Latin American E-commerce: A New Chapter, Mirroring North America, with Boundless Blue Ocean Opportunities

![]() 11/19 2024

11/19 2024

![]() 598

598

Author | Lilith

Editor | Li Xiaotian

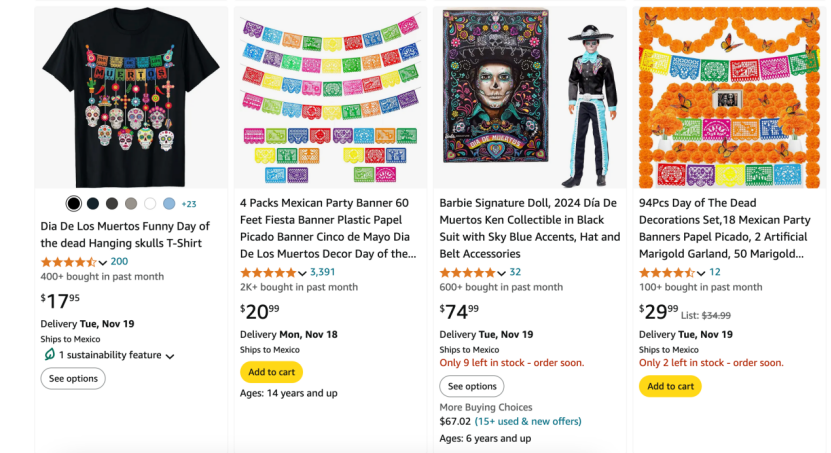

In early November, Mexico celebrated the annual Day of the Dead. Much like the movie "Coco," people wore masks of otherworldly characters and brightly colored traditional attire, laughing and enjoying the visually stunning parade. Streets in Mexico were still filled with stalls selling related decorations, but increasingly, Mexican consumers are purchasing Day of the Dead decorations and costumes through e-commerce platforms. According to a Statista report, the number of users in Mexico's e-commerce market is continuously growing. In 2024, Mexico's e-commerce market had approximately 74 million users, and projections indicate that these numbers will double in the next five years.

Day of the Dead-related products on Amazon

Source: Amazon

This shift in consumer behavior is due to the rapid rise of e-commerce in Latin America in recent years.

According to Amazon's "Cross-border E-commerce Industry Insights Report on Exports to Latin America" (hereinafter referred to as the "Report"), Latin America has become one of the fastest-growing regions in global e-commerce. In 2023, the size of Latin American e-commerce was $272 billion, with a year-on-year growth rate of 30%. The compound annual growth rate from 2023 to 2026 is expected to exceed that of markets like Africa and Asia, forecasted at 21% (access the full report at the end of the article). More and more sellers are flocking to this blue ocean market – as of the second quarter of 2024, the total number of active Chinese sellers on Amazon's Latin American sites (Mexico and Brazil) increased by 80% compared to the same period last year. For sellers, Latin America is no longer a mysterious region far away from China on the map; its veil is gradually being lifted, revealing a new market landscape and unlimited business opportunities. On November 6, Amazon released the "Report" to further reveal the full picture of this cross-border blue ocean market in Latin America.

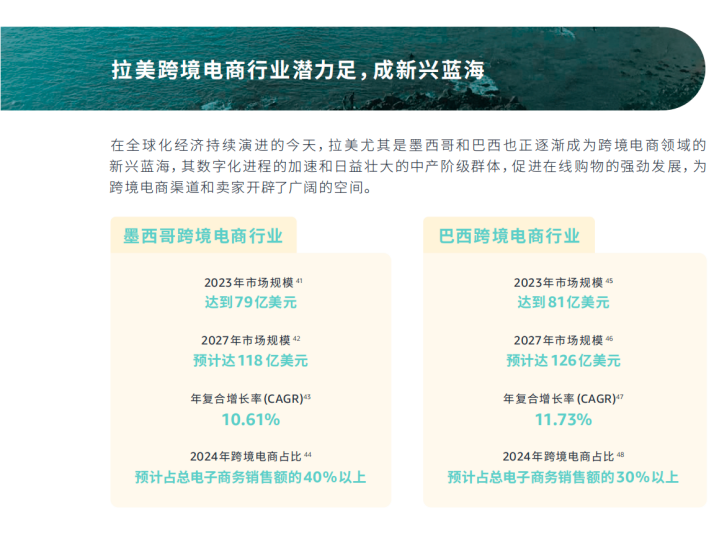

When we talk about the Latin American e-commerce market, Mexico and Brazil are unavoidable topics – both countries are among the top five economies in Latin America, with strong economic foundations and development potential. As the two most populous countries in Latin America, their e-commerce markets have even broader growth potential. The "Report" shows that in 2023, the cross-border e-commerce industry in Mexico had a market size of $7.9 billion, and it is expected to exceed $10 billion, reaching $11.8 billion by 2027, with a compound annual growth rate of 10.61%. Brazil's figures are equally impressive, with a market size of $8.1 billion in 2023 and an expected market size of $12.6 billion by 2027, with a compound annual growth rate of 11.73%.

