Can Pinduoduo withdraw gracefully? Can it succeed?

![]() 11/26 2024

11/26 2024

![]() 514

514

Has Pinduoduo's financial report 'blown up' again?

On November 21, after Pinduoduo released its third-quarter financial report, U.S. stocks opened sharply lower and ultimately closed down 10.64%.

The sharp drop in stock price is related to Pinduoduo's performance falling short of expectations this time. Whether it is revenue or profit, the results delivered by Pinduoduo this time have a certain gap with outside expectations. According to a UBS report, Pinduoduo's revenue growth rate is 3% lower than expected, and its adjusted profit is 7% lower than expected.

Moreover, this is not the first time that Pinduoduo's growth has fallen short of expectations. After the release of the previous quarter's financial report, Pinduoduo's stock price plummeted due to revenue growth falling short of expectations, with intraday declines exceeding 30% at one point.

Is Pinduoduo no longer viable? Is this former 'star of Chinese stocks' falling? Let's take a closer look to see if Pinduoduo is truly in trouble or being underestimated.

01 Growth has slowed, but it's still the fastest

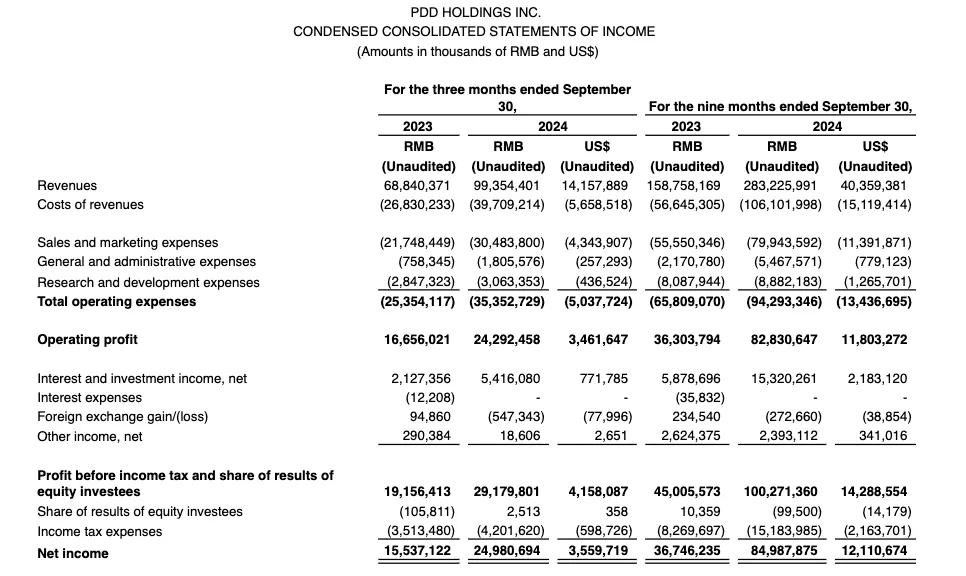

According to the financial report, during Q3, Pinduoduo's revenue was 99.354 billion yuan, a year-on-year increase of 44%, and its net profit attributable to shareholders was 24.981 billion yuan, a year-on-year increase of 61%.

Revenue growth exceeding 40% and net profit growth exceeding 60% have indeed slowed down compared to Pinduoduo's previous triple-digit growth rates.

In terms of revenue growth, Pinduoduo's growth rates were 123% and 131% in Q4 of last year and Q1 of this year, respectively, slowing down to 85.7% in Q2. In terms of net profit growth, the growth rates were 146%, 246%, and 144% in Q4 of last year and Q1 and Q2 of this year, respectively.

Compared to these figures, Pinduoduo's growth has indeed slowed down. Previously, Pinduoduo executives also stated directly at the financial report meeting that "Pinduoduo's high-income growth is unsustainable."

This statement is in line with market laws. No industry or company can maintain high-speed growth indefinitely. Moreover, in comparison, Pinduoduo is still a frontrunner.

It should be noted that Taobao and JD.com, the other two major domestic e-commerce giants, are still experiencing single-digit revenue growth.

During Q3 of this year, Alibaba's Taobao platform generated revenue of 99 billion yuan, a slight year-on-year increase of 1%. In the previous quarter, Taobao Group even experienced a 1% decline.

JD.com's Q3 revenue was 260.4 billion yuan, a year-on-year increase of 5.1%, while Q2 revenue was 291.4 billion yuan, a year-on-year increase of only 1.2%.

In terms of profitability, Taobao Group's adjusted EBITA was 44.6 billion yuan, a year-on-year decrease of 5%. JD.com's net profit attributable to shareholders this quarter was 11.7 billion yuan, a year-on-year increase of 47.8%, due to cost control and product structure optimization to increase gross profit margins. However, this growth rate did not exceed that of Pinduoduo.

