E-commerce Sector Reconnects with Social Commerce

![]() 01/16 2025

01/16 2025

![]() 527

527

In late 2024, WeChat's introduction of the 'Send Gifts' feature created ripples in the tranquil internet landscape. This move reportedly led to a surge in Tencent-related stocks, with Weimob skyrocketing by over 54%. Even brands associated with gift-giving scenarios, such as Three Squirrels and Laiyifen, saw their stock prices rise.

Shortly thereafter, Douyin also ventured into the gift-giving market, supporting both e-commerce gifts and local life group buying transfers. After navigating through various trends like content, interest, and cross-border, the entire e-commerce sector appears to have rediscovered social commerce. In reality, e-commerce platforms have never fully abandoned social elements.

Whether it's live streaming or short videos, there's an undeniable social undertone. Pinduoduo stands out as the most successful in social commerce. Even today, traditional e-commerce giants like Taobao are still reluctant to cede ground to Pinduoduo, retaining some social functionalities on their platform.

Will social commerce make a comeback post-2024?

According to Grand View Research, global social commerce revenue is projected to reach $6.2 trillion by 2030, over 8.5 times the scale in 2022. A ShopEx report shows that from 2019 to 2024, the transaction scale of domestic social commerce also exhibited rapid growth.

Perhaps, the e-commerce sector finds it challenging to innovate, thus turning its focus back to social commerce.

E-commerce Platforms Still 'Need' Social Elements

In recent years, e-commerce platforms have primarily competed on price, supply chain, and traffic. In the era of live streaming e-commerce, traditional and short video e-commerce platforms continuously tried to invigorate consumer vitality through videos, text, interest circles, and cost-effectiveness. However, this approach has gradually waned.

The renewed emphasis on social commerce by e-commerce platforms is closely tied to the maturing of live streaming e-commerce. iiMedia Research data shows that the growth rate of China's live streaming e-commerce market dropped from 600% in 2018 to an expected 15% in 2024, projected to further decline to 12% in 2025.

Since the beginning of 2024, the continuous downfall of internet celebrities has left the content ecosystem pursued by the e-commerce market in an awkward state of uneven development. Taking Douyin as an example, data indicates that in January and February of 2024, Douyin e-commerce achieved a total GMV of nearly 500 billion yuan, with a cumulative year-on-year growth rate exceeding 60%. By March, Douyin e-commerce's year-on-year growth rate dipped below 40% for the first time, further declining to under 30% after the second quarter.

Guosen Securities reports that since March 2024, the GMV growth rate of live streaming e-commerce led by Douyin and Kuaishou has significantly declined. From May to June, the GMV of top influencer live streams on major e-commerce platforms including Douyin, Kuaishou, and Taobao halved. Notably, Douyin's content field growth rate fell to a single digit in the first half of 2024.

The sudden cooling of the live streaming sector under the content ecosystem caught e-commerce platforms off guard. A year-long price war has also exhausted the market, leading to disorder. Consequently, major e-commerce platforms are exploring new consumption scenarios and consumer motivation through social relationships.

Firstly, the value of social gameplay was evident during the heyday of Pinduoduo's 'cut one knife' feature.

Over the past two years, while most e-commerce platforms struggled with growth, Pinduoduo's user base continued to expand. Currently, its annual active user count exceeds 900 million, with an average monthly active user count of 790 million, and the number of active buyers has surpassed Alibaba for the first time. This could be a market response to consumption downgrading but is also attributed to Pinduoduo's early adoption of social commerce to reach beyond the Fifth Ring Road.

Secondly, current e-commerce platforms are grappling with a consumer winter. When major platforms fail to achieve effective incremental growth, they start focusing more on core users. Core users became a major focus during this year's Double 11. Taobao data reveals that in 2024, the number of orders placed by Taobao's 88VIP members increased by over 50% year-on-year.

Over the past year, the number of Taobao's 88VIP members has surpassed 42 million, and the scale of annual cooperating brands has increased by over 300% year-on-year. More than half of top brands' business comes from 88VIP. From a certain perspective, infusing more 'social elements' into e-commerce platforms is also about regaining the essence of 'human connection'.

Moreover, social gameplay possesses natural communication genes. In recent years, not only have e-commerce sector platforms been competing but merchants, internet celebrities, and the entire industry chain have also been on edge. Marketing costs for merchants have been steadily rising, and even top internet celebrities' marketing expenses are escalating. Data shows that the average online marketing service revenue per daily active user on a leading short video platform was 5.9 yuan in 2017, which rose to 158.7 yuan in 2023—an increase of nearly 27 times in six years. Relying on the traffic aggregated by social commerce can invisibly alleviate merchants' marketing pressure, which might also explain the surge in companies like Three Squirrels' stock prices.

