The Ascent of High-Speed Copper Cable Connectors: Unveiling Related Stocks

![]() 12/26 2024

12/26 2024

![]() 678

678

Recently, stocks related to high-speed copper cable connections have once again captured the market's attention. What sparks such a substantial response in the market for high-speed copper cable connections, and how does it reshape the broader communications industry landscape?

01. Understanding High-Speed Copper Cable Connections

High-speed copper connection, also known as "high-speed connector" or "high-speed copper cable connection," constitutes a pivotal data transmission component within an efficient signal transmission system.

This technology leverages copper conductors to directly transmit electrical signals, enabling interconnection between components, devices, or systems. DAC (Direct Attach Copper) technology is favored in sectors like data centers, high-performance computing, and telecommunications due to its advantages of low cost, high speed (exceeding 20Gbps), and minimal energy consumption.

As mentioned at the GTC2024 Conference, replacing optical modules with copper cable interconnection in NVL72 can significantly reduce costs. Traditional optical connections remain expensive in certain scenarios, but advancements in high-speed copper cable connection technology have lowered costs while maintaining high-speed transmission.

Leading domestic enterprises have successfully developed a new generation of high-speed copper cable connection technology, offering transmission rates over 40% higher than previous products. Additionally, technologies like Active Electrical Cable (AEC) continue to evolve. By incorporating CDR (Clock and Data Recovery) chips at both ends of the cable to retime and drive the signal, these technologies address the issues of high loss and limited transmission distance in traditional copper cables, supporting longer end connections.

Furthermore, the government has implemented a range of policies and measures to encourage technological innovation and increase R&D investment, with a focus on high-end manufacturing and other sectors. These policies encompass financial support, market expansion, technological innovation, and other aspects, providing a robust foundation for the research and application of high-speed copper cable connection technology. For instance, the government has set up special funds and guided social capital investment to support research and application, while also encouraging enterprises to actively expand domestic and international markets and enhance market share.

According to LightCounting's report, the annual compound growth rate of high-speed copper cables is projected to be 25% from 2023 to 2027, with shipments expected to reach 20 million units by 2027.

