Successive departures of technical experts leave Kuaishou facing a talent crisis

![]() 12/04 2024

12/04 2024

![]() 713

713

"Amid various adverse factors, Kuaishou's pursuit is becoming increasingly arduous. However, AI and overseas expansion have also become new engines for Kuaishou's pursuit of change."

@ New technological knowledge original

The personnel turmoil at Kuaishou seems far from over.

Recently, according to insiders, Ren Kai, the head of the recommendation architecture for Kuaishou's community science line, has recently resigned, with his whereabouts unknown. "TechNews" inquired about this matter with relevant personnel from Kuaishou but has not yet received a response.

Ren Kai, image source: Shen Ma's WeChat Moments

According to public information, Kuaishou's community science line is the AI algorithm engine department for its core scenarios, using a complete set of AI solutions to implement and manage various algorithm logic for videos, live streams, e-commerce, and local life, such as content understanding and generation, recommendation, social interaction, content discovery, community growth, etc., to enhance various user metrics on Kuaishou and explore new product user interests.

Ren Kai is also a powerful "general" in this business unit. He graduated with a bachelor's degree from the Department of Computer Science at Tsinghua University in 2009 and obtained his Ph.D. from Carnegie Mellon University in 2015. During his doctoral studies, he published multiple top-tier conference papers in the systems field.

After obtaining his Ph.D., Ren Kai served as a research scientist in Instagram's advertising group. As a founding member of the Instagram advertising group, he built the Instagram advertising ranking service from scratch and collaborated with the team to grow Instagram advertising revenue to billions of dollars within a year.

In 2019, Ren Kai returned to China to join Kuaishou, serving as the head of the recommendation architecture, responsible for the construction of the core recommendation system and the middle platform, including recommendation online services, large-scale real-time training of recommendation models, and recommendation heterogeneous computing projects.

According to a report on the Carnegie Mellon University Beijing Alumni Association's official account, in March 2022, Ren Kai's position was Senior Technical Director of Kuaishou's recommendation architecture (M3C), although sources claim he has since reached the M4A level.

It is worth mentioning that this year, Kuaishou has experienced frequent personnel changes, with several senior executives in key positions having resigned.

01 Batch departures of technical executives

According to incomplete statistics, several vice president-level technical executives have left Kuaishou this year, including Yuan Shuai, vice president of Kuaishou's Magnet Engine and head of the short video business, Wang Zhongyuan, head of multimodal, Liu Qi, chief audio-video architect, Fu Ruiji, head of technology for the knowledge graph and large model agent, and Song Yang, vice president of Kuaishou and head of recommendation algorithms.

Among them, Yuan Shuai's departure is particularly noteworthy. Yuan Shuai has a rich career history at Kuaishou. He joined the company in 2019, initially serving as the head of music. In 2022, he became the head of the creator services team at Kuaishou. Subsequently, his career took another turn when he was transferred to the commercialization department, where he successively held positions as head of the Magnet Cluster and Kuaishou Alliance businesses. Both of these businesses are crucial components of Kuaishou's commercialization strategy, and Yuan Shuai achieved remarkable results in both roles.

Yuan Shuai

By the end of 2023, Yuan Shuai was entrusted with another important role, becoming the head of the Magnet Engine's short video business. However, it was during his tenure in this core business that Yuan Shuai quietly resigned, leaving his whereabouts a mystery.

Additionally, Kuaishou's chief audio-video architect Liu Qi and knowledge graph and large model agent technology leader Fu Ruiji both left the company, one after the other, in April and May, respectively. The former participated in the development of products such as Kuaishou Cloud Clip and StreamLake during his tenure; the latter is a "big shot" in the field of artificial intelligence and previously served as the deputy director of the AI Research Institute at iFLYTEK. In March 2021, he joined Kuaishou's MMU and led the development of the industry's first billion-level multimodal short video encyclopedia knowledge graph "Kuaizhi" and Kuaishou's large model agent technology KwaiAgents.

Song Yang, who joined Kuaishou in June 2020, served as vice president (at the M4B level) and head of the Model and Application Department within Kuaishou's Community Science Division, responsible for recommendation models across Kuaishou's short videos, live streams, e-commerce, advertising, and other domains. After being transferred to the search department at the end of 2023, he has since fallen silent.

02 Cheng Yixiao at the helm, restructuring the architecture

Kuaishou has now entered the Cheng Yixiao era, with Su Hua stepping down as CEO and Chairman of the Board in 2021 and 2023, respectively.

Under Cheng Yixiao's leadership, Kuaishou has entered an era of profitability, and he has made many significant adjustments to the company, including scaling back overseas operations to stop losses and disbanding some unprofitable businesses. For example, in March of this year, Kuaishou officially disbanded its Beijing Game Business Unit.

However, the short video sector has not yet reached its conclusion. The acceleration of Video Number's entry into the market to some extent signifies that the short video sector has entered a new competitive phase, with Kuaishou, Douyin, and Video Number competing for content and users.

For Su Hua, the performance of e-commerce, large models, and other businesses in the coming years will directly determine the upper limit of Kuaishou. The successive departures of senior executives this year may be a continuation of Cheng Yixiao's strategy after Su Hua adjusted Kuaishou's structure.

At the end of 2023, Kuaishou announced a new round of organizational restructuring. It is reported that the restructuring involves 15 business lines under the main site, e-commerce, and commercialization divisions, with a total of 25 middle managers affected. This is the largest organizational and management restructuring since Kuaishou's IPO.

Architectural restructuring implies that some businesses will be merged, which also means that some executives will be sidelined. This may explain the continuous departures of senior executives from Kuaishou in recent months.

In fact, Kuaishou's organizational issues extend beyond talent management, with hidden dangers also present in employee management.

