Layout in multiple popular tracks, is SinoTech a "real gold" or a "false flame"?

![]() 11/25 2024

11/25 2024

![]() 682

682

Author|Hengxin

Source|Bowang Finance

SinoTech has once again appeared in the ranks of "monster stocks."

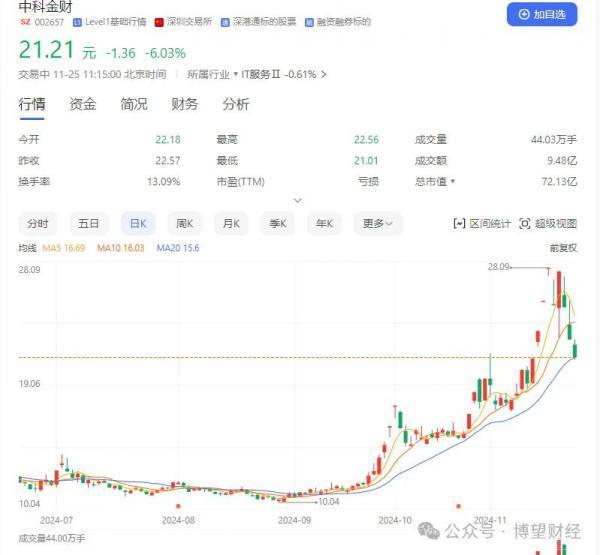

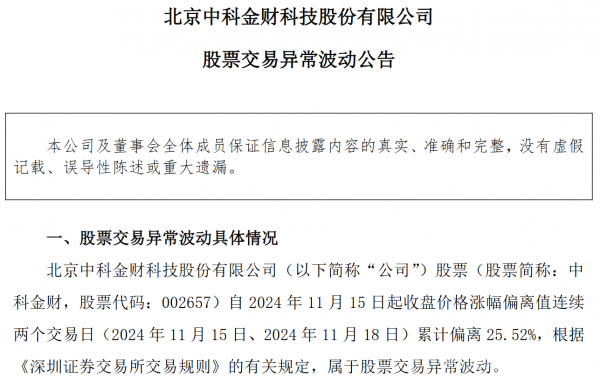

From November 13th to 18th, after achieving consecutive daily limits, SinoTech's share price miraculously plunged on the 19th. As of press time, the share price closed at 21.21 yuan per share. SinoTech's volatility has also attracted the attention of regulatory authorities, prompting the company to issue multiple announcements.

According to reports, an analyst from Huaxin Securities stated, "The recent frequent fluctuations in SinoTech's share price are mainly due to short-term speculation by hot money. Although the stock experienced a 'near-limit up' on the 20th, there were obvious signs of capital outflows from the daily limit, and investors should avoid blindly chasing gains in the short term."

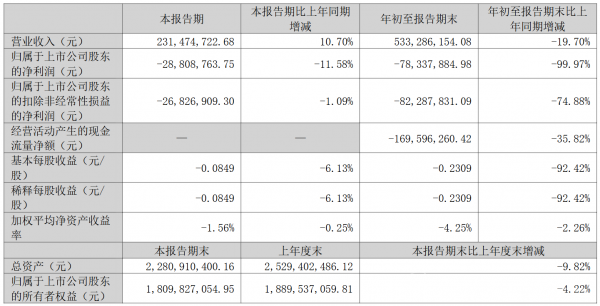

From a fundamental perspective, SinoTech's performance has been poor. Recently, SinoTech released its financial report for the first three quarters of 2024, showing that operating revenue for the period was 533 million yuan, a year-on-year decrease of 19.7%, with a net profit attributable to shareholders of -78.3379 million yuan, a year-on-year decrease of 99.97%. At the same time, the price-to-earnings ratio was -58.44, and the price-to-book ratio was 3.38 (industry ranking: 65/124). These data all indicate that SinoTech's profitability is worrying, and its valuation is not high.

But why has it been able to sustain consecutive daily limits?

01

Following the trend of the times, adorned with numerous popular labels

According to the official website, SinoTech was established in December 2003 and successfully listed on the Shenzhen Stock Exchange in 2012. It is a leading domestic digital economy technology empowerment platform based on financial technology solutions and data center solutions, focusing on core technology research and development in AGI, WEB3.0, digital yuan, and data elements, and dedicated to promoting the digital transformation of industries.

Nothing impresses investors more than impressive performance, but SinoTech has been able to remain hot in the market by leveraging popular concepts.

What's hot, do what's hot. Perhaps this is the most straightforward evaluation of SinoTech. As early as the heyday of internet finance, SinoTech entered the fields of internet finance and supply chain finance through acquisitions such as a 50% stake in Da Jin Suo and a 40% stake in Anliang Futures. A series of operations led to a significant surge in SinoTech's share price. However, with changes in fields like internet finance, SinoTech's once-proud businesses have now become burdens, leading to a continuous decline in performance.

But this has not deterred SinoTech from finding a path to wealth. Since last year, it has accelerated its layout in popular fields such as computing power and AI.

