SWTimes, the parent company of Travel 365, files for IPO in Hong Kong: 90% of GTV comes from Gaode Maps, ride-hailing gross margin turns negative

![]() 11/28 2024

11/28 2024

![]() 667

667

Recently, Shengwei Times Technology Co., Ltd. (hereinafter referred to as "Shengwei Times") submitted an IPO application for listing on the main board of the Hong Kong Stock Exchange, with CITIC Securities International as the sponsor.

As one of the representatives of small and medium-sized ride-hailing platforms, Shengwei Times has been continuously losing money, with the gross margin of its ride-hailing business turning negative in the first half of the year, and it relies heavily on Gaode Maps for orders. What are the odds of its bet on Robotaxi paying off?

Continuous losses with an expanding trend, ride-hailing gross margin turns negative

Shengwei Times is an intercity and intracity road passenger transport information service provider, mainly offering intercity road passenger transport services and intracity ride-hailing services.

Specifically, Shengwei Times' business started with passenger transport services and currently includes online ticketing services and customized passenger transport services. The "Cloud Station Management" system promotes automation of a series of daily operations by integrating hardware and software within passenger stations into a unified information system and cooperating with major OTAs such as 12306, Utrip, Tongcheng, Ctrip, and Fliggy to provide passenger flow for passenger stations. In terms of customized passenger transport, the "Passenger Transport Reach" system provides solutions for the digital operation of passenger transport enterprises, including customized bus services at airports, high-speed railway stations, and campuses.

On the company's "Travel 365" platform, passengers can inquire about bus schedules, book tickets, obtain information about bus stations, view announcements, manage orders, and contact customer service. They can also purchase air tickets and train tickets. On the "365 Intercity Travel" platform, passengers can use various services such as intercity carpooling, dedicated buses, and customized charter services through the WeChat mini-program.

Since 2018, Shengwei Times has started providing ride-hailing services through cooperation with mainstream aggregation platforms such as Gaode Maps.

For the years 2021, 2022, 2023, and the first half of 2024 (the "reporting period"), the company's revenues were RMB 554 million, 816 million, 1.206 billion, and 726 million, respectively; net profits for the same periods were RMB -587 million, -499 million, -482 million, and -285 million, respectively.

After excluding the impact of changes in the book value of redemption rights issued to investors and share incentives, the adjusted net profits for each period were RMB -55.608 million, -50.532 million, -17.756 million, and -16.730 million, respectively. The adjusted net loss for the first half of 2024 showed a further expansion compared to the RMB 4.335 million for the same period last year.

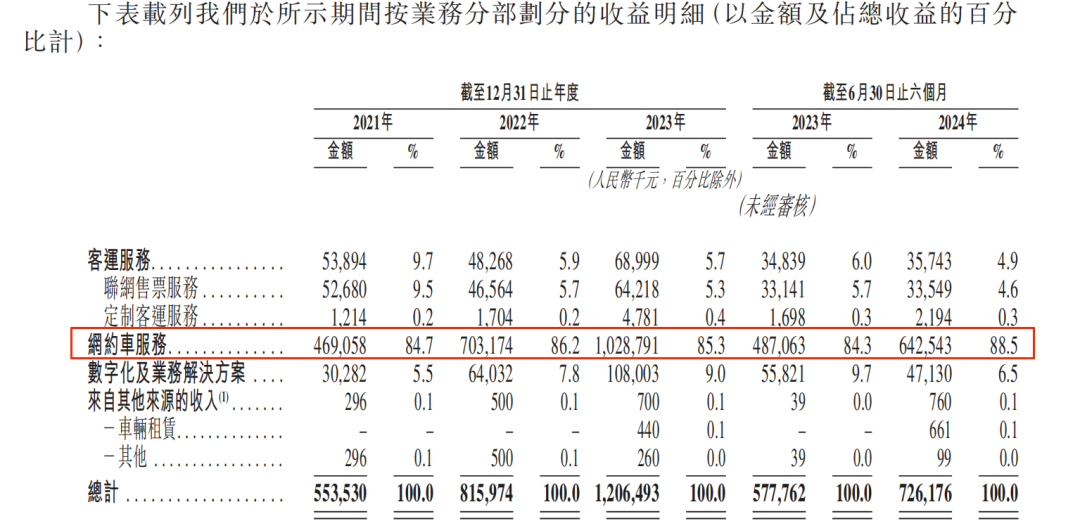

Despite starting as a passenger transport service business, the related revenue is now negligible, accounting for only 9.7%, 5.9%, 5.7%, and 4.9% of total revenue during the reporting period. In contrast, revenue from ride-hailing services accounted for over 80% of total revenue during the same periods.

