Kuaishou is looking for "spiritual sustenance" beyond e-commerce

![]() 11/25 2024

11/25 2024

![]() 436

436

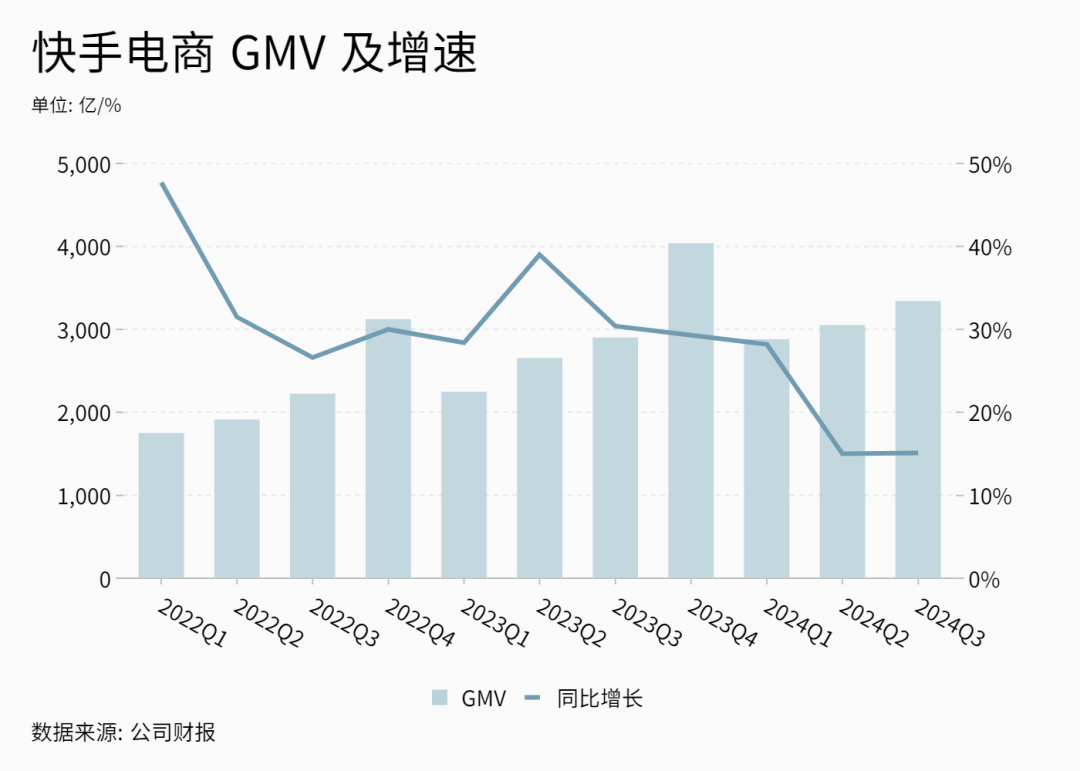

In recent years, the maturity of Kuaishou's commercialization has been assessed primarily through the performance of its e-commerce business. However, under the new circumstances, the perception that "e-commerce drives the overall business" may need some adjustment.

