SF Express goes to Hong Kong with a discounted IPO, with internationalization as the new bet

![]() 11/29 2024

11/29 2024

![]() 546

546

With its international business not yet firmly established and domestic profits compressed, going to Hong Kong with a discounted IPO is currently the best option for SF Express.

SF Express, which listed on the Hong Kong stock exchange for a secondary listing, closed flat on the first day but saw its shares drop below the IPO price the next day.

In June last year, J&T Express was the first to knock on the door of the Hong Kong Stock Exchange, followed closely by SF Express, which submitted its prospectus in August. However, the application expired within six months due to the failure to complete the listing hearing. In June this year, SF Express finally achieved its goal of a second listing on the Hong Kong Stock Exchange, officially issuing shares at HK$34.30 per share on November 27. Wang Wei, the founder of SF Express, rang the bell at the Hong Kong Stock Exchange, accompanied by delivery drivers.

It should be noted that the RMB 200 billion market value of SF Express is inseparable from the support of nearly 500,000 delivery drivers. Among the costs of SF Express in 2023, nearly 36% of the costs came from human outsourcing.

Typically, when an A-share listed company chooses to conduct a secondary listing on the Hong Kong stock exchange, the trading price will generally be lower than that on the A-share market. There is also the concept of A/H premium rate or H/A discount rate in the secondary market. On November 26, SF Express closed at RMB 42.07 per share on the A-share market, confirming this convention once again.

Internet companies such as BAT and Xiaomi chose to list in Hong Kong mainly because they could not meet the profit threshold required by the A-share market. Meanwhile, most state-owned enterprises listed in both A-share and H-share markets do not focus much on market value management but rather aim to open up international financing channels.

Among its peers, JD Logistics and J&T Express are currently trading below their IPO prices on the Hong Kong stock exchange. Even as the leading domestic express delivery company, SF Express's secondary listing also saw its shares drop below the IPO price the next day, which is not surprising.

A company's stock performance in the secondary market does not fully reflect its operating conditions. Wang Wei once bluntly stated, "After going public, the company becomes a money-making machine, and daily fluctuations in stock prices affect the company's nerves, which is detrimental to corporate management."

In this Hong Kong listing, SF Express issued a total of 170 million shares. If the over-allotment option is not exercised, the net proceeds from the offering will reach HK$5.662 billion, making it the second-largest IPO in Hong Kong this year. 45% of the funds raised will be used to strengthen international and cross-border logistics capabilities. SF Holdings has emerged as a leading integrated logistics service provider in China and Asia, following UPS, DHL, and FedEx on the global stage.

On one hand, SF Express's international business has not yet stabilized and urgently needs to increase investment in the face of competition; on the other hand, the profit margin in the domestic market continues to shrink, and liabilities have been rising. Even going to Hong Kong with a discounted IPO (on the evening of November 24, SF Express Holdings' H-shares were priced at HK$34.3, a 24% discount to the A-share closing price of RMB 42 on the 25th), has become the best option for SF Express at present.

From personally carrying suitcases back and forth between Hong Kong and Guangdong ports as a "human courier" to the 73 cargo routes at Ezhou Huahu Airport operating day and night, Wang Wei's understanding of the express delivery and logistics industry is that self-operation is the key.

When construction of Ezhou Airport began in 2017, SF Express's net profit was only RMB 4.7 billion. This "China's first cargo airport" cost nearly RMB 20 billion, effectively burning through SF Express's four years of profits in one go, indirectly leading to a huge loss for the group in 2020. Wang Wei had to publicly apologize at the shareholders' meeting but also expressed a determination not to compromise.

Since 2020, SF Holdings has significantly increased fixed asset investments year by year. By 2021, its investment had soared to RMB 19.2 billion, setting a new record.

SF Express's heavy investment in a self-operated model has always been challenged by the Tongda Express system, represented by STO Express, ZTO Express, YTO Express, and Yunda Express. The latter's franchise model only requires investment in major transportation routes and operation centers in key regions, while lower-level network terminals are all handled by franchisees for pick-up and delivery.

