Qualcomm FY2025 Q2 Earnings Report: Profit Growth Surpasses Expectations

![]() 05/06 2025

05/06 2025

![]() 648

648

Produced by Zhineng Zhixin

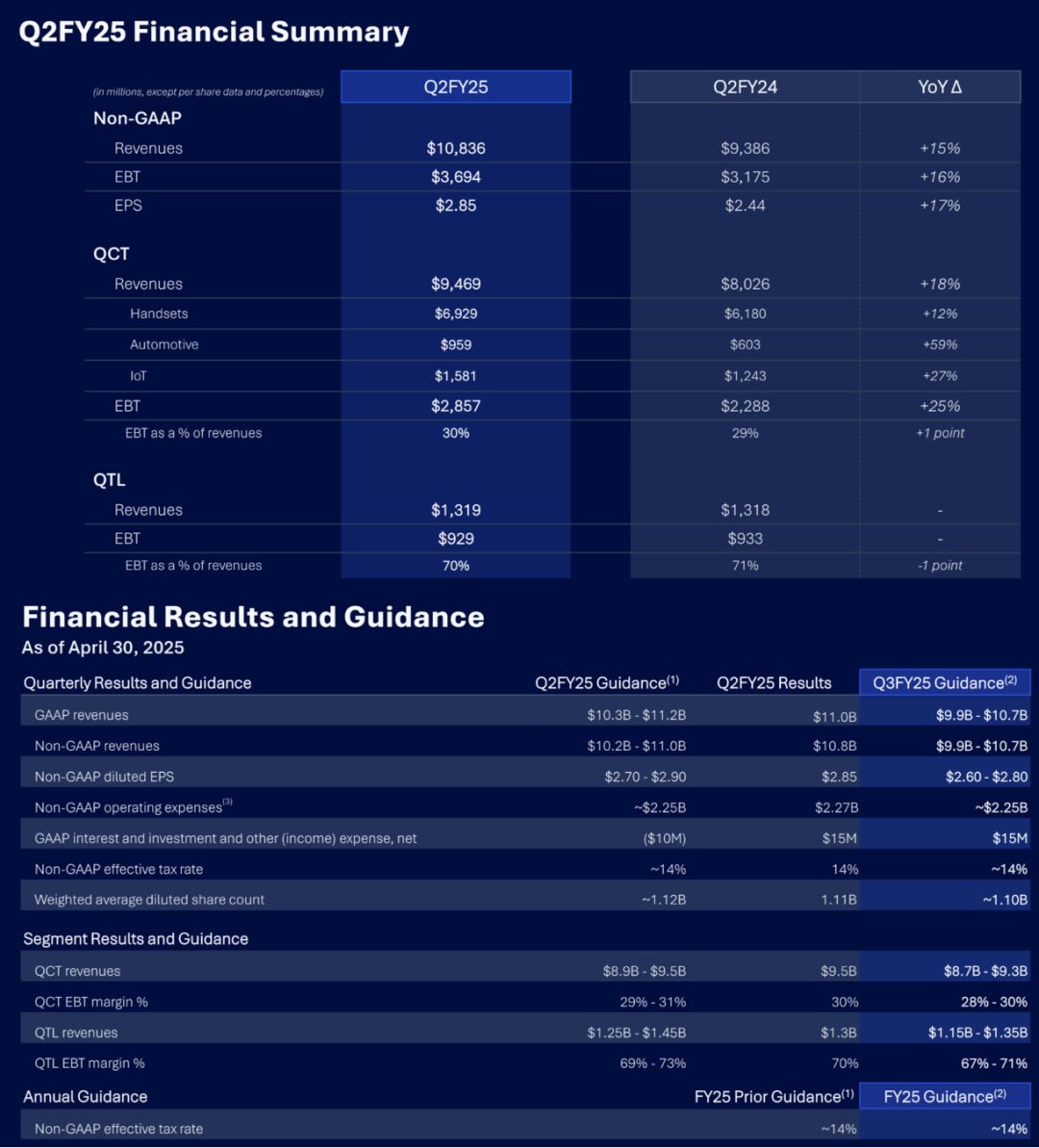

On May 1, 2025, Qualcomm released its second-quarter fiscal year 2025 earnings report, revealing revenues of $10.98 billion, an increase of 16.9% year-on-year, and net profits of $2.81 billion, up 20.6%, surpassing analysts' expectations.