Regarding cross-border e-commerce, Pinduoduo did not separately disclose revenue and profit data for Temu. However, according to media reports, Temu's GMV reached $20 billion in the first half of the year, exceeding last year's annual level.

According to a Bernstein analysis report, Temu's global gross merchandise volume (GMV) is expected to reach $54 billion in 2024 and is expected to achieve global profitability in 2024.

Compared to Alibaba's cross-border e-commerce business, during the third quarter, Alibaba's international revenue increased by 29% year-on-year to 31.672 billion yuan; adjusted EBITA was a loss of 2.905 billion yuan, compared to a loss of 384 million yuan in the same period last year, mainly due to increased investments in AliExpress and Trendyol cross-border businesses, which are still in the early investment stage.

According to Amazon's disclosure, revenue from its e-commerce retail business was $61.411 billion in the third quarter, a year-on-year increase of 7%. Amazon stated that it faces fierce competition from discount retailers such as Shein and Temu.

These data comparisons also show that Temu's development cannot be underestimated.

In summary, although some parts of Pinduoduo's financial report data this time fell short of expectations, Pinduoduo's double-digit growth rate during Q3 is very impressive, whether compared to domestic e-commerce giants or overseas leading players.

After the release of the Q3 financial report, a relevant research report from Goldman Sachs believed that Pinduoduo is one of the undervalued stocks in China. Goldman Sachs has raised its target price for Pinduoduo from $169 to $172.

02 Missed some opportunities, but still the 'efficiency king'

Regarding the growth falling short of expectations in the third quarter, Chen Lei, Chairman and Co-CEO of Pinduoduo, stated at the financial report meeting that the reason was due to increased competition in the e-commerce sector and various business challenges.

Pinduoduo mentioned that as peers significantly increased their marketing expenses, Pinduoduo also increased its marketing expenses. The marketing expenses for Q3 were 30.484 billion yuan, a year-on-year increase of 40%.

At the same time, Pinduoduo increased its investment in ecosystem construction and successively launched several major initiatives such as the 'Billion Reduction and Exemption', 'E-commerce Westward Expansion', and 'New-quality Merchant Support Plan'. These initiatives promoted cost reduction and revenue increase for merchants through cash refunds, exemptions, and other means. Among them, Pinduoduo invested 1 billion yuan in subsidies and 2 billion yuan in traffic resources solely for supporting new-quality merchants.

These investments can be said to have directly led to Pinduoduo's growth falling short of expectations. From the financial report, Pinduoduo's revenue mainly comes from commission income and advertising income. According to Dolphin Investment Research and Analysis, during Q3, Pinduoduo's advertising income was basically the same as expected, while commission income was 3 billion yuan less than expected, which was the main reason for the revenue growth falling short of expectations this time.

Dolphin Investment Research and Analysis pointed out that Pinduoduo's subsidies to merchants, such as partially reducing technology service fees, returning commissions in certain cases for returned goods, and lowering merchant deposits, may indeed have led the market to underestimate the impact of these exemptions and return policies on commission income.

In addition, Zhao Jiazhen, Co-CEO of Pinduoduo, bluntly stated that the team's own factors also led to missed macro opportunities. This year, macro policies that have had a significant driving effect on some industries and consumers were not fully leveraged due to the team's limitations in historical capabilities related to third-party platform operations, resulting in significantly higher costs for channel platforms to maintain the competitiveness of the same products compared to other peers.

In contrast, under the 'trade-in' policy, JD.com's 'electronics and household appliances' category generated revenue of 122.56 billion yuan, a year-on-year increase of 2.7%, reversing the embarrassing situation of a 4.6% year-on-year decline in the previous quarter.

Due to the 'Double 11' shopping festival combined with the trade-in policy on the Tmall platform, 589 brands achieved sales of over 100 million yuan during the entire 'Double 11' period, a 46.5% increase from last year, setting a new record. Among them, 45 brands such as Haier, Midea, and Xiaomi exceeded sales of 1 billion yuan.

Zhao Jiazhen pointed out that due to missed macro opportunities, the gradual aging of the team, historical experience limitations, and insufficient capabilities, the team's disadvantages compared to peers will be significant for some time, which will inevitably affect Pinduoduo's current and future profitability.

However, it is undeniable that Pinduoduo's organizational efficiency is still very impressive among a host of Internet giants.

Taking Q3 as an example, based on the revenue generated per employee, although Pinduoduo has not disclosed the latest employee size, the number of employees was 17,400 at the end of last year, with Q3 revenue of 99.354 billion yuan, resulting in a per-employee output value of 5.71 million yuan.