This year, SinoTech has deepened its technology research and development, taking "intelligence" as the core concept of its technology. It has invested in research and development in directions such as multi-scenario and multi-base large model engines and AI Agents, promoting the in-depth application of artificial intelligence technology in its main business and industry, and forming technical research and development achievements such as software copyrights. It has also implemented projects with customers such as CIB Digital Finance and a certain city commercial bank.

Based on integrated learning algorithms, the research and development of multi-scenario and multi-base large model engines can manage mainstream large model bases at home and abroad, automatically routing and scheduling the optimal large model based on industry and scenario requirements. SinoTech has established extensive contacts and cooperation with leading enterprises in the AI field both internationally and domestically, standing at the forefront of global AI development and maintaining technological leadership and business foresight.

At the same time, SinoTech closely monitors and follows the latest development trends of Web3.0 and the metaverse, developing multi-modal hyper-realistic digital humans, 2D/2.5D digital humans, AI digital humans, digital human content production engines, metaverse scene development tools, etc., and actively exploring the application of Web3.0 and metaverse technologies in the industry.

For example, in the e-commerce field, SinoTech can provide AI digital human live streaming, AI real-scene/video live streaming, and AI robot walking live streaming solutions, embedding vertical large models and multi-modal driving image models for e-commerce live streaming. It has provided AI digital human services for brands on mainstream e-commerce platforms and also launched local life content e-commerce solutions, serving merchants through AI tools such as intelligent scripting, intelligent montage, and intelligent material expansion. In addition, in the direction of text-to-video, SinoTech has reserves in technologies such as video character recognition, video generation, and real-time rendering, exploring applications in micro-short dramas and short videos.

Of course, this is only a microcosm of the popular labels on SinoTech. In fact, SinoTech's labels include AI concepts, digital currencies, the metaverse, blockchain technology, etc. For example, in the metaverse field, SinoTech has collaborated with Bank of Shanghai to create the market's first metaverse bank that can be roamed, interacted with, and traded – the Bank of Shanghai Metaverse Bank. It is reported that the Bank of Shanghai Metaverse Bank supports the creation of digital avatars belonging to customers, and its digital employees can provide all-day companion services to customers entering the space.

02

Driven by the "three-pronged approach," continuously consolidating the moat

Then why only SinoTech?

The answer to this question is simple. One can delve into the secrets behind it by studying the remarkable performance of AI.

First, user experience is king, and SinoTech understands this well.

As everyone knows, the continuous progress of AI technology and the continuous expansion of application scenarios have enabled many enterprises to apply it to improve efficiency, optimize management, and enhance user experience. SinoTech adheres to driving the development of the digital economy through innovation. With the continuous iteration of software and information technology, it has continuously expanded in fields such as software integration, big data, and artificial intelligence. For a long time, it has provided technology services such as financial technology and data centers for financial institutions, governments and public utilities, and enterprise customers. Due to certain differences and customization characteristics of customer needs, in addition to providing professional technology, comprehensive technology service capabilities are also required to ensure application implementation. SinoTech has established long-term and stable cooperative relationships with customers, winning their continuous trust, providing solid support for its continuous development and technological innovation, and maintaining high business continuity. This real demand-driven approach has made SinoTech more competitive in the capital market.

Secondly, data is power, and SinoTech is layout the computing power market.

Data shows that in the third quarter of 2024, the overall growth rate of the AI industry was as high as 30%, with particularly significant increases in AI applications in the financial and education sectors. Gradually, investors have realized that AI is not only at the forefront of technology but also a part of future business models that can transform the landscape of traditional industries, which undoubtedly stimulates the market's enthusiastic pursuit of related enterprises. Based on its business of data center integrated services, SinoTech has developed integrated computing power services, exploring services such as the construction of privatized computing power centers, the reconstruction of computing power centers, cloud computing power deployment, computing power optimization, and the maintenance of computing power centers, and has formed strategic cooperation with multiple smart computing centers in China.

Finally, talent is competitiveness, and SinoTech has improved its technical talent construction system.

To promote continuous innovation and development, SinoTech has formed and improved a complete, reasonable, and effective talent construction system in its operations and management, striving to create an environment where everyone is a striver. SinoTech focuses on the introduction of outstanding talents in the industry, continuously improving talent training and promotion mechanisms to enhance employees' diverse capabilities. In the cultivation of technical talents, SinoTech has also established a relatively complete research and development talent cultivation mechanism, providing opportunities for the growth of technical talents from multiple dimensions such as training and learning, practical guidance, and industry exchanges. Currently, SinoTech has a strong reserve of research and development talents, with technical talents accounting for more than 70% of the total. In recent years, the number of high-end technical talents has continued to grow. SinoTech has established AGI research and development centers in Beijing and Hangzhou, gathering outstanding talents in various directions such as large model algorithms, AIGC algorithms, NLP algorithms, speech algorithms, CV algorithms, and AI model engineering, which is conducive to enhancing its technological innovation capabilities, sustainable development capabilities, and comprehensive competitiveness.

With the support of popular concept stocks, what will be the future trend of SinoTech, and can its financial indicators improve? The market still needs to provide answers, and we will wait and see.