Chip sales (QCT division) surged by 18%, automotive business skyrocketed by 59%, IoT business grew by 27%, and licensing revenue (QTL) increased by 13%, fueled by robust momentum in 5G, automotive, and AI sectors.

However, third-quarter guidance fell short of expectations. We will delve into Qualcomm's growth drivers, market positioning, and challenges from two perspectives: financial performance and business highlights, alongside its diversification strategy and technological innovation. We will also explore how Qualcomm sustains its edge in the fiercely competitive semiconductor market through technological leadership and diversified strategies.

Part 1

Financial Performance and Business Highlights:

Dual Growth Pillars of Chip Sales and Licensing Revenue

● Qualcomm's Second Quarter Fiscal Year 2025

◎ Revenues reached $10.98 billion, up 16.9% year-on-year, exceeding the forecasted $10.65 billion;

◎ Net profits stood at $2.81 billion, a 20.6% year-on-year increase.

◎ Non-GAAP revenues were $10.8 billion, up 15% year-on-year, with an operating profit margin of 28.4% and a free cash flow margin of 21.3%, indicating efficient operations and healthy cash flow.

◎ The QCT division (devices and services, primarily chip business) drove growth, with revenues of $9.5 billion, up 18% year-on-year. Revenues from the mobile phone business amounted to $6.929 billion, up 12%, fueled by strong demand for flagship chips like the Snapdragon 8 Gen 3 in China's high-end Android market;

◎ Automotive business revenues reached $959 million, up 59% year-on-year, marking a record for the fifth consecutive quarter;

◎ IoT business revenues were $1.581 billion, up 27%, demonstrating the widespread adoption of edge AI and 5G connectivity.

◎ QTL division (licensing business) revenues were $1.319 billion, up 13% year-on-year, with an EBT profit margin remaining high at 69%-73%, underscoring Qualcomm's robust bargaining power in the 5G patent arena.

In the second quarter, Qualcomm launched the Qualcomm X85 5G modem-RF platform, integrating AI capabilities to support high-speed connectivity for Android smartphones and extending to fixed wireless access (FWA) devices, such as the Qualcomm Dragonwing Gen 4 Elite platform. This platform enhances network performance through 5G Advanced technology, suitable for home, industrial, and enterprise settings.

◎ Qualcomm's collaboration with IBM and Palantir introduces generative AI and ontological capabilities into edge devices, further expanding AI applications in the industrial IoT and enterprise markets.

◎ In the PC sector, over 85 devices based on the Snapdragon X platform are in production or development, aiming for 100 commercial devices by 2026, showcasing Qualcomm's ambitions in the AI PC market.

◎ In the automotive sector, Qualcomm secured 30 new Design Wins, with 14 commercial vehicles equipped with the Snapdragon Digital Chassis solution, encompassing cockpit, ADAS, and autonomous driving functions, highlighting its rapid penetration into the intelligent connected vehicle market.

However, Qualcomm's third-quarter guidance missed expectations, with projected revenues of $9.9 billion to $10.7 billion (midpoint of $10.3 billion), lower than analysts' expectations of $10.33 billion. This conservative outlook sparked market concerns about smartphone demand and the trade environment, particularly tariffs.

Chief Financial Officer Akash Palkhiwala noted that the indirect impact of tariffs is unpredictable, but the company's diversified global supply chain helps mitigate risks.

Qualcomm's mobile phone business accounts for 63% of total revenues, with 46% originating from the Chinese market. Demand from Chinese OEMs such as Xiaomi, OPPO, and Vivo drives high-end chip sales.

