Good News Abounds as Another Trillion-Yuan Market Takes Off

![]() 12/20 2024

12/20 2024

![]() 593

593

This is not merely a commercial rivalry; it's a war for the future.

Author: Huashang Taolue

In the fierce global competition for technological and capital supremacy, space has emerged as a new "battleground."

At 5 a.m. on September 10, SpaceX's Falcon 9 rocket, carrying the Crew Dragon spacecraft, lifted off from NASA's Kennedy Space Center in Florida to execute the "Polaris Dawn" mission: a crew of four non-professional astronauts embarked on a spacecraft to enter the Van Allen radiation belts around Earth, planning to conduct the first commercial spacewalk.

This marks the farthest human space journey from Earth in over 50 years, since NASA's Apollo program. Musk tweeted, "This will be an epic feat."

As this historical moment unfolds, China's private commercial aerospace sector is also picking up speed.

[New Era of Commercial Aerospace]

726 days!

This is the time it took for China's first commercial aerospace launch site, the Hainan Commercial Aerospace Launch Site, to progress from the start of construction to being capable of executing launch missions, on the cusp of witnessing its maiden rocket launch. It also symbolizes the "acceleration" of China's aerospace industry following the convergence of commercialization and aerospace.

Unlike other launch sites, both in terms of operation mode and service targets, the Hainan Commercial Aerospace Launch Site will emphasize market-oriented and commercial operations to streamline launch processes, reduce costs, and enhance launch efficiency.

Behind the word "commercial" lies a higher density of launch demand.

As early as April this year, Xinwen Lianbo reported on the popularity of the Hainan Commercial Aerospace Launch Site. Despite being under construction, multiple leading domestic commercial aerospace enterprises, including CAS Space, Landspace, and Skyroot Aerospace, had already landed or planned to land in Wenchang International Aerospace City, queuing up to reserve rocket launch slots.

Private enterprises are the main driving force behind this trend.

In 2014, the State Council issued a document for the first time "encouraging private capital to develop, launch, and operate commercial remote sensing satellites to provide market-oriented and professional services," marking the dawn of China's commercial aerospace era, attracting a flood of private enterprises into this burgeoning industry.

Qichacha data shows that over the past decade, the number of registered commercial aerospace-related enterprises in China has surged from 1,022 in 2014 to 16,889 in 2023, an increase of over 16 times. In the first half of 2024, China registered 7,425 commercial aerospace-related enterprises, bringing the total to over 60,000, with over 80% being private enterprises.

Satellite manufacturing enterprises, represented by Chang Guang Satellite, WINER, GalaxySpace, and SpaceTy, satellite launch and ground equipment manufacturing enterprises such as iSpace, Landspace, and Skyroot Aerospace, and satellite application and operation enterprises, including China Satcom, Hi-Target, and BDStar, are gradually becoming key players in driving innovation in China's commercial aerospace sector.

Compared to the "national team," private enterprises boast a more streamlined operation process and flexible supply chain options, enabling faster technological innovation and breakthroughs. Over the past decade, these enterprises have achieved multiple firsts in commercial aerospace.

In July 2019, iSpace successfully launched China's first privately developed commercial carrier rocket into orbit; in December 2020, SpaceTy's "Hai Si 1" satellite was successfully launched, filling the gap in China's commercial SAR satellites; in July 2022, CAS Space's "Li Jian 1," the largest solid-propellant carrier rocket, completed its maiden flight; and in July 2023, Blue Origin's "Zhuque 2" became the world's first liquid oxygen-methane rocket to successfully enter orbit.

According to the "Blue Book of China's Aerospace Science and Technology Activities (2023)," China conducted a total of 67 space launches in 2023, of which 26 were commercial launches, with a launch success rate of 96%. That year, a total of 120 commercial satellites were developed and launched, accounting for 54% of the total number of satellites developed and launched throughout the year.

In 2024, commercial aerospace was first written into the government work report as a "new growth engine."

With the active involvement of both the government and enterprises, the market potential of China's commercial aerospace is being rapidly unleashed.

Most securities trader research institutions believe that by 2025, the size of China's core commercial aerospace market will exceed 300 billion yuan, and when associated markets are included, the overall annual market size could approach one trillion yuan.

