Can Ctrip Thrive Beyond Market Tailwinds?

![]() 01/09 2025

01/09 2025

![]() 689

689

In 2024, Ctrip flourished. The net profit for the first three quarters alone has already surpassed the highest level since 2018.

However, will the growth spurred by market recovery sustainably drive Ctrip's development? Can an industry with such high gross margins remain immune to the encroachment of both industry peers and cross-border giants?

Ctrip's approach to market demands appears passive, lacking the initiative to create incremental value. Does this mean that Ctrip can only ride the wave of market tailwinds?

1

Ctrip's Lack of 'Staying Power'

According to financial reports, Ctrip's net profit for the first three quarters of 2024 exceeded 15 billion yuan, surpassing the entire year's profit of 2023. More notably, the gross margin increased, with Ctrip's net profit for the third quarter reaching 6.8 billion yuan and its gross margin exceeding 82%. After three years of dormancy, the travel market has boomed since 2023, providing Ctrip with a robust developmental impetus. Although the 2024 annual report has yet to be released, the net profit for the first three quarters has already hit its highest level since 2018. From 2018 to 2023, Ctrip's net profits were 1.096 billion, 6.998 billion, -3.269 billion, -0.645 billion, 1.367 billion, and 10 billion yuan, respectively. Will the growth fueled by market recovery become a normalized driver for Ctrip's development? Can an industry with such high gross margins remain untouched by the interests of other industry giants and cross-border players?

The pandemic's impact on the consumer market is irreversible. After three years, consumer needs and preferences have shifted, such as reduced travel budgets and shorter travel distances, posing new challenges to Ctrip's traditional business model. Adaptability and proactiveness have never been Ctrip's strong suits. The first quarter of 2023 saw the strongest 'revenge' consumption demand, yet Ctrip's operating costs surged by 53%, R&D expenses increased by 35%, selling expenses by 108%, and administrative expenses by 53% during this period. In the latest financial report, Ctrip's operating costs for the third quarter of 2024 were 2.8 billion yuan, a year-on-year increase of 13.5%; R&D expenses were 3.6 billion yuan, a year-on-year increase of 1.8%; sales and marketing expenses were 3.4 billion yuan, a year-on-year increase of 22.6%; and administrative expenses were 1 billion yuan, a year-on-year increase of 1.7%. This underscores Ctrip's passive stance towards market demands, lacking the initiative to create incremental value. When consumer demand is robust, Ctrip increases its marketing investments, leading to sustained high performance. As consumer demand stabilized in 2024, Ctrip leveraged this trend to generate profits, but the AI-led technological revolution it emphasizes has not been reflected in its R&D investments. Does this mean that Ctrip can only thrive on market tailwinds and lacks the operational resilience to stabilize its core business amidst market changes? Admittedly, it is challenging for any individual or company to defy the overall trend of the times, but exceptional companies rely on business acumen to navigate recessions and welcome their next golden opportunity. As the 'Zuo Zhuan' once stated, 'You began with this, you must end with this.' This saying has evolved to convey a deeper meaning: 'You flourished with this, you must adapt to survive beyond it.'