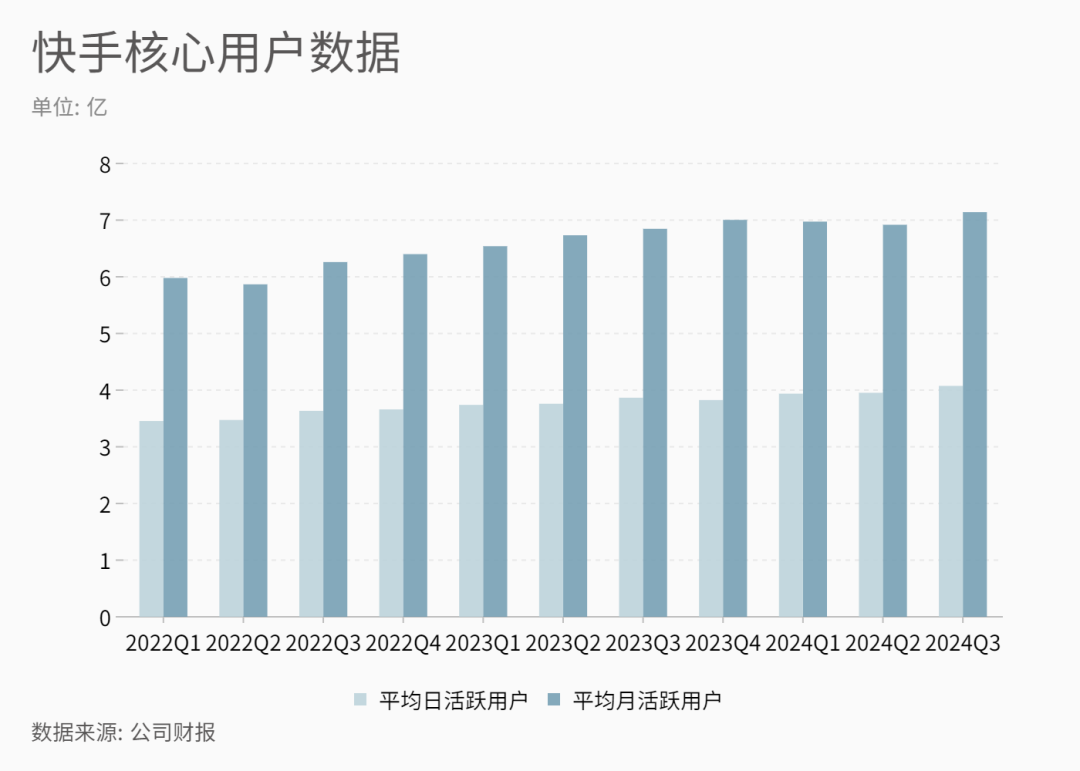

In Kuaishou's latest quarterly financial report, the most impressive and stable performance is the number of active users. The app has an average of 407.5 million daily active users (DAU), up 5.4% year-on-year, and 714.1 million monthly active users (MAU), up 4.3% year-on-year. This marks the first time Kuaishou's average DAU has exceeded 400 million.

New Standpoint Illustration

Currently, internet app traffic has entered a period of normalized growth slowdown. According to CNNIC, by the end of 2023, the number of online video users in China reached 1.067 billion, accounting for 97.7% of total internet users. Among them, short video users numbered 1.053 billion, accounting for 96.4% of total internet users.

With incremental growth becoming increasingly difficult and the red ocean market shrinking, the competition among platforms for user time has become a "zero-sum game." As a leading player in the industry, Kuaishou has been able to boost user data through a series of operational strategies (brand effects, technological capabilities, and content innovation) amidst increasing traffic concentration. However, this has also been accompanied by increased sales and marketing expenses.

The just-concluded Q3 covered the Paris Olympics, during which Kuaishou demonstrated proficiency in operating sports IPs. By combining licensed broadcasts with self-produced content and interactive gameplay, Kuaishou achieved 310.6 billion exposures for related content during the Olympics, effectively boosting traffic. To increase usage frequency, the platform has also optimized mechanisms such as content mixing and traffic distribution. In Q3, Kuaishou's DAU spent an average of 132.2 minutes on the app daily, with total user engagement time increasing by 7.3% year-on-year.

Leveraging abundant traffic and live streaming for e-commerce, Kuaishou drives internal advertising growth, forming a logical chain for its commercialization. However, a loosening in this chain is evident as e-commerce growth begins to slow, and the previously intertwined advertising business seeks more "external assistance." While Kuaishou's leading position in the industry has delayed the impact of peak traffic, the pressure to efficiently monetize is undeniable. We have also seen the platform increasingly adopt AI as a solution to improve efficiency.

Once considered the ceiling for internet monetization, the e-commerce business may no longer provide a "lifeline" for traffic platforms.

01. Binding and Unbinding

In 2021, Kuaishou defined the concept of "internal advertising cycle," referring to advertisements placed by live streaming merchants and anchors within the platform, creating a closed loop for traffic exposure and product diversion. At that time, Kuaishou's pillar business of live streaming rewards was declining, while Douyin (TikTok's Chinese version) had already successfully implemented the live e-commerce model.

According to a 2022 report by LatePost, in the first quarter of that year, over one-third of advertising revenues for both Kuaishou and Douyin came from "internal advertising cycles." As a result, ByteDance's advertising revenue became the highest in China, while Kuaishou's advertising revenue was only a quarter less than Baidu's. In Q1 2021, advertising revenue contributed by Kuaishou's internal cycle accounted for less than 25%, but this proportion exceeded 35% a year later.

New Standpoint Illustration

The growth of internal advertising is highly correlated with e-commerce GMV revenue. However, in Q2 this year, Kuaishou's e-commerce GMV growth rate fell below 20%, and in Q3, it increased by 15.1% year-on-year, remaining flat from Q2.

