Which cross-border e-commerce company has the strongest profitability?

![]() 11/25 2024

11/25 2024

![]() 667

667

Cross-border e-commerce refers to an international business activity where trading entities from different customs territories complete transactions through e-commerce platforms, conduct payment and settlement, and deliver goods via cross-border logistics to finalize the transactions.

Profitability is typically manifested by the amount of earnings a company generates over a certain period and the level of those earnings. Analyzing profitability involves a deep dive into a company's profit margins.

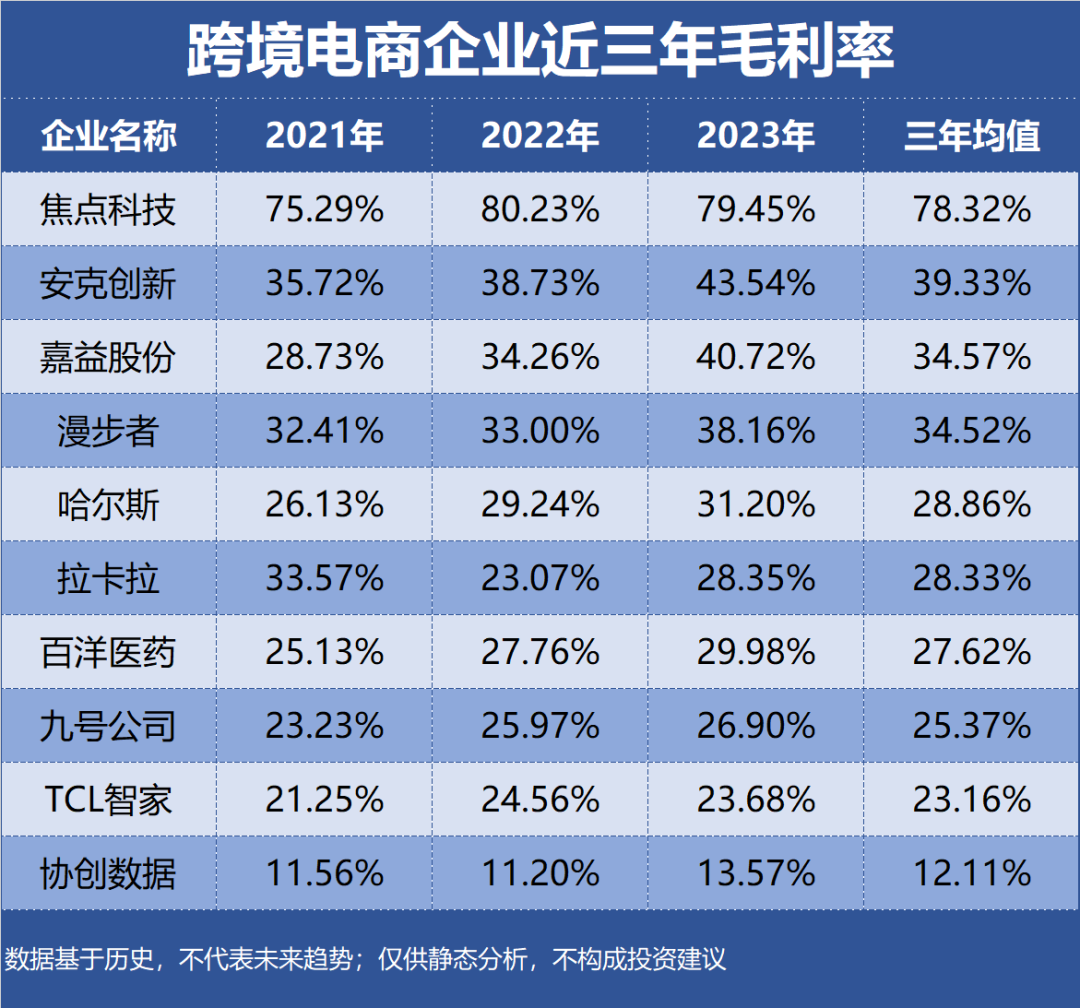

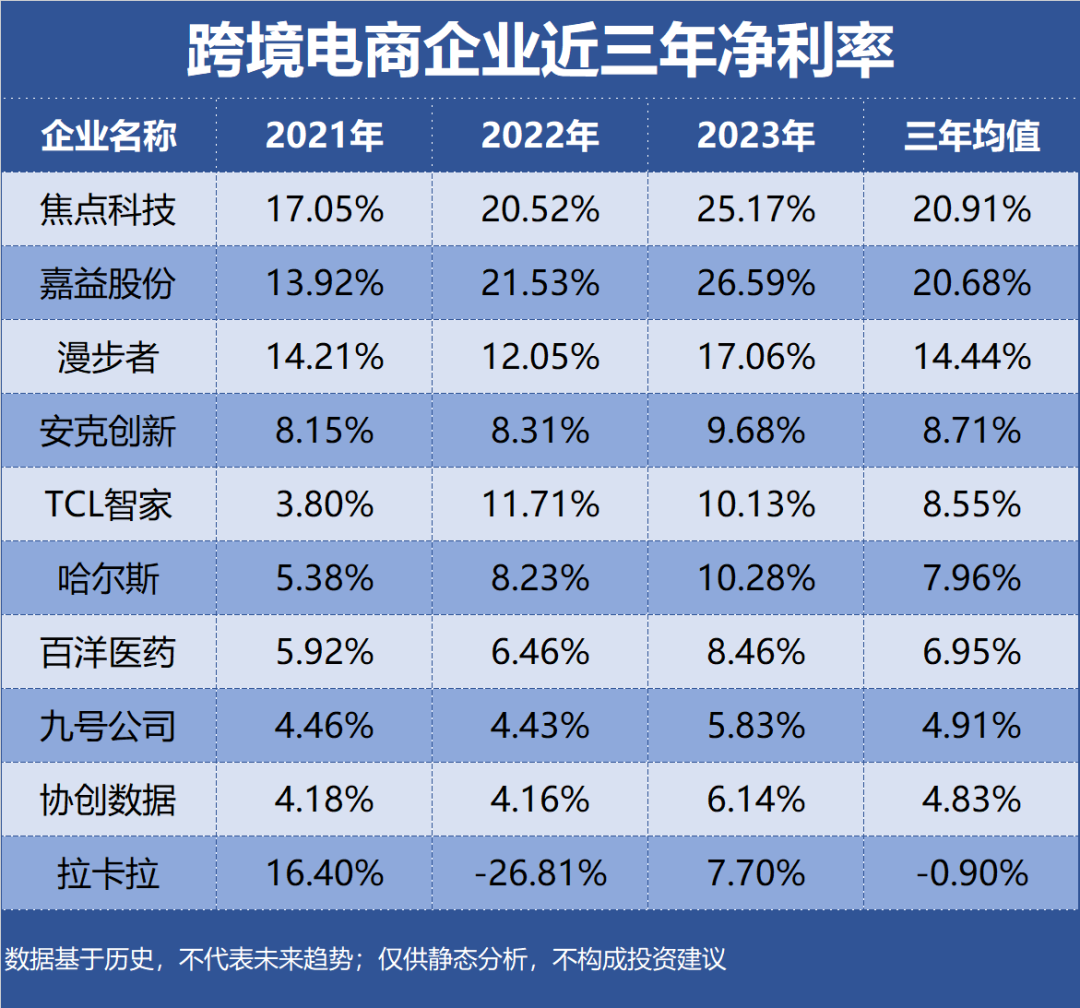

This article, part of the Enterprise Value series focusing on Profitability, selects 237 cross-border e-commerce companies as research samples, using indicators such as Return on Equity (ROE), Gross Profit Margin, and Net Profit Margin for evaluation.

Data is based on historical information and does not represent future trends; it is intended for static analysis only and does not constitute investment advice.

Top 10 cross-border e-commerce companies by profitability:

10th Hals

Industry Segment: Other Household Items

Profitability: ROE 17.40%, Gross Margin 28.86%, Net Margin 7.96%

Performance Forecast: ROE fluctuated between 15%-20% in the last three years, with the latest forecast average at 18.32%

Main Product: Vacuum containers are the primary source of revenue, accounting for 87.40% of revenue with a gross margin of 28.43%

Company Highlights: Hals insists on a dual-wheel drive development strategy combining OEM+ODM businesses with independent brands, actively exploring cross-border e-commerce channel construction. Its products are currently sold on channels such as Amazon US and Amazon Europe.

9th Focus Technology

Industry Segment: Cross-border E-commerce

Profitability: ROE 14.21%, Gross Margin 78.32%, Net Margin 20.91%

Performance Forecast: ROE has risen continuously to 16.66% in the last three years, with the latest forecast average at 17.48%

Main Product: Network information technology services are the primary source of revenue, accounting for 71.66% of revenue with a gross margin of 78.86%

Company Highlights: Focus Technology successfully launched its professional cross-border B2B online trading platform, Kailuo, aiming to open up online trading channels for Chinese suppliers and overseas small and medium-sized intermediaries, pioneering a new blue ocean in cross-border e-commerce.

