Instant retail enters the stage of 'hand-to-hand combat' and 'price war'

![]() 11/19 2024

11/19 2024

![]() 680

680

After JD.com's self-operated supermarket 'JD Seven Fresh' completed the integration with front-end warehouses and fully launched the 'super low price, truly cheap, not afraid of comparison' campaign, on November 15, JD Seven Fresh officially announced again with harsh words: 10% cheaper! Competitors dare to follow, and JD Seven Fresh dares to continue to lower prices.

Even though when previously responding to rumors of a 'price war', JD Seven Fresh pointed out that they were not deliberately targeting anyone, but simply offering low prices. However, the current highly confrontational statement undoubtedly pushes the competition over commodity prices in instant retail to new heights, and JD Seven Fresh's determination to offer 'low prices' is also evident.

To some extent, we can regard the recently 'resurgent' front-end warehouse model as an entry point to glimpse the escalating 'battle' in instant retail.

From previously being controversial in the market, applied by some fresh food e-commerce platforms, and then abandoned, to being 'revisited' by players like Hema and JD Seven Fresh in the second half of this year, and with previous front-end warehouse 'stalwarts' Dingdong Maicai and Meituan (Xiaoxiang Supermarket, Meituan Lightning Warehouse) also bringing new market dynamics: the former will increase the density of front-end warehouse layout in Jiangsu, Zhejiang, and Shanghai regions to 110, while the latter has announced its ambition to 'open 100,000 Lightning Warehouses by 2027'. In addition, there is good news that 'Pupu Supermarket's fulfillment expense ratio has dropped to 18%', as well as Ele.me's 'new three-year' strategic layout to open 100,000 nearby official flagship stores...

From O2O to new retail to community group buying to today's instant retail, with the gradual maturation and iteration of the front-end warehouse model, the supply ecosystems of players like Meituan, JD.com, Alibaba, Dingdong Maicai, Pupu Supermarket, and Sam's Club have become increasingly prosperous, and the divisions in instant retail competition have also emerged.

01 Local life moves towards 'open warfare'

The common highlight in the financial report data of Alibaba (FY25Q2, released on November 15) and JD.com (FY24Q3, released on November 14) is the increase in retail business revenue. Specifically, Alibaba's local life revenue increased by 14% to 17.725 billion yuan, ranking among the top in the group; JD.com's retail segment achieved revenue of 224.986 billion yuan, a year-on-year increase of 6.1%, still contributing the majority of revenue.

In terms of 'JD Second Delivery', after JD.com comprehensively upgraded its instant retail business in May this year (integrating the 'JD 1-Hour Delivery' and 'JD Daojia' brands into 'JD Second Delivery'), Dada Group's Q3 2024 earnings report showed that the average monthly number of placing orders and order volume of JD Second Delivery in the JD.com App field both increased by more than 100% year-on-year. As of the end of September, the number of operating stores for JD Second Delivery exceeded 600,000, with a year-on-year increase of more than 70%.

The latest financial report data of the aforementioned internet companies reveal the development trend of local life and instant retail business. Although the business scale and revenue performance of other leading players have not been disclosed, based on comprehensive data from recent years, in absolute terms, Meituan still firmly holds the throne in the local life services sector, while the growth rates of latecomers like Douyin and Kuaishou cannot be overlooked.

'Retail Business Finance' believes that, based on corporate attributes, players in the instant retail sector can basically be divided into three factions: early-mover instant e-commerce represented by Dingdong Maicai and Pupu Supermarket, internet resource-based players represented by Meituan, JD.com, and Alibaba, and transformative retail enterprises represented by Walmart, Wumart, Lawson, MINISO, and Watson's.

Figure: Players in the three factions of instant retail

Early-mover instant e-commerce usually has strong regional characteristics and is somewhat limited in market size.

For example, after achieving profitability in the Shanghai region in December 2021, Dingdong Maicai (NYSE: DDL) further consolidated its dominant position in the Jiangsu, Zhejiang, and Shanghai regions in the third quarter of this year, with 13 cities in the region achieving a year-on-year increase in GMV of more than 50%.

