The Decline of the Greatest Tech Company: AT&T

![]() 02/07 2025

02/07 2025

![]() 465

465

If I were to ask which tech company has been the most influential in the past 100 years, many might list today's giants like Apple, Google, Microsoft, and NVIDIA. Some might even recall IBM or Cisco. However, I argue that compared to a company from the past, these all pale in comparison. That company is AT&T, formerly known as "American Telephone and Telegraph." Why do I say this? Because almost every convenience we enjoy in telecommunications today can be traced back to AT&T's innovations.

In 1877, Alexander Graham Bell, the father of the telephone, invented the device and founded AT&T in 1885, focusing on long-distance telephone networks. Soon, AT&T became synonymous with the telephone. In 1925, AT&T acquired the research division of Western Electric and established Bell Labs, allocating 3% of its sales to research, allowing scientists to focus on innovation without funding constraints. This attracted the best minds of the time, kickstarting a series of groundbreaking inventions.

Bell Labs was a hotbed of talent, with each building uniquely designed to foster chance encounters among scientists. For instance, Shannon, an eccentric information theorist, would ride his unicycle through the long corridors, juggling balls and nodding to colleagues. This playful environment was a hallmark of Bell Labs.

After World War II, Bell Labs' inventions flourished. In 1947, they invented the transistor, paving the way for the digital era. By 1958, they had developed the laser, a technology used today from ophthalmic surgery to fiber optic communication. From 1969 to 1973, they created the UNIX system and C language, forming the foundation of modern operating systems. Bell Labs also invented solar cells, cellular phones, digital switches, and more, earning numerous international awards and patents.

In short, every step humanity has taken towards the telecommunications and internet era is indebted to Bell Labs. Their inventions have significantly impacted world economic development, earning them the title of the "womb of the technological revolution" in the 20th century.

As the pioneer of the global telephone and telegraph business, AT&T achieved a natural monopoly of the American telephone market as early as 1892. To address antitrust concerns, they signed the Kingsbury Commitment in 1913, allowing independent telephone companies to access their network. AT&T combined technological inventions with business operations, forming a unique system of business innovation and circulation. By 1956, AT&T dominated 99% of the long-distance and 85% of the local telephone markets in the United States.

So, how did such a powerhouse decline? The answer lies in extreme greed and a lack of innovation. Just as AT&T was thriving, the dawn of the internet arrived, yet AT&T clung to traditional copper cables, even obstructing ARPANET's use of their lines in the 1970s. In 1995, driven by shareholder profits, AT&T's equipment manufacturing division proposed a spin-off, leading to the creation of Lucent Technologies. This move separated AT&T's equipment and telecommunications services, disrupting their complementary relationship.

Lucent, with only one-time equipment sales and no stable cash flow from AT&T, began restricting research and funding, killing the lab's innovation capabilities. To please shareholders, Lucent joined forces with banks to "borrow" money to small companies to purchase its equipment, leading to a financial bubble that burst in 2000. Lucent's stock price plummeted, and they were forced to close most of Bell Labs' research departments, laying off numerous scientists. In 2006, Lucent was acquired by France's Alcatel for a fraction of its peak value.

Meanwhile, AT&T, now focused solely on telecommunications services, faced shareholder pressure to spin off more businesses for quick profits. This led to further disintegration, and by 2005, AT&T was acquired by its former "subsidiary" SBC, marking the end of the greatest tech company in history.

In summary, AT&T's decline began in 1995 when they failed to adapt to the optical fiber revolution and instead clung to outdated copper cables. When Bell Labs scientists laid the foundation for the internet with the Unix system, AT&T's legal team was busy in court, accusing ARPANET of patent infringement. Greed and a lack of innovation eventually led to AT&T's downfall, a cautionary tale for all tech giants.

As garage entrepreneurs in Silicon Valley reshaped the world with the TCP/IP protocol, the marble steps of AT&T's Manhattan headquarters resounded with scornful laughter aimed at "non-voice communication services."

When Jobs introduced the iPhone to AT&T, these wizards adept at terabit-per-second transmission technology hesitated, fearing an overspend on user traffic.

As the internet emerged as the dominant trend of the era, AT&T's management attempted to shoehorn the internet into their outdated "Universal Service" model, leveraging their monopoly on telephone services.

While companies like Apple, Google, Amazon, and Microsoft innovated relentlessly, AT&T was preoccupied with shareholder greed, lending to small firms to promote equipment, and boosting share prices through company splits.