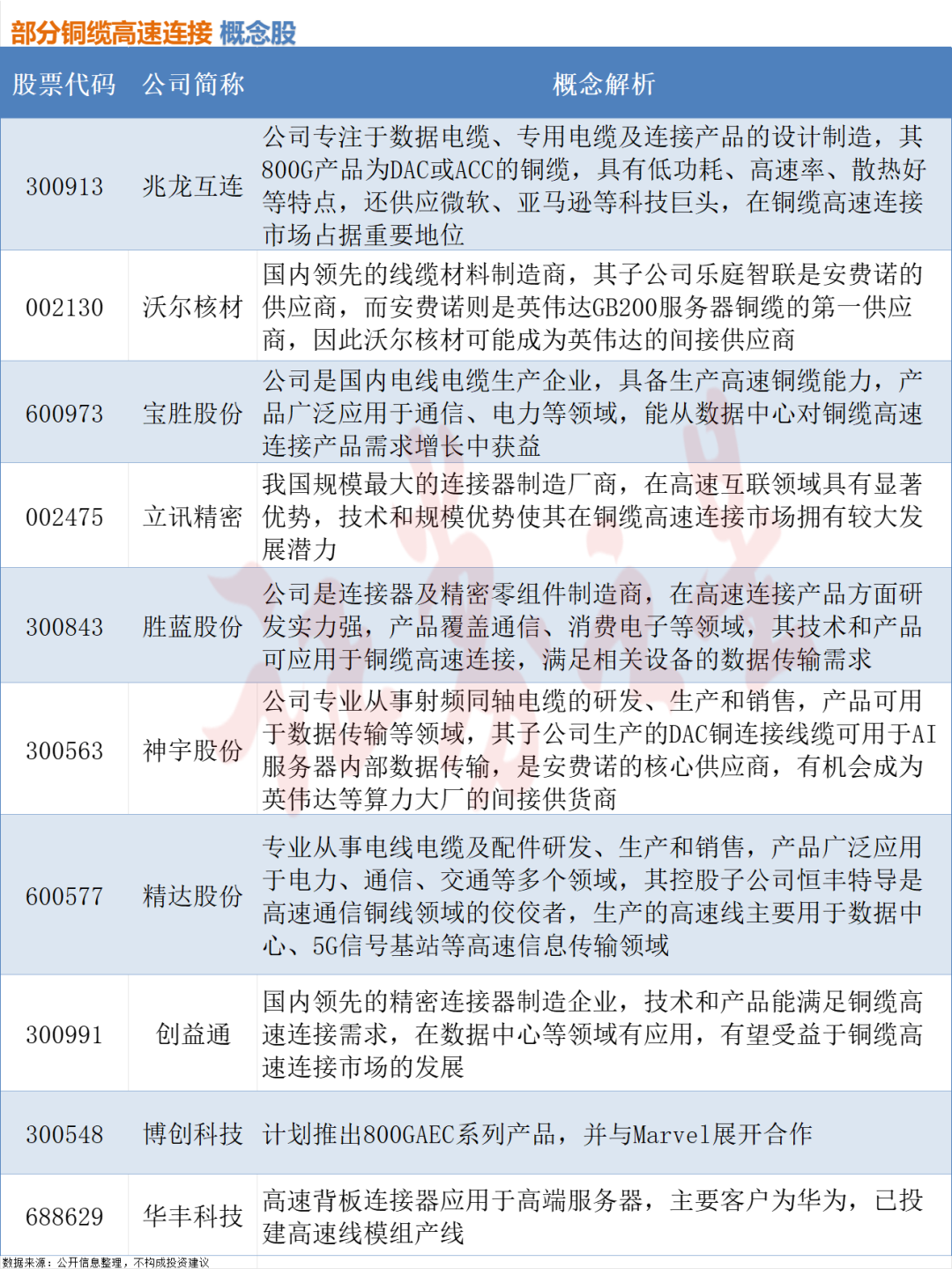

02. Overview of Related Concept Stocks

With the surging demand for AI computing power, high-speed copper cables, as a crucial material for AI, are poised to propel the performance of related A-share listed companies. Here's an overview of related concept stocks:

Minsheng Securities notes that AI-driven capital expenditures by domestic and international giants are anticipated to remain high in 2025. In this context, it is recommended to keep a close eye on the demand for short-distance optical modules and data center interconnect (DCI) within high-growth, high-certainty data centers, as well as the incremental market for copper interconnects stemming from network architecture upgrades.

With their advantages of high bandwidth, speed, and cost-effectiveness, DAC high-speed copper cables are expected to emerge as the optimal solution for data center network connections. For example, NVIDIA's Blackwell architecture directly enhances DGX bandwidth by 18 times and AI FLOPs by 45 times through the adoption of the DAC copper interconnection solution. In the future, high-performance AI computing will spur demand for copper cables, and LightCounting predicts that the global high-speed interconnect market size could reach $2.8 billion by 2028.

Focusing on the sector's overall opportunities, CITIC Securities' chief analyst in the computer industry expresses optimism about the Agent model in 2025, with AI applications accelerating across various fields. In the medium to long term, this is anticipated to drive several times the new demand for computing power. It is advisable to continuously monitor investment opportunities related to the entire AI industry chain. Specifically, there are three main investment themes:

Firstly, AI computing power, as the acceleration of AI applications fuels new demand for inference-end computing power.

Secondly, AI Infra, as scenario-based and industrial model development stimulates demand for data services and model platforms, with high certainty for industrial development.

Thirdly, AI applications, as the enhancement of model capabilities accelerates the implementation of application forms like Agents, driving companies in sectors such as office, education, management, end-side, and embodied intelligence to swiftly realize business growth potential.

- End -