The "Either-Or" Pricing Strategy Disrupts Cross-Border E-commerce

![]() 01/27 2025

01/27 2025

![]() 710

710

Amidst the evolving landscape of cross-border e-commerce, merchants must embrace and adapt to these changes.

Cover source: Unsplash

The new year heralds the intensification of the price war in cross-border e-commerce, with its ripple effects spreading overseas.

Since the second half of last year, Amazon, which had been relatively inactive, has become increasingly aggressive. In June, during a closed-door meeting, it announced plans for a "low-price store," which was officially launched as "Amazon Haul" in December.

Prior to this, Amazon had quietly introduced tools like "price competitiveness labels" and "price history query functions" to aid buyers in selecting the lowest-priced products, indirectly compelling sellers to engage in a "price war."

Behind Amazon's initiative to seek change lies the rapid rise of platforms like TEMU and SHEIN, which have intensified competition within the e-commerce industry in the United States, forcing Amazon to make significant adjustments to counteract their impact.

To this end, Amazon has begun targeting its main site merchants with "low prices," but will long-time comfortable cross-border e-commerce sellers bite?

1

Chaos in Cross-Border E-commerce

Since the second half of last year, Amazon's low-price strategy has become increasingly aggressive. Initially, some merchants reported receiving warning letters from Amazon, requiring them to make an "either-or" choice. Subsequently, the renowned digital brand Anker was suspected of withdrawing from TEMU and returning to Amazon. Users noted that when searching for the Anker brand on TEMU's US site, the brand store was displayed as "temporarily closed," leaving only product displays from third-party merchants.

