Can a small electronic price tag support an IPO? Hanshow faces overseas patent litigation

![]() 12/02 2024

12/02 2024

![]() 579

579

Producer | Bullet Finance

Art Director | Xing Jing

Reviewer | Song Wen

When it comes to electronic price tags, many people may pay more attention to the product prices when shopping in supermarkets rather than the price tags displaying the price information.

The role of electronic price tags cannot be underestimated. They can be linked to the backend operation and frontend cash register system to uniformly change prices and promotions for thousands of products in supermarkets, and also enable precise positioning of goods.

They can even achieve uniform pricing among multiple supermarket chains, reducing errors caused by frequent changes, not only saving paper but also significantly improving the operational efficiency and service quality of supermarkets and hypermarkets.

(Image / Electronic price tag from Hanshow's official website)

In fact, in this highly specialized niche market, a 'hidden champion' has emerged in China: Hanshow.

On November 15 this year, Hanshow took another step towards an IPO on the ChiNext board of the Shenzhen Stock Exchange, with its status changing to 'Submitted for Registration,' bringing it closer to going public. However, the hidden concerns behind its development cannot be ignored.

1. Continuous double-digit growth in performance, with a net profit of 700 million yuan in one year

Hanshow was founded on September 14, 2012, with Hou Shiguo as its founder, current chairman, and general manager.

Public information shows that Hou Shiguo, born in 1975 and graduated from Beihang University, joined Huawei in 2000. During his eight years at Huawei, he participated in the development of Huawei HiSilicon chips.

In April 2007, Hou Shiguo also joined FJKS Technology (Beijing) Co., Ltd. as the R&D director and later joined Beijing Jianyue Na Electronics Co., Ltd. as the deputy general manager the following year.

Starting in 2011, Hou Shiguo began serving as the general manager of Beijing Hanshow. In 2013, Hou Shiguo led Hanshow to develop the first generation of commercial electronic price tag products.

From 2017 to 2018, Hanshow intensified its overseas expansion, successively establishing subsidiaries in France and Germany to expand the European market. In 2019, it set up a European center in Amsterdam, and in 2021, it established Hanshow USA.

Currently, Hanshow serves over 400 customers in more than 50 countries and regions worldwide.

Since 2013, Hanshow has launched over 40 electronic price tag products across multiple series and iterated its system software more than 20 times.

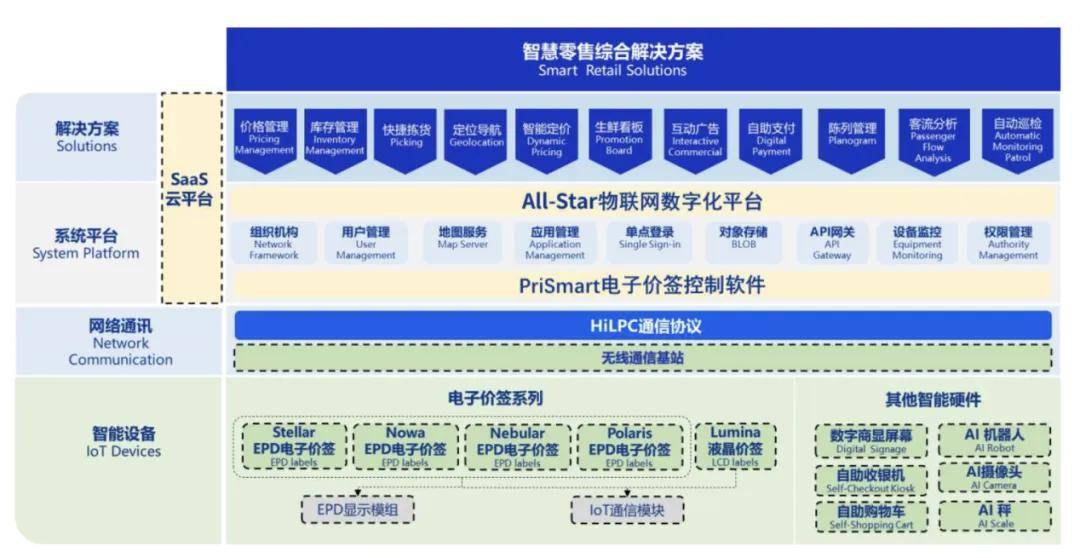

From 2016 onwards, Hanshow has evolved from a mere supplier of electronic price tags to a solution provider, launching its Smart Store Solution in 2018.

