

However, in this game with few players, it is also difficult for the BOSS to break through the territory it has captured.

Taking this year's explosive outbound travel as an example, people's consumption psychology and attitudes have undergone significant changes.

Cost-effective consumption has become a trend, with people no longer blindly pursuing high-end luxury. At the same time, more and more people, especially young people who have an increasing influence on overall decision-making in family travel consumption, are beginning to focus on personalized and in-depth experiences, pursuing more unique travel experiences.

According to the "2024 China Outbound Travel Industry Development Trend Report" (hereinafter referred to as the "Report") released by Fastdata, since the recovery of outbound travel supply in 2023, young Chinese tourists, who have more comprehensive access to global travel information and are reluctant to be constrained by fixed arrangements, particularly favor independent travel.

Against this backdrop, as the industry leader, Ctrip has always remained composed. Established in 1999, Ctrip has a particularly strong industry foundation. Since 2014, it has successively invested in or acquired Tuniu, Tongcheng, eLong, Qunar, and others, forming the Ctrip ecosystem. In the outbound travel business layout, it has extremely strong resources and channel advantages.

However, travel consumption is not monolithic, and the non-standardized nature of demand also leaves room for latecomers to explore. In the middle of this year, Flying Pigs stated at the "Overseas Local Entertainment Partners Conference" that:

In the independent travel entertainment category, such as island diving, aurora watching, and night cruises, the value output per user click in 2023 increased by over 30% compared to 2019;

More than 1,000 new merchants operating overseas local entertainment and scenic spot ticketing joined within one year;

In popular destinations such as Thailand, Japan, Malaysia, Singapore, Australia, Maldives, and New Zealand, comparing the number of inbound tourists statistically reported by their official agencies with the number of outbound travelers using Flying Pigs' overseas local entertainment services and ticketing, on average, about one out of every three Chinese tourists places an order on Flying Pigs.

Duan Yongping once had a widely spread view within the investment circle: product differentiation does not refer to being so-called "unique" but rather to this "uniqueness" being exactly what users need and what others fail to satisfy.

Although Flying Pigs lags behind Ctrip in terms of overall market share, it has gradually achieved a leading share in some previously considered "non-mainstream" niche areas.

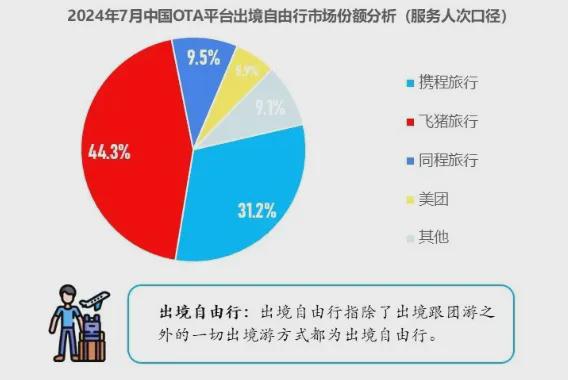

The aforementioned "Report" shows that in the burgeoning independent travel market, Flying Pigs ranks first with a market share of 44.3%, continuing to lead in areas such as overseas local entertainment and visa services. Ctrip and Tongcheng follow with market shares of 31.2% and 9.5%, respectively.

Source: Fastdata "2024 Outbound Travel Trend Report"

From the perspective of overall market share, Ctrip ranks first with a share of 48.3%, followed by Flying Pigs in second place with a share of 29.6%.

Industry insiders analyze that in the fiercely competitive travel market, Flying Pigs insists on blazing new trails for some new supply and expands its supply territory by capturing demand.

Looking back four years ago, the entire travel market entered an unprecedented trough.

Compared with predecessors like Ctrip, Tuniu, Tongcheng, and the early eLong, Flying Pigs entered the market relatively late and was not a market leader. The crisis was more apparent than that faced by Ctrip, which had already started making money in full swing.

The predecessor of Flying Pigs was Alitrip. In 2014, the business was upgraded to Alitrip.com and officially renamed Flying Pigs two years later.