Against the backdrop of slowing social retail sales growth and a gradual recovery in consumer demand, e-commerce platforms have intensified competition. Since last year, the two major "factions" of e-commerce have delved deeper into each other's territories, with shelf e-commerce enhancing content creation and content e-commerce exploring pan-shelf transformations. In Q3, Kuaishou's pan-shelf GMV accounted for 27% of its total e-commerce GMV.

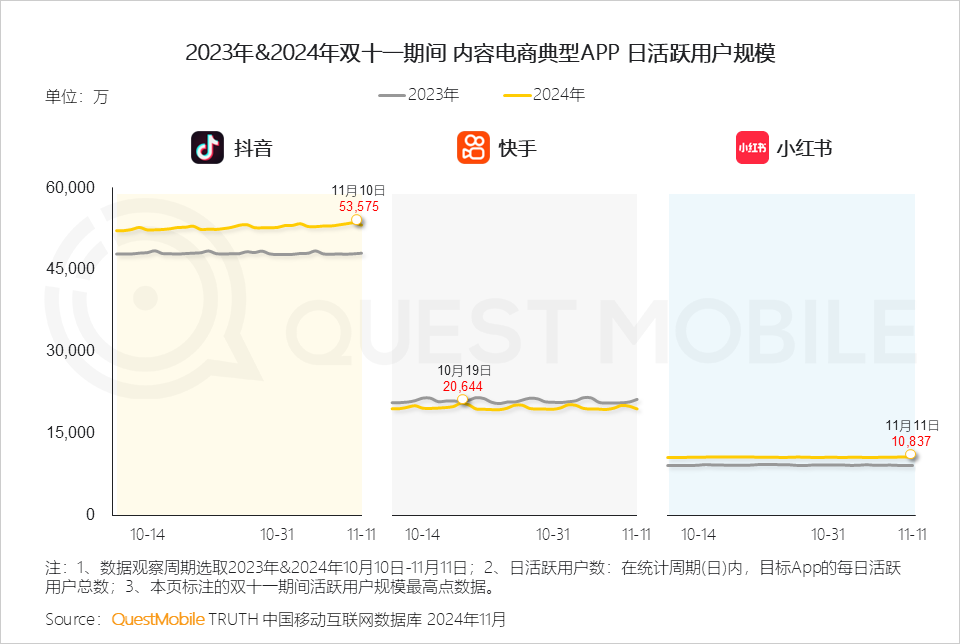

Considering Q3 is typically a slow season for e-commerce, we will continue to monitor performance in Q4, which covers major sales periods. However, according to QuestMobile's "2024 Double 11 Insight Report," the trend of integration continues, with content e-commerce platforms deeply participating in promotions through "live streaming + shelf" models, while comprehensive e-commerce platforms respond by increasing support for live streaming.

Source: QuestMobile

On the other hand, external advertising revenue has become increasingly prominent in recent quarters' financial reports. In Q3, Kuaishou's online marketing services revenue reached 17.6 billion yuan, up 20% year-on-year. Given that the growth rate of internal advertising usually aligns with that of e-commerce GMV, the pulling effect of external advertising is evident.

The financial report highlights two key factors: one is efficiency optimization through tool enhancements, with differentiated Universal Auto X (UAX, a fully automated bidding solution) provided for different industries and scenarios, enhancing the stability of customer marketing investments. Official data shows that the total marketing consumption of fully automated bidding solutions accounted for 50% of the overall marketing consumption of external marketing customers during the quarter.

The other factor is short dramas. According to iResearch Consulting, over 90% of advertisers chose short video/live streaming platforms for advertising in 2023, and over 90% expect to increase their budgets for such platforms in 2024. As a new form of marketing primarily reliant on short videos, short dramas have relatively ample marketing budgets. Kuaishou has a first-mover advantage in the short drama industry but has been exploring its business model.

However, as the industry matures, the previously dominant IAP (In-App Purchase) model is gradually transitioning to a dual focus on IAP and IAA (In-App Advertisement). The upper limit of IAP lies with the consumer end, and due to the relatively weak content payment awareness of domestic short video users, the B-end-related IAA model is more acceptable, unlocking more commercial value from free content. Kuaishou also mentioned in its financial report that it successfully implemented the IAA short drama model during the quarter, resulting in a year-on-year increase of over 300% in short drama marketing consumption.

The growth of external advertising has been laying the groundwork for several quarters and has played a balancing role amidst the slowing growth of e-commerce. As the popularity of one commercialization "star" wanes, Kuaishou is pushing another "star" onto the main stage.