This not only greatly improves efficiency in expanding scale and capturing market share but also alleviates the financial pressure on express delivery companies by fully utilizing social resources.

In contrast, SF Express, which bears all links in the entire express delivery chain on its own, must invest heavily in infrastructure networks. Financial statements show that SF Express's liability scale increased from RMB 34.7 billion in 2018 to RMB 118.2 billion in 2023, with the asset-liability ratio rising from 48% to 53%. The latest data shows that SF Express's liability scale in the first half of 2024 was RMB 121 billion, reaching the level of the entire previous year.

Substantial capital investment in the main business is only one aspect. These expenditures may not generate returns or achieve the expected economic benefits in the short term. However, in recent years, SF Express has gradually tightened its capital investment. In the first half of 2024, its capital expenditure dropped to RMB 5.1 billion, indicating that SF Express may have entered a new stage of investment returns.

In addition, since SF Express was backdoor listed on the A-share market in 2017, it has also embarked on a simple and brutal "buy, buy, buy" model.

From 2018 to 2021, SF Express successively invested RMB 1.7 billion to acquire a 71% stake in Guangdong Xinbang Logistics; invested USD 100 million in the US logistics service platform Flexport; acquired the China business of DHL for RMB 5.5 billion; and acquired a 51.5% stake in Kerry Logistics, which was listed on the Hong Kong stock exchange, for HK$17.555 billion.

Three years of mergers and acquisitions pushed SF Express's A-share market value to a peak of over RMB 500 billion, but its gross profit margin halved compared to the initial public offering.

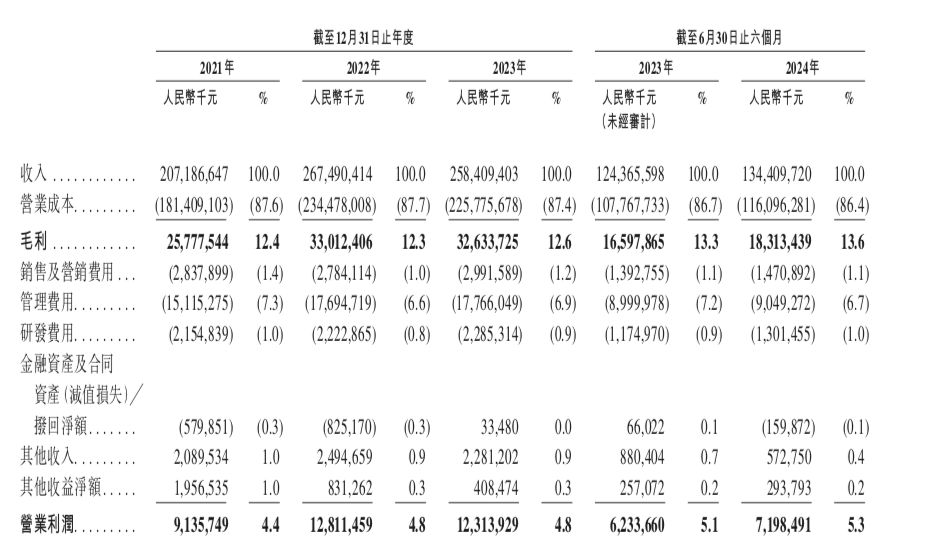

Data shows that SF Express's gross profit margins from 2021 to 2023 were 12.37%, 12.49%, and 12.82%, respectively, with net profit margins of 1.89%, 2.62%, and 3.06%, respectively. With profitability failing to improve, SF Express's market value has continued to shrink, falling to around RMB 200 billion.

SF Express is not unaware of the severity of the Hong Kong stock market. In 2021, two of its subsidiaries, SF REIT and SF Express (City), were listed on the Hong Kong stock exchange but are currently trading below their IPO prices; Kerry Logistics, which was acquired and consolidated, saw a brief surge but soon returned to normal. However, the international label and more diversified financing channels after listing in Hong Kong are still necessary for SF Express, which is eager to go abroad and in desperate need of funds.