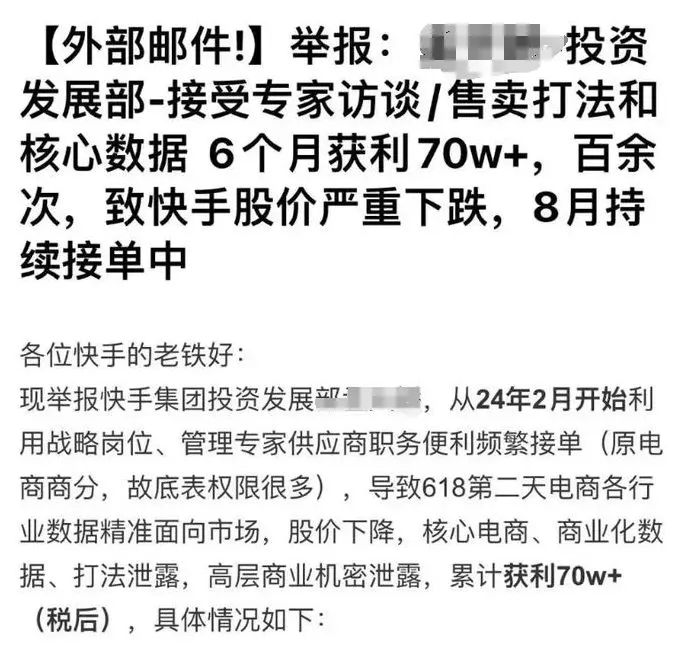

In early September of this year, an email accusing Kuaishou employees of leaking core company data and planning strategies, leading to a drop in share prices, circulated online. The email was sent to multiple senior executives at Kuaishou, including co-founder Cheng Yixiao.

Subsequently, a disciplinary notice from Kuaishou revealed that after investigation and verification, a former employee of the Finance/Business Analysis Department had used their position to repeatedly query and download company business data and leaked it to multiple external consulting firms for profit, causing significant losses and a detrimental impact to the company.

This incident exposed many loopholes in Kuaishou's internal governance. As the company grows in size, strengthening the protection of business secrets and intellectual property rights and establishing a sound internal control system and risk early warning mechanism will become core issues for Kuaishou.

03 Dual-track operations, new bets on commercialization

Kuaishou's self-transformation and proactive attitude towards a rapidly changing market are inseparable from its anxiety.

Firstly, in the secondary market, compared to its peak, Kuaishou's market value has shrunk significantly. The decline in share prices, to some extent, represents the capital market's attitude towards Kuaishou's growth potential. Therefore, Kuaishou also needs to tell new stories to meet market expectations.

Kuaishou's main business, short videos, has already been outpaced by Douyin and has even lost its position as the "second place" player. Tencent's Video Number, backed by WeChat's vast user base, is developing rapidly and gradually eroding the short video market.

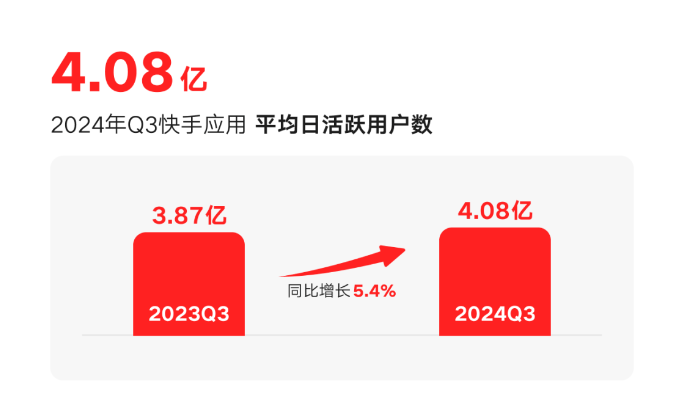

Kuaishou's DAU for the third quarter of 2024 was 408 million, representing a 3.29% quarter-on-quarter increase and a new high in user data, although growth has begun to slow. Over a longer timeline, from the first quarter of 2023 to the third quarter of this year, Kuaishou's DAU was 374 million, 376 million, 387 million, 383 million, 394 million, 395 million, and 408 million, respectively, indicating slow growth and a gradual approach to a ceiling.

Guohai Securities previously estimated that Video Number's daily active user count reached 450 million in 2023, already exceeding Kuaishou's third-quarter figures for this year. However, in terms of average usage time, Video Number falls short at less than 60 minutes, compared to Kuaishou's 120 minutes.

Amid various adverse factors, Kuaishou's pursuit is becoming increasingly arduous. Nevertheless, AI and overseas expansion have also become new engines for Kuaishou's pursuit of change.

Currently, the monthly commercial revenue of Keling AI exceeds ten million yuan, and the membership subscription service for consumers and the API service for businesses have received positive market feedback. Financial reports show that the average monthly number of users using Kuaishou Search exceeded 500 million in the third quarter, with the average daily number of searches increasing by over 20.0% to 730 million.

Kuaishou's overseas short video app "Kwai" is growing rapidly in the Middle East and North Africa, with over 20 million monthly active users spending an average of one hour per day on the app, demonstrating remarkable user engagement and attractiveness. Financial reports show that overall revenue from overseas markets increased by 104.1% year-on-year in the third quarter of this year, reaching 1.3 billion yuan.

Judging from the current series of implementation strategies and personnel changes, Kuaishou has entered a critical juncture in its transformation. AI and overseas expansion offer abundant possibilities, but commercializing new businesses is indeed the most urgent task for Kuaishou at present. Additionally, from a longer-term perspective, besides new businesses, maintaining stable growth in foundational businesses should also be a concern for Kuaishou.