Cold Reflections on the Intense Rivalry Between Meituan, JD.com, and Alibaba

![]() 05/09 2025

05/09 2025

![]() 672

672

Article | RingBellTalks

Few would have anticipated the fierce intensity of commercial games among industry giants in 2025.

The food delivery battle between JD.com and Meituan, two titans in local retail, swiftly engulfed all societal strata. Subsequently, Alibaba's newly revamped Taobao Flash Sales joined forces with Ele.me, increasing subsidies and entering the fray. Today, the chaos among giants is escalating, with unrest continuously spreading and fermenting among merchants, riders, customers, public opinion, and institutions.

In this battle, many SMEs feel uneasy: The giants continue to blur boundaries and seize market shares, shrouding the competitive landscape in instability. Who can escape? The fierce competition between giants is already intense; imagine the impact on SMEs operating in vertical and segmented fields. If giants set their sights on these areas, it will undoubtedly be a devastating blow from a higher dimension.

This current game will undoubtedly trigger a new "butterfly effect." It is foreseeable that subdivided industries such as catering, retail, supermarkets, convenience stores, and fresh produce e-commerce will witness a new round of dividends and transformations. Many small and medium-sized chain brands and local stores must turn to the food delivery model amidst this chaos, enhancing their online operations to seize market share; otherwise, they risk elimination in this industry reshuffle.

For SMEs inadvertently drawn into this game, the survival strategy of "operating with lighter loads and competing with speed" may be the optimal solution to navigate the current commercial battle. However, the order of "lightness" and the direction of "speed" merit careful consideration.

Research has shown that, in the past, when enterprises faced various risks under unstable competition, they often defaulted to using Yidianyun's flexible office IT solutions to "lighten" IT assets and accelerate IT configuration evolution, achieving healthy cash flow and rapid advancement.

01

Instability is the Norm

Operating with Lighter Loads is the First Choice for Healthy Cash Flow

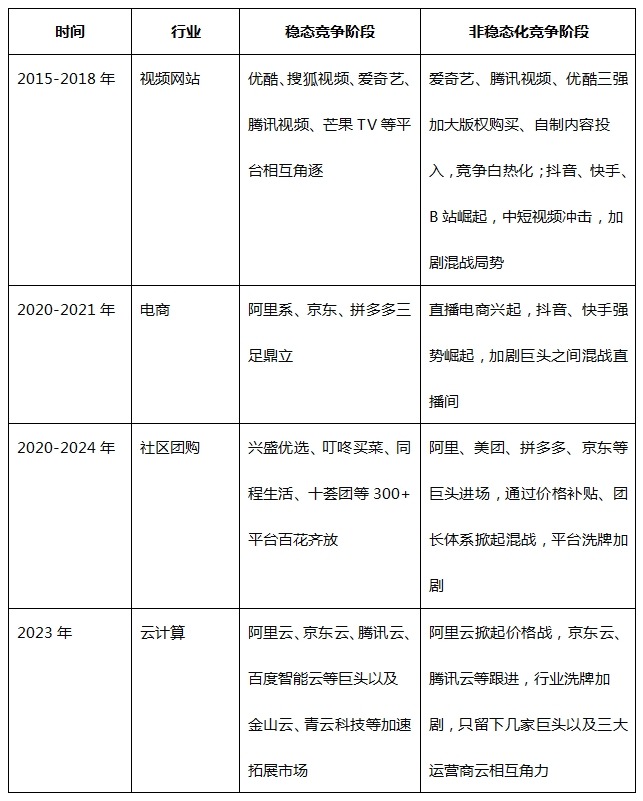

Throughout the market's development cycle, numerous examples of chaos among giants abound. Stable competition is only relative and temporary. Influenced by various factors, the market inevitably moves towards unstable competition.

