Did Pinduoduo Help Jiang Fan Return to Alibaba?

![]() 11/28 2024

11/28 2024

![]() 450

450

Author | Meng Xiao

For more financial information | BT Financial Data

The main text contains 4206 words with an estimated reading time of 11 minutes

After three years, Jiang Fan returns to the power center of Alibaba.

On November 21, Alibaba issued an announcement. The announcement was not long, with only 195 words including punctuation, stock codes, and registered capital. However, it released a wealth of signals, indicating Jiang Fan's official return after causing a sensation across the internet three years ago.

On the same day, Wu Yongming, CEO of Alibaba Group, also issued an internal letter confirming the matter. The letter announced that Alibaba's new organizational structure would be adjusted. Taobao and Tmall, the International Digital Commerce Group, as well as e-commerce businesses like 1688 and Xianyu would be fully integrated to form Alibaba's e-commerce business group covering the entire domestic and international industry chain.

This indicates that after leaving the core business of Taobao and Tmall for three years overseas, Jiang Fan has returned to the power center of Alibaba with his solid business capabilities. Moreover, this time, he is in charge of all domestic and international e-commerce businesses.

Alibaba's organizational restructuring is not surprising, but what surprises the industry is the CEO of Alibaba's e-commerce business group. This new CEO, who shoulders the heavy responsibility of Alibaba's future and manages over 500 billion yuan, is Jiang Fan. Previously, due to a personal scandal, Jiang Fan was reassigned overseas by Alibaba for 35 months and only resumed his position as an Alibaba partner one year ago. Just 17 months after returning as an Alibaba partner, he once again became Alibaba's "leading man," responsible for the company's core e-commerce business and reporting directly to Wu Yongming.

Alibaba's adjustment this time follows the usual practice of adjustments after "Singles' Day." However, this round of changes is still considered an "epic" adjustment by the industry. Alibaba's domestic and international e-commerce businesses, which have undergone numerous mergers and separations, have finally "merged into one," with related e-commerce businesses forming a unified territory. Jiang Fan, who has performed well in Alibaba's overseas business, taking on the role of helmsman also confirms previous rumors. As Alibaba's growth slows and it enters a period of constant adjustment, Jiang Fan's return has attracted particular attention from the outside world.

