Tariff shock looms, crisis and opportunity for cross-border merchants

![]() 04/15 2025

04/15 2025

![]() 535

535

Author|Mangzhong

Disclaimer|The lead image is sourced from the internet. For reprints of original articles from Jingzhe Research Institute, please leave a message to apply for authorization.

In the wee hours of the morning, the container cranes at Shenzhen Yantian Port are still busy "shelving" goods for transoceanic cargo ships. As these goods cross the Pacific Ocean, they also face new trade challenges – the "reciprocal tariff" policy implemented from April directly affects the pricing of each product.

Since the US unilaterally announced an additional 34% tariff on China, the four rounds of "tariff tit-for-tat" completed within 10 days have raised tariffs on the US from 34% to 125%, setting a record for the fiercest game in modern trade history. This tariff storm has not only greatly impacted the stability of global supply chains, but has also placed countless small and medium-sized Chinese cross-border sellers at a crossroads of survival and development.

Cross-border trade faces an "earthquake"

With the implementation of a new round of Sino-US tariff policies, the economic and trade relations between the two countries are facing a new adjustment window.

Chinese export enterprises are generally facing operational pressures, with rising costs of raw materials, logistics, and tariffs continuously compressing profit margins. Notably, some manufacturing enterprises have already initiated countermeasures: reducing transportation risks through supply chain localization, increasing R&D investment to enhance product added value, and exploring emerging markets to diversify trade risks. These structural adjustments are reshaping the international competitiveness of Chinese manufacturing.

On April 2, the United States announced an additional 34% tariff on Chinese goods exported to the US, covering all categories from agricultural products to high-tech products. After combining with existing tariffs, the tariff rate on Chinese goods to the US rose to 54%. On April 8, the tariff rate was raised to 84%, and on April 12, China implemented a retaliatory tariff of 125%, and news emerged that Tesla's Shanghai factory had halted expansion. This series of policies has already impacted the global supply chain.

The implementation of the policy has directly triggered a comprehensive impact on the stability of the upstream and downstream of the global supply chain, with overseas e-commerce platforms and cross-border sellers alike bearing the full brunt.

For example, Chinese cross-border e-commerce platforms like Temu and Shein, which have rapidly developed through the direct mail packet model, have been leveraging the low-cost advantage of China's supply chain to seize the US market. However, as trade frictions gradually expanded from 2024, the platforms are also shifting the focus of their business models.

As early as last year, Temu began a comprehensive transition to a semi-managed model, encouraging merchants to stock up through overseas warehouses to achieve "localized sales"; Shein has already established three large distribution centers in the United States to accelerate logistics distribution and service response speed.

According to reports from Ebrun, while Chinese goods face tariff barriers, Amazon's low-price mall, Amazon Haul, has also begun introducing branded goods already in inventory in US warehouses, including well-known brands such as Adidas, Levi's, and Gap. This means that Amazon Haul is transforming from its original unbranded low-price model to a branded direction to avoid tariff impacts and cater to consumer preferences.

For leading enterprises operating in overseas markets, actively responding to policy changes has become a core capability.

Anker Innovation, a 3C accessories enterprise mainly in the North American market, responded to questions related to "tariff pressure" on April 8, stating that in addition to the CN+1 supply chain strategy of transferring some production capacity, the company is also continuously advancing the CN+2 supply chain strategy, which involves establishing or expanding production and supply chain facilities in other countries. Meanwhile, before the tariff directive took effect on April 9, the company accelerated the transportation and stockpiling of goods to target markets, leveraging existing inventory to buffer short-term cost pressures, relying on the global logistics and warehousing network it has already built.

'Made in China' faces triple shackles

As Sino-US tariff policies continue to escalate, various export enterprises are generally facing cost pressures.

According to analysis by the EWTO Research Institute, under the T86 policy (i.e., the cancellation of tariffs on small packages valued at less than $800), based on the latest policy adjusted on April 8, cross-border e-commerce export goods will incur an additional tariff cost of 90% or $75 per item (increasing to $150 per item after June 1, 2025). As a result, the price advantage of Chinese cross-border e-commerce enterprises will be basically "wiped out," and profitability and market competitiveness will be significantly reduced.

According to the cross-border e-commerce service company TMO Group, as tariffs, customs clearance costs, and logistics fees rise, the profit margins of small and medium-sized sellers are being extremely compressed, and the profit margins of low-value-added categories such as clothing and toys may be compressed to below 5%. Therefore, small and medium-sized sellers may be forced to raise prices or withdraw from the market in the short term.

When the Jingzhe Research Institute queried relevant data, it also found that according to National Bureau of Statistics data, in 2024, the operating revenue of China's textile industry above a certain size increased by 4% year-on-year, and total profits increased by 7.5% year-on-year, with a profit rate of 3.9%. After China's tariffs on the US reached an unprecedented record, it is no longer realistic to try to absorb the pressure caused by tariffs by reducing profits.

Rising costs are just one of the challenges faced by the supply side. A deeper impact is that under the influence of tariffs, the overall increase in supply chain costs inevitably leads to an increase in commodity prices in the terminal market. Although manufacturing enterprises can directly transfer tariff pressure to customers or consumers by raising prices, when competing with locally produced goods, they also need to assess whether they possess sufficient differentiation advantages.

A background that cannot be ignored is that although Chinese technology companies such as Huawei and DJI have gained certain international fame, a large number of unbranded "Made in China" products still suffer from insufficient brand power, leading to a prevalent stereotype of "cheap and low-quality" in overseas markets.

The "Overseas Consumers, Products, and Pricing Survey Report" released by Kantar pointed out that Chinese products still have shortcomings in terms of premium pricing power, and the motivation of European and American consumers to choose Chinese products is mainly focused on cost-effectiveness rather than brand premium. Especially in the field of unbranded electronics, consumers are more inclined to regard them as "low-priced substitutes."

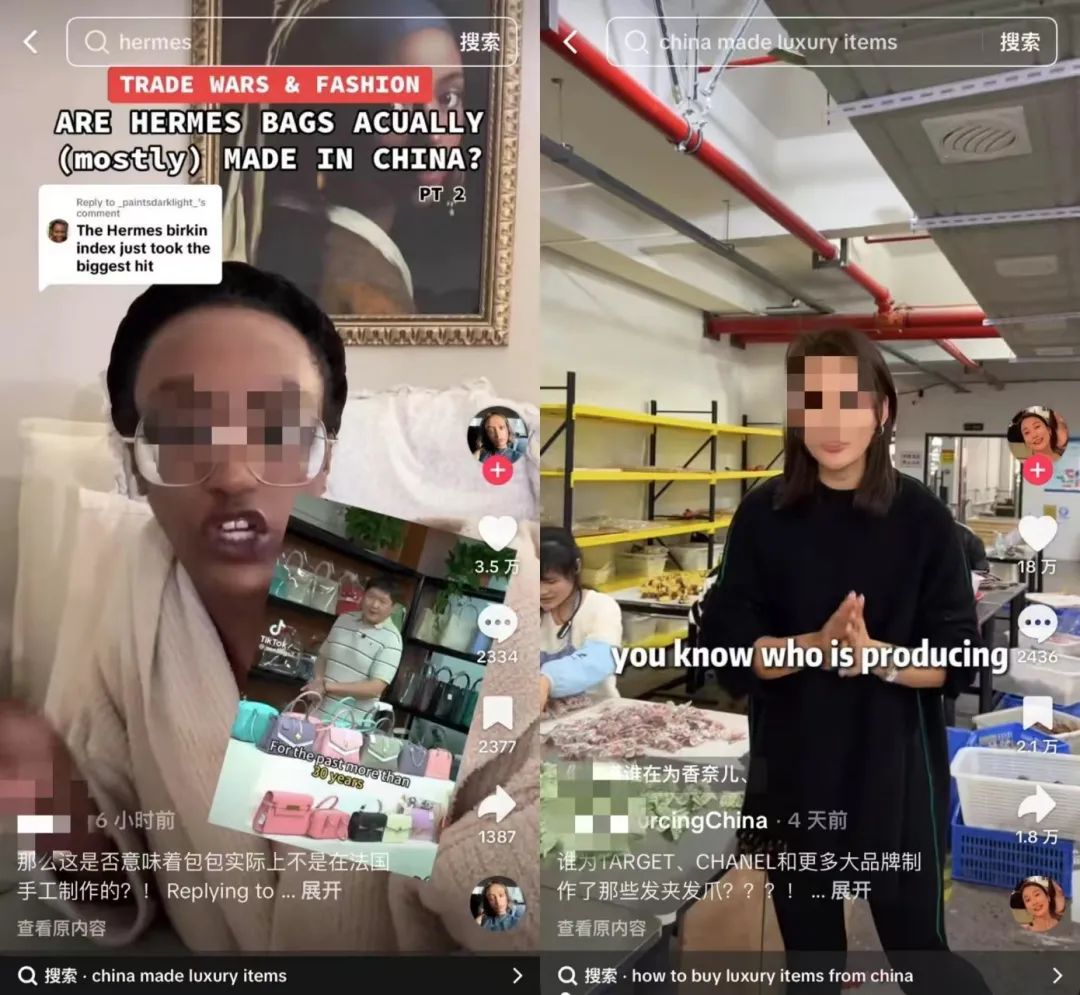

However, some Chinese manufacturing enterprises are leveraging the dissemination of social media to try to break overseas consumers' one-sided perception of "Made in China".

For example, some Chinese manufacturers have begun to post videos on TikTok "exposing" that many luxury brand bags and jewelry are made in China and are priced exorbitantly, attracting significant attention from overseas consumers. Some manufacturers have even started direct sales online, attracting consumers to purchase in live streaming rooms.

Although it is unclear how much specific help this behavior has provided in boosting sales, overseas consumers have begun to re-examine the quality of "Made in China" and reflect on whether the high profits earned by well-known overseas brands through the "OEM + private label" model are worth continuing to pay for.

The way out for small and medium-sized manufacturers

Against the backdrop of adjustments to global trade rules, shifting from relying on supply chain advantages to building brand advantages has become an important task for Chinese cross-border enterprises. Brand building can not only enhance product premiums but is also an important safeguard against policy risks and market fluctuations.

Taking Anker Innovation, a leading enterprise in the overseas 3C field, as an example. Anker Innovation's North American team is adept at keeping up with the preferences of young users and achieving audience coverage through engaging social media content. For example, Anker Innovation once created a Meme meme ridiculing the "similarity" between Apple and Samsung products, and the brand was also the first charging brand to obtain third-party authorization for Apple's USB-C to Lightning data cable, thus attracting the attention of Apple users.

In addition, Anker Innovation has not forgotten to leverage the "celebrity effect." Last August, during a live conversation between Trump and Musk, keen-eyed netizens discovered that Trump was using Anker MagGo series products from Anker Innovation, and soon the model and price of this product were also uncovered by netizens. Interestingly, this product is priced at $89.99 (approximately RMB 646) on Amazon, higher than the RMB 399 price on the domestic JD.com platform.

*Image source: Anker Innovation official website

Against the current backdrop of adjustments to global trade rules, Chinese cross-border enterprises need to break through the model of relying solely on supply chain cost advantages and explore more sustainable development paths. Optimizing tariff costs through precise regional layout has become an effective means for enterprises to enhance their competitiveness.

For example, mobile phone and automobile enterprises can assemble core components and local auxiliary materials through the bonded warehouse in Monterrey, Mexico, and the products can meet the 75% regional value requirement of the USMCA (United States-Mexico-Canada Agreement) to obtain partial tariff exemptions. This "origin reconstruction" strategy not only avoids high tariffs but also maintains supply chain flexibility.

The deep cultivation of regional markets is also worthy of attention. For example, TECNO (Transsion Holdings), known as the "king of localization" in the African market, has launched multi-SIM multi-standby mobile phones, long-lasting batteries, and cameras with deep skin tone portrait optimization functions tailored to the characteristics of the African market, precisely meeting local needs. At the same time, it has deployed multiple sub-brands (such as Infinix, Itel) to cover different consumption levels.

In Africa, where daily electricity supply may not be guaranteed for 24 hours, TECNO covers remote areas through local agent networks and offline experience stores, addressing the weak logistics and payment infrastructure in Africa. In 2023, TECNO's market share in Africa exceeded 40%, firmly occupying the first position. Such deep localization not only lowers the barriers to market entry but also enables a rapid response to regional needs.

In the current industry environment of tariff policy adjustments, the phrase "export to domestic sales" has evolved from a joke to a feasible strategy for overseas enterprises to respond to the market.

From kitchen appliances to sweeping robots and floor washing machines, Chinese people's demand for household appliances has always been upgraded with the updating of products and technologies, and the national "trade-in" and consumption subsidy policies have also provided assistance to enterprises.

According to Ministry of Commerce data, the national subsidy policy in 2024 drove sales of eight categories of household appliances to exceed 56 million units, generating sales of RMB 240 billion. Among them, the sales volume of sweeping robots alone increased by nearly 70% year-on-year from September to December 2024. From the beginning of this year to 0:00 on April 8, consumers purchased 35.709 million units of 12 categories of household appliances for trade-in, driving sales of RMB 124.74 billion. The national subsidy policy has significantly boosted consumption in the home appliance market, especially the sales growth of high-efficiency products and mid-to-high-end household appliances, which has also created new market space for manufacturing enterprises engaged in "export to domestic sales".

The intensification of the global wave of trade protectionism is essentially a game for dominance during the restructuring of the global industrial chain. The survival logic of small and medium-sized Chinese enterprises going overseas is shifting from the "cost red ocean" to the "value blue ocean". The key to breaking the deadlock lies in transitioning from relying solely on cost advantages to a three-dimensional driving model of "strengthening supply chain resilience as the foundation, building brand premium barriers, and diversifying market layouts to disperse risks."

Tariff barriers may temporarily suppression the flow rate of Made in China, but they cannot change its momentum towards high-value segments. As the era of "low-price free shipping" comes to an end, the story of "brand going global" is just beginning.