The domestic express delivery industry has been engaged in a "price war" for many years, causing once familiar brands such as Deppon and Best to sell themselves for self-preservation. As an industry leader, SF Express has also been inevitably affected.

According to third-party data, SF Express's share of the domestic market was 11.5% in 2014, with its unique timeliness advantage bringing a 61.2% industry premium. In the following years, other express delivery companies continuously lowered industry average prices in the price war, while SF Express merely maintained its original pricing level. By 2018, the industry premium had reached 93.7%, but its market share had dropped to 7.63%.

Although revenue and profit are still sufficient for SF Express to retain its position as the leading express delivery company in the short term, the Tongda Express system and the newly rising J&T Express, relying on their respective e-commerce platforms, can fully occupy a larger e-commerce parcel market before improving timeliness to launch a counterattack on SF Express, the last fortress.

Sensing the threat, SF Express began lowering its high prices in 2019, continuing until 2021, when it reduced the industry premium rate all the way to 64.3%. During this period, it also established SF Best Express in 2020, focusing on e-commerce parcels and a franchise model.

However, SF Express, which chose to join the competition rather than fight it, did not achieve the desired results. Its market share never exceeded 10%, and the profit loss caused by price reductions was real and painful. Ultimately, in 2023, it abandoned the strategy of "trading price for volume" and returned to being a high-priced player, selling SF Best Express to J&T Express.

In 2024, statistics released by the State Post Bureau showed that the cumulative domestic express delivery volume in the first half of the year reached 80.16 billion items, a year-on-year increase of 23.1%; and cumulative express delivery revenue reached RMB 653 billion, a year-on-year increase of 15.1%. However, the data growth does not uniformly reflect the situation of individual express delivery companies.

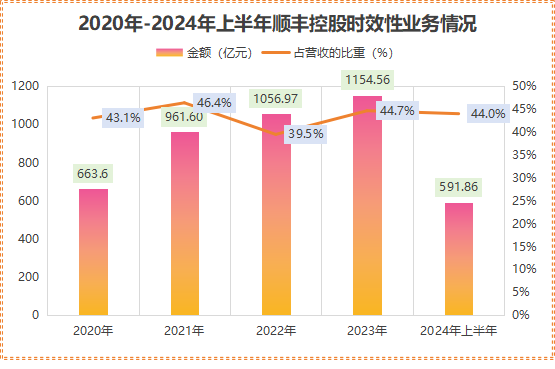

The prospectus shows that SF Express's business is divided into three parts: express and bulk business, same-city instant delivery business, and supply chain and international business. Among them, the "small but beautiful" time-sensitive express delivery remains the main business, driving the express delivery segment to become the company's pillar business; however, the same-city instant delivery has been underperforming, contributing less than 3% of revenue for three consecutive years.

▲Photo/New Stock Radar

However, SF Express's advantage in "time-sensitive express delivery" is waning. The mid-year report for 2024 shows that this business still accounts for 44.03% of SF Express's total revenue, generating nearly RMB 60 billion in revenue. Although it is still the largest business, JD.com, STO Express, ZTO Express, YTO Express, and Yunda Express have increased speed and reduced prices, putting pressure on SF Express.

Although SF Holdings' business volume is lower than that of JD Logistics, STO Express, ZTO Express, YTO Express, and Yunda Express, which are "tied" to e-commerce platforms, its average revenue per ticket is seven times that of these companies. Taking the May revenue per ticket of SF Express, STO Express, YTO Express, and Yunda Express as examples, they were RMB 15.25, RMB 2.23, RMB 2.03, and RMB 2.01, respectively, with year-on-year decreases of 1.17%, 2.82%, 16.8%, and 9.05%, respectively. More parcels and higher revenue have led to lower unit prices and even lower profits.