Meanwhile, the Hainan Commercial Aerospace Launch Site will fill a critical gap in China's commercial aerospace sector, infusing unprecedented vitality into the industry's development. Guo Qiang, Deputy Secretary of the Party Committee of the Hainan Commercial Aerospace Launch Site, even described it as:

'We are making history. The new era of China's commercial aerospace is beginning in Wenchang.'

['Even Faster']

'Three, two, one, ignition.'

In January 2020, at the Jiuquan Satellite Launch Center, Liu Chang, co-founder and vice president of GalaxySpace, and her colleagues finally witnessed the launch of their own satellite.

Along with the rocket, China's first low-orbit broadband satellite supporting 5G communication also soared into the sky.

▲At 11:02 a.m. on January 16, 2020, China's first broadband communication satellite with a communication capacity of 10 Gbps, GalaxySpace's first satellite, was launched into orbit. The rocket used for this mission was the KZ-1A.

Similar to Musk's "Starlink" plan, such satellites, when forming a constellation, can effectively solve the problem of global network coverage and access. This also marks China's commercial aerospace taking the first step towards a "space internet."

Just before that, SpaceX successfully launched the third batch of 60 Starlink satellites, bringing the total number of deployed satellites to 180.

This filled Liu Chang, who watched her own satellite launch, with a sense of success and pride, as well as a sense of urgency driven by the situation. "Every day, we see Musk launch 60 satellites on one rocket, and we also feel anxious. We can't just have one satellite in the sky; we need to go faster," she said, describing the gap between China's commercial aerospace and SpaceX as "equivalent to them already building supercars while we're still making four-wheeled carriages."

To date, SpaceX has launched over 7,000 Starlink satellites, with 6,396 in orbit, accounting for 60% of the total number of satellites in orbit globally. Starlink is now officially available in 105 countries and regions, with over 3.7 million global subscribers and has begun turning a profit.

Although on August 6 this year, Guoxin Satellite's "one rocket, 18 satellites" mission pressed the "accelerator" button for China's version of "Starlink," it is still difficult to compare with SpaceX in terms of scale and speed.

The lag in development time is undoubtedly an important reason for this gap. Taking SpaceX, founded in 2002, as a reference, China's commercial aerospace started more than a decade later. From rocket technology, satellite deployment to commercialization, SpaceX has seized the initiative.

Since its inception, SpaceX has significantly reduced launch costs with its outstanding performance in liquid rocket and reusable technology, gradually establishing its dominance in the global commercial aerospace sector and increasingly demonstrating strong efficiency advantages.

According to SpaceX's official website, the per-kilogram launch cost of the Falcon 9 rocket has dropped to $3,000, while the average launch cost for global commercial aerospace is still between $10,000 and $20,000 per kilogram. According to Musk's vision, after the "Starship" enters service in the future, it will achieve three launches per day, further reducing launch costs to $200 per kilogram.

In 2023, the United States conducted a total of 116 rocket launches, of which 98 were from SpaceX. Excluding two experimental "Starship" launches, the reusable Falcon 9 and Falcon Heavy rockets successfully launched 96 times, accounting for 43% of the global total; the total launch mass reached 1,195 tons, accounting for 80% of the global total; and the number of satellites launched was 2,514, accounting for 87% of the global total, including 1,948 Starlink satellites.

In comparison, last year, China's private rockets only conducted 13 launches, with 12 successfully reaching orbit. There is still a significant gap in the frequency of rocket launches, and there is also a noticeable lag in the exploration of rocket reuse technology.

However, this gap also signifies huge development potential.

In recent years, with increased government support for commercial aerospace, more technology, capital, and talent have flowed into the aerospace industry, helping China's commercial aerospace continuously set new records.

For example, in April last year, Skyroot Aerospace's "Vikram-II" became the first privately developed liquid oxygen-kerosene rocket in China to reach orbit; in July, Blue Origin's "Zhuque-2" rocket successfully launched, becoming the world's first liquid oxygen-methane rocket to successfully reach orbit. Compared to traditional fuels, liquid oxygen-methane offers more environmental advantages and higher reuse potential, significantly reducing launch costs for rockets.