According to CINNO statistics, Hanshow accounted for approximately 62% of the domestic electronic price tag market share in 2023. From 2021 to 2023, among global listed company competitors, Hanshow ranked in the top three in terms of electronic price tag revenue.

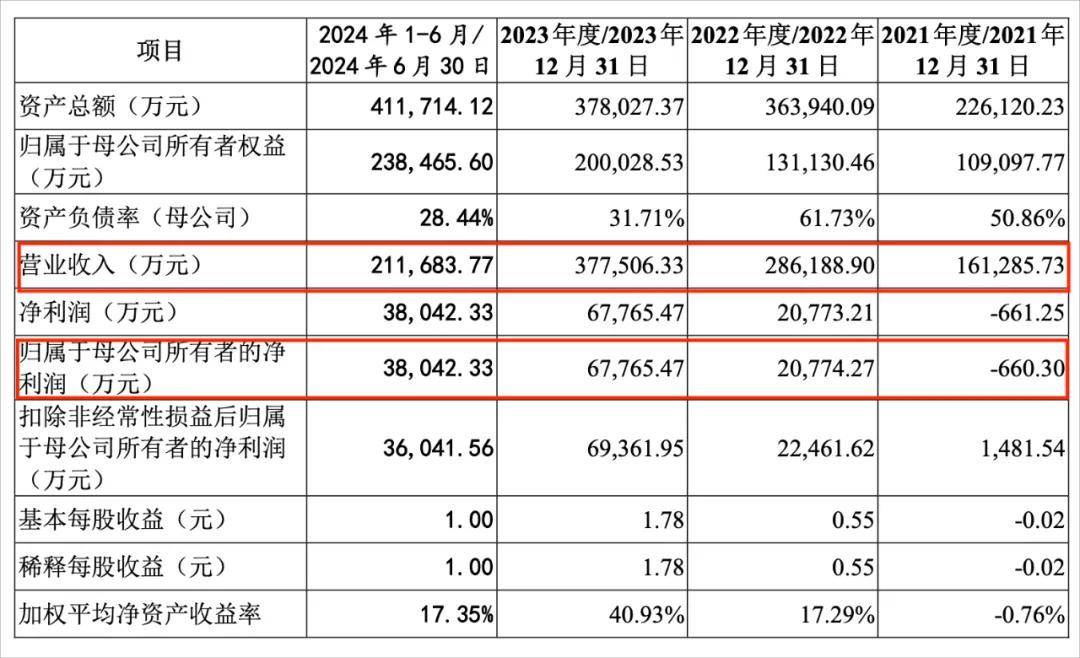

The latest registration draft of the prospectus shows that Hanshow generated revenues of approximately 1.613 billion yuan, 2.862 billion yuan, 3.775 billion yuan, and 2.117 billion yuan in 2021, 2022, 2023, and the first half of 2024 (hereinafter referred to as the 'reporting period'), respectively. The net profits attributable to the parent company's owners during the same period were -6.603 million yuan, 208 million yuan, 678 million yuan, and 380 million yuan, respectively.

It can be seen that in 2022, 2023, and the first half of 2024, the company achieved double-digit growth in both revenue and net profit.

(Image / Hanshow's Prospectus)

In addition, Hanshow predicts in its prospectus that it will achieve full-year revenue of 4.35 billion yuan to 4.55 billion yuan in 2024, representing a year-on-year growth of 15.23% to 20.53% compared to the previous year. The net profit attributable to the parent company's owners is expected to be 700 million yuan to 750 million yuan, representing a year-on-year growth of 3.30% to 10.68%.

Looking at the revenue from specific products in the main business, the first is electronic price tag terminals. During the reporting period, their revenues were 14.27 billion yuan, 26.64 billion yuan, 35.18 billion yuan, and 19.44 billion yuan, accounting for 88.48%, 93.07%, 93.2%, and 91.38% of total revenue, respectively. This business is Hanshow's primary source of income.

Hanshow's electronic price tags are also divided into different series, including Nebular, Stellar, Polaris, Nowa, Lumina, and others.

In terms of application scenarios, the Stellar, Nowa, and Nebular series are mainly used for product shelves, general merchandise stacks, and refrigerators. The Nowa series, featuring a lens-free design, is primarily used in special scenarios such as pharmacies. The Lumina series, with its larger individual screens, is mainly used in fresh produce stacks and refrigerators.