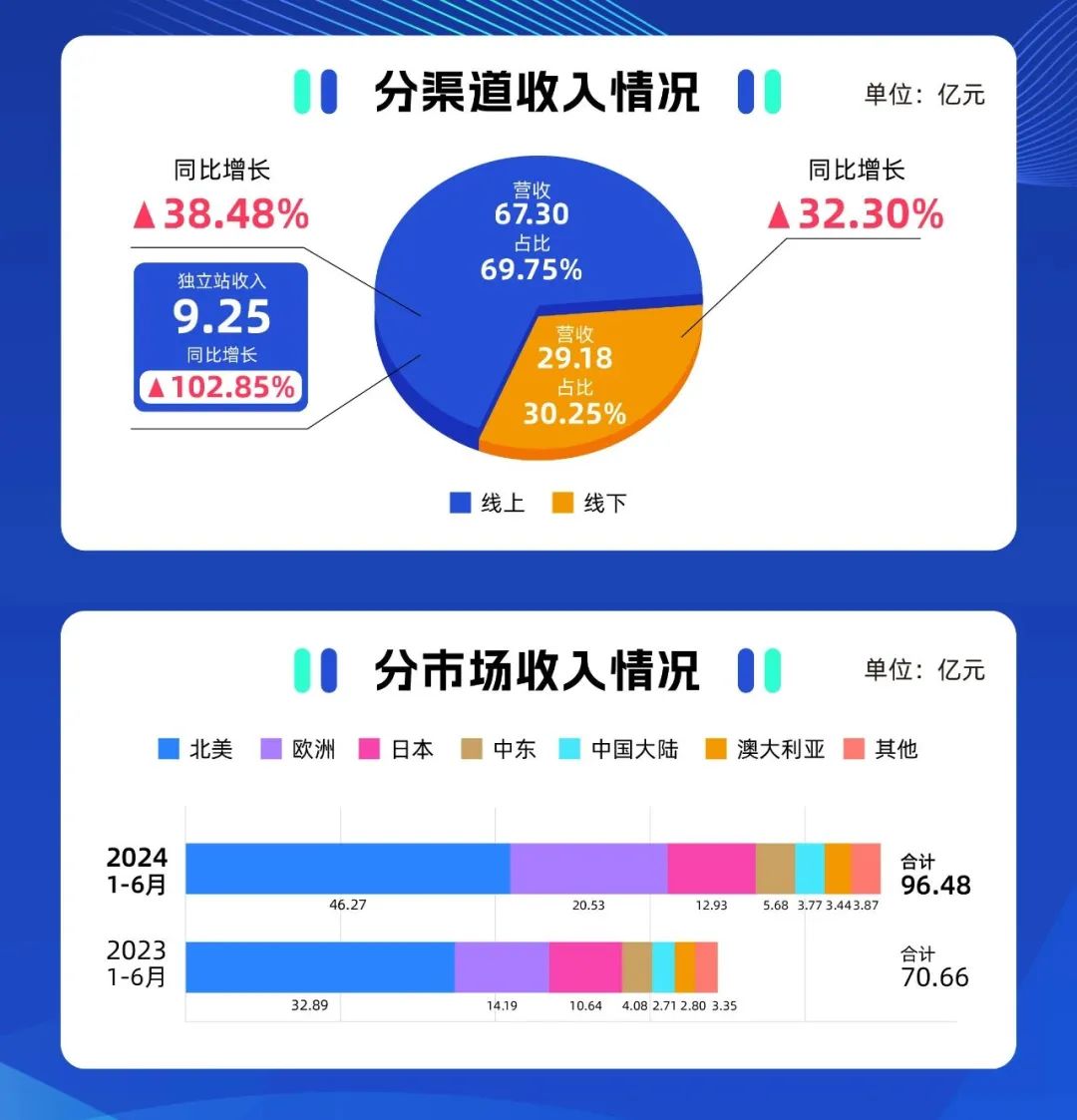

In recent years, Anker has been a top seller on Amazon, consistently ranking first in sales in the US region. From January to June last year, Anker achieved revenue of 9.648 billion yuan, over 5 billion yuan of which came from sales on Amazon.

However, starting in July last year, Anker began selling on TEMU in a semi-managed mode, with pricing controlled by the platform, whereas on Amazon, Anker directly controls pricing. Nonetheless, Anker's prices on TEMU are still benchmarked against Amazon. Some users noted that in most cases, its prices on Amazon are cheaper. Industry insiders suggested this might be due to Anker and the platform conducting A/B testing on prices, corresponding to both parties' future pricing power.

This is not good news for Amazon. Historically, Amazon has relied on its high-end market positioning and comprehensive logistics and delivery system to help startups build brands while also gaining consumer trust.

However, with the rise of low-price cross-border e-commerce platforms like TEMU, even though they still cannot directly compete with Amazon in terms of logistics and services, they have already snatched away many users with their "low prices." According to Salesforce data, 61% of consumers use platforms like TEMU primarily because they are "cheap."

Additionally, TEMU is brewing major moves, including attracting more branded merchants. Compared to the price war, TEMU is also following the development path of Pinduoduo by recruiting branded merchants to drive the platform's upward development, but Amazon seems unwilling to give TEMU more space.

Although Amazon swiftly denied the rumors following the "either-or" controversy, stating that the claim it requires sellers to sell exclusively on Amazon is untrue, in reality, even if Amazon does not intervene with "visible" means, it can still promote merchants to implement "lowest prices" through traffic allocation, reward and punishment systems, etc. While merchants can choose to abandon the Amazon platform, considering the platform's traffic and scale, most merchants actually have no choice.

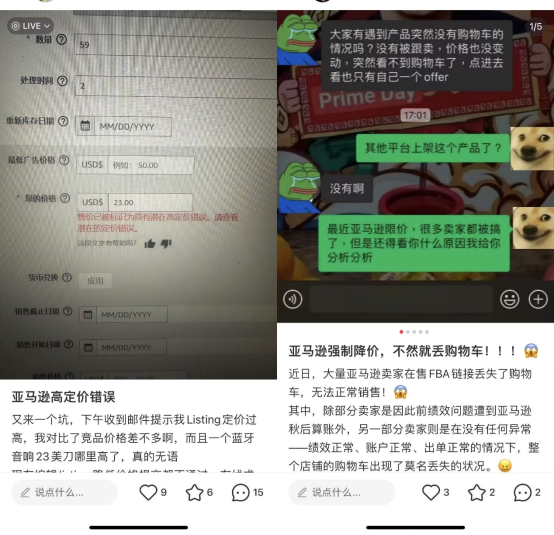

According to the self-media "Cross-border E-commerce Cross-border House," some local US sellers reported their product links being directly blocked by Amazon due to suspicions of selling at lower prices on TEMU.