Historical cases teach us that tighter cash flow under unstable competition makes decision-making more prone to getting out of control. The community group buying frenzy in 2020 serves as a bloody lesson: Over 300 platforms nationwide emerged in a burst, igniting a "hundred group war." Some small and medium-sized community group buying platforms expanded rapidly in the early stages. However, with the entry of giants, they struggled under the pressure of burning money for subsidies, supply chain encirclement, and heavy marketing. Many small and medium-sized platforms could not withstand the immense financial pressure, coupled with insufficient profits and an inability to achieve healthy cash flow, forcing them to retreat step by step and eventually exit the market with regret, such as the bankruptcy of Tongcheng Life and the shutdown of Shihui Group.

In fact, taking the real economy as an example, seasoned businesspeople who have weathered fierce commercial battles do not underestimate mobile vendors. By eliminating fixed costs like rent, water, and electricity, their business returns are more direct and lucrative, ensuring positive profits. The success logic behind these individual businesses is highly instructive for today's entrepreneurs.

For modern enterprises, whether in traditional industries (like manufacturing) or emerging fields (such as fintech), IT expenditure has become an infrastructural cost for enterprise operations. It is also a core driver for enhancing efficiency, expanding markets, and bolstering anti-risk capabilities. An IDC report points out that among global enterprise IT expenditures, the compound annual growth rate (CAGR) for hardware is 9.4%, while that for software is as high as 19%. The rapid growth of hardware and software underpins modern enterprises' continued reliance on IT. Therefore, under unstable competition, opting for a more flexible and cost-effective IT office model is precisely many enterprises' first choice to ensure business operations while maintaining healthy cash flow.

Taking the consumer goods industry as an example, in 2020, live streaming sales on Douyin peaked. When other time-honored brands hesitated, Manting, a domestic daily chemical brand, swiftly decided to embrace Douyin live streaming. However, problems soon arose after entering the market. Due to live streaming's high IT equipment requirements, large-scale procurement significantly increased fixed costs, which was unrealistic and constrained the company's cash flow management, pushing Manting into a dilemma.

The key to breaking the deadlock lay in moving away from the traditional IT equipment procurement model and choosing a more flexible and cost-effective office IT solution. Ultimately, Manting partnered with Yidianyun to resolve the IT equipment configuration issue through a leasing model, gracefully entering the Douyin live streaming arena. Today, Manting's annual sales on Douyin have reached 280 million yuan. That year's correct decision and swift entry became pivotal to the revitalization and successful transformation of this old domestic brand.

In the view of Manting's rotating general manager, choosing to partner with Yidianyun that year was undoubtedly the right decision. Its use-and-return model not only met the needs of expanding into new sectors that year but also alleviated the company's concerns about fixed costs, playing a crucial role in subsequent business adjustments.

So, how significant is the gap between the asset-light model and the asset-heavy model? The CEO of Zhenshi Intelligence once did the math. As an AI technology enterprise, 80% of its employees are technical personnel with high IT equipment demands. Adopting a large-scale leasing model can reduce the company's cash flow expenditure by 70% compared to the procurement model.

Cash flow is the foundation for an enterprise's survival, and for SMEs, it is even more crucial for enhancing their survival capabilities in unstable competition.

02

Abandon the Traditional Logic of "Low-Configuration Survival"

Enterprises Need Low-Cost "Rapid Evolution" Today

However, under unstable competitive conditions, many enterprises often fall into another strategic trap – choosing a low-configuration survival model to reduce cost pressure. This is another misconception. Delaying the replacement expenditure of some individual items will instead hamper the overall organization's efficiency, particularly concerning IT hardware and operations and maintenance.

In fact, the market already offers more flexible and relaxed office IT solutions that can alleviate enterprises' financial pressure while facilitating "rapid evolution." These solutions free up enterprises' funds from heavy IT costs, reallocating them to more critical business development, enabling them to navigate unstable market fluctuations and achieve new business growth without compromising hardware experience, payment pressure, after-sales service, or any other aspect.