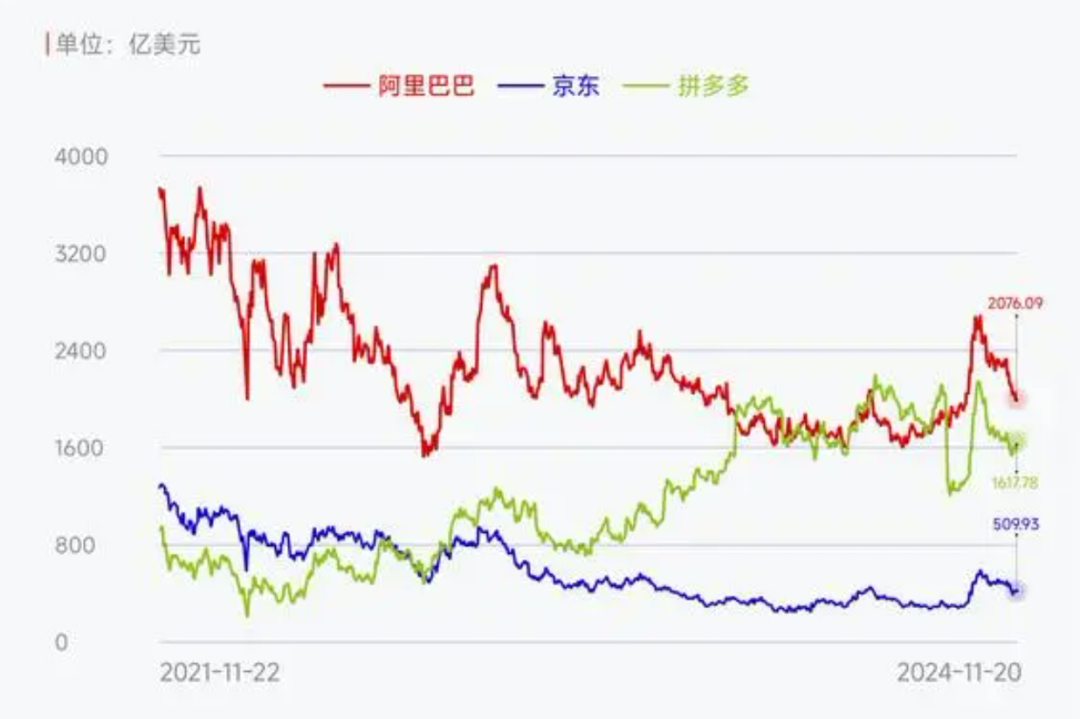

Surprisingly, on the day after Alibaba's announcement, Alibaba's U.S. and Hong Kong stock prices fell simultaneously. U.S. stocks fell by 2.86%, and Hong Kong stocks fell by 4.38%. Alibaba's latest market capitalization is $204.5 billion in the U.S. and HK$1.59 trillion in Hong Kong. The market capitalizations of both U.S. and Hong Kong stocks have fallen by 73% from their 2020 peaks, and Alibaba's U.S. market capitalization was even surpassed by Pinduoduo for a time.

1

Huang Zheng's Lifelong Rival?

Some industry insiders believe that Jiang Fan is to Alibaba what Zhou Shouzi is to Xiaomi, both potentially being groomed as successors.

The difference is that Lei Jun offered 100 million shares (now worth approximately 3 billion yuan) but failed to retain Zhou Shouzi, who instead joined ByteDance. Jiang Fan, due to a personal scandal, was reassigned overseas by Alibaba, leaving him with only a theoretical chance of becoming Alibaba's successor. After all, Alibaba has a vast pool of talented individuals, and no one expected Jiang Fan to return from reassignment in less than three years (35 months).

Jiang Fan is actually not ordinary.

Born in Urumqi in 1985, Jiang Fan attended Urumqi No. 1 High School during his youth and is a typical techie. Although he was not the top student academically, he demonstrated a high aptitude for computers in junior high school. In the 2002-2003 National High School Student Olympiad in Informatics, he won the first prize in the provincial division. Because of this achievement, the 18-year-old Jiang Fan was admitted to Fudan University without taking the entrance exam.

Jiang Fan may have felt that schoolwork was too simple, and he would stop answering questions once he estimated he could pass the exam. In his view, such exams were a waste of life and it was better to do something meaningful, like programming. Jiang Fan's ability to estimate scores was indeed strong, as he earned a bachelor's degree in computer science from Fudan University with an average score of 61. At the age of 20, he interned at Google, responsible for the development of maps, search, and content. At that time, Google still had operations in mainland China, and getting into Google was a privilege.

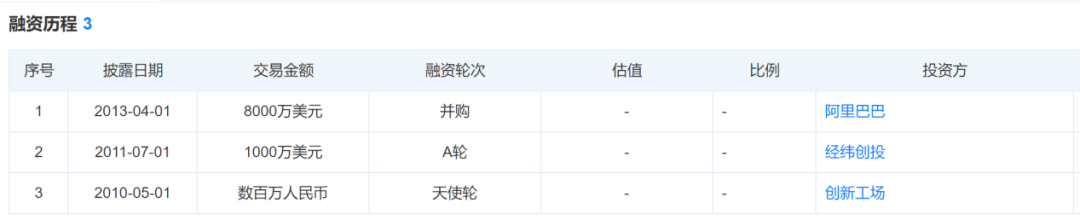

In 2010, Jiang Fan chose to start his own business and founded Umeng, a service platform for mobile developers. That year, Jiang Fan was 25 years old. By 2013, just three years after its establishment, Umeng had covered nearly 600 million active devices, 180,000 apps, and 60,000 developers. It received investments from well-known investment institutions such as Li Kaifu's Innovation Works and Matrix Partners, with a valuation exceeding 50 million dollars. Also in this year, Alibaba acquired Umeng at a premium of 80 million dollars, and the 28-year-old Jiang Fan had truly achieved financial freedom.

According to the acquisition agreement, Jiang Fan could take a position at Alibaba. At that time, Daniel Zhang, COO of Alibaba and known as Xiaoyaozi, was recruiting a large number of talented individuals for Alibaba. Zhang Yong's hard criteria were individuals between the ages of 35 and 45 who were financially free. Because individuals who met this criterion had proven their abilities and their work purpose was not for promotion or a raise but rather a sense of mission.

