Jack Ma Abandons Stubbornness, Alibaba Unloads Burdens

![]() 12/18 2024

12/18 2024

![]() 671

671

Text/Guo Jiayi

Editor/Zhang Xiao

The essence of corporate greatness lies in making prudent decisions—choosing what paths to pursue and which to avoid. These choices often determine a company's direction and even its fate.

When Steve Jobs returned to Apple in 1997, he simplified the product line to just four core products: iMac, iPod, iPhone, and iPad. This strategic move continues to benefit Apple today. Similarly, when Liu Qiangdong decided to transition JD.com online in 2004, despite initial skepticism and even resignations from some employees, his bold choice paved the way for the company's success.

Conversely, overreaching ambitions can lead to downfall. Jia Yueting's overzealous expansion led to LeTV's collapse. Despite a decade-long focus on building cars, he has only managed to deliver a handful this year.

These pivotal decisions, shrouded in uncertainty, can either propel a company to new heights or plunge it into crisis. They offer boundless possibilities or unmitigated disaster.

For most companies, the line between what to do and what not to do is blurred by the unknown. This discernment is based on a multitude of factors, including market trends, consumer behavior shifts, and the courage and resolve of decision-makers.

Alibaba, the corporate giant now undergoing a comprehensive transformation, has opted to sell Intime Retail at a loss of RMB 9.3 billion. This sale reflects Alibaba's strategic shift.

Yesterday (December 17), Alibaba Group Holding Limited announced the sale of 100% of Intime's equity to a consortium comprising Youngor Group and Intime management. Prior to the sale, Alibaba held approximately 99% of Intime's equity.

Alibaba stated that the total proceeds from the sale amounted to approximately RMB 7.4 billion (USD 1 billion), with an anticipated loss of RMB 9.3 billion (USD 1.3 billion).

Selling Intime was not a spur-of-the-moment decision but part of Alibaba's broader strategy to monetize its "non-core businesses" after focusing on e-commerce and cloud services over the past two years. Bloomberg reported as early as this year that Alibaba was considering selling Intime Retail.

Moreover, given Alibaba's recent business restructurings, the sale of RT-Mart may also be imminent.

Last December, Alibaba's subsidiary, Alibaba.com, transferred shares in several listed companies to Hangzhou Haoyue, including Meinian Onehealth Healthcare, Focus Media, Qianfang Technology, Easyhome, YTO Express, Red Star Macalline, and Lirenlizhuang. Hangzhou Haoyue, another Alibaba subsidiary, signaled its intent to offload all shares within six months, as disclosed by Lirenlizhuang on November 27.

Alibaba's strategic choices and rationale at this juncture are becoming increasingly clear:

While Alibaba remains optimistic about the potential of AI in e-commerce and cloud computing, it has chosen to let go of its stubbornness regarding new retail, recognizing disappointments and opting to cut losses. This represents the will of Alibaba, its current CEO Wu Yongming, and Jack Ma.

01 'Grow Stronger, Achieve New Glories'

Since its inception, Alibaba has faced numerous crossroads, with Jack Ma often choosing the right path.

This was evident when Alipay was spun off from Taobao and when Alibaba Cloud was supported by Wang Jian.

However, as Alibaba grew and diversified its investments, choices became less straightforward. What seemed right a few years ago might not hold true today.

Image/Alibaba Group official website

Alibaba's investments in new retail have yielded varying outcomes at different stages.

Initially, Alibaba's investments complemented its e-commerce business, such as improving logistics with Best Logistics in 2008 and enhancing Taobao's image search with Taotaosearch in 2010.

This approach changed with the advent of the mobile internet era.

In 2013, Jack Ma acknowledged that Alibaba lagged behind competitors in mobile business development. He vowed to achieve competitiveness through mergers and acquisitions.

The arrival of Zhang Hongping and Joseph Tsai accelerated Alibaba's investment diversification, moving beyond e-commerce into seemingly unrelated fields.

Zhang Hongping outlined Alibaba's investment philosophy: some investments integrated with existing businesses, where Alibaba took a controlling stake; others were minority investments for financial gain, emphasizing ecosystem building.

Under this strategy, Alibaba acquired businesses across local life, mass entertainment, and new retail segments.

Key acquisitions included Gaode Maps (2014) and Ele.me (2018) in the local life segment, and Alibaba Pictures, Damai.cn, and Youku in mass entertainment.

Alibaba's bet on new retail was also substantial, with investments in Hema, Intime Retail, and RT-Mart.

This shift marked Alibaba's ambition to transcend being just an online shopping platform, aiming to permeate all aspects of people's lives, both online and offline.

