Billion-dollar AI giant, change in actual controller

![]() 11/26 2024

11/26 2024

![]() 652

652

Click on 'Short, Concise, Fast Explanation' to follow us. For tips, please DM us

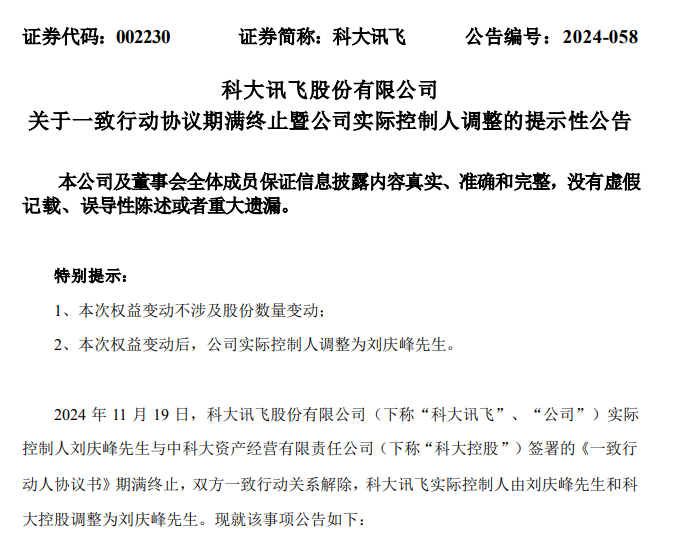

On the evening of November 20, iFLYTEK announced that the 'Agreement on Concerted Action' signed between actual controller Liu Qingfeng and iFLYTEK Holdings expired and was terminated, and the concerted action relationship between the two parties was dissolved. The actual controller of iFLYTEK was adjusted from Liu Qingfeng and iFLYTEK Holdings to Liu Qingfeng alone.

According to Short, Concise, Fast Explanation, in November 2014, Liu Qingfeng and iFLYTEK Holdings signed the 'Agreement on Concerted Action', which was renewed in November 2019, extending its validity for another five years until November 19, 2024.

This means that the concerted action relationship between the two parties, which lasted for 10 years, has been terminated. Why is that?

iFLYTEK stated that iFLYTEK Holdings, in compliance with the requirements of the 'Guiding Opinions of the General Office of the State Council on the Reform of Enterprise Systems Affiliated to Institutions of Higher Learning' and the 'Notice of the Ministry of Education and the Ministry of Finance on Comprehensively Promoting the Reform of Enterprise Systems Affiliated to Central Universities', will not renew the expired concerted action agreement with Liu Qingfeng.

In other words, iFLYTEK Holdings' decision not to renew is mainly related to relevant policies.

Will Liu Qingfeng's control over iFLYTEK decrease after the dissolution of the partnership?

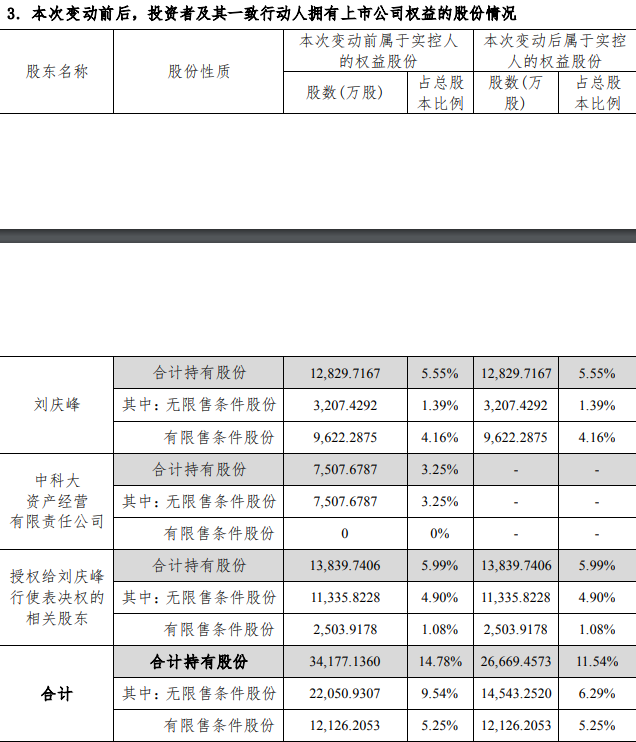

According to Short, Concise, Fast Explanation, before this change, Liu Qingfeng held a 5.55% stake in iFLYTEK, and iFLYTEK Holdings held a 3.25% stake. Additionally, some shareholders delegated their voting rights to Liu Qingfeng, bringing their combined shareholding to 14.78%.