Secondly, Hanshow's accessories and other product businesses generated revenues of 125 million yuan, 127 million yuan, 144 million yuan, and 85.5876 million yuan during the reporting period, accounting for 7.72%, 4.44%, 3.8%, and 4.04% of total revenue, respectively.

Finally, Hanshow's software, SaaS, and technical services generated revenues of 61.3396 million yuan, 71.3782 million yuan, 113 million yuan, and 87.3836 million yuan, accounting for 3.8%, 2.49%, 3%, and 4.13% of total revenue, respectively.

During the reporting period, the company's comprehensive gross profit margins were 22.19%, 19.46%, 32.59%, and 37.25%, respectively. The gross profit margins for 2021 and 2022 showed a downward trend, but there was a rapid rebound in 2023 and the first half of 2024.

For this IPO, Hanshow plans to raise approximately 1.182 billion yuan, with 540 million yuan earmarked for the Store Digitalization Solution Project, 292 million yuan for the AIoT R&D Center and Informatization Construction Project, and an additional 350 million yuan for supplementary working capital.

2. Revenue reliance on overseas markets faces patent litigation

Although Hanshow's domestic market share exceeds 60%, its primary revenue comes from overseas markets.

The prospectus reveals that during the reporting period, the company's overseas main business revenue was 12.26 billion yuan, 26.63 billion yuan, 36.13 billion yuan, and 19.97 billion yuan, accounting for 76.04%, 93.05%, 95.72%, and 94.32% of the company's main business revenue, respectively.

Among these, revenue from European regions accounted for 58.64%, 64.55%, 63.33%, and 53.73%, respectively, representing a significant portion.

This is primarily due to the mature retail market and strong payment capabilities in Europe, coupled with high labor costs, leading to a strong demand for smart retail. As a result, Hanshow's products enjoy high recognition and penetration in the European market.

In contrast, Hanshow's revenue in domestic regions during the reporting period was approximately 3.87 billion yuan, 1.99 billion yuan, 1.62 billion yuan, and 1.2 billion yuan, accounting for 23.96%, 6.95%, 4.28%, and 5.68% of total revenue, respectively.

Since 2021, the company's domestic revenue has not exceeded 7%.

According to the 'Global Electronic Paper Price Tag Market Research Report' issued by CINNO, in terms of global market share in 2023, SES accounted for approximately 31% (ranking first), Hanshow accounted for approximately 28% (ranking second), SoluM accounted for approximately 22% (ranking third), and Pricer accounted for approximately 10% (ranking fourth). These four companies collectively account for approximately 91% of the global market share.

In 2021 and 2022, the combined global market share of these four companies was approximately 83% and 85%, respectively. Clearly, the electronic price tag market is becoming increasingly concentrated, and competition is likely to intensify accordingly.

From 2021 to 2023, Hanshow's share of the global electronic price tag market was approximately 22%, 23%, and 28%, respectively, showing a continuous growth trend.

However, at the same time, Hanshow also faces the risk of patent litigation from SES, the industry leader.

The prospectus discloses that as of November 8, 2024, there were a total of six ongoing patent lawsuits or related legal measures initiated by SES and its subsidiaries against Hanshow. The litigation procedures include one patent infringement lawsuit, one patent invalidation lawsuit, and four other patent-related legal measures in which Hanshow and its subsidiaries are respondents.

These lawsuits involve regions in Europe and the United States. SES alleges in the lawsuits that Hanshow has infringed upon three of its U.S. patents and one European patent.

Hanshow stated that according to public searches, the patents held by SES have family patents in countries such as Japan, Mexico, Singapore, South Korea, Australia, Austria, Brazil, and China. Therefore, they do not rule out the possibility that the dispute between SES and Hanshow may expand further in scope. (Editor's note: Family patents refer to a group of patents that share the same inventive concept but have modified or varied content, filed in different languages and countries, resulting in a family of patents that are published or granted.)

In addition, Hanshow also revealed that the patent infringement case in the Eastern District of New York, USA, has a longer period from court acceptance to trial compared to other state courts, approximately 5-6 years, with a trial to judgment period of approximately 1-2 years.

In Paris, France, the first instance of a patent invalidation lawsuit in the Paris Court of Justice typically takes 20-28 months, with an appeal period of approximately 24 months. The European Patent Office's opposition procedure generally takes approximately 15 months, with an appeal period of approximately 2.5-3.5 years.