Source: The "Report"

As economic cooperation between China and Latin American countries continues to deepen, total exports are also continuously increasing. More and more sellers are being attracted to this future "multi-billion dollar market." For observers who have not yet ventured into the Latin American market, they may find it helpful to initially and simply view the Latin American market as a "younger version of North America." Firstly, due to its proximity to North America, Latin American consumers' attitudes are deeply influenced by North American culture. The ESG (Environmental, Social, and Governance) concept that is popular in North America is equally important to Latin American consumers. The "Report" points out that an increasing number of Mexican consumers are incorporating sustainable development concepts into their consumption behavior. Currently, 54% of Mexican consumers consider environmental and social impacts when purchasing products, and this trend is likely to continue rising in the future. In this context, some sellers actively cooperate with environmental protection organizations to carry out public welfare activities and focus on the ESG impact of product design, allowing their products to be better recognized by environmentally friendly consumers.

Source: Unsplash

Latin American consumers not only pay attention to the impact on the external environment and society but also value the meaning of products to themselves. In American dramas, we often see lifestyles such as yoga and intermittent fasting, and similarly, the concept of "healthy living" is also prevalent in Mexico. Data shows that in Mexico, 19% of respondents own fitness wearable devices/health tracking devices, and 20% of respondents expect to increase their spending on these products in the future.

Secondly, similar to the North American ecosystem, social media marketing in Latin America is booming. Don't overlook the power of social media – in the Netflix reality show "Selling Sunset," an agent sold a multimillion-dollar mansion solely through their Instagram followers. In Latin America, especially Brazil, once known as the "country that loves playing with their phones the most," 73% of online consumers make purchases through advertisements on Instagram. The same is true in Mexico, where 49% of Generation Z and 40% of Millennials say they are heavily influenced by social media when shopping. The popularity and influence of social media have provided new marketing ideas for Latin American brands and sellers. Xu Yi, CEO of Cyxus, a brand specializing in fashion glasses, said, "We have a dedicated social media team that operates off-site social media and also collaborates with local influencers. Often, influencers will purchase products and share them on social media, bringing considerable traffic to our Amazon store and instilling a sense of trendy brand awareness." Due to the influence of North American consumer culture and ecology, the most similar aspect between Latin American and North American e-commerce markets lies in "product categories." The popular product categories in the Latin American e-commerce market have a high degree of overlap with the best-sellers in the North American market. Data from the "Report" shows that from January to August 2024, 85%-90% of the top 20 product categories sold by Chinese sellers on Amazon's US site overlapped with the top 20 categories on Amazon's Mexico and Brazil sites. This means that initially, Chinese sellers can "reuse" their experience in expanding the North American market to open up this boundless blue ocean market in Latin America.

In 2019, Lily, the founder of Shenzhen Cikun Technology, replicated her experience selling lamps on Amazon's US and European sites by listing her popular models on the Mexican site. However, by observing sales trends, Lily gradually discovered that "there are some differences in demand (between Latin America and Europe/the US)." In the US and some European countries, lamps with simple designs are more popular among consumers, but the same products on the Mexican site received higher recognition for their retro and intricate designs. Therefore, although Latin America shares many similarities with North America, as an emerging market, Latin American consumers have their own preferences. In addition, this fertile land presents more unique opportunities. Firstly, from a macro perspective, the development of e-commerce in Latin America is still in its early stages, with far less competition than in North America and relatively broader growth potential. The "Report" points out that Latin America has a population of 660 million, and in 2024, the overall number of e-commerce users in Latin America is expected to increase to 290 million, equivalent to two-fifths of the region's population, representing an extremely high growth rate. However, it is worth mentioning that the remaining three-fifths of the population represents potential e-commerce consumers, and this consumer potential will be rapidly unleashed in the future. Lily originally intended to test product performance in the Latin American market, but the final results surprised her. In 2020, the sales of Cikun Technology's test products in Mexico grew exponentially, from just over 10 orders per day initially to over 100 orders per day.