New retail was a crucial move, embodying Jack Ma's vision. He declared, "The era of pure e-commerce is over. In the next ten to twenty years, there will only be new retail."

To this end, Alibaba made significant acquisitions related to new retail, including Ele.me for USD 9.5 billion, Intime for USD 2.5 billion, a stake in RT-Mart for HKD 22.4 billion, and becoming Suning's second-largest shareholder in a mutual investment worth CNY 28.2 billion. Earlier this year, China Business Herald reported that Alibaba invested at least CNY 15 billion in Hema.

At the time, Alibaba was unfazed by the high costs, driven by the vision of transforming offline business formats into online equivalents.

For instance, despite RT-Mart's declining revenue and Feiniu.com's losses, and Intime's modest growth, Alibaba paid a 42% premium for its acquisition.

Then-CEO Daniel Zhang stated, "Alibaba has a clear positioning for Intime Retail as a flagship in transforming and upgrading online and offline retail and department stores."

Looking back, new retail reflected the stubbornness of Alibaba, Daniel Zhang, and especially Jack Ma.

02 An Unexpected End to the Radical New Retail Experiment

Alibaba's new retail strategy involved more than just acquisitions.

It entailed a mature business structure with Alibaba Cloud, Cainiao, and Alipay as the infrastructure, Taobao and Tmall as the base, and various new retail pillars targeting different business forms.

For example, investments in Suning focused on home appliances and digital products, Intime Retail on apparel and department stores, and Hema and RT-Mart on fast-moving consumer goods.

This collaboration seemed mutually beneficial at the time—Alibaba had the vision, resources, and modest traffic to transform declining offline supermarkets, while these businesses could enhance Alibaba's GMV.

This synergy did materialize in some cases.

Post-acquisition, Intime Retail accelerated its digital transformation within Alibaba's new retail system, with 60 department stores nationwide and 40 million digital members.

Similarly, Tmall gained from this partnership, acquiring valuable brand manufacturer resources.

However, the overall progress of Alibaba's new retail ecosystem did not meet expectations.

In Q3 this year, Alibaba's "all other" revenue, including RT-Mart, Intime, and Hema, declined 7% year-on-year, with adjusted EBITA down 87%.

Alibaba noted that excluding physical retail operations like RT-Mart, Hema, and Intime, the company's performance would improve, with revenue up 8% and adjusted EBITA rate around 24%, a 4% increase.

These heavily operated physical retail businesses had become a burden, contributing little revenue growth and incurring losses with no short-term improvement in sight.

From a synergy perspective, businesses like Intime and RT-Mart had fulfilled their historical roles. For instance, Tmall now has sufficient brand manufacturer resources.

As synergies waned, these investments increasingly resembled financial ventures.

Alibaba needed to make new choices, navigating a more competitive environment and a new consumption cycle amidst technological shifts. These factors necessitated a reevaluation of Alibaba's new retail strategy.

Alibaba has made its choice. Over the past two years, it has become increasingly clear about what to pursue and what to avoid.

03 Jack Ma Corrects Course: Trading 'Giving Up' for 'Gaining'

In 2019, Jack Ma stepped down as Chairman of Alibaba Group's Board of Directors, and for nearly five years thereafter, he maintained a relatively low profile on the company's internal network.

However, over the past year, Jack Ma has made several significant statements on Alibaba's internal platform.

One instance was in November of last year, when Pinduoduo's market value surpassed Alibaba's for the first time. An employee discussed this development on the internal network, prompting Jack Ma to comment that he firmly believed Alibaba would adapt and improve. He noted that great companies are often born in challenging times and that the era of AI-driven e-commerce presents both opportunities and challenges for all players.

Another notable occurrence was in April of this year, when Alibaba's co-founder and Executive Chairman, Joseph Tsai, candidly reflected on the company's recent mistakes in an interview video released by the Norwegian Sovereign Wealth Fund, describing it as "shooting itself in the foot." Following this, Jack Ma posted a lengthy article titled "To Reform, To Innovate," affirming Alibaba's internal reforms and boosting employee morale.

On September 10, during Alibaba's 25th-anniversary celebrations, Jack Ma shared a thousand-word essay on the internal network, reflecting on the company's past achievements and acknowledging the challenges it currently faces. He wrote, 'Today, we witness the resurgence of AI technology in the internet industry amidst fierce competition across various sectors. Many of Alibaba's businesses are confronted with challenges and the risk of being overtaken... As we near the quarter-way mark of our journey from 25 to 102 years, we must remain vigilant, ensuring we do not lose ourselves amidst the pressures of competition and changing circumstances.'