However, peers like Intel have recently issued cautious outlooks, warning of economic recession risks. The semiconductor industry's sensitivity to global demand is expected to result in low single-digit growth for the smartphone market in 2025, while 5G smartphones are forecasted to achieve high single-digit to low double-digit growth.

Part 2

Diversification Strategy and Technological Innovation:

Qualcomm's Long-term Growth Engine

Under CEO Cristiano Amon's leadership, Qualcomm is reducing its reliance on the mobile phone market through a diversification strategy, with the automotive and IoT businesses emerging as new growth pillars.

● The automotive business benefits from widespread adoption of the Snapdragon Digital Chassis solution.

◎ Qualcomm is collaborating with global automotive OEMs on 30 new designs encompassing the cockpit, connectivity, and ADAS, and anticipates the automotive business to continue growing at over 50% in fiscal year 2025.

◎ BMW's expanded collaboration with Qualcomm will integrate AI-driven assisted driving features into more models.

● The IoT business spans smart glasses (like the Snapdragon-powered Ray-Ban Meta glasses), industrial sensors, and edge AI devices.

Qualcomm has strengthened its technology portfolio for the industrial IoT through acquisitions of Edge Impulse and FocusAI, enhancing its capabilities in model optimization and deployment for edge AI, thereby boosting product competitiveness. It has also attracted more developers by expanding its software ecosystem.

● Qualcomm's technological leadership in 5G and AI is its core competitiveness.

The Qualcomm X85 modem supports 5G Advanced, offering higher spectral efficiency and low latency, suitable for smartphones, FWA, and industrial IoT. The Dragonwing Gen 4 Elite platform drives growth in the fixed wireless access market through AI-optimized network management.

Qualcomm has made significant strides in the AI PC field, with the Snapdragon X Elite platform supporting generative AI functions (such as real-time translation and virtual assistants). Its integration with Microsoft Copilot+ positions it as a strong competitor to Intel and AMD.

Qualcomm's patent portfolio plays a pivotal role in its QTL business. In the second quarter of fiscal year 2025, QTL revenues were $1.319 billion, up 13%, due to long-term licensing agreements with companies like Apple, Samsung, and Transsion.

Although the expiration of the licensing agreement with Huawei has constrained the growth of QTL revenues, Qualcomm has compensated for some of these losses through new agreements with Chinese OEMs.

In April 2025, Qualcomm acquired Movian AI, the generative AI division of VinAI, bolstering its edge AI algorithms capabilities. The acquisitions of Edge Impulse and FocusAI strengthened the software ecosystem for the industrial IoT, enabling Qualcomm to provide end-to-end solutions from chips to model optimization.

These acquisitions not only augmented technological capabilities but also fortified R&D strength through the integration of AI talent hubs like Montreal.

Qualcomm's ecosystem development is also evident in its collaborations with companies like IBM and Palantir to jointly develop enterprise-level generative AI solutions, extending Qualcomm's chips and AI technology to hybrid cloud-edge scenarios, spanning industries such as finance, manufacturing, and healthcare, thereby expanding its market reach.

Summary

Qualcomm's Growth Momentum and Future Prospects Qualcomm's second-quarter fiscal year 2025 earnings report underscores its robust momentum in chip sales, 5G technology, and diversification strategies. The 18% growth in the QCT division, 59% surge in the automotive business, and 27% increase in the IoT business reflect Qualcomm's transformation from a mobile phone chip supplier to a multi-domain technology leader.

Innovative products like Qualcomm X85, Dragonwing Gen 4 Elite, and Snapdragon X Elite, coupled with collaborations with companies like IBM and Palantir, have consolidated Qualcomm's leading position in the 5G Advanced and edge AI markets. Strategic acquisitions such as Movian AI and Edge Impulse further enhance its technology ecosystem, laying the groundwork for sustained growth.