At the same time, China's commercial rocket companies have also made significant progress in rocket recovery technology.

In May 2022, Deep Blue Aerospace successfully completed a kilometer-level Vertical Takeoff and Vertical Landing (VTVL) flight test, becoming the second company globally to complete such a test after SpaceX. In January 2024, Blue Origin's Zhuque-3 VTVL-1 test rocket successfully completed its first large-scale Vertical Takeoff and Landing (VTVL) flight test mission.

According to Landspace, the company is developing the "Pallas 1," a medium-to-large reusable liquid-fueled carrier rocket, with the first launch expected by the end of this year. This rocket has a lifting capacity of up to 15 tons and a launch cost of less than 20,000 yuan per kilogram, with the potential to further reduce this cost to below 10,000 yuan in the future.

It is foreseeable that with the gradual maturity of rocket reuse technology and the continuous reduction of launch costs, China's commercial aerospace is expected to occupy a larger share in this space "land grab."

[The Business of Space]

On September 6, 2024, the third batch of 10 satellites from Geely's future mobility constellation were successfully launched from the Taiyuan Satellite Launch Center and entered their pre-booked orbit. The constellation covers 90% of the global area 24/7 through 30 satellites in three orbital planes, officially providing satellite communication services to overseas users.

This is the first time a Chinese commercial aerospace enterprise has provided satellite communication services to global users.

By achieving this milestone, Timeshiro has completed the entire industrial chain layout from satellite research and development, mass production, tracking, telemetry, and control (TT&C), to application, becoming China's first commercial aerospace company to achieve a commercial closed loop.

This year, Timeshiro completed its first overseas commercial deployment test in Oman, achieving a communication success rate of 99.15% and network availability of over 99.97%, demonstrating the huge value of satellites in remote monitoring, data transmission, emergency communication, and other aspects.

However, this is just a microcosm of Chinese commercial aerospace enterprises exploring the "space economy."

Currently, there are over 350 commercial satellites in orbit in China, widely used in communications, remote sensing, navigation, and other fields. From weather forecasting to food delivery, from mobile navigation to flood relief, more and more commercial satellites are not only driving the development of the aerospace industry but also gradually changing our lives.