Image source: Shengwei Times prospectus

However, the gross margin of the company's ride-hailing services during the reporting period was only 2.3%, 2.9%, 1.2%, and -0.5%, respectively, resulting in an overall gross margin of 8.6%, 6.6%, 7.1%, and 3.5% for the company. This not only indicates a relatively low gross margin but also suggests a continuing downward trend.

Shengwei Times attributed the negative gross margin in the first half of the year to increased incentives for drivers and passengers to enhance competitiveness. During the initial stage of its ride-hailing business, the company expanded its geographical coverage by incentivizing drivers and passengers, thereby achieving revenue growth.

The "second" ride-hailing platform? 90% of GTV comes from Gaode Maps

The company's self-description in the prospectus fully demonstrates that with the right qualifiers, anyone can claim to be number one.

According to the prospectus, as of June 30, 2024, Shengwei Times was the second-largest ride-hailing platform in China in terms of the number of "Online Ride-Hailing Business Licenses," according to data from Frost & Sullivan. As of the latest practicable date, the company had obtained 191 "Online Ride-Hailing Business Licenses," with a cumulative number of registered drivers reaching approximately 1.5 million.

The "Online Ride-Hailing Business License" is one of the "three licenses" required for ride-hailing operations and serves as the legal basis for legal operations in the local area. It is generally issued by the local municipal transportation authority, often on a "one city, one license" basis. Therefore, 191 licenses indicate that the company has obtained legal operating rights in approximately 191 cities, which only supports the claim of the company's broad geographical coverage.

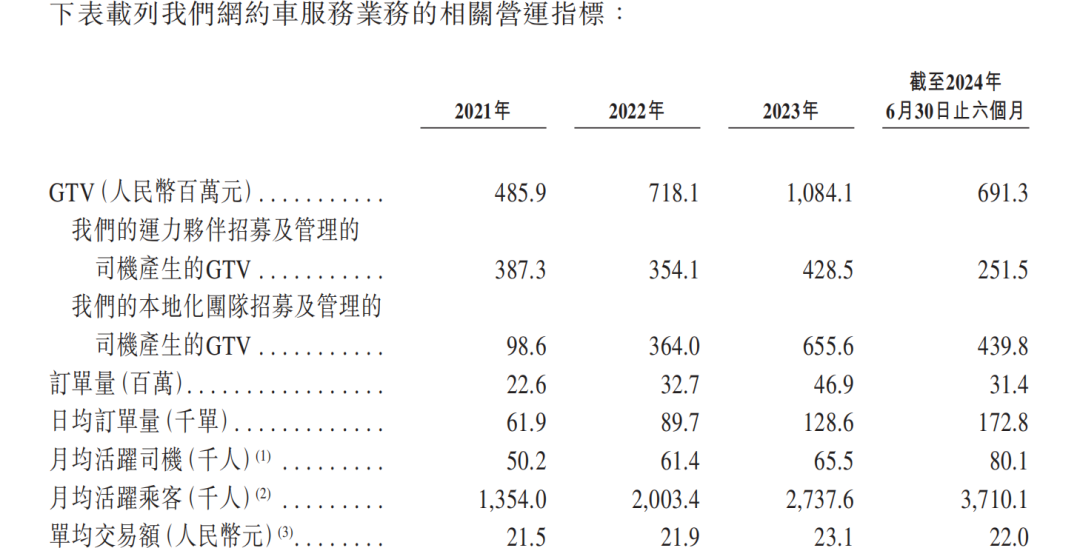

However, in terms of GTV, which is more closely watched within the industry, the figures for the reporting period were RMB 486 million, 718 million, 1.084 billion, and 691 million, respectively, with order volumes of 22.6 million, 32.7 million, 46.9 million, and 31.4 million during the same periods.

Image source: Shengwei Times prospectus

According to statistics from IPO Insight, from January to June 2024, the ride-hailing regulatory information interaction system received a total of 5.389 billion order information, roughly calculating that Shengwei Times' market share in the first half of 2024 was only about 0.58%.

The prospectus reveals that the Chinese ride-hailing service market is relatively concentrated, with the top five participants accounting for approximately 90.7% of the total market share in 2023. Based on GTV in 2023, Shengwei Times ranked 15th.

According to Didi Chuxing's financial report, it handled approximately 5.954 billion ride-hailing transactions in China in the first half of 2024. Although direct comparisons are not possible due to potential differences in statistical methods, the gap is apparent. Even the massive Didi Chuxing only achieved annual profitability in 2023, leaving the profitability of other small and medium-sized platforms uncertain.