After experimenting with various strategies, e-commerce platforms still 'need' social elements. WeChat and Douyin have been the pioneers in this field. However, it's worth seriously discussing how much value social elements can still offer to the stagnant e-commerce sector today.

Do Young People Still Have a 'Consumer Desire'?

It's crucial to note that in the past, the integration of e-commerce and social commerce was based on the former using the latter's vast user traffic to convert it into effective consumer motivation, thereby completing the marketing and transaction loop within the ecosystem. Nowadays, whether it's WeChat or Douyin, their gift-giving functions seem more like an expansion of consumption scenarios and an exploration of new consumer desires amidst insufficient motivation.

It's undeniable that consumers have lost their desire to consume.

Since the beginning of 2024, the bleak outcomes of several consecutive consumption events seem to indicate to all e-commerce platforms that the winter persists, and even cost-effectiveness has lost its appeal to consumers. A Bain & Company survey shows that in 2021, over 75% of Chinese consumers were still excited about Double 11, but two years later, this proportion has dropped to just 53%. During the same period, the proportion of consumers willing to increase spending on Double 11 fell from 51% to 23%.

Subsequent events like Double 12, Christmas, and New Year's celebrations saw even less activity. The sense of ritual that young people once cherished used to drive the entire consumer market by capitalizing on key moments. Today, young people with waning consumer desire are gradually ignoring the rituals they once pursued, but e-commerce platforms still seem to be clinging to this point and repeatedly emphasizing it.

This applies to WeChat's gift-giving feature and Douyin's gift-giving and transfer functions. Some platforms even consider gift-giving consumption among young people as the primary consumption scenario. A prime example is POIZON. Data reveals that out of the 690 million monthly searches on POIZON, up to 410 million are related to gift-giving.

But does this scenario truly fulfill e-commerce platforms' visions of new consumer motivation? Not necessarily.

Stimulating this generation of young people's consumer desire is a collective dilemma faced by the entire consumer market. The latest data shows that the proportion of domestic consumers who believe they can meet their monthly expenses fell from 88% in the first quarter to 83% in the third quarter of 2024, a decrease of 5 percentage points. This is the crux of the sluggishness in all consumer motivation.

Furthermore, do young people still care about social consumption?

Indeed, the scale of the gift-giving economy in China cannot be underestimated. Even during the past three years of travel restrictions, over 60% of domestic consumers engaged in gift-giving consumption 2 to 6 times. A survey indicates that in terms of gift consumption amounts, over 90% of users spend between 500 and 1000 yuan on gifts, followed by higher prices ranging from 1000 to 3000 yuan.

However, the phenomenon of 'lightweight' social interaction among contemporary young people is becoming increasingly common. 54.4% of surveyed youth believe they don't need to invest much time and energy in maintaining relationships. Specifically regarding consumption, it's even more evident. 86% of the surveyed population has social expenditure accounting for less than 30%. About 30% of people have social expenditure accounting for less than 10%, and only a small number have relatively high social expenditure, with approximately 1.8% having social expenditure accounting for more than 50%.

Coincidentally, iiMedia Research data also shows that among millennials, the proportion of social consumption lags far behind daily consumption like clothing and dining. Interestingly, Tencent actually laid out the concept of gift-giving early on. In 2014, the Tencent Industry Foundation invested in 'GiftTalk', but this vertical e-commerce platform announced layoffs and transformation in 2017.

In late 2024, major e-commerce platforms remembered this approach once again. Perhaps young people's attitudes are no longer enthusiastic, but the middle-aged group with stronger gift-giving demand and consumer ability has become the new target for WeChat and Douyin. However, it's easy to imagine the likelihood of middle-aged people using WeChat to send lipstick or Three Squirrels, or opening Douyin to send milk tea.

In 2025, Few 'Tricks' Left for E-commerce Platforms

As the cost-effectiveness war, revered as a golden rule by the entire consumer market, loses its charm, e-commerce platforms are about to enter a helpless 'window period'. Live streaming e-commerce, content creation, product management, price competition, supply chain efficiency... Even seemingly outdated social gift-giving has returned to the historical stage. Where will the entire e-commerce sector head next?

What's certain is that in 2025, the anxiety of major e-commerce platforms will only intensify.