Relying on Alibaba, Flying Pigs initially approached travel with an e-commerce mindset, enjoying traffic dividends without having to do hard work.

Born with a "golden spoon," Flying Pigs was quite restless in its early years, making a splash in the industry by high-profile announcements such as reducing the price of Antarctic tours and collaborating with well-known airlines to launch aurora routes. However, after the pandemic hit, the situation it had painstakingly created with large investments quickly cooled down. Worse still, its weaknesses in areas such as customer service became apparent.

However, the foundation of the tourism industry has never been about the amount of traffic.

The biggest problem with building a travel platform following Taobao's model is the uneven service quality of merchants operating on the platform. If Flying Pigs cannot determine the supply, it will have little say over merchants.

The premise of discussing any differentiation is still the stable delivery of the most basic services.

According to Zhuang Zhuoran, CEO of Flying Pigs, if a travel platform does not provide good enough services, resulting in a poor first-time user experience, then users are likely to not choose it again the next time. No matter how much new traffic there is, it will be useless.

Flying Pigs realized the urgency of this issue. In March 2022, Zhuang Zhuoran sent a letter to all employees announcing the initiation of organizational reforms at Flying Pigs. In his view, the top priority for Flying Pigs is to return to an entrepreneurial mindset and transform into an organization that values service and fulfillment.

Since then, Flying Pigs has been frantically making up for lost time in terms of its supply chain. The supply chain is a "slow business," and it is inevitable to spend more time and invest more resources. Previous reports have indicated that Flying Pigs' business development, technology, and customer service teams have expanded rapidly, and upstream investment activities have also intensified.

Imagine if these "mud-legged" tasks had not been done, and sales were driven solely by traffic. When the spotlight of Double 11 shines, how many hotels and airlines would be willing to bring their products to Flying Pigs' grand promotion?

However, Flying Pigs has not radically transformed into a full-fledged OTA but has retained its platform positioning in some categories, aiming to combine OTA and OTP strategies.

"Compared to the 'iOS' of the travel industry, Flying Pigs prefers to be 'Android,' allowing different partners to participate and focus on what they do best," Zhuang Zhuoran said at the 2023 TTF (Travel Tech Forum) conference.

Whether this path can be successful has no precedent to refer to.

However, from a timing perspective, merchants who have "suffered from OTAs for a long time" are coincidentally blazing a new trail.

Earlier this year, giants such as Marriott and Hilton successively announced the tightening of member benefits distributed through third-party distribution channels. The industry generally believes that this move aims to prevent OTAs from maintaining high commission rates while taking away customers with high repurchase rates and to maintain the value and brand value of membership. Interestingly, their official flagship stores on Flying Pigs, as direct sales channels, retain their benefits.

In July, it was reported that Huazhu Group required all its brands to ensure that the proportion of OTA channel orders does not exceed 30%. Prior to this, mainstream brands such as Homeinn, Huazhu, Jin Jiang, Super 8, and Dongcheng had also begun adopting strategies for direct connections through OTA channels, gradually prohibiting stores from privately cooperating with non-directly connected OTA channels.

Where should mid-tier brands and smaller hotel and travel sellers find reliable public traffic becomes an opportunity beyond traditional OTA forces.

However, it must be admitted that today's internet companies can no longer return to the glory days of the mobile internet wave a decade ago. The logic of survival and growth has changed. The era of burning money to gain market share is over, and the era of land grabbing followed by harvesting is also gone. The internet is getting used to unsexy stories.

Against this backdrop, the ability to return to basics and endure loneliness is even more valuable.

Looking at the entire tourism industry, compared to e-commerce, local lifestyles, and new energy vehicles, it has long been lukewarm. However, in an era of cautious consumption, as people's wallets shift towards leisure and entertainment, it is precisely some inconspicuous companies that can earn definite profits. Ctrip, which leads the Chinese concept stocks, and Tongcheng, which consistently makes profits, have already written their answers on the previous page.

Flying Pigs, at a turning point, still needs time and to wait for a better opportunity. But there is no doubt that in the ever-changing travel market, finding the right position for oneself and gaining a firm foothold secures a ticket for the second half.

END