Furthermore, the development of autonomous taxis, or Robotaxi, may pose significant risks to the industry.

According to the prospectus of a previously listed company, Qichuxing, it is estimated that the size of the Chinese Robotaxi market will expand to RMB 163.96 billion by 2035, squeezing the ride-hailing market space with a compound annual growth rate of 27.4% from 2030 to 2035, during which time the compound annual growth rate of ride-hailing will decrease to -8.8%.

The effective rollout of commercial Robotaxi operations requires mass-produced vehicles, technology, and operations, with automakers, autonomous driving companies, and platforms all playing essential roles. Among them, mobility platforms hold the user entry point and possess the strongest business and user operation experience.

However, Shengwei Times currently relies heavily on Gaode Maps as a traffic entry point for its ride-hailing operations and does not even have an independent application or mini-program.

IPO Insight found that the company's "Travel 365" app does not have a ride-hailing entry point, and clicking on the ride-hailing option in its "365 Intercity Travel" mini-program directly redirects to the "Gaode Taxi" mini-program.

The prospectus shows that the company's ride-hailing service business relies on cooperation with a limited number of mainstream aggregation platforms. During the reporting period, Gaode Maps, owned by Alibaba, was consistently the company's largest aggregation platform service provider. The GTV (Gross Transaction Value) generated through Gaode Maps accounted for 95.3%, 92.9%, 89.5%, and 93.4% of the total GTV of the ride-hailing service business during each period, respectively.

In other words, Shengwei Times does not have full control over the traffic flow of its ride-hailing platform.

Meanwhile, the competition in the Robotaxi industry should not be underestimated. Currently, well-known companies such as Luobotukuai, Pony.ai, and Qichuxing are all conducting commercial operations in various locations, while Yuanrong Qixing, a subsidiary of Alibaba, and Didi's autonomous taxi projects are also under testing. It is currently uncertain whether another "subsidy war" similar to the initial stage of the ride-hailing industry will emerge.

Shengwei Times began operating autonomous taxis in Suzhou in 2023. As of June 30, 2024, its autonomous taxi service was in a free trial phase, with each vehicle averaging about 20 orders per day, generally considered the "lifeline" for ride-hailing orders.

In the future, Shengwei Times plans to cooperate with automakers and autonomous driving technology providers to launch services such as autonomous taxis, Robobuses (autonomous buses), and Robovans (autonomous vans).

The autonomous taxi business is also listed in the company's fundraising projects. The company plans to strengthen its cooperation with autonomous taxi partners (including automakers and autonomous driving technology providers), gradually increase advertising activities for the autonomous taxi business, and pay attention to the development of the Chinese autonomous driving industry, considering investments in related platform research and development.

Dispersed shareholding among controlling shareholders, Alibaba Travel as the largest shareholder

The company's founder, Jiang Shengxi, served as the vice president of UFIDA Network (600588.SH) before starting his own business. On September 28, 2012, he registered the company's predecessor, Beijing Shengwei Nanling Information Technology Co., Ltd., with an investment of RMB 470,000 from Chen Shulin, the major shareholder of Nanling Technology (300921.SZ) (held on behalf of Jiang Shengxi and later taken over by Haidai Zhushi), and was joined by UFIDA colleagues Yang Yang and Zhang Jintao, who currently serve as the company's executive director and chief executive officer, and executive director and chief technology officer, respectively.

Similar to the scripts of other entrepreneurs from large companies, just three months after its establishment in November 2012, Huayi Financial Holdings (8123.HK) Chairman Wang Jiawei and his affiliated private equity firm Chengdu Yingchuang each invested RMB 20 million and obtained 25% shares each, valuing the company at approximately RMB 80 million at the time.

