With a market value of 220 billion, who doesn't know Cambricon?

![]() 11/28 2024

11/28 2024

![]() 565

565

Generating hundreds of millions in revenue annually but suffering consecutive losses for nearly five years, Cambricon reached a new high market value of 220 billion yuan on November 27 with a one-day gain of 10%.

In less than a year, Cambricon's share price has soared nearly threefold from the beginning of the year. However, it is well-known that there have been no significant changes in its fundamental business operations over the past few years. The rise in share price is more due to investors chasing concepts such as AI, chips, and domestic substitution.

Faced with this situation, how long can Cambricon's impressive performance last?

The ambition for "autonomy" has nurtured a 10-fold chip stock in the Chinese Academy of Sciences (CAS) series

Listed on the STAR Market, Cambricon Technologies Corporation Limited, with its full name, is a typical potential stock in the "CAS series." It is also one of the rare AI chip companies in the A-share market that specializes in GPUs. Its main business includes the research, design, and sales of core AI chips applied in various cloud servers, edge computing devices, and terminal devices.

According to Tianyancha, the second-largest shareholder of Cambricon is Beijing Zhongke Suanyuan Asset Management Co., Ltd., while the largest shareholder and controlling shareholder is Chen Tianshi, a natural person. Chen Tianshi graduated from the University of Science and Technology of China's Young Scholars Program and School of Computer Science. He is currently a researcher at the Institute of Computing Technology, Chinese Academy of Sciences, and the chairman and CEO of Cambricon Technologies Corporation Limited.

Due to these backgrounds, Cambricon, founded in 2016 and listed in July 2020, has always been regarded by investors as the "first AI chip stock" in the A-share market.

Especially after the global AI industry exploded in 2022, with NVIDIA, the leading global AI chip company, experiencing a surge in performance and soaring concept stocks, Cambricon became one of the few rare stocks in the domestic market that could be used to "benchmark" NVIDIA.

Market data shows that the latest high price set by Cambricon has reached a maximum increase of 10.5 times compared to its lowest point in the past three years, making it the only 10-fold chip stock in the A-share market during the same period.

Of course, due to its reputation, Cambricon's performance is also well-known in the market. Since its listing, Cambricon's revenue has consistently remained at around 700 million yuan per year, with consecutive losses. According to performance reports, from 2020 to 2023, Cambricon's net loss attributable to shareholders after excluding non-recurring items reached 659 million yuan, 1.111 billion yuan, 1.579 billion yuan, and 1.043 billion yuan, respectively.

However, at the same time, Cambricon still invests firmly in research and development expenses of over 1.1 billion yuan each year, far exceeding its revenue scale. From 2021 to 2023, Cambricon's research and development expenses amounted to 1.136 billion yuan, 1.523 billion yuan, and 1.118 billion yuan, respectively.

As of the first three quarters of this year, Cambricon achieved revenue of 185 million yuan, recorded a loss of 724 million yuan, and incurred research and development expenses of 659 million yuan. The bulk of expenses goes to research and development, but there is insufficient conversion, which is currently Cambricon's pain point.

Nevertheless, it has become a consensus in a sense not to discuss Cambricon's fundamentals. More often, the market holds greater confidence and expects this enterprise with a strong research background to deliver a high-scoring answer regarding independent AI chips.

According to official website data from November 2023, the Institute of Computing Technology, Chinese Academy of Sciences, has over 600 employees; five research departments with 16 research centers or laboratories; two first-level discipline doctoral training programs, two postdoctoral stations, and approximately 1,600 graduate students. This is the "big tree" behind Cambricon.

It is evident that behind the extremely high valuation premium, the market believes that Cambricon shoulders the important task of indigenizing domestic AI core chips.

A similar logic may continue to appear in other enterprises in the future, such as the domestic GPU unicorn Moore Threads, which is rumored to be preparing for an IPO. This startup, founded by Zhang Jianzhong, former NVIDIA's global vice president and general manager of China, is regarded as the "Chinese NVIDIA" by the market and currently has a valuation exceeding 25 billion yuan.

Cambricon has caught a good time

Leveraging the powerful capabilities of generative AI to accelerate the intelligent upgrade of various industries is currently a consensus among multiple industries worldwide.

At the same time, the billions of large model parameters in generative AI consume enormous computing power, leading to a surge in demand for computing power. The demand for the computing power of the underlying chips of large models has also been released simultaneously over the past two years.

According to Gartner's report data, the global market size for AI chips is expected to grow to $67.1 billion by 2024 and is projected to further expand to $119.4 billion by 2027.

Therefore, the first step in achieving a consensus on generative AI is to solve the problem of ultra-high computing power.

As of now, Cambricon's product line has covered smart chips and accelerator cards for the cloud and edge, training systems, processor IPs, and software, meeting AI computing needs of different scales at the cloud, edge, and terminal levels. These include Cambricon's 1A, 1H, and 1M series of smart processors for terminal scenarios and edge intelligent accelerator cards based on the SiYuan 220 chip.

These products have already begun to provide abundant underlying computing power support for customers in industries such as the internet, energy, and finance in their demand for intelligent upgrades.

Meanwhile, based on the explosion in demand for AI computing power and the improvement of Cambricon's high-end product matrix, Cambricon is still making some changes.