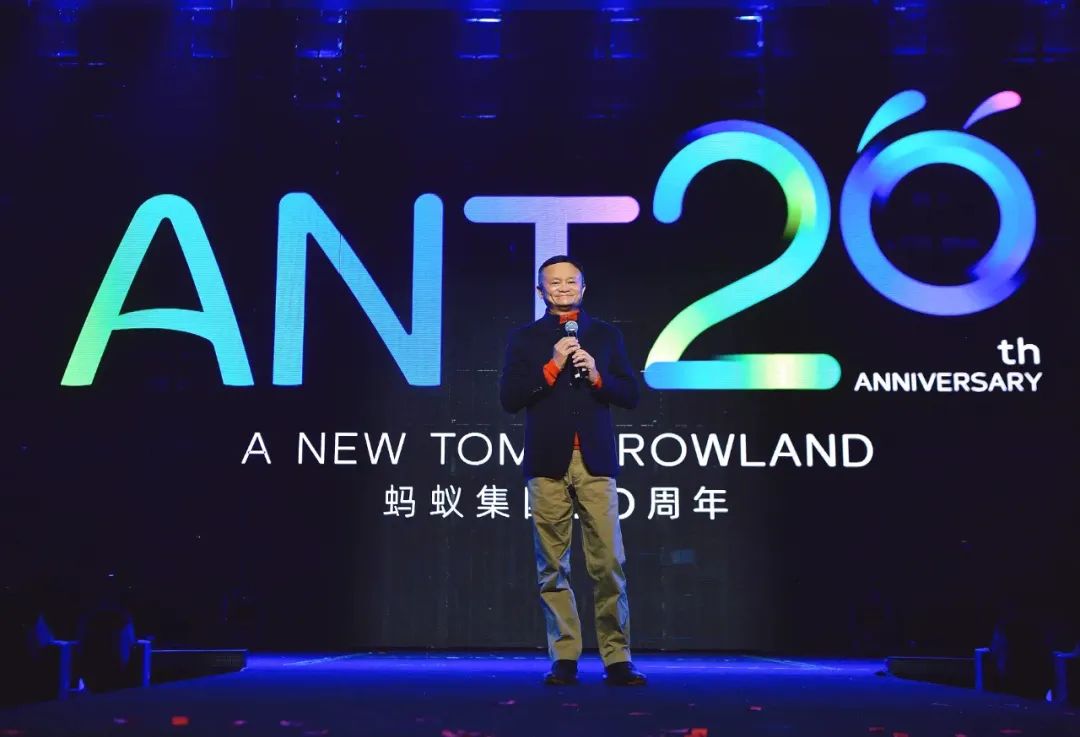

Furthermore, on December 8 this year, Jack Ma delivered a three-minute speech at the 20th-anniversary event of Ant Group.

Image/Ant Group's official Weibo

He remarked, 'Twenty years ago, our generation was incredibly fortunate to have embraced the opportunities presented by the dawn of the internet era. However, the transformative impact of the upcoming AI era over the next two decades will surpass everyone's imagination, marking an even greater epoch.'

Jack Ma's recent statements underscore his continued influence, despite his gradual retreat from the public eye. He consistently emerges at crucial junctures to guide Alibaba towards new directions, sound the alarm, and inspire its employees. These responsibilities are not exclusive to him; current CEO Wu Yongming and Joe Tsai could also assume these roles. However, it is evident that no one fulfills them quite like Jack Ma.

The messages conveyed through Jack Ma's recent statements are powerful and unequivocal, virtually outlining Alibaba's next course: focusing on e-commerce, cloud computing, and AI.

In fact, Alibaba's current strategic choices and compromises have been in motion for some time, with Jack Ma's quiet influence evident behind the scenes.

Last May, Jack Ma held a small-scale meeting with the heads of various businesses within Taobao and Tmall Group. He emphasized that the methodologies that had previously driven Alibaba's success might no longer be applicable. He outlined three strategic directions for Taobao and Tmall: returning to Taobao's roots, re-focusing on users, and embracing the internet's essence.

Jack Ma identified Taobao, rather than Tmall, as the next growth opportunity.

In line with this vision, Wu Yongming's establishment of three core directions for Alibaba—"revolving around technology-driven internet platform businesses, AI-powered technology enterprises, and a global commercial network"—serves as both a strategic realignment and a tone-setting exercise.

Alibaba has clarified its commitment to dedicating more resources and energy to its core competencies, including e-commerce, cloud computing, AI, and logistics. The company aims for greater focus and has ceased blind business expansion.

As an executive from an internet company once remarked, Alibaba's previous mindset was one of not wanting to miss out on any major field. However, the company has now shifted its stance, decisively reducing its scope and turning around without hesitation when it genuinely aims to lighten its load and pivot.

This embodies the courage and resolve of both Jack Ma and Alibaba.