Last year, the renowned craft beer brand Uberbrew had to adjust its business lines and implement an organizational "downsizing" plan to weather market volatility due to significant consumer downgrading. Before this downsizing plan, they chose Yidianyun's leasing solution, utilizing its use-and-return service to avoid the worry of idle IT equipment post-"organizational downsizing." Moreover, Yidianyun's deposit-free, pay-after-use, and other models helped Uberbrew maximize financial relief, successfully saving 90% of one-time IT expenditures. This was a strategically sound adjustment from both organizational and financial perspectives.

Similar examples are also emerging in the gaming industry. As a leading marketing brand in the internet and gaming industries, Xinxian Zhongshi has long served top game manufacturers such as Perfect World, Tencent Games, NetEase Games, and Shanda Games. It is also a core agent for Bilibili, with its business having high and complex demands for IT equipment.

If a substantial amount of IT equipment were procured independently, it would be costly and unfriendly to the company's cash flow, unable to guarantee long-term after-sales service and changes in IT demand due to subsequent business project alterations. After comprehensive consideration, they chose Yidianyun's services such as on-demand selection and configuration, in-lease upgrades, use-and-return, and timely response, which well met Xinxian Zhongshi's complex IT needs at that time. At that time, the company's Guangzhou business department had high-frequency IT upgrade and replacement needs. Xinxian Zhongshi only needed to contact Yidianyun for rental, return, and replacement. Whether due to aging or lagging computers or the initiation or suspension of projects, all IT needs could be resolved through Yidianyun in one stop, with zero business downtime.

IT has become a yardstick to measure the degree of collaboration among modern enterprises. Enterprises with a high degree of IT dependence grow closer to the role of ecological peers with office IT solution providers during their development process, where collaboration becomes more important than service. As a digital technology company, Yixiu's business focuses on both design and development, with extremely high demands for the continuous operation of IT equipment. Computer hardware and software issues often need swift resolution; otherwise, they will seriously impact the company's business.

Therefore, Yixiu places great emphasis on its partners' service response capabilities. According to Yixiu's internal staff, they have encountered computer malfunctions during late-night overtime numerous times, and their service provider, Yidianyun's engineer team, always responds swiftly and resolves issues in a timely manner. This has laid the foundation for the long-term cooperative relationship between the two parties over the past six years.

Yidianyun's free warranty service during the lease period not only offers 24/7 customer service online to respond to needs but also boasts a professional IT engineer team of nearly 6,000 people who can arrive at the scene within 2-4 hours (or within half an hour in special areas) to conduct technical repairs and on-site services. During the repair period, standby machine services are also provided to ensure office efficiency, and its comprehensive services guarantee the normal operation of the enterprise's business. This "on-call" service functions as a "refueling station" on enterprises' long journey, enabling them to focus on the present and move forward with peace of mind.

03

Final Thoughts

In the current unstable competition, the health of cash flow and the speed of organizational transformation compel enterprises to seek a more flexible and trustworthy office IT solution to unshackle and upgrade increasingly burdensome office IT. The core competitiveness of modern enterprises is no longer "how many resources they own" but "how efficiently they can mobilize resources." The ultimate significance of the asset-light office IT model of leasing instead of purchasing is to allow SMEs to preserve relatively abundant cash flow and living space in fierce unstable competition, enabling them to navigate various future risks and challenges.

Today, the food delivery war among JD.com, Meituan, and Alibaba continues to simmer. For ordinary SMEs, this mutual attack can be both a challenge from cross-border competition among giants and an opportunity for industry reshuffling. Whether or not they are in the vortex, the warning to enterprises remains the same: To survive, the survival strategy of "operating with lighter loads and competing with speed" must be implemented.

While "lightening" IT assets, achieving enterprise evolution and business expansion with more suitable IT configurations may be the most feasible means to ensure enterprises' survival capabilities amidst the current chaos among giants.

*All images in this article are sourced from the internet