2

Advanced Technology vs. Outdated Tactics

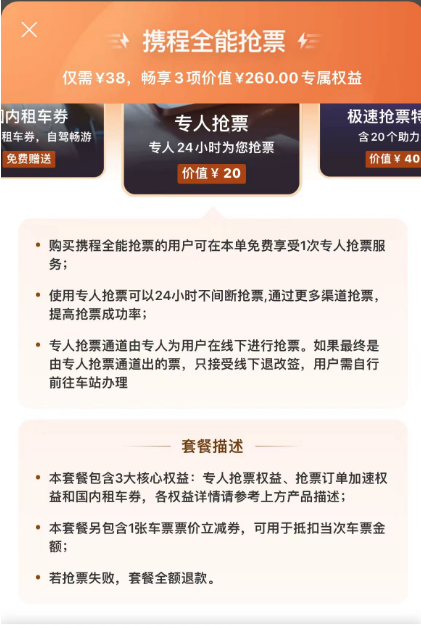

Ticketing and accommodation have always been the cornerstones of Ctrip's revenue. Similarly, the ticketing business has also been a 'disaster area' for travel e-commerce platforms employing questionable tactics in recent years. As a travel giant, Ctrip is not immune to this at the ticketing level. In the early years, 12306 frequently crashed due to server and technical issues, unable to meet peak-hour ticket-buying demands. Consequently, platforms or products with temporary technological advantages could compete with 12306 for customers by leveraging superior server resources and operational concepts, giving rise to various ticket-grabbing browsers and acceleration packages. These ticket-grabbing products rely on programs to monitor ticket availability, helping users lock in remaining tickets first by utilizing internet speed differences once they become available, and advancing users' queuing order to increase the success rate of ticket grabbing. After entering the market, these products attracted a significant number of users. Compared to 12306's perpetual 'freezing,' third-party software that can monitor and grab tickets in real-time is obviously more capable of ensuring users' travel needs are met. Similarly, third-party ticket-grabbing products differentiate prices based on internet speed and other technological capabilities. For example, adding 20 yuan can obtain ticket-grabbing assistance with a certain level of internet speed; adding 50 yuan far exceeds the original level. For users unwilling to pay extra, most ticket-grabbing products also provide a sharing option for assistance, turning every ticket-grabbing user into a carrier for attracting new users and promoting activity. Ticket-grabbing products rose due to 12306's decline and declined due to 12306's technological advancements. When 12306 upgraded its servers, especially with the addition of the waiting function, it dealt a significant blow to third-party ticket-grabbing platforms. The waiting function is an official ticket-grabbing feature of 12306 that allows customers to prepay ticket fares in case of insufficient tickets, automatically purchasing tickets once available, and fully refunding customers if no tickets become available. Meanwhile, 12306 stipulates that official waiting orders enjoy the highest priority when tickets are sold out, and only after all waiting orders are satisfied are remaining tickets publicly sold, at which point third-party ticket-grabbing products can be used. This means that in terms of ticket queuing priority, the advantage of internet speed at the ticket-grabbing level is minimal. Theoretically, since 12306 launched the waiting function in 2019, third-party ticket-grabbing platforms would quickly decline until they completely disappeared. However, this is not the case in reality. Perhaps due to the large information gap in ticketing or the accumulation of a loyal user base through past third-party platforms' success rates, the ticket-grabbing business of these platforms has undergone many variations but has never disappeared. For this reason, 12306 has repeatedly explained that the logic of 'acceleration packages' does not apply to the ticketing industry today, and was still 'debunking rumors' in 2023: 'Acceleration packages' are designed and provided by third-party platforms and are not an official function of the 12306 website, so they cannot guarantee providing users with tickets. Regardless of the ticketing software used, users ultimately need to queue in the 12306 ticketing system. Moreover, using these acceleration packages may lead to risks such as delayed ticket issuance, excessively high fees for ticket refunds and modifications, personal information leakage, and slow refunds. Reports indicate that during the National Day ticket-grabbing period in September 2023, a media outlet attempted to purchase a ticket from Changsha to Xi'an on September 29 using the Ctrip App. When entering the ticket-grabbing interface, the Ctrip App recommended different types of ticket-grabbing services such as 'Continuous Grab Waiting,' '24-hour Dedicated Help Grab,' 'Dual Channel,' and 'Fast Ticket Grab Privilege.' Additionally, when selecting ticket-grabbing packages, users could also choose to grab window seats or aisle seats, each costing 10 yuan per seat. Furthermore, Ctrip has launched an exclusive benefit called 'Ctrip All-round Ticket Grab' priced at 38 yuan. According to its description, using dedicated ticket grabbing allows for 24-hour uninterrupted ticket grabbing, increasing the success rate through more channels.

However, even if such services are purchased, they merely entail users entrusting their travel information to the Ctrip platform, with Ctrip filling in the information to buy tickets on 12306, which is identical to users buying or waiting for tickets themselves, except that it saves time and energy. Therefore, the highest priority for ticket grabbing remains the official channel of 12306. Despite 12306's repeated debunking of rumors, ticket-grabbing services on third-party platforms remain popular. Essentially, this type of service is a low-cost business. When tickets are successfully grabbed, it is attributed to the powerful functions of the service; when tickets are not grabbed, full refunds are given, with the profits from successfully grabbed tickets covering the resource consumption when tickets are not grabbed. There's an internet joke that 'one of the major contradictions in today's society is between the people's growing intelligence and outdated tactics.' The market landscape and competitive situation have undergone significant changes, with the buyer's market gradually rising, and simple, pure, and trustworthy platforms being sought after.

If, as a travel giant, innovation is used to create an information gap, this is not a good sign.

3

Cross-border Competitors and Ctrip's Weaknesses

The popularity of live streaming and short videos has impacted numerous business models and naturally exerted considerable pressure on Ctrip, a travel and tourism giant. The most direct competitors stem from powerful traffic players represented by Douyin. Douyin has also made numerous moves in the travel industry in 2024. For instance, in April, the 'Beautiful Countryside Awaits You' rural tourism digital enhancement initiative was launched, encompassing three special initiatives: assisting county-level special activities, supporting key villages and towns, and supporting rural cultural tourism creators. In September, the 2024 'Guizhou is Worth It' Douyin special promotional event was launched, introducing Guizhou's unique tourism routes and itineraries, engaging tens of thousands of local cultural tourism merchants and thousands of influencers for content resonance. In November, the 'Come to Zhejiang and Buy' 2024 Heart-Pounding Zhejiang Douyin Tourism Exchange was held, including the launch of a digital AI video show, cities and prefectures jointly setting up the main venue, and live broadcasts by anchors and influencers to promote cultural tourism consumption in Zhejiang.