SF Express is already a unique existence in the industry. After abandoning its obsession with market share, its gross profit margin has remained above the industry average, but competitive pressure has never diminished. JD Logistics, which also adopts a self-operated model, and Cainiao, which is preparing to go it alone after Alibaba's reforms, have been continuously advancing into the comfort zone of SF Express, the time-sensitive express delivery segment, in recent years. The Tongda Express system and J&T Express are also shortening delivery times step by step through digital construction.

The initial concerns have now come true, and previous efforts have fallen short of expectations. Unable to compete domestically, SF Express can only turn its gaze overseas. This express delivery giant, which has already become the largest in Asia and the fourth largest in the world, must face a more complex situation in the global market.

Supply chain and international business have always been regarded by SF Express as the second growth curve, increasing from 8.7% of revenue in 2020 to 33.6% in 2022. This is largely attributed to SF Express's acquisition and consolidation of Kerry Logistics in 2021.

However, the good times did not last long. After the global air and sea freight prices fell post-pandemic, SF Express's international business took a sharp turn for the worse in 2023, plummeting from a peak revenue of RMB 48.47 billion in 2022 to RMB 25.76 billion, once dragging down SF Group's overall revenue for the first time in many years. The latest data for 2024 shows that the international business has recovered somewhat but has not yet reversed the downturn.

By choosing a secondary listing on the Hong Kong stock exchange, SF Express specifically stated in its submission materials that it had "passed the peak period of capital expenditure," seemingly avoiding the image of being short on funds. Instead, it continuously emphasized its "internationalization" strategy in announcements: "To further advance the internationalization strategy, build an international capital operation platform, enhance the international brand image, and improve comprehensive competitiveness."

It is evident that Wang Wei has bet on SF Express's next stage being overseas expansion.

As early as the shareholders' meeting in August 2023, Wang Wei seemed eager about SF Express's internationalization pace. He bluntly stated, "SF Express cannot be slower than its competitors. (Listing in Hong Kong) is out of internationalization considerations. Although SF Express has made some investments in international business before, it is not enough. SF Express needs an international capital platform."

In fact, SF Express's planned overseas layout began as early as 2009, leveraging the Korean beauty product purchasing trend at that time. It took only two years to cover the entire territory of South Korea. After 2013, it successively expanded its business to Thailand, Singapore, Malaysia in Southeast Asia, and Japan in East Asia.

Kerry Logistics is the largest third-party logistics enterprise in the Southeast Asian market. However, this is also the birthplace of J&T Express, the predecessor of J&T Express. The latter was founded in Indonesia in 2015. According to data from the third-party agency Frost & Sullivan, J&T Express's market share in Southeast Asia reached 22.5% in 2022.

SF Express, which wants to extricate itself from the quagmire of domestic price wars, will still face the same competitors overseas.

The Tongda Express system is not willing to struggle in the unprofitable incremental competition and has also regarded going abroad as a direction for experimentation. Zhou Jian, the former CEO of SF Best, which was sold by SF Express, joined YTO Express as the Executive President of International Express, with J&T Express in the Southeast Asian market as the primary imaginary enemy.

Today, with the rapid expansion of Temu, the cross-border e-commerce platform under Pinduoduo, J&T Express has extended its business to North America. Similarly, Alibaba and JD.com, which also have overseas e-commerce businesses, are driving Cainiao and JD Logistics to take the lead in international logistics and distribution.",

Judging from SF Express's past overseas business layout strategy, obtaining the status of a Hong Kong-listed company makes it easier to carry out mergers and acquisitions. In the second half of 2023, Kerry Logistics announced plans to sell some of its affiliated companies engaged in express delivery services in the Asia-Pacific region and Europe to SF Express for HK$250 million again."],"["It is foreseeable that SF Express's grand strategy of internationalization is highly likely to continue the "buy, buy, buy" model of mergers and acquisitions. However, as an independent third-party express delivery company lacking the logistics logic driven by business flow, SF Express must also find a strong partner to compete with e-commerce express delivery companies.