At Alibaba in Q3, the number of employees was 198,000, with revenue of 260.348 billion yuan, resulting in a per-employee output value of 1.3149 million yuan; at Tencent in Q3, the number of employees was 108,800, with revenue of 487.811 billion yuan, resulting in a per-employee output value of 4.4836 million yuan.

Due to the large number of delivery personnel, JD.com's employee count has increased more than tenfold in ten years, reaching 620,000, with revenue of 260.386 billion yuan, resulting in a per-employee output value of only about 420,000 yuan.

From this perspective, the current Pinduoduo can still be called the 'efficiency king'.

03 Speed does not represent everything; Pinduoduo wants to 'withdraw gracefully'

It should be noted that part of the reason for Pinduoduo's Q3 growth falling short of expectations was to cope with more intense market competition and increased investments, or perhaps because Pinduoduo is 'actively slowing down' and wants to 'withdraw gracefully'.

Since the second quarter of this year, the consistent message from Pinduoduo's conference calls has been to 'lower expectations'.

The sharp drop in stock price in the second quarter, in addition to warning about future growth slowing down, also included a strong statement from Pinduoduo's management that there would be no stock repurchases or dividends in the short term. For many investors, this made Pinduoduo seem 'unfriendly to general investors'.

On August 8 this year, Huang Zheng, the 44-year-old founder of Pinduoduo, became China's richest person with a fortune of $46.9 billion. However, after the release of the second-quarter report at the end of August, Pinduoduo's stock price plummeted, and Huang Zheng also lost his position as the richest person. This was even joked about at the time, saying that 'Pinduoduo is so ruthless that it even shorts itself'.

The continuous indication of a desire to 'withdraw gracefully' for two consecutive quarters is closely related to Pinduoduo's current situation.

Once, Pinduoduo tightly grasped consumers' sensitivity to price and rapidly rose to prominence through a low-price strategy, breaking the 'dual giant' situation of Alibaba and JD.com in the e-commerce industry. However, the once high-speed growth concealed many contradictions encountered during Pinduoduo's development.

As growth slows down, many problems in development will gradually be exposed. This year, the 'only refund' policy has caused controversy. Under the pressure of the 'only refund' policy and stringent penalty policies, hundreds of merchants have repeatedly besieged Pinduoduo's headquarters to defend their rights. Pinduoduo has been questioned for sacrificing merchants' interests to achieve its own high-speed growth, exposing issues of coordination of interests between Pinduoduo and merchants.

A more serious accusation is its harm to China's manufacturing industry.

On November 19, Zhong Shanshan, the founder of Nongfu Spring, criticized Pinduoduo, stating, 'Internet platforms have lowered price systems, especially price systems like Pinduoduo's, which are a huge detriment to Chinese brands and industries.'

Yang Jirui, the former president of Chongqing Technology and Business University, recently pointed out at a symposium regarding the phenomenon of 'forced low-price competition' that in order to adapt to a long-term environment of excessive low-price competition, enterprises cut long-term investments and R&D expenditures, lacking motivation for technological innovation and brand building. Some platforms manipulate using hidden methods such as traffic, and high-quality merchants cannot obtain the due traffic support, 'forming a prisoner's dilemma in vicious competition.'

He stated that after market order is disrupted, small and medium-sized merchants are hit harder. Their forced exit increases market monopolization and affects industry diversity; it triggers a 'vicious game between merchants,' further disrupting market order and increasing governance difficulties.

Professor Xu Xuchu, from the China Institute for Rural Studies at Zhejiang University, who has observed and researched county-level industries for many years, believes that excessively low prices will squeeze the development space of small and medium-sized enterprises. This business model, when 'going abroad,' will damage the reputation of 'Made in China' and impact local manufacturing industries.

Some netizens complained, 'The only focus is on low prices. Without profit, companies cannot earn money, consumers do not benefit, and everyone will suffer the consequences!'

Due to multiple factors, Pinduoduo placed more emphasis on slowing down and valuing the long-term value brought by ecological investments in the third quarter. Chen Lei stated, 'To cope with industry competition, we will firmly implement a high-quality development strategy, continue to implement the 'exemption + support' measures, and continuously improve the platform and industrial ecology to bring greater inclusive benefits to both supply and demand sides.'

In the current global e-commerce landscape, Pinduoduo is still on the offensive, whether it is deepening its presence in the domestic market or actively expanding in overseas markets. It has become an important player that e-commerce giants such as Alibaba, JD.com, and Shein cannot easily ignore.

However, this once wildly running wild horse is now actively slowing down, beginning to focus and adjust its pace. This does not mean that Pinduoduo's ambitions have diminished; on the contrary, it wants to go further with a more stable posture. However, when Pinduoduo actively slows down, it remains to be seen when it can change its reputation and achieve results, which requires time to verify.

Images sourced from the official Weibo account. Infringement will be deleted.