Young people who ride at night in Kaifeng have never suffered from not getting their deposits back

![]() 11/25 2024

11/25 2024

![]() 473

473

In the Baidu Post Bar for ofo yellow bikes, some netizens have been recording their deposit refund progress since May 2019. The first screenshot they posted from the ofo yellow bike client shows, "You are currently in line number 15,968,143." By the end of October 2019, the last screenshot posted by this user showed, "You are currently in line number 15,219,390."

Cover Source: Unsplash

While Zhengzhou university students ride shared bikes over 50 kilometers, spending four to five hours heading east, shouting the slogan "Youth has no price, bikes take you straight to Kaifeng," Wang Xue is constantly refreshing the ofo shared bike mini-program, studying the refund policy, and hoping that the next second Alipay will pop up a "+199" income notification.

Since ofo was founded in 2014, marking the first boom in the sharing economy, this year marks the 10th anniversary of the emergence of shared bikes. Every morning at 8 a.m., when stepping out of the subway station, Wang Xue scans a Hello Bike on time and rushes to the company. She has yet to find a replacement mode of transportation. As one of the 16 million people who have been waiting for a deposit refund since 2018, she is still in an endless queue.

During her student days, she found the yellow bikes very appealing, and she was also proactive in applying for a refund after ofo's collapse. At that time, she would periodically check the online refund progress to see if it was her turn. However, after graduation and changing phones, logging in became inconvenient, and over time, she almost forgot about it. But whenever she sees ofo-related news, she still feels cheated, like being harvested as scallions while others benefit.

In the six years since the yellow bikes were forgotten by the world, there has been a group of people who have never forgotten.

In the Baidu Post Bar for ofo yellow bikes, some netizens have been recording their deposit refund progress since May 2019. The first screenshot they posted from the ofo yellow bike client shows, "You are currently in line number 15,968,143." By the end of October 2019, the last screenshot posted by this user showed, "You are currently in line number 15,219,390."

On Xiaohongshu, users who call themselves "ofo's big victims" share their experiences with deposit refunds. "They've run away for six years, the deposit hasn't been refunded, and the refund entry is closed," "The queue number hasn't moved in a year, and the refund seems like it will never come..."

In the world of shared bikes, the relationship between ofo and its users is like that between cats and mice, or Pleasant Goat and Big Big Wolf. Every time, they feel like they are almost getting their deposit back, but in the end, the other side always manages to escape at the last minute.

When Wang Xue chats with friends who are also ofo users, she complains, "Time is indeed the only cure. Some things are forgotten as they drag on. When I look again, the app has been removed. People waiting for refunds line up from China to France. No one will keep waiting for a refund forever, but there are always people on the road to getting their deposits back."

Ofo's "cold violence" was not sudden. In December 2022, the topic "#Tmall demands 500 million yuan in arrears from ofo and Dai Wei#" trended on social media, but ultimately, Tmall failed. Seeing that even large companies couldn't compete with ofo, let alone the "tightening spell" of 199 yuan, Wang Xue gradually lost hope.

At the beginning of 2023, Wang Xue discovered that the ofo yellow bike client could no longer receive SMS verification codes and could not log in normally. The "ofo Yellow Bike" WeChat mini-program could still be logged into, but the mini-program only had two options: "My Wallet" and "Deposit-Free," and did not open a deposit refund entry.

Anxious, she immediately called the ofo official customer hotline, but was prompted that "this number is temporarily not in service." The office phone provided on the ofo official website was also unreachable. Friends in the industry told her that this situation usually meant that the server had been completely shut down or temporarily shut down due to issues, but the latter was unlikely.

When ofo became an unforgettable white moon that "haunts" people during festivals, causing discomfort, Wang Xue, who had already let go of her obsession, only hoped that her grandchildren would receive a "time deposit" of 199 yuan from afar when they come of age.

1

"Pinduoduo"-style deposit refund

No one knows where ofo has gone; it disappeared even faster than it appeared. Since June 2021, when ofo-related companies were listed as execution debtors by the court, and it was discovered during the trial process that "the company had no property available for execution," signs of a golden Cicada shell escape had already begun to appear.

Since the second half of 2021, ofo-related companies have been cancellation in succession, including Qingdao Bykelock Technology Co., Ltd., Shanghai Bykelock Network Technology Co., Ltd., Shenzhen Branch of Beijing Bykelock Technology Co., Ltd., Dongxia Datong (Beijing) Management Consulting Co., Ltd. Jinan Branch, etc.