The seller noted that the links of three of its products were blocked by Amazon, with the reason given being that their prices were not competitive compared to external sources, specifically citing the product's selling price on TEMU as the external reference price. Although no direct reason was provided, the implication of an "either-or" choice was clear.

Earlier, some merchants complained that Amazon forced sellers to lower prices, or some products would be forcibly removed from the shelves, citing "uncompetitive pricing that does not meet the requirements to become a recommended offer" as the reason.

Surprisingly, while Amazon and TEMU were engaged in their rivalry, Walmart also made a "stealthy" move. Some merchants reported receiving notices from Walmart reducing commissions, with commissions for some products dropping from 15% to 3%, allowing them to reduce prices on the Walmart platform to the same level as Amazon and TEMU.

2

The Market Cannot Accommodate a "Second Place"

The "either-or" strategy employed by e-commerce platforms is not new to domestic consumers. In December 2023, the Beijing Higher People's Court ruled on JD.com's lawsuit against Tmall's "either-or" practice, finding that Ali's monopolistic behavior caused severe damage to JD.com and ordering it to pay JD.com compensation of 1 billion yuan.

The long-standing rivalry between JD.com and Ali over the "either-or" strategy dates back to 2013, when an executive of JD.com accused Ali of requiring JD.com merchants to choose between the two platforms. Since then, disputes over "either-or" have not only occurred between JD.com and Ali but also between JD.com and Dangdang.com and Suning Appliance.

Walmart's "stealthy" move is reminiscent of when Pinduoduo quietly carved out a path in the e-commerce market with its social fission and low-price advantages during the battle between Ali and JD.com.

This underscores that in the business world, there are no unchanging strategies or conventional tactics. In any segment market, there is only one "first place," which will inevitably try every means to suppress the "second" and "third" places while actively seeking change and even referencing the offensive strategies of latecomers to maintain its "leading position."

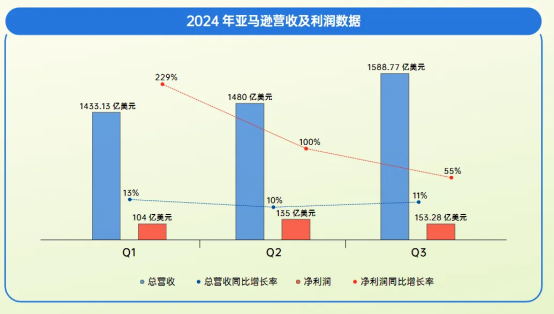

This is also Amazon's current situation. Financial report data shows that in the first three quarters of 2024, it achieved revenue of 450.167 billion dollars, a year-on-year increase of 11.20%; cumulative net profit was 39.244 billion dollars, a year-on-year increase of 98.19%, with both revenue and profit maintaining steady growth.

However, Amazon's revenue growth rate has flattened. Although net profit remains considerable, the growth rate has been declining quarter by quarter, with profit growth rates of 229% in the first quarter, 100% in the second quarter, and only 55% in the third quarter.

In the second-quarter earnings call last year, Amazon's Chief Financial Officer noted that revenue growth in the North American market was slightly lower than expected, primarily due to consumers opting for cheaper products, resulting in a decline in average selling prices (ASP).

The growth in net profit is primarily attributed to cost reductions and efficiency enhancements through AI technology, as well as revenue generated by the cloud business. In comparison, the growth rate of Amazon's e-commerce business is significantly lower than that of the industry.