02. All Eyes on AI?

As an efficiency tool, AI has become an alternative standard configuration for internet companies, but different enterprises have varying positions on it.

Integrating AI into its core business, e-commerce platforms commonly use it to streamline operations, enhance efficiency, and optimize resource allocation. Consumers can perceive changes mainly in the fulfillment of personalized needs, such as recommending products based on browsing history and purchase records or developing AI tools based on question-and-answer interactions to address ambiguous user needs. Taobao's "Ask Taobao," tested in September last year, falls into this category.

AI has a broader application on the merchant side. Part of the infrastructure of e-commerce platforms is to provide operational support for merchants. However, due to the complexity of the mechanisms, many small and medium-sized merchants outsource this work to third-party operators. AI can automate some processes, such as content generation, logistics optimization, and data management, lowering thresholds and costs simultaneously. The QuestMobile Double 11 report also shows that typical e-commerce platforms almost always provide AI support in marketing to reduce costs.

Source: QuestMobile

For platforms like Douyin, which entered the e-commerce business through content, AI can also reach the levels of content supply and traffic operation. For example, the independent AI app Doubao expands the enterprise's traffic window. Or Jianying, led by the former CEO, explores using AI to aid creation, aiming for a productivity revolution.

In short, platforms with core businesses similar to Kuaishou have all tried to make AI a growth engine. Alibaba's domestic and international e-commerce business groups established complete AI teams last year. Doubao currently leads in downloads and DAU and attempts to replicate the traffic growth path of super apps.

At the World Internet Conference, which opened on November 20, Yang Yuanxi, co-founder of Kuaishou Technology, mentioned that AI can create new formats, scenarios, and models by connecting content with commerce, supply with demand, and users with communities. Since 2023, Kuaishou has successively launched the Kuaiyi large language model, recommendation large model, and video generation large model KeLing, applying similar ideas to focus on content ecology and intelligent operations.

However, as a relatively latecomer with a need to present a new vision to the market, Kuaishou needs to arm its most distinctive business with AI to make further progress. At this point, short dramas may be the most suitable vehicle.

In February this year, Sora directed the focus of the AI video generation field. In June, Kuaishou launched its video generation large model "KeLing," featuring text-to-video, image-to-video, and video continuation functions.

In July, China's first AIGC original fantasy micro-drama "The Miraculous Seas and Mountains: Breaking Waves" was exclusively launched on Kuaishou, with all scenes generated by AI, supported by KeLing. In September, Kuaishou announced the launch of the "KeLing AI" Movie Co-Creation Plan, collaborating with nine renowned directors, including Li Shaohong, Jia Ke, and Ye Jintian, to produce nine AIGC short films, all generated by AI.

Combining the previous information, the IAA model for short dramas is basically viable, with free content earning revenue through mid-roll ads. The platform now needs to enrich its content library, and using AI generation to increase production seems to fill this gap. However, there are two variables.

Content quality is one concern. Currently, there are not many AI short dramas available to gauge market evaluation. More crucially, there is the issue of cost. Using Sora as a reference, under certain conditions, the training computing power demand of Sora is 4.5 times that of GPT-4, and the inference computing power demand is nearly 400 times that of GPT-4. Large-scale AI generation of short dramas is often driven by cost reduction considerations, but realizing this plan requires technological advancements.

02. Final Thoughts

How to effectively leverage AI video generation seems to be a question Kuaishou is also waiting for "crowd wisdom" to answer.

According to official data, since its launch in June this year, "KeLing AI" has over 5 million users, generating over 51 million videos and exceeding 150 million views in total. Recently, Kuaishou launched the independent "KeLing AI" app and gradually improved its membership payment system. As a UGC-based content platform, Kuaishou opens tools to users, waiting for the community to naturally generate its content and even culture, echoing Kuaishou's original "startup story."

The internet has long considered e-commerce the ceiling for monetization because it is closer to direct economic transactions compared to models like advertising and value-added services. Coupled with the traffic dividend of short videos, content e-commerce can take shortcuts in monetization rates. When growth encounters bottlenecks and the dividend is depleted, timely introduction of new technologies and stories can serve as new stimuli.

However, as a platform essentially driven by traffic, the best position for AI in Kuaishou may also be as a "golden support," expanding the upper limits of businesses like e-commerce and short dramas, provided that these businesses have a solid foundation and adaptability.

*Images and illustrations in the article are sourced from the internet.