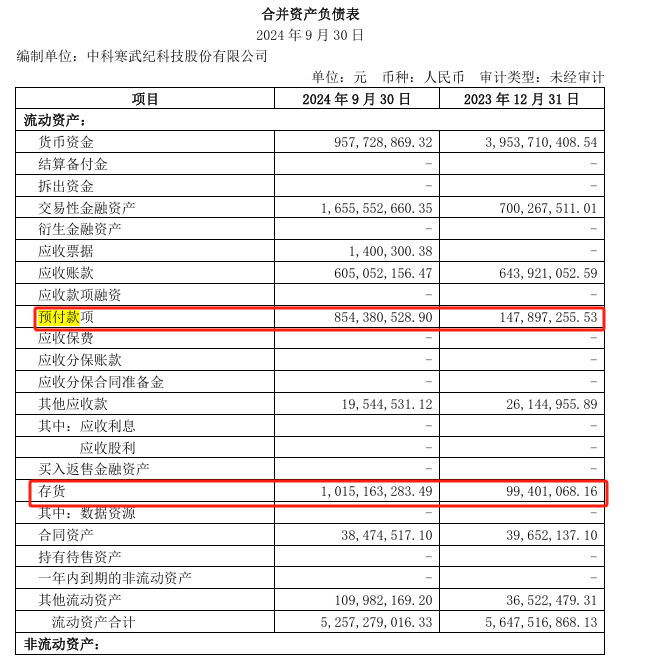

Reviewing the financial statements reveals that as of the first three quarters of 2024, Cambricon's inventories surged more than three times compared to the end of the previous half-year, reaching a scale of 1.015 billion yuan; concurrently, its prepayments also hit a new high, increasing by 54% from the end of the previous year to 854 million yuan.

Some securities firms have commented that this double increase indicates that Cambricon is placing larger orders upstream and expanding the scale of material preparation and production, suggesting a relatively optimistic future growth outlook.

The analyst team led by Zong Jianshu from Changjiang Securities believes that Cambricon has already done a lot of preparatory work in the core links of the supply chain, and its core AI chip products have successively completed wafer and packaging and testing production, with new product supplies expected.

In terms of research and development, Cambricon has continuously launched new products this year: in May, it introduced a new cloud IP and an AI chip; recently, it again released China's first chiplet AI chip, SiYuan 370, as well as two accelerator cards based on SiYuan 370, the MLU370-S4 and MLU370-X4, and a newly upgraded Cambricon Neuware software stack.

It is reported that SiYuan 370, which completed tape-out as early as the third quarter of last year and was gradually sent for testing by customers in the second quarter of this year, has now entered the early stages of sales. It has conducted in-depth application adaptations with mainstream domestic internet vendors such as Alibaba Cloud and Baidu, and its performance in scenarios such as speech and vision has exceeded customers' expectations.

With the continuous launch of high-performance new products and positive market feedback, coupled with the continuous improvement of Cambricon's supply and delivery capabilities, the company can at least provide the market with more stories to tell.

Is the entry into the application phase of AI a positive or negative development?

All fluctuations can be regarded as short-term, even if they are tenfold, they are only the result of a concentrated release of market enthusiasm.

Currently, both the leading topic and speculative leader in AI are being explored in more sub-sectors. Can Cambricon, a chip star, hold on and not be diverted?

This may depend on the market game potential of new hotspots. Zhi Tong Finance previously quoted Bill Stone, Chief Investment Officer of Glenview Trust, as saying, "The software industry is lagging, but it looks set to become the next winner in artificial intelligence."

He also had another consideration, namely, "There is too much good news in the chip sector, especially in artificial intelligence chips. When uncertainty increases, their valuation has already been high."

Although he was referring to sentiment trends in the overseas market, the internal game logic has great similarities. Under such a shift in perception, market sentiment towards AI hardware has fallen significantly, and even NVIDIA's strong performance has failed to win favor with its investors.

In contrast, the share price of Snowflake, an American data analysis software company, has soared driven by strong consensus expectations, especially as the surge in demand for AI software has stimulated another data analysis company, Palantir, to exceed expectations in performance, supporting the logic of profitability in AI+ applications.

Financial reports show that Palantir's revenue in the third quarter was $726 million, a year-on-year increase of 30%, exceeding market expectations; concurrently, its net profit hit a record high of $144 million.

In the domestic market, it has also been affected by this shift in market sentiment. Recently, AI applications have become a key investment hotspot in the market. As of the close of November 27, over a dozen stocks, including Holitech, Tom Cat, and Perfect World, closed at their daily limit up. Additionally, over a dozen AI+ application enterprises, such as 263.net, Tiandi Online, and Focus Technology, also closed at their daily limit up.

Conversely, hard tech sectors that have previously surged significantly, such as advanced packaging, memory chips, and CPO computing hardware, which are somewhat similar to Cambricon, have been continuously in a correction period. Even if there is a rebound, the momentum is not strong. How Cambricon will move forward depends on how strong its independence is.

Overall, there are not many companies with a market value of over 220 billion yuan in the A-share market, and it is rare for a company to have a "giant market value but nothing to say about its performance." Cambricon is a unique case, and to maintain its position at a high level, it needs to make a hundredfold effort. Just as many people are waiting for Cambricon to fall from its pedestal, many also hope it can stand a little firmer. Or even higher.

Source: Songguo Finance