Simultaneously, Douyin has benefited from the recovery of travel consumption demand post-pandemic. On January 7th of this year, Douyin Life Services announced the initiatives and achievements of its service provider ecosystem construction over the past year. In 2024, Douyin Life Services created multiple marketing campaigns centered around festivals such as Spring Festival, May Day, summer vacation, and National Day. During the National Day period, hotel accommodation orders increased by 205% year-on-year, with 'intangible cultural heritage tours' and 'family tours' being favored; during the Spring Festival period, the average daily consumption scale of Douyin Life Services surged by 153% year-on-year, and consumption amounts in third-tier and below cities increased by 1.87 times. Ctrip's long-time rival Meituan is no exception. According to Meituan's latest financial report, its core local business, including hotel and travel, and on-site services, increased by 20.2% year-on-year, accounting for 74% of total revenue; it achieved an operating profit of 14.6 billion yuan, an increase of 44.4% year-on-year, with the operating profit margin increasing by 3.5 percentage points to 21%. Additionally, some new competitors have also joined the fray. In July 2023, New Oriental established New Oriental Cultural Tourism Company; in August, Gree Group established Zhuhai Haichen Cultural Tourism Co., Ltd. Some large hotel chains have also strengthened their membership systems under the pressure of commission fees from OTA platforms, reducing their dependence on OTA platforms from the consumer entry point. For example, hotel membership points can only be accumulated through first-party bookings. Surrounded by formidable rivals, Ctrip's core competitiveness is being questioned: For the consumer demand unleashed post-pandemic, Ctrip can enjoy growth, but so can its competitors, especially amidst the era of live streaming and short videos, where rivals' growth momentum is even stronger. So, when it comes to riding market tailwinds, where lies Ctrip's competitive edge?

Clearly, reputation is not Ctrip's strongest suit. Public scrutiny has plagued the company due to issues ranging from bundled sales to child abuse incidents in kindergartens, resold orders, frequent user complaints, big data price discrimination, and system failures. These incidents have not only infringed upon users' rights and interests but also tarnished the company's reputation and brand image, bringing its business ethics under intense scrutiny. Even in 2023, there were still instances where Ctrip unauthorizedly altered the room rates of homestay owners, attributing it to staff misoperation. Additionally, the improper handling of Ctrip's financial products was denounced by Yun Shu, the founder and CTO of Mo'an Technology, in a post on his verified Weibo account. Yun Shu revealed that while purchasing tickets, users were unknowingly enrolled in Ctrip's loan services and, upon being informed of a 1,000 yuan overdue payment, were guided by Ctrip to pay only the minimum repayment amount of 10%, with the remaining balance retained in the Ctrip account.

Ctrip's primary user base comprises high-net-worth individuals with high education and income levels, predominantly business professionals. Centering on this demographic, Ctrip has established a one-stop business travel service to streamline consumer decision-making. For instance, Ctrip's investment portfolio spans the entire travel ecosystem, encompassing short-term rentals, hotels, tourism, communities, travel notes, leisure vacations, car rentals, cruise ships, and more, alongside a network of over 600,000 member hotels and supplier resources such as international and domestic airline tickets, train tickets, and bus tickets. However, this advantage alone is insufficient to create a formidable moat, as competitors can replicate such services over time. In the digital realm, the determining factor of success often hinges not on current scale but on the advancement or obsolescence of the business model.

Alibaba, founded with the slogan 'to make it easy to do business everywhere,' focused on the supply side, while Pinduoduo swiftly rose to rival Taobao Group by 'pampering users' and catering to the demand side. Model barriers constitute the tallest walls and hardest moats to cross.

Does the model that has propelled Ctrip to its current industry position still retain its dominance?

Similar to Alibaba and JD.com, Ctrip once embarked on strategic initiatives aimed at 'consumption upgrades,' believing that the growing number and spending power of domestic middle-class individuals would sustain an even broader market. However, the pandemic-induced shift in consumption concepts was unforeseen, and the rise of Pinduoduo underscored the immense potential of the lower-tier market. As the middle class shifts their preferences from five-star hotel vacations to rural self-drive tours, business travelers' reimbursement standards transition from business class flights to second-class high-speed train seats, and young consumers' accommodation choices move from hotels to camping, Ctrip, as a traditional travel giant, must adapt to these evolving consumption trends.

For Ctrip, which has historically 'relied on favorable conditions,' this is a straightforward 'fight against the wind' and a 'throne defense battle' amidst slowing growth.

To prevail in this 'fight against the wind,' Ctrip must enhance internal management, improve service quality, bolster market competitiveness, and adapt to industry changes. Simultaneously, the company must innovate and optimize its products and services to meet customers' ever-changing needs, employing fewer tactics and more sincerity to restore its reputation as a travel giant. (Image sources: Ctrip, Douyin official WeChat, etc.)