For reference, Amazon achieved net sales of 61.411 billion dollars in the third quarter of last year, a year-on-year increase of 7%. According to a survey report by Stocklytics, the value of the e-commerce market in 2024 is expected to reach 4.11 trillion dollars, with a year-on-year increase of 15%.

It is evident that the rise of cross-border e-commerce platforms like TEMU has begun to seize Amazon's original market share, which also limits Amazon's net profit growth.

With a growing sense of crisis, change is inevitable for Amazon. As an e-commerce platform established for 30 years, Amazon has gradually transitioned from a vigorous "youth" to a traditional "middle-aged" platform, facing a situation somewhat similar to that of Ali and JD.com.

Fortunately, Amazon also has the courage to make a "turnaround." For now, it has already started to disrupt itself.

First, the launch of the low-price strategy. An Amazon executive stated that the low-price store "Amazon Haul" can bring profit growth to Amazon while enabling it to provide attractive product selections for the rapidly growing low-price segment market and tap into new incremental markets.

Second, deepening its focus on Chinese sellers. At the latest 2025 Seller Kickoff event, Amazon announced it would intensify efforts on the low-price mall and open intelligent supply chain managed services to Chinese sellers, among other initiatives. In 2024, Amazon also mentioned holding more seminars targeting sellers from third- and fourth-tier cities in China.

Behind Chinese sellers lies China's powerful supply chain resources. The price advantage of cross-border e-commerce platforms represented by TEMU also relies on the industrial belt resources behind Chinese sellers. Amazon obviously aims to follow suit to further enrich its product pool.

3

An Era of Great Change for Sellers

However, for now, Amazon is still undergoing market tests. For instance, the low-price store "Amazon Haul" has been online for over a month and is still in a "beta version." Some users have complained about slow delivery and lost orders.

Moreover, there is still a significant gap between the shopping experience and product richness of "Amazon Haul" compared to TEMU, possibly due to the smaller number of products and the lack of interaction and promotion to match.

But for domestic cross-border merchants, this ultimately adds another option, especially as TikTok recently faces immense pressure and policy uncertainties globally, with some TikTok sellers even selling their stores at low prices before the ban.

As we enter 2025, the landscape of the cross-border e-commerce industry is likely to become even more complex. First, policies in countries worldwide are facing greater uncertainties. For example, Vietnam previously required TEMU to suspend its operations; the European Union is also considering imposing new taxes on cross-border e-commerce platforms, which may affect the competitiveness of most cross-border products.

Second, competition among cross-border e-commerce platforms will intensify, forcing each platform to introduce more new rules and strategies. At the end of last year, Amazon strengthened its review of platform rules, resulting in an increasing number of seller accounts being suspended. According to incomplete statistics, about 5,000 Chinese seller stores were banned by Amazon in November alone.

Furthermore, merchants must further adapt to the strategies of different platforms. For example, recently, TEMU opened in-station advertising functions for semi-managed sellers. Prior to this, TEMU primarily adopted a natural traffic allocation mechanism, meaning players may need to explore new traffic strategies based on "absolute low prices."

In the face of changes in the cross-border e-commerce industry and platforms, merchants must embrace and adapt to these changes.

On one hand, in addition to competing on price, merchants can also focus on quality and product categories, emphasizing higher-profit products and using efficiency to offset cost pressures. On the other hand, merchants can diversify their layouts and attempt to build and operate stores on different platforms to mitigate the impact of new tariff policies.

Finally, merchants tired of the price war can consider expanding their brands overseas, impressing overseas consumers through innovation in technology, design, and concept, such as telling the story of Chinese culture and creating unique product features.

Over the past year, amidst the global economic slowdown, platforms and merchants have begun to realize that only by opening up new arenas can they find new growth. For instance, Amazon is deploying low-price stores; TEMU is launching advertising investments; and AliExpress is focusing on services, providing more benefits to high-quality POP merchants...

To some extent, change may bring greater uncertainty, but risks and opportunities coexist. For domestic cross-border merchants, the challenges in 2025 are evident, but opportunities are also being nurtured amidst difficulties.