However, compared to Beijing and the Guangzhou-Shenzhen region, Dingdong Maicai's GMV increased by 14.6% and 2.9% year-on-year in this quarter, respectively, with significantly lower growth rates than in the Jiangsu-Zhejiang-Shanghai region. It can be seen that the long-established Jiangsu-Zhejiang-Shanghai region is the core support for Dingdong Maicai, and only by focusing on this region and continuing to win battles can it have the confidence to respond to the reignited front-end warehouse competition.

The development of Pupu Supermarket is similar. From Fuzhou, Xiamen, Shenzhen, and Guangzhou, it has expanded to Wuhan, Chengdu, and Foshan. Under the large warehouse model, Pupu also demonstrates a trend of stronger regions becoming even stronger in terms of cost control and operational efficiency.

Internet resource-based players have always been known for their style of concentrating resources and conducting dimensionality reduction strikes. Drawing lessons from past community group buying competitions, platforms can not only utilize resources from all parties to encroach on territory and 'roll out' scale but also save costs and 'save' profits from various links. Of course, the starting point for all of this is still the sense of crisis brought about by the decline in traffic dividends.

As for transformative retail enterprises, they have basically experienced a change in mindset from waiting and seeing to 'having to do it'. Although their intention to follow the trend and test the waters is strong, the possibility of changing course is not small. This reflects the iterative maturation of the front-end warehouse model and the general trend towards instant retail, as well as the proposition of how 'warehouse-store integration' enterprises should proceed next.

The advantage of such enterprises lies in their ability to quickly convert existing stores. Apart from those who are more willing to take control of operations into their own hands, such as Hema, RT-Mart M Member's Store, and JD Seven Fresh, which choose to build their own front-end warehouses, some retailers or brands that lack an interconnected digital operating system and mature fulfillment service capabilities are currently more willing to cooperate with third-party platforms like Meituan Flash to increase investment in Meituan Lightning Warehouses or directly open nearby official flagship stores on the Ele.me platform. This is regarded as one of the most convenient paths for them to achieve standardization, intelligence, and immediacy in 'consumption, fulfillment, and after-sales'.

The three types of players each have their own advantages, disadvantages, and resources to rely on. Moving from covert to overt warfare, what is at stake is the number of front-end warehouse locations and profit models, while what is being compared is the strength of product power and price competitiveness.

Taking the Guangzhou-Shenzhen market as an example, Pupu Supermarket, Sam's Club, and Xiaoxiang Supermarket rank among the top three in market share. Although other traditional chains like Walmart, CR Vanguard, and Tianhong are facing greater pressure, while ensuring store service fulfillment and exploring regional online consumption trends, they have also begun to distinguish themselves from online platforms from the perspective of quality living spaces. This is a beneficial practice to prevent themselves from resorting to desperate measures and falling into the single role of a 'warehouse'.

02 'Playing method' is monotonous: fresh food attracts customers, self-branded products anchor the store, and regional victory prevails

Fierce competition burns through each company's funds, manpower, and patience, but there is nothing new under the sun. Patterns and phenomena that repeatedly occur in commercial society and history indicate that even in 'instant retail', which is regarded as a new retail format and a new consumption model, the number of moves that can be made is limited and even similar.

First, fresh food attracts customers.

As one of the few areas in retail that can maintain significant growth, fresh food categories are undoubtedly the core competitive point in the market. The product structure of fresh food attracting customers and standard products generating profits is still the standard model for instant e-commerce at this stage.

Although the front-end warehouse model is commonly used in the fresh food retail industry, due to high construction costs and difficult operational challenges, there has been much debate about whether this model can be 'viable'. The root of the problem lies in the fact that fresh food is a category with a high loss rate and is not high-frequency, easily falling into a dilemma of high product loss, low gross margin, and even higher costs without large-scale orders.

This is also why after entering the market through fresh food, instant retail ultimately needs to move towards a full range of products, focusing on private label brands, pre-made meals, leisure goods, and other commodities. Ultimately, this is to improve profit margins and ensure better survival.

Second, self-branded products anchor the store.

Dingdong Maicai, Hema, and Pupu Supermarket are all emphasizing the development of private label products. Currently, the user penetration rate of private label products at Dingdong Maicai is over 70%, and the sales of Pupu Supermarket's private label product matrix, with 'Youci' and 'Suizi' as the core, are expected to approach 5 billion yuan this year, accounting for 15%-20% of total sales, while Hema's private label products have even crossed oceans.

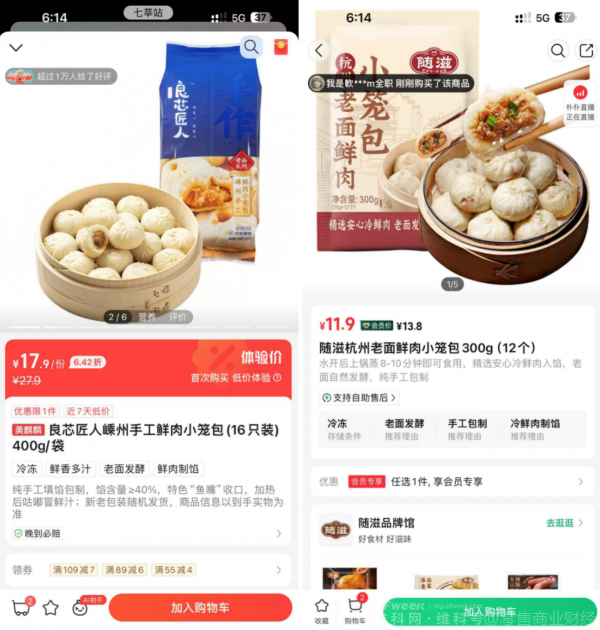

Figure: Private label products of Dingdong Maicai and Pupu Supermarket

'Retail Business Finance' believes that private label products are not just a means to achieve low prices; more importantly, they demonstrate the brand's and platform's understanding of the target customer group. This understanding cannot be copied directly, and the core value of private label products lies in the 'inclusiveness' achieved after achieving scale effects.

Taking the Junlebao yogurt that the author has repurchased multiple times as an example, the promotional price of the branded product 'Junlebao Jianchun 0 Added Sugar Yogurt Tub 1.2kg' sold by Pupu Supermarket is 16.9 yuan (original price 19.9 yuan), while the 'Xiaoxiang x Junlebao Pure Enjoy Probiotic Yogurt 1.2kg' jointly developed by Xiaoxiang Supermarket and Junlebao is only sold for 9.9 yuan (original price 12.9 yuan).

Junlebao Yogurt Image Source: Meituan and Pupu Supermarket APP

When the weight, packaging, and taste of the product are similar, products created through collaboration between channel providers and brand suppliers can effectively increase profit margins and profitability. For consumers, the product power of related products is immediately apparent on the price side.

Third, regional victory prevails.

From the perspective of recent changes in the competitive landscape of the instant retail front-end warehouse model: JD Seven Fresh has completed the integration of front-end warehouses, increasing market investment with 'super low prices' while upgrading products and services; Hema has chosen to restart front-end warehouses in Shanghai, but the cost challenge remains unresolved, having little impact on Dingdong Maicai's expansion space in the short term; Xiaoxiang Supermarket is progressing rapidly in North and South China, with relatively steady business expansion in East China.

The current race among platforms for front-end warehouses is mainly reflected in the fierce competition for grassroots delivery personnel and ground promotion personnel. The accumulation and release of regional advantages and the high-density layout of front-end warehouse stores ultimately aim to reduce fulfillment costs, improve delivery efficiency, and enhance supply chain scale effects and economies of scale through increased order density.

When we further review the current situation of instant retail, it seems that only Tmall Supermarket has remained silent? Interestingly, Alibaba is precisely the forward-looking player who first proposed the concept of 'nearby e-commerce'.