8th Lakala

Industry Segment: Financial Information Services

Profitability: ROE 0.23%, Gross Margin 28.33%, Net Margin -0.90%

Performance Forecast: ROE peaked at 23.12% in the last three years, with the latest forecast average at 17.10%

Main Product: Payment services are the primary source of revenue, accounting for 88.28% of revenue with a gross margin of 30.20%

Company Highlights: In cross-border e-commerce, Lakala has launched a cross-border technology platform, connecting global payment financial institutions, platform enterprises, service providers, and other participants in cross-border e-commerce.

7th Edifier

Industry Segment: Branded Consumer Electronics

Profitability: ROE 14.41%, Gross Margin 34.52%, Net Margin 14.44%

Performance Forecast: ROE fluctuated between 10%-18% in the last three years, with the latest forecast average at 18.01%

Main Product: Headphones are the primary source of revenue, accounting for 64.25% of revenue with a gross margin of 41.56%

Company Highlights: The trademarks 'Edifier' and 'EDIFIER' have been registered as international trademarks in over 80 countries and regions. Edifier's audio products are primarily sold on platforms like Amazon.

6th Ninebot

Industry Segment: Other Transportation Equipment

Profitability: ROE 10.55%, Gross Margin 25.37%, Net Margin 4.91%

Performance Forecast: ROE fluctuated between 9%-12% in the last three years, with the latest forecast average at 18.63%

Main Product: Electric two-wheelers are the primary source of revenue, accounting for 50.74% of revenue with a gross margin of 22.26%

Company Highlights: Ninebot expands its independent brand sales channels and strengthens communication and services with local users through close cooperation with local e-commerce platforms, mainstream regional distributors, and retailers.

5th Anker Innovation

Industry Segment: Branded Consumer Electronics

Profitability: ROE 19.00%, Gross Margin 39.33%, Net Margin 8.71%

Performance Forecast: ROE has risen continuously to 21.88% in the last three years, with the latest forecast average at 21.93%

Main Product: Charging and energy storage products are the primary source of revenue, accounting for 51.56% of revenue with a gross margin of 42.98%

Company Highlights: Anker Innovation primarily sells its products globally through mainstream third-party online B2C platforms such as Amazon, eBay, Rakuten, and Tmall.

4th Xiechuang Data

Industry Segment: Consumer Electronics Components and Assembly

Profitability: ROE 12.60%, Gross Margin 12.11%, Net Margin 4.83%

Performance Forecast: ROE fluctuated between 9%-19% in the last three years, with the latest forecast average at 24.34%

Main Product: Data storage devices are the primary source of revenue, accounting for 64.76% of revenue with a gross margin of 11.82%

Company Highlights: Xiechuang Data's cross-border e-commerce cloud business primarily targets MCN agencies, foreign trade enterprises, overseas brand owners, and other small and medium-sized enterprises domestically and abroad, providing social media matrix and overseas live streaming services.

3rd TCL Smart Home

Industry Segment: Refrigerators and Washers

Profitability: ROE 36.96%, Gross Margin 23.16%, Net Margin 8.55%

Performance Forecast: ROE peaked at 65.35% in the last three years, with the latest forecast average at 42.80%

Main Product: Refrigerators and freezers are the primary source of revenue, accounting for 84.94% of revenue with a gross margin of 24.92%

Company Highlights: TCL Smart Home conducts some of its export business through online cross-border e-commerce platforms, currently accounting for a relatively small proportion.

2nd Baiyang Pharmaceutical

Industry Segment: Pharmaceutical Distribution

Profitability: ROE 24.34%, Gross Margin 27.62%, Net Margin 6.95%

Performance Forecast: ROE fluctuated between 22%-28% in the last three years, with the latest forecast average at 26.74%

Main Product: Brand operation business is the primary source of revenue, accounting for 63.53% of revenue with a gross margin of 44.10%

Company Highlights: Baiyang Pharmaceutical's online sales are primarily conducted through Baiyang Mall and third-party online marketplaces. It is also actively exploring cross-border e-commerce business and the social e-commerce platform "Baiyang Yimei".

1st Jiayi Corporation

Industry Segment: Other Household Items

Profitability: ROE 32.50%, Gross Margin 34.57%, Net Margin 20.68%

Performance Forecast: ROE has risen continuously to 43.90% in the last three years, with the latest forecast average at 38.48%

Main Product: Stainless steel vacuum insulated containers are the primary source of revenue, accounting for 93.51% of revenue with a gross margin of 39.14%

Company Highlights: Jiayi Corporation's main business involves beverage and food containers made from various materials. The company also has a cross-border e-commerce business.

Top 10 cross-border e-commerce companies by profitability, ROE, gross margin, and net margin over the past three years: