Ele.me: Difficult Breakthrough in the Takeout Market, Profitability Issues Remain Unsolved

![]() 11/19 2024

11/19 2024

![]() 572

572

Currently, the instant retail market has become a key battlefield for local lifestyle enterprises, and Ele.me is also accelerating its layout at this critical juncture. Recently, Ele.me plans to open 100,000 "Near-Field Brand Official Flagship Stores" over the next three years, focusing on building "instant retail that aligns with Ele.me's characteristics."

Stockstar notes that behind Ele.me's accelerated layout in instant retail lies the fact that after Alibaba initiated the "1+6+N" organizational transformation, it no longer blindly supports Ele.me financially. With the takeout market dominated by Meituan, Ele.me finds it difficult to break through, and the company urgently needs to find new growth engines. Meanwhile, considering Ele.me's gap with competitors like Meituan in terms of user base and traffic, the company's plan to open 100,000 "Near-Field Brand Official Flagship Stores" has sparked considerable doubt.

01. Doubts Surround the "Near-Field Brand Official Flagship Store" Strategy

At the recent Instant E-commerce Future Business Summit, Ele.me CEO Han Liu stated that the company will firmly adhere to the "1+2" long-term strategy in the next three years. Among them, "1" represents Ele.me's commitment to healthy growth and becoming a home delivery dining platform that understands consumers better; "2" represents a focus on building "instant retail that aligns with Ele.me's characteristics" and "instant logistics networks oriented towards market value extension."

In recent years, with the popularization of the concept of "everything can be delivered" and a significant increase in consumer demand for instant delivery, the instant retail market has shown robust growth momentum. Relevant data shows that in 2023, the order size of the domestic instant delivery industry was approximately 40.9 billion, with a year-on-year increase of 22.8%. The instant delivery market size was 341 billion yuan, with a year-on-year increase of 24.8%. It is estimated that by 2027, the size of the instant e-commerce market will exceed 5 trillion yuan. Against this backdrop, the instant retail market has become a must-win territory for many local lifestyle enterprises.

It should be noted that although instant retail is currently one of the popular sectors, the industry has been developing for nearly a decade. In the early exploration of this sector, fresh food e-commerce enterprises represented by Hema, Dingdong Maicai, and Missfresh were the first to try the "dark store" model to meet users' instant demand for fresh food products.

However, the drawbacks of the "dark store" model are evident. It not only requires substantial warehousing costs, labor costs, and logistics and distribution expenses in the early stages but also requires ongoing maintenance expenses in the later stages. High operating expenses have also caused fresh food e-commerce platforms like Dingdong Maicai and Missfresh to face profitability issues, resulting in losses for consecutive years.

As a late entrant, Ele.me recognizes the high cost challenges of the dark store model. Therefore, the company has chosen to focus on store deployment in instant retail through the "Near-Field Brand Official Flagship Store" strategy.

Some analysts point out that Ele.me is not abandoning the "dark store" model, but it may not be its primary approach. After joining the "Near-Field Brand Official Flagship Store" model, brands can cooperate with manufacturers to build an "integrated store and warehouse" and authorize dealers to distribute through different stations or rely on third-party partners' "dark stores" to provide instant retail services. In this model, Ele.me does not need to bear too many warehousing costs but leverages the platform's supply chain management advantages to better connect online and offline resources.

Simultaneously, Ele.me has launched a plan to open 100,000 near-field brand official flagship stores over the next three years. According to Ele.me, as of now, the number of valid stores in Ele.me's official flagship stores exceeds 20,000, including brands such as Mengniu Group's Daily Fresh, Tsingtao Beer, Nongfu Spring, and Philips.

Stockstar notes that the company's plan is not favored by the market.

On the one hand, when choosing a platform to join, brands will naturally prioritize platforms with larger traffic and the potential to generate more orders. In the current market, Meituan dominates due to its large user base and powerful traffic distribution capabilities. In contrast, Ele.me does not have an advantage. If Ele.me cannot deliver the expected revenue to brands, they may turn to other platforms with more obvious traffic advantages.

According to the latest data, during this year's Double 11 shopping festival, the total sales of instant retail channels reached 28.1 billion yuan. In this field, Meituan Flash Delivery ranked first, followed by JD Instant Delivery and Ele.me in second and third places, respectively. There is a certain gap between Ele.me and Meituan and JD.com.

On the other hand, to ensure the profitability of brand flagship stores, Ele.me has to consider directing traffic to them, which will inevitably affect the traffic acquisition of non-flagship store merchants (such as convenience stores). Once this traffic allocation mechanism is implemented, it will undoubtedly disrupt the balance of the platform ecosystem, meaning that Ele.me's brand flagship store plan faces certain challenges from the outset of implementation.

Furthermore, industry insiders point out that while the "Near-Field Brand Official Flagship Store" strategy gives brands greater autonomy, it also limits Ele.me's direct control over the density and breadth of the instant retail network.

02. Still in the Red

Stockstar notes that behind Ele.me's accelerated layout in instant retail lies the established dominance of Meituan in the takeout market, making it difficult for Ele.me to break through. More troublingly, Ele.me is currently facing profitability issues, and the company urgently needs to find new profit growth points.

In fact, since Ele.me was merged into Alibaba in 2018, Alibaba has placed high hopes on it and planned to share the takeout market with Meituan. To this end, Alibaba provided resource support and directed traffic through multiple channels such as "Alipay + Mobile Taobao," hoping to rapidly increase Ele.me's market share.

However, this strategy failed to achieve the expected results. Although these traffics brought about an increase in payment demand, they did not effectively convert into dining demand for Ele.me. Meanwhile, with the support of Dianping and Tencent traffic, Meituan achieved greater user coverage, further consolidating its market share.

Until 2020, Alibaba conducted an internal reflection on its local life services and no longer obsessed over market share. Since then, the market pattern of a 70-30 split in the takeout market has been established and has persisted to this day.

Last March, Alibaba initiated the "1+6+N" organizational transformation, shifting from the past group-managed model to a holding company management model with multiple independent business groups and companies, each establishing their board of directors and CEO responsibility system. As one of the core businesses of the local lifestyle group, Ele.me subsequently entered an independent operation stage of self-financing and self-responsibility.

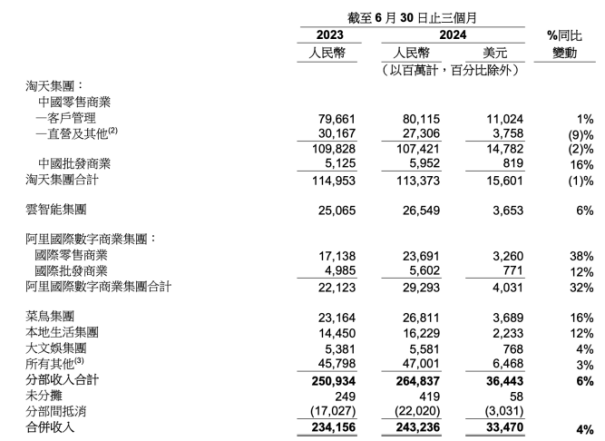

Currently, Ele.me has been independently operating for over a year. In terms of performance, in Alibaba's latest financial report, the local lifestyle group business to which Ele.me belongs has still not achieved profitability. In the second quarter of 2024, revenue from the local lifestyle group increased by 12% year-on-year to 16.229 billion yuan, driven by the growth of Ele.me and Gaode orders. However, adjusted EBITA still recorded a loss of 386 million yuan, indicating that it is still in a state of loss. (This article was originally published on Stockstar, written by Li Ruohan)

- End -