……

In 1948, Claude Shannon, the father of information theory, penned "A Mathematical Theory of Communication" in Bell Labs' Building D. The article featured a renowned law of entropy increase: all great systems are destined for entropy growth! Monopolies build towers that eventually collapse into innovation graveyards, while bureaucracies fueled by control desires and profit greed inevitably consume the fruits of technological revolution. Today, Nvidia's chip business boasts a gross margin of up to 78%. Remarkably, even after being transferred 18 times, these chips remain highly sought-after collateral for major banks. Nvidia even allows dealers to use supply contracts as collateral to borrow funds, which are then used to purchase more Nvidia chips. It's said that the H100 chips destroyed in a Silicon Valley warehouse fire could have purchased the entire Chinatown.

Currently, Apple has seen minimal real innovation in at least a decade, yet its profits surpass those of all other mobile phone manufacturers combined. Beyond hardware profits, its dominant 30% Apple tax has become the company's most stable revenue stream.

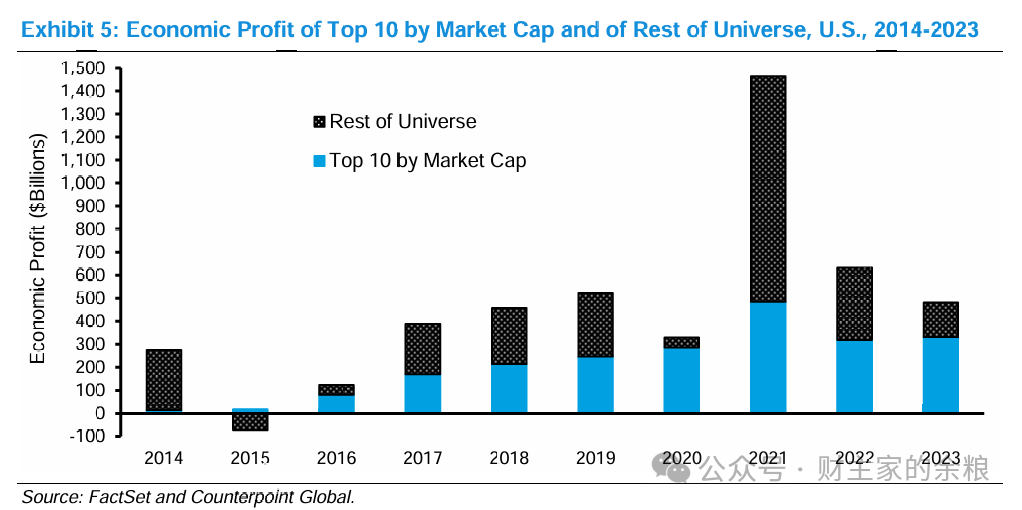

Amidst technology giants' promotion, many SMEs have dismantled their IT departments, migrating to the cloud. However, within a few years, cloud service providers like Amazon, Microsoft, and Google tripled their prices in new contract negotiations, leaving SMEs at their mercy. ……Driven by greed, we observe that from 2020 to present, companies like Nvidia, Apple, Google, Microsoft, Amazon, and Meta often boast gross profit margins above 50% and net profit margins astonishingly above 30%. Their revenues and profits soar annually, amassing immense wealth in the global internet market. In 2023, the top 10 companies by market capitalization accounted for over 60% of the combined gross profits of all S&P 500 companies.

I asked DeepSeek to reflect on the greed of these tech giants, using AT&T's decline as a lens. AT&T's downfall is a cautionary tale for tech companies, with every byte a warning to technological tyrants. As Cook gazes upon Apple's "spaceship" headquarters, Page sketches the quantum future in Google labs, Huang Renxun envisions the future of home AI, and Nadella and Bezos pride themselves on cloud computing success, a colossal shadow looms from the folds of time and space within AT&T's bronze dome at 195 West Street, New York. This is the inevitable fate all tech giants must confront – to be the spark igniting innovation or the tombkeeper guarding its ashes? Lastly, a tidbit on AT&T's twilight era: around 2000, a Chinese internet company was founded by someone admiring Lucent, a spin-off from AT&T. Lucent's name translates to "messenger of light," but in Chinese, "Lu" became "land," and "cent" became "cent," forming "six cents company." Hence, the founder named his company Tencent ("one-tenth of a dollar company"), later translated into Chinese with his surname, becoming Tencent. Yes, it's the major shareholder of QQ, which you used daily before, and WeChat, which you use daily now. And the reason you're reading this article is that I wrote it – thanks to that one-tenth of a dollar company.