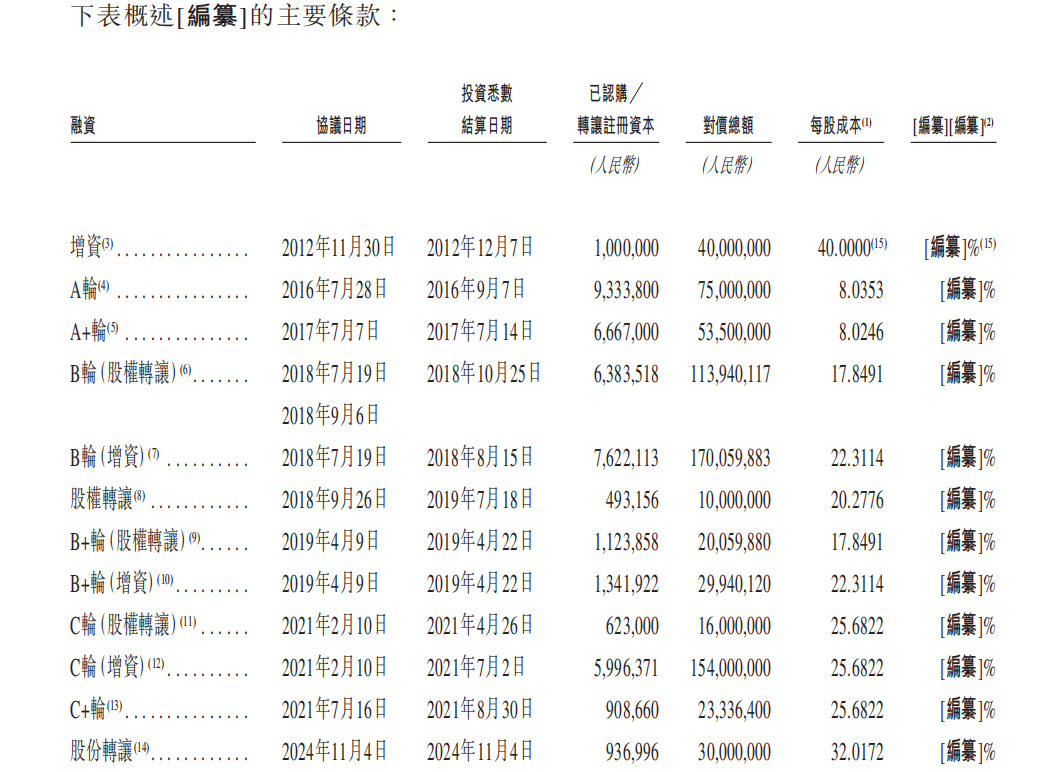

In the Series A investment round in September 2016, Alibaba Group's wholly-owned subsidiary, Alibaba Travel, acquired a 20% stake for RMB 75 million, becoming the company's largest shareholder. In the Series A+ round on July 7, 2017, Alibaba Travel invested an additional RMB 53.5 million, increasing its shareholding to 30% and valuing the company at approximately RMB 428 million.

In August 2018, to mitigate share dilution, Jiang Shengxi acquired a 25% stake in the company for a total of RMB 100 million from the employee stock ownership plan and other shareholders, briefly restoring his position as the largest shareholder.

In the Series B investment round in September 2018, Alibaba Travel, SoftBank Group, Guangzhou Danshuiquan, and Guokai Chuangxin jointly invested approximately RMB 170 million, valuing the company at approximately RMB 1.36 billion at the time.

Subsequently, in the Series B+, Series C, and Series C+ rounds in April 2019, February 2021, and August 2021, the company received investments of RMB 29.9401 million, 154 million, and 23.3364 million, respectively, with the company's valuation gradually reaching RMB 1.39 billion, 17.54 billion, and 17.77 billion.

In addition, according to a share transfer event on November 4, 2024, Shanghai Yuanhong transferred shares worth RMB 936,996 to Chengdu Yunzhiya for a consideration of RMB 30 million, valuing the company at approximately RMB 2.216 billion at the time.

Image source: Shengwei Times prospectus

Currently, Alibaba Travel is the company's largest shareholder with a 27.01% stake, while Jiang Shengxi directly holds a 20.67% stake, making him the second-largest shareholder. However, Jiang Shengxi, Wang Jiawei, Chengdu Yingchuang, Haidai Zhushi, Shidai Zhongcheng, and Shidai Xincheng have entered into voting rights entrustment agreements, collectively having the right to control the exercise of approximately 42.20% of the voting rights, forming a controlling shareholder group.

Due to the large number of members in the controlling shareholder group, the dispersed shareholding, and the lack of close relationships among the shareholders, significant changes in the company's control may occur if the relevant entrustment agreements are terminated.

In addition, as the largest shareholder, Alibaba Group has numerous related transactions with the company.

During the reporting period, the company's procurement amounts from the top five suppliers or the sales costs incurred from transactions with the top five suppliers accounted for 12.8%, 12.7%, 11.0%, and 9.8% of the total procurement amount or total sales cost, respectively. Among them, the largest supplier, Alibaba Group, accounted for 6.8%, 7.2%, 6.5%, and 6.1% of the total procurement amount or total sales cost, primarily for passenger flow and other information services.