Zhang Yong was impressed by Jiang Fan and asked if he wanted to do something together, something he could one day tell his grandchildren about? To perform on the Alibaba stage and leave a lasting impression? Unconcerned about money, Jiang Fan was moved by Zhang Yong's sense of mission and became a senior director of Taobao's wireless business unit.

Xiaoyaozi may have valued Jiang Fan due to their similar outsider backgrounds. Neither of them were truly "Alibaba people." Zhang Yong had an impressive work history at PricewaterhouseCoopers and Shanda Group and was promoted unusually quickly after joining Alibaba in 2007.

Jiang Fan rose to power based on his own abilities. The monthly active users of the mobile Taobao business he was responsible for increased from 30 million in 2013 to 60 million. He only took over this business for one year, and by September 2015, the monthly active users of mobile Taobao exceeded 110 million. Jiang Fan's mentor, Zhang Yong, also became the head of Alibaba in 2015. With Zhang Yong's appreciation and his own abilities, Jiang Fan's position continued to rise. In December 2017, Jiang Fan became president of Taobao. In March 2019, he concurrently served as president of Tmall and was included in the list of Alibaba partners in the 2019 fiscal year annual report released in June of that year. In charge of Alibaba's two most profitable departments, he became Alibaba's first post-80s dual president. At that time, Jiang Fan was already considered Alibaba's successor.

Wang Xing of Meituan posted on Weibo in 2019, "In the coming years, it will be exciting to watch the competition between Huang Zheng of Pinduoduo and Jiang Fan of Taobao/Tmall, two very intelligent people. If Jiang Fan can win this battle, he will undoubtedly be Alibaba's next CEO. If he is interested in the role." Wang Xing's high evaluation of Jiang Fan shows that he also views Jiang Fan as Alibaba's successor.

But as we all know, what happened next was that Jiang Fan was reassigned overseas for three years and only recently returned.

2

Alibaba Without Jiang Fan for Three Years

During the three years that Jiang Fan was reassigned overseas, Alibaba's development was not particularly smooth.

Alibaba's financial reports show that in 2021, its revenue was 853.1 billion yuan, with a year-on-year increase of 18.93%. In 2023, its revenue was 941.2 billion yuan, with a year-on-year increase of 8.34%. Among them, revenue growth in 2022 was only 1.83%. Over the three years, Alibaba's revenue increased by only 88.1 billion yuan, which seems impressive, but during the same period, Pinduoduo's revenue increased from 93.95 billion yuan to 247.6 billion yuan, an increase of 153.65 billion yuan, and JD.com's revenue increased from 951.6 billion yuan to 1.085 trillion yuan, an increase of 133.4 billion yuan. Among the three major e-commerce giants, Alibaba had the smallest growth volume. In terms of growth volume, it was inferior to Pinduoduo and JD.com, and in terms of revenue volume, it was inferior to JD.com.

According to the financial report, the 8.34% revenue growth rate in 2023 was significantly slower than the 50.58% and 35.26% growth rates in 2018 and 2019. Regarding net profit, there was a significant decline of 58.66% in 2021, falling from 150.6 billion yuan in 2020 to 62.25 billion yuan. Since then, Alibaba's net profit has never exceeded 100 billion yuan again.

Alibaba's gross profit margin and net profit margin have declined to varying degrees in the past three years. The gross profit margins were 36.76%, 36.72%, and 37.70% respectively, showing a slight increase but a significant decline compared to 45.09% and 44.60% in 2018 and 2019. The net profit margins for the past three years were 5.52%, 7.55%, and 7.58% respectively, while the net profit margins for the three years earlier were 21.29%, 27.54%, and 19.98% respectively. In comparison, Alibaba's net profit margin has fallen more significantly.

The changes in the U.S. market capitalization of Alibaba, JD.com, and Pinduoduo in recent years also provide some insights. Alibaba's market capitalization has fallen the most, while JD.com's market capitalization has also declined but to a lesser extent. Pinduoduo's market capitalization has soared, surpassing Alibaba multiple times to become the highest-valued U.S.-listed e-commerce company. Although Alibaba's market capitalization has now surpassed Pinduoduo, the gap between the two is not significant, and Alibaba's position as the top e-commerce company is still challenged.

The industry even believes that during the three years Jiang Fan was absent, Alibaba's business was constantly eroded by JD.com and Pinduoduo. The once-glorious Singles' Day, with sales of 268.4 billion yuan in 2019, gradually lost its luster from 2020 onwards. The growth rate of transaction volume declined to 26%, and by 2021, this growth rate further slowed to 8.5%. In 2022, Alibaba even began to stop publishing transaction volume data. This year, Alibaba also did not publish transaction volume data for Singles' Day.