Therefore, Hanshow may face overseas litigation for an extended period in the future.

Currently, Hanshow has hired intellectual property legal experts worldwide to actively respond to the lawsuits.

As of June 30, 2024, the main expenses paid by Hanshow for the lawsuits and other legal measures related to SES were approximately 27.1594 million yuan, accounting for approximately 1.86% of the company's total profit from 2022 to June 2024.

Hanshow also expects that the total potential future expenses will not exceed 57.28 million yuan.

With its main business revenue coming from overseas markets, Hanshow faces the risk of intellectual property litigation overseas, which may have a prolonged impact. These risks may also affect the company's performance after going public.

3. Over 99% outsourcing, with high supplier and customer concentration

'Bullet Finance' noticed another noteworthy aspect in the prospectus.

During the reporting period, the company adopted a production model primarily based on outsourcing and supplemented by in-house production. The proportion of outsourced processing of complete machines to the total incoming quantity of complete machine products was 89.57%, 99.19%, 99.83%, and 99.91%, respectively.

Currently, Hanshow's main outsourcing factories include BYD, Luxshare Precision, and HKC.

Hanshow explained that considering the company has already completed capacity and quality run-ins with the three outsourcing factories, and given the limited scale of its in-house production capacity, it has concentrated its production resources on supplementing the capacity of key electronic paper display modules, resulting in the proportion of outsourced processing of complete machines exceeding 99% since 2022.

However, outsourcing has also encountered 'unreliable' situations. The company disclosed the amount of returns and exchanges and their proportion of revenue from 2020 to the first half of 2023 in its responses to inquiries. Among them, the amount and proportion of returns and exchanges in 2020 were 2.2451 million yuan and 0.19%, respectively, significantly higher than other years.

Hanshow explained that the slightly higher proportion of returns and exchanges in 2020 was mainly due to the return of 54,000 defective electronic price tags from the Nowa series, amounting to 1.8679 million yuan. These tags had quality issues due to poor crimping by the outsourcing factory, and the factory bore the related costs according to the agreement.

Although the amount and proportion of returns and exchanges have since remained stable, the risks associated with such outsourcing require long-term mitigation.

In terms of R&D, Hanshow also needs to continue increasing its investment.

From 2021 to 2023, Hanshow's R&D investments were 122 million yuan, 124 million yuan, and 168 million yuan, accounting for 7.57%, 4.32%, 4.46%, and 4.62% of revenue, respectively.

It can be seen that the compound annual growth rate of R&D expenses is less than 20%. Over the past three years, the company's revenue has grown at a compound annual rate of 52.99%, with R&D investment growth significantly lower than revenue growth, which may affect the company's technological innovation and long-term competitiveness.

Hanshow admitted in its prospectus that its current electronic price tags and other store digitization products and key core components mainly rely on outsourcing and outsourcing procurement. The company lacks sufficient in-house production equipment and facilities, has limited manufacturing capabilities, and needs to improve its R&D collaboration capabilities and scale effects.

This is also one of the reasons why they are seeking to raise funds for the industrialization project of store digitization solutions.

Additionally, Hanshow faces high supplier and customer concentration risks.

During each period of the reporting period, the company's purchases from the top five suppliers accounted for 67.69%, 62.88%, 58.96%, and 64.08% of total purchases during the same period, indicating a high degree of purchasing concentration.

Among the risk factors, Hanshow also pointed out that it relies heavily on the electronic paper film supplier E Ink Holdings and currently lacks a reliable alternative supply channel in the short term.

On the client side, the combined sales revenue from Hanshow's top five customers accounted for 39.17%, 56.37%, 55.14%, and 55.08% of the company's revenue during the respective periods, indicating high customer concentration.

Currently, although Hanshow has achieved consistent performance growth, it still faces long-term patent litigation risks in overseas markets. Hou Shiguo also needs to strengthen the company's R&D investment to ensure continuous innovation and in-house production capabilities, and expand cooperation partners on both the supply and demand sides to reduce business risks.

Although electronic price tags are a relatively niche product, the global market size is expected to reach 34.9 billion yuan by 2028. Hanshow Technology's success in listing on the A-share market and its continued expansion of global market share will continue to be closely monitored by "Bullet Finance".

*The featured image in the article is from: Hanshow Technology's official website.