After this change, Liu Qingfeng and related shareholders who have delegated their voting rights to him hold a combined 11.54% stake in iFLYTEK, approximately one-tenth, indicating a significant decrease in controlling interest compared to before.

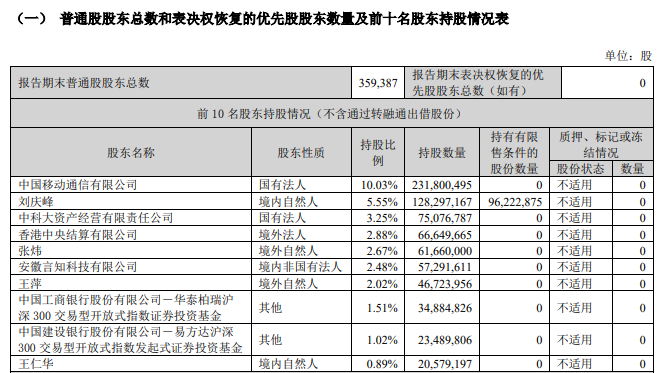

At the end of the third quarter, China Mobile was the largest shareholder of iFLYTEK with a 10.03% stake, followed closely by Liu Qingfeng and iFLYTEK Holdings. Additionally, Anhui Yanzhi Technology Co., Ltd. is a company controlled by Liu Qingfeng.

Furthermore, the top three natural person shareholders of iFLYTEK Holdings, Zhang Wei, Wang Ping, and Wang Renhua, hold shares of 2.67%, 2.02%, and 0.89% respectively, totaling 5.58%.

After dissolving the concerted action relationship with iFLYTEK Holdings, although Liu Qingfeng still holds the largest voting rights in iFLYTEK, the gap with the largest shareholder, China Mobile, has further narrowed. If China Mobile desires, it would not be difficult for them to take control of iFLYTEK. To strengthen his control, Liu Qingfeng may need to increase his stake in the company with his own funds.

However, this does not seem easy.

As of November 20, the total market value of iFLYTEK was 113.8 billion yuan, meaning that 1% of the equity corresponds to a market value of over 1.1 billion yuan, and 5% corresponds to nearly 5.7 billion yuan. This indicates that Liu Qingfeng would need a significant amount of capital to further consolidate his control.

In fact, iFLYTEK's performance has not been impressive. In the first three quarters, it achieved operating revenue of 14.85 billion yuan, a year-on-year increase of 17.73%. However, the net profit attributable to shareholders and the non-deductible net profit were losses of 344 million yuan and 468 million yuan, respectively, representing year-on-year decreases of 445.91% and 44.38%, respectively.

It should be noted that iFLYTEK's losses are directly related to high R&D and marketing expenses.

In the first three quarters, R&D expenses amounted to 3.037 billion yuan, a year-on-year increase of 30.37%, with an R&D expense ratio as high as 20.45%. Additionally, sales expenses were 2.553 billion yuan, a year-on-year increase of 11.53%, with a sales expense ratio of 17.19%.

iFLYTEK stated in its mid-year report that the primary reason for the losses was the company's active pursuit of new opportunities in general artificial intelligence. In the first half of 2024, it invested over 650 million yuan in large model research and development, core technology independence and controllability, industrial chain controllability, and industrial application expansion of large models.

As a result, the 'iFLYTEK Spark' large model was upgraded. The company claims that the upgraded V4.0 version fully benchmarks GPT-4 Turbo in terms of foundational capabilities and has also launched multiple software and hardware products for education, healthcare, automotive, and enterprise intelligence.

(Short, Concise, Fast Explanation - Original work. Do not reproduce without permission! PS: If there is any infringement or data error, please contact us promptly for correction)