Previously, on August 30, the State Administration for Market Regulation announced that Alibaba had completed three years of rectification and achieved good results. Alibaba responded, "This is a new starting point for development," which indirectly confirms that Alibaba has taken a significant turn during these three years.

3

'Alibaba Has No Choice'"

Before Jiang Fan's return, Alibaba's top-level structure had undergone two significant adjustments, and Xiaoyaozi also retired.

In March 2023, Daniel Zhang, then the "top leader" of Alibaba Group, initiated what was called the company's "most important organizational change," and then retired himself three months later. At that time, there were rumors that Jiang Fan would return. Wu Yongming, the current CEO of Alibaba, was already familiar with Jiang Fan when he was starting his business. Wu Yongming played a key role in the acquisition of Umeng, which may have laid the foundation for Jiang Fan's return.

Jiang Fan's return is not surprising to many industry insiders. Those close to Alibaba believe that "Jiang Fan is indeed the most suitable candidate in the current management team" and that "Alibaba has no choice." Jiang Fan's abilities demonstrated during his "relegation" period also qualify him for the role. With domestic market traffic peaking, the overseas market is crucial for Alibaba, and it is in this market that Jiang Fan has proven his abilities.

After taking over Alibaba's International Digital Commerce Group, Jiang Fan quickly reorganized the overseas business, forming cross-border businesses (AliExpress, International Station) and multiple overseas local businesses represented by Lazada. At the same time, he rapidly introduced fully managed and semi-managed models. The results of these bold reforms have been significant.

Before Jiang Fan took over Alibaba's International Digital Commerce Group, international retail business revenue accounted for only 5% of Alibaba's total revenue, less than that of Alibaba Cloud, Cainiao, and Local Life Services. But as of September 2024, the revenue share has increased to 13.4%.

According to the financial report, Alibaba's International Digital Commerce Group serves hundreds of millions of overseas consumers and reaches over 47 million active small and medium-sized enterprise buyers worldwide. It drove overall order growth for businesses such as Lazada, AliExpress, Trendyol, and Daraz in fiscal year 2023. Alibaba's fiscal Q2 2025 financial report data shows that the International Digital Commerce Group's Q2 revenue was 31.672 billion yuan, an increase of 29% from 24.511 billion yuan in the same period last year. Among them, international retail commerce revenue was 25.618 billion yuan, an increase of 35% year-on-year. Due to his outstanding performance in the overseas market, Jiang Fan was once again included in the list of Alibaba partners in the 2023 annual report.

Investor Shi Baogang believes that Jiang Fan's return may be the best choice for Alibaba. "Currently, Pinduoduo is in the spotlight, and after its market capitalization surpassed Alibaba's, Alibaba may have truly felt the crisis. Previously, Jack Ma has always promoted that Alibaba will change, which may confirm Jiang Fan's return to lead Alibaba in bold reforms."

However, in Shi Baogang's view, although Jiang Fan has achieved impressive results in Alibaba's overseas business, it is not yet time to celebrate prematurely. "The overseas market competition is equally fierce. Southeast Asian e-commerce giant Shopee, Pinduoduo's overseas e-commerce platform Temu, fast fashion e-commerce giant Shein, and TikTok are all formidable competitors. Alibaba cannot relax in its overseas business."

In fact, it's not just Alibaba. In recent years, e-commerce platforms have undergone significant changes in leadership. JD.com has transitioned from Liu Qiangdong to Xu Lei and then to Xu Ran, Pinduoduo from Huang Zheng to Chen Lei, and even the "new king" of short video e-commerce, ByteDance, has transitioned from Zhang Yiming to Liang Rubo. Reform has become the main theme for e-commerce platforms. Compared to these successors, Jiang Fan's path has been more challenging, but this may unleash his potential even more, bringing new hope to Alibaba.

Jiang Fan, who has now returned, has greater power and broader business responsibilities. In addition to taking over Taobao and Tmall, he continues to oversee international commerce, and the two star segments of 1688 and Xianyu have also been incorporated under his command. It's time for the returning Jiang Fan to make a big splash.

The article reflects the author's personal views. If you have any questions or feedback, please leave a comment directly in the comment section.