That year, ofo even introduced a feature to refund deposits by inviting friends. The task description for "Invite Friends to Help Refund Deposits" read: "The more friends, the faster the refund, with no cap." In addition, there were also tasks such as friend order rewards and special 10-yuan recharges, with the description "Refund 2.5 yuan immediately upon successful recharge." Netizens jokingly called it the "Pinduoduo-style deposit refund," with one wave of users being exploited by another, always telling them, "You're almost done refunding all your deposits."

Prior to this, after the ofo shared bike function was phased out, the APP had several entries listed side by side: "View Deposit," "JD Special Area," "9.9 Special Price," "Deer Mall," and "VIPS Special Area." It even introduced a "I Want to Borrow Money" feature to direct traffic to multiple third-party installment online lending platforms. Refunds could only be withdrawn after users jumped to third-party platforms to shop through the ofo refund platform, somewhat giving the impression of using deposits as leverage and giving up hope.

Ofo is gone, but creditors are still waiting downstairs.

Earlier this year, familiar names reappeared in court announcements. Ofo-related companies Dongxia Datong (Beijing) Management Consulting Co., Ltd. and Beijing Bykelock Technology Co., Ltd. added another entry for execution debtors, with an execution target of over 16.86 million yuan, tracing back to 2017.

The plaintiff, Wisdom Valley Company, produced a total of 140,000 shared bikes for the purchaser Dongxia Datong at a total price of 52.2 million yuan. Currently, more than 16.86 million yuan remains unpaid.

However, for the current ofo, this newly added execution information is just a number.

Ofo has 458 judicial disputes involving its related enterprise Dongxia Datong alone, with a history of 352 entries for execution debtors. Currently, the company's cumulative total execution amount exceeds 1.6 billion yuan. According to high-risk information on the Qichacha App, "This company is a discredited company publicized by the Supreme People's Court."

At this point, ofo has embarked on an unusual path of "deadbeat behavior."

Industry insiders have calculated that as of now, ofo yellow bikes still owe deposits to at least 16 million people. If calculated at 99 yuan per person, the outstanding deposit amount is at least 1.58 billion yuan.

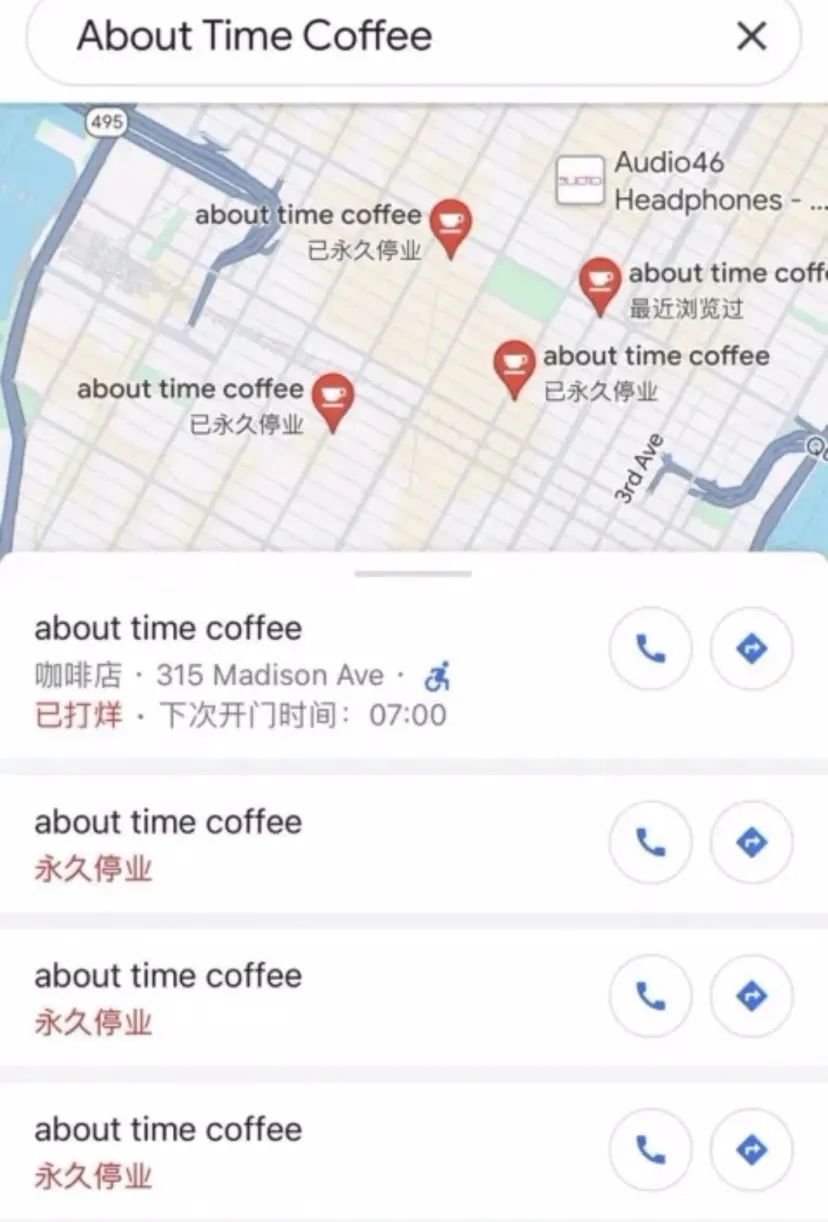

However, after leaving behind a pile of dissolved companies and receiving over 40 consumption restriction orders, founder Dai Wei's entrepreneurial dream is not yet extinguished. According to China Entrepreneur magazine, in the first half of 2023, ofo founder Dai Wei opened a coffee shop in the United States called About Time Coffee, specializing in canned coffee, with five chain stores in bustling areas of the country. The project is said to have received over 10 million dollars in funding.

Relying on a bit of traffic from ofo, Dai Wei has not yet given up. But he has never been able to break out of the time cycle of "entrepreneurship - financing - bankruptcy." Currently, all About Time stores are marked as "Permanently Closed." The last tweet on the About Time Coffee INS account was in September, and there are still netizens commenting, "Refund my deposit."

Dai Wei, who once shouted, "One day, our ofo today will impact the world like Google," has finally become a passerby in the entrepreneurial universe.

2

Why did ofo fail?

If "Approaching Science" were still on the air, the mystery of ofo's exit from the historical stage would surely rank among the world's unsolved puzzles alongside the Loch Ness Monster and UFOs.

To solve such a puzzle with detective thinking often requires returning to the crime scene and reconstructing the "entrepreneurial motives" of the founders through reasoning.

The birth of ofo yellow bikes naturally had a campus startup vibe. Its predecessor was a sharing initiative launched by Dai Wei at Peking University. To this day, sharing project proposals have become a formula for various innovation and entrepreneurship competitions, but back then, they were undoubtedly the "star center" position.

In 2015, Dai Wei recycled bikes from students as shared bikes, announcing plans to launch 10,000 shared bikes at Peking University and recruit 2,000 shared bike owners from among the faculty and students. This entrepreneurial project was quickly recognized by the market. By October of the same year, ofo had an average of 4,000 daily orders on the Peking University campus and received its first round of funding of up to 9 million yuan.

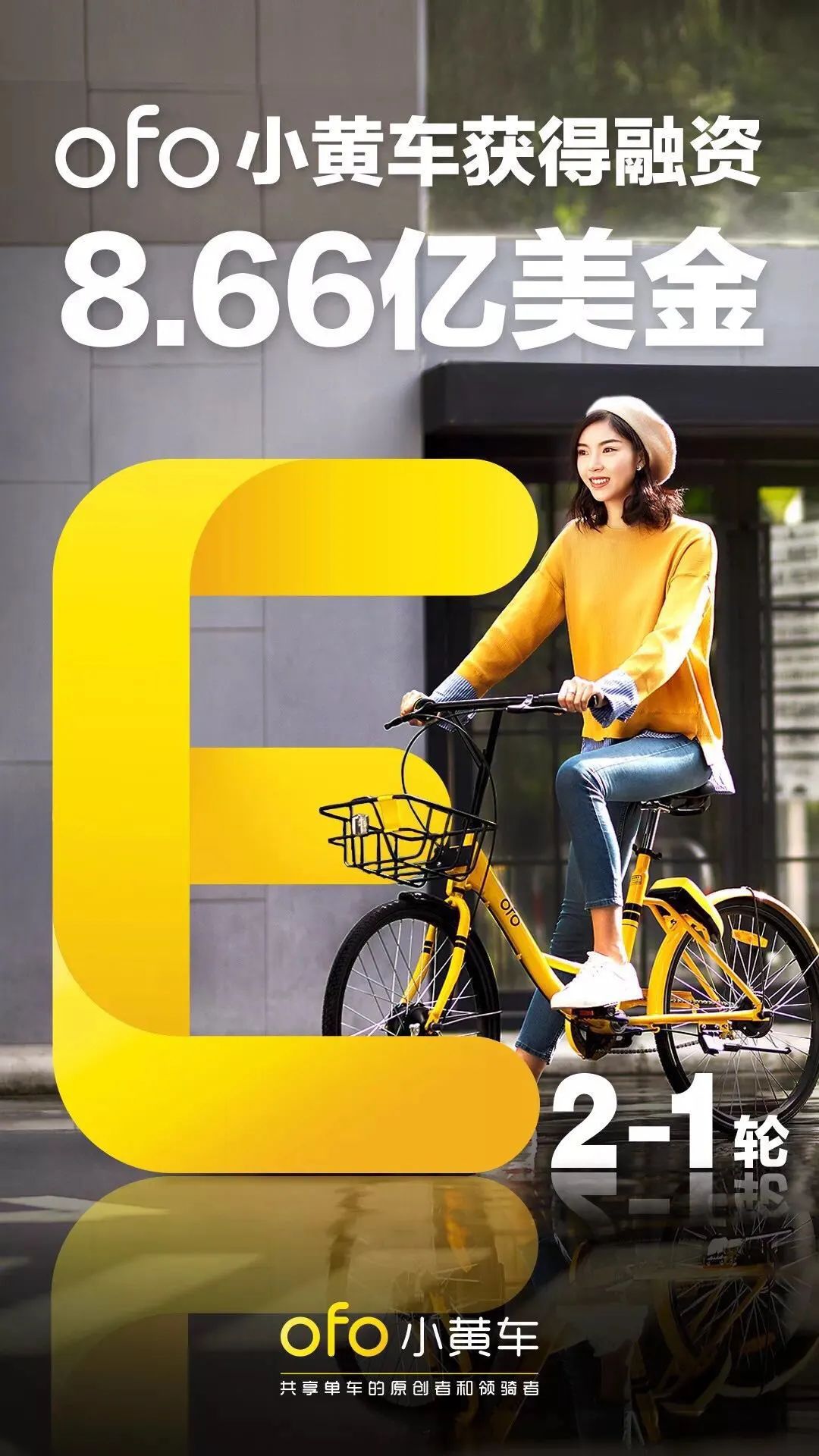

Subsequently, this campus startup project underwent continuous transformation and quickly entered the vision of more investors. In January 2016, ofo received investment from Zhu Xiaohu and GSR Ventures and gradually gained popularity in the market as "the next Didi." In October of the same year, ofo left the campus and began facing the more complex urban scenarios of later maintenance. At the same time, ofo underwent five rounds of funding in just one year, with the total funding amount exceeding 200 million dollars at that time.

It is not difficult to see that ofo, lacking a core competitive product, took the path of "burning money + expansion," and they had the capital to go head-to-head. Confronting Mobike and Hello Bike head-on, as the first person to eat the crab, ofo walked with pride and strength all the way.

At that time, if placed in the popular movie "Victory Assured," Dai Wei might have been portrayed as the character "Bai Sheng." What he lacked the most was confidence. After the early bike tour project received an angel investment of 1 million yuan from Weile Capital, Dai Wei began playing the game of burning subsidies, and it didn't take long for the 1 million yuan to be burned up.

Both relied on coupons to retain users. Didi survived because car owners always control the ownership of the cars, just like Huang Yimei's famous quote, "Cars belong completely and absolutely to themselves." However, ofo needed to manage and maintain a large number of shared bikes scattered around the city. In the absence of users willing to actively share, ofo had to choose to purchase and manage the bikes themselves.

Moreover, shared bikes are different from online car-hailing. The driving threshold is low, and the resources required are lightweight. For the platform, having fewer drivers means one less resource that constitutes a core competitive barrier.

At the end of 2016, ofo initiated a nationwide frenzy of expansion and subsidies, announcing its rapid entry into 11 cities in 10 days at a rate of "one city per day." After the 2017 Spring Festival, ofo planned to increase the number of covered cities to over 100.

Since then, ofo has had to purchase 3 to 4 million bikes per month, worth about 300 million dollars; the headquarters rapidly expanded to 3,700 people, and human resources expenditure combined with national operation and maintenance—at that time, ofo could burn through the valuation of a unicorn in just over three months.

The Shared Bike Data Report "Interpreting Mobike and ofo Users and the Future" released by Tencent Penguin Intelligence in March 2017 showed that the proportion of ofo users reporting bike malfunctions was significantly higher than that of Mobike users, reaching 39.3%. However, at the cooperation launch event with Fuda in April of the same year, Dai Wei still said, "The speed of manufacturing bikes cannot be slower than the speed of scrapping bikes. This is the key to reducing the damage rate."

On one side are a large number of scrapped bikes, and on the other side is the pressure to continuously manufacture new bikes. Ofo, caught between these two forces, is like a tightly stretched rope in a tug-of-war. No matter how tough it is, there will come a day when it breaks.

From shared bikes to shared power banks and shared umbrellas, the sharing economy was born with a more social attribute. It is a reuse of idle resources, concentrating social idle resources and demands on a platform through the internet and using digital matching to allow demanders to obtain paid use rights for idle resources.

Industry insiders analyze that if it is to be transformed into a business logic with revenue as the starting point, it requires a more rigorous and complete business design, coupled with a more scientific governance approach, to improve efficiency in terms of technology research and development and resource allocation. Rapid expansion and rapid capital absorption before a mature business model is clear is the essential reason why ofo has increasingly deviated from its original form.

Zeng Qiang, the founder of Summitview Capital, has a different evaluation: "There is nothing wrong with ofo's business model or its timing. The positive social energy it generated in the early stages was also not a problem. Its problem was that it placed too many competitors among its shareholders during the early stages of financing, laying the groundwork for a losing situation where competitors controlled the situation."

But regardless of whether ofo's business model had issues or why it increasingly deviated from its course, the end of the story has already fallen. After ofo refused to merge with Mobike, the latter was absorbed by Meituan, while Alibaba and Didi, once ofo's biggest supporters, invested in Hello Bike and launched their own bike-sharing brand, Qingju, respectively. Today, Mobike founder Li Bin is fully committed to the automotive brand NIO, and the former "bike-sharing trio" seems to have become a thing of the past.

In 2017, many shared bike companies had already dropped out one after another: Wukong Bike, 3Vbike, Xiaoming Bike, Xiaolan Bike, and Xiaobai Bike, which sparked a bit of excitement due to investment from Xiaomi ecosystem enterprise QiJi in late 2016, became "names etched in the hearts" of users along with ofo.

3

Shared bikes eventually return to big companies

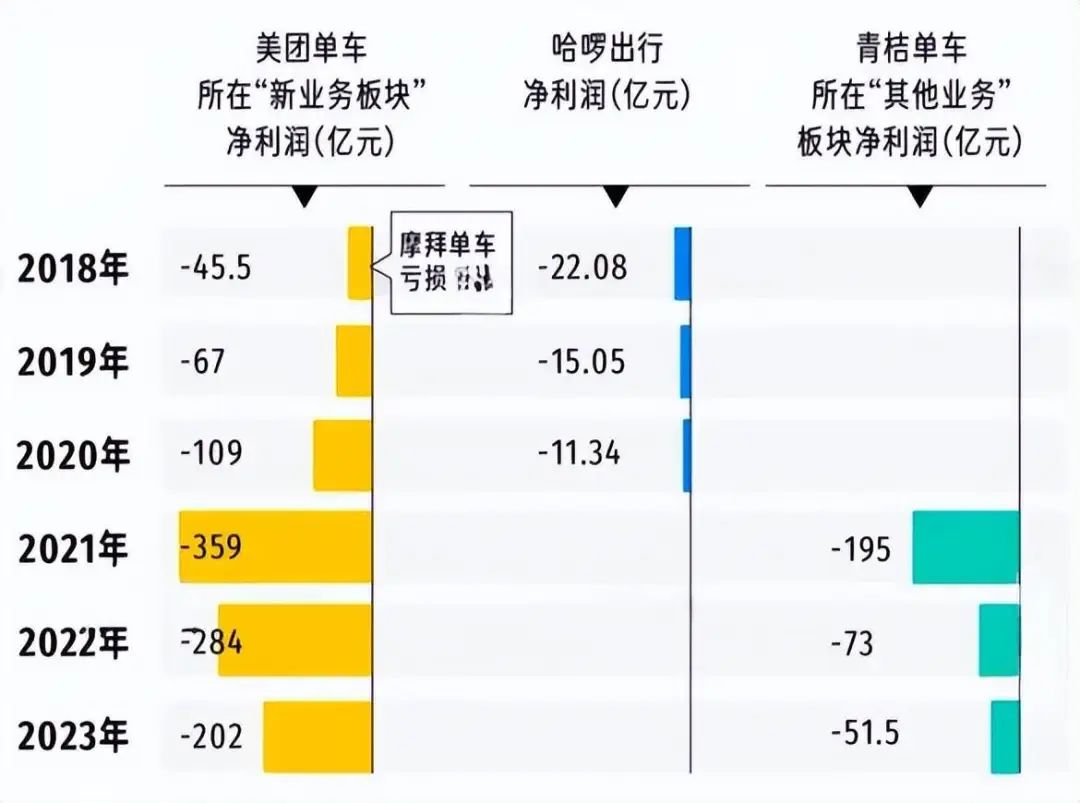

Didi incubated Qingju Bike, Mobike changed its name to Meituan Bike, and Hello Bike, which has long been prefixed with the "Alibaba system" in the market, rely on the stronger ecosystems and more substantial capital of their respective parent companies and have already secured their places at the table.

In the post-shared bike era, a tripartite confrontation has emerged among Meituan Bike, Didi Qingju, and Hello Bike. Their commonality is that they rely on abundant online traffic entry points. Opening Alipay or WeChat's scan function can quickly unlock a shared bike without the need to download an additional app, making the path very enticing.",

In addition to business losses, bike-sharing companies' reputation has been declining. If you see bike-sharing trending on Weibo, clicking in will most likely be related to money. Whether it's previous deposit issues or repeated price hikes, they have been heavily criticized by users.

Starting in January 2022, Hello Bike took the lead in raising the price of its 7-day riding package to 15 yuan and the 30-day package to 35 yuan. In August, Meituan announced that the undiscounted prices for its 7-day, 30-day, and 90-day riding cards would be adjusted to 15 yuan, 35 yuan, and 90 yuan, respectively. Since then, the annual bike rental fee has reached 420 yuan, and compared to the cost of users purchasing their own bicycles, the attractive pricing power is no longer present.

Although when announcing the price increase, both Meituan and Hello Bike had already explained the reasons: increased hardware and maintenance costs. Users still felt "betrayed," refused to pay the fee, and voted with their feet.

Now, like all industries adopting heavy-asset operating models, bike-sharing companies face two choices: lightening their heavy assets; or if that is difficult, attempting more refined operations.

Without engaging in price wars or reputation battles, bike-sharing companies still have aces up their sleeves. In its early days, Hello Bike had a relatively simple business model, but after careful operation, it gradually expanded into new businesses with its large user base. In 2018, Hello Bike upgraded to Hello Mobility, and with the launch of Hello Bike Assist, Hello Ridesharing, Hello Battery Swap, Hello E-bike, Hello Ride Hailing, hotel reservations, and other services, Hello Bike hopes to transform from a bike-sharing company to a mobile mobility platform.

Meituan has also integrated bike-sharing into its lifestyle ecosystem, serving as a complementary transportation option alongside food delivery, grocery shopping, pharmacy services, and travel.

As a bike-sharing brand that rapidly rose to prominence leveraging Didi's traffic pool, Qingju's role is to enhance Didi's transportation capabilities. Didi relies on it to attract and cultivate users, then direct them to its ride-hailing business, while also improving Didi's "one-stop diversified mobility platform."

The bike-sharing industry is no longer competing for market share through massive capital injection and aggressive market expansion, but has shifted to a more rational and regulated business model. After a decade, the ebb and flow of the tide have witnessed the rise and fall of different companies, but there is still no definitive answer as to whether bike-sharing is a good business model.

Rather than getting caught up in a three-way standoff, it might be better to think outside the box. Perhaps, as the saying goes among CBD white-collar workers, "Early-morning workers don't deserve the right to choose bike-sharing." Whether it's yellow, green, or blue bikes, users don't care about a few cents' difference; they simply scan whatever is available. So relax, and leave the answer to time.