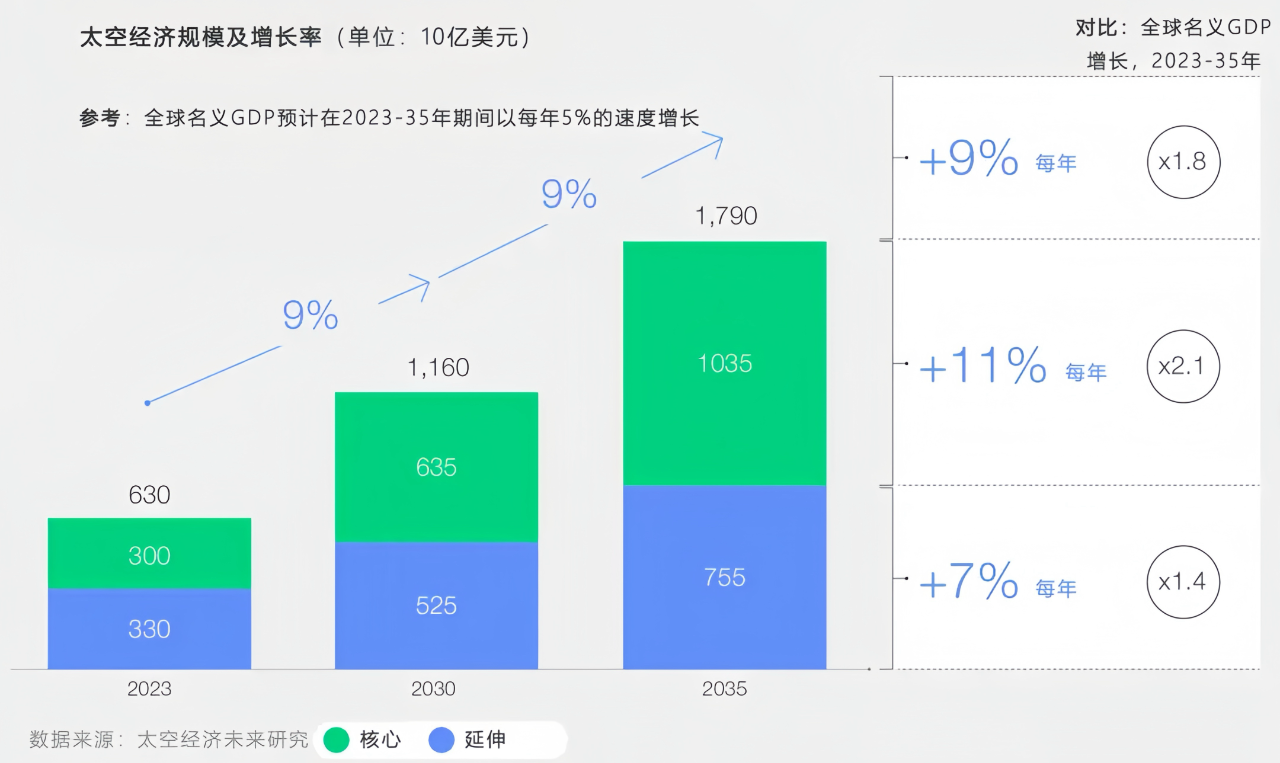

A report jointly released by the World Economic Forum and McKinsey & Company pointed out that by 2035, the global space economy will reach a total value of $1.8 trillion, with an average annual growth rate of 9% compared to $630 billion in 2023, making it an important engine for economic growth in the next decade.

Elon Musk once said in an interview, "It's not just technology that sends (commercial) rockets into space, but also capital. Money is the 'fuel'."

Nowadays, China's commercial aerospace is also welcoming an influx of capital.

Relevant data shows that in 2023, there were approximately 170 financing events in China's commercial aerospace sector, with a total disclosed amount exceeding 18.5 billion yuan. Since the beginning of 2024, there have been nearly 50 financing events in China's commercial aerospace sector. In the first quarter of this year, Guoxin Satellite completed an A-round financing of 6.7 billion yuan, the largest financing round in China's commercial aerospace sector in recent years.

In a relatively weak investment and financing environment, commercial aerospace has emerged as one of the few popular tracks.

However, commercial aerospace is, ultimately, a business, and its core goal remains profitability. While rocket launches and satellite deployments are important, forming an effective commercial closed loop and achieving sustainable economic returns are crucial for the long-term development of enterprises.

Despite being the world's pioneering commercial aerospace company to establish a commercial closed loop, SpaceX's journey took over two decades of relentless exploration and accumulation. Its space internet service, Starlink, only attained break-even status in November of last year. Numerous other enterprises, facing prolonged losses, have either succumbed to despair or ceased operations altogether.

Furthermore, the commercial aerospace industry poses exceedingly high technical barriers and stringent safety requirements. For instance, although the rocket test accident involving Skyroot Aerospace in June this year did not result in casualties, it still disrupted the lives of residents near the test site and had a negative impact.

This incident serves as a reminder that commercial aerospace endeavors must strike a balance between pursuing speed and innovation, while simultaneously enduring the rigorous tests of safety and responsibility.

On September 7, Musk tweeted once again, setting his sights on the distant stars and outlining a bold plan for Mars exploration: Unmanned "Starships" will be launched to Mars within two years, followed by manned missions four years later, with the ambitious goal of establishing a self-sufficient city on Mars within the next two decades.

This grand vision undoubtedly sparks global imagination and anticipation for the space economy, escalating the global competition in commercial aerospace to new heights.

For China's commercial aerospace enterprises, this represents not just a battle of technology and capital, but also a contest of time and patience.

[参考资料]

[1] "推动商业航天发展:开启2.0时代‘价格战’"——《北京日报》

[2] "‘老航天’的‘新事业’"——《人民网》

[3] "商业卫星在灾害应急中大显身手 民营航天商业潜力待挖掘"——《证券时报》

[4] "预计到2035年,太空经济将达到1.8万亿美元"——《世界经济论坛》

[5] "民营‘中国星链’出征:时代星罗加速全球卫星互联网时代到来"——《证券日报》

-END-

欢迎关注[华商韬略],遇见影响时代的人物,阅读战略传奇。