Firstly, domestic offline channels have gradually begun to recover under the pressure of online e-commerce for many years, performing well in both sales and average selling price declines, sometimes even surpassing online channels. Data shows that offline channel sales increased by 1.8% in the first three quarters of this year, and the average selling price decline narrowed to 3%. During the same period, the average selling price decline of e-commerce channels reached 6%, and their market share fell slightly by 0.6%, experiencing negative growth for the first time.

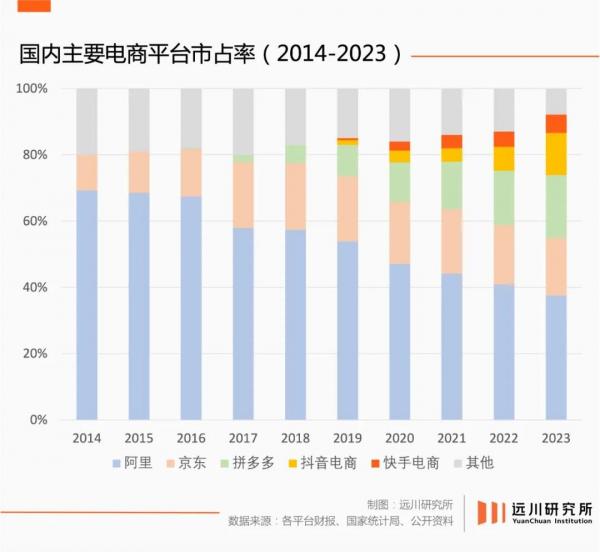

Secondly, although the price war has subsided, and major platforms have temporarily ended the period of intense competition, external competition has never ceased. The market share of leading platforms has been continuously declining. From 2020 to 2024, the combined market share of Alibaba and JD.com has declined by over 20%. However, Douyin and Kuaishou have been slow to catch up. Taking Double 11 as an example, data summarized by the Fudan Consumption Big Data Laboratory shows that Tmall and Taobao still account for 38% of Double 11 sales, JD.com accounts for 20%, and Douyin accounts for 13%.

There's still a considerable gap between short video platforms and traditional e-commerce platforms. As for WeChat and Xiaohongshu, they will only pay more attention to e-commerce in 2025. During Tencent's Q3 earnings call, nearly half of the questions were related to Video Numbers and WeChat Stores.

However, is there a way for the e-commerce sector, plagued by insufficient internal and external motivation, to push the 'wheel' forward by even one millimeter?

Firstly, continuing the price war is almost impossible. Throughout 2024, more than one e-commerce platform was dragged down by the disorderly price war. Since Pinduoduo first introduced the 10 billion subsidy program in 2019, subsidies and low prices have become the least innovative tactics in the e-commerce sector. In 2020, Alibaba piloted the 10 billion subsidy program on Juhuasuan, and in 2023, JD.com launched a daily 10 billion subsidy channel on its homepage.

In fact, besides blindly pursuing low prices, enhancing user experience and merchant return may be effective means for platform traffic growth. Currently, with sluggish traffic growth, leading e-commerce platforms are further enhancing the consumer experience of core users. A prime example is Taobao. In the second half of 2024, Taobao continuously increased membership-related benefits, especially for 88VIP.

Merchant return is also tied to the harmonious ecosystem of platforms, merchants, and users. Starting from the second half of the year, Taobao, JD.com, Pinduoduo, Douyin, etc., have all begun addressing the issue of merchant traffic costs. From a certain perspective, this is one of the main purposes behind the resurgence of social tactics.

Previously, when Douyin introduced group buying transfers, third-party data revealed that in scenarios involving gift-giving through group buying, the proportion of new merchant customers among gift recipients surpassed 50%, surpassing the level of new customers in non-transfer group buying orders during the same period. This significant finding greatly mitigated the challenge for merchants to acquire new customers and drive traffic.

With a monthly active user base of 1.382 billion, WeChat aims not only to 'nurture' its own e-commerce ecosystem but has also garnered the attention of other platforms. In September, Taobao integrated WeChat Pay, marking the first time in nearly eight years of mutual exclusivity that WeChat and Taobao achieved 'interoperability'. A Jefferies report anticipates that the synergistic effect of this partnership will unlock a potential user base of 245 million, and increasing the overall traffic supply will effectively reduce merchants' acquisition costs.

Behind every strategic move in the e-commerce sector lies a vast ambition.

Consumption Frontline provides you with professional, incisive, and neutral insights into the business world. This article is original content, and any form of reprinting that retains the author's relevant information is strictly prohibited.