Domestic Bluetooth Chip Performance Surges by 272%!

![]() 05/12 2025

05/12 2025

![]() 545

545

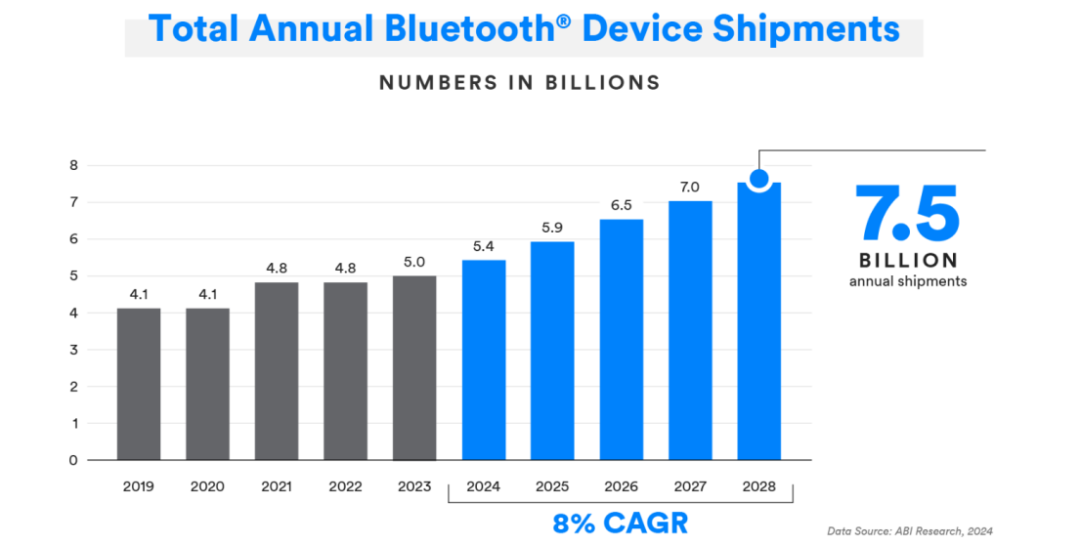

Global shipments of Bluetooth devices surpassed 5 billion units in 2023. By 2024, the market for True Wireless Stereo (TWS) earphones reached 330 million units, marking a 13% year-on-year increase, restoring double-digit growth. Projections indicate that annual Bluetooth device shipments will reach 7.5 billion units by 2028, with a compound annual growth rate (CAGR) of 8% over the next five years. These figures underscore the combined impact of the recovery in the consumer electronics market and the burgeoning demand for IoT devices.

Source: Bluetooth SIG

Long dominated by international giants like Qualcomm and Nordic, the high-end Bluetooth chip market has recently seen domestic manufacturers gradually break through barriers through technological advancements. Besound Technology's BES2600YP chip, featuring a 'Bluetooth + noise reduction + in-ear detection' three-in-one solution, has entered the high-end headset market, and its share price has more than tripled within a year. Actions Semiconductor has launched the world's first triple-core heterogeneous AI audio chip, integrating CPU, DSP, and NPU, with computing power increased by over three times, supporting low-latency voice interaction and real-time translation.

RDA Microelectronics' transformation is particularly notable. Previously focused on white-label chips priced at $1, the company collaborated with ByteDance's Volcano Engine in 2023 to achieve software and hardware adaptation with large models, thereby elevating its product unit prices to the mid-to-high-end range. This shift from 'quantity' to 'quality' signifies the transition of domestic chips from cost competition to technology-driven strategies.

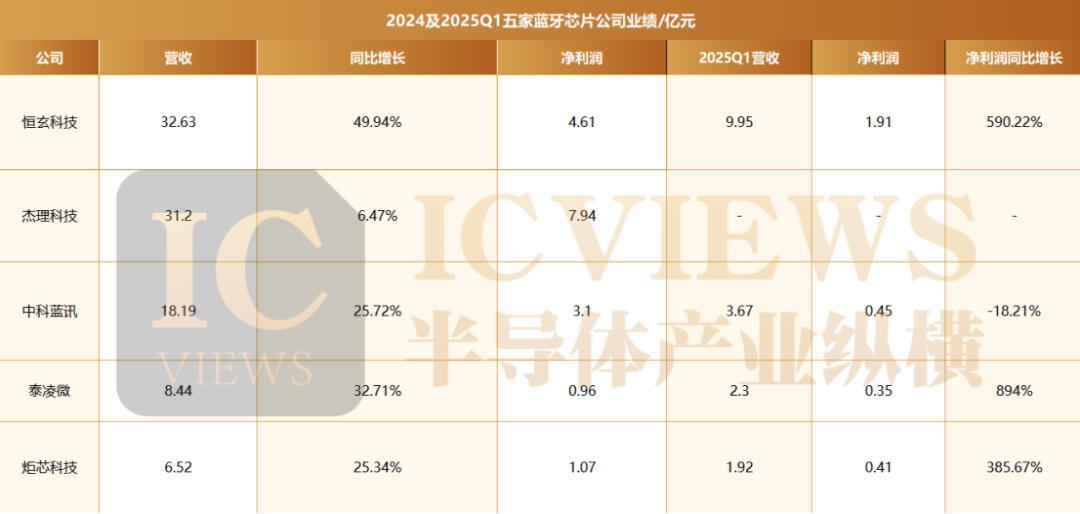

Besound Technology: In 2024, the wearable market flourished, with continuous upgrades in terminal applications and increasing demand for main control chips. Besound Technology launched smart wearable chips such as BES2800, BES2700iBP, and BES2700iMP, significantly increasing its market share in smart Bluetooth headsets and smartwatches, leading to rapid revenue growth. The company's total operating revenue for 2024 reached 3,263,139,200 yuan, a year-on-year increase of 49.94%. Net profit attributable to the parent company owners amounted to 459,519,300 yuan, a substantial year-on-year increase of 271.70%, with both revenue and net profit reaching record highs since the company's inception. The company's overall gross profit margin stabilized at approximately 34.70%, a year-on-year increase of 0.5 percentage points, with a quarter-by-quarter improvement trend. Research and development expenses for the full year 2024 were approximately 621 million yuan, an increase of approximately 12.93% year-on-year.

Actions Semiconductor: According to Actions Semiconductor's annual report, the company's revenue in 2024 was 3.12 billion yuan, with a net profit of 794 million yuan, the highest among these five companies, marking a year-on-year increase of 27.03%. The company focuses on the research, development, and sales of system-on-chip (SoC) for radio frequency, audio, video, etc., adopting a Fabless model that emphasizes integrated circuit design while outsourcing wafer fabrication, packaging, and testing. During the reporting period, the company increased its R&D investment, with expenses reaching 286 million yuan, a year-on-year increase of 3.67%. The company's gross profit margin was 35.77%, an increase of 2.68 percentage points from the previous year. Net cash flow generated from operating activities was 455 million yuan, a year-on-year decrease of 46.00%. Total assets were 3.995 billion yuan, a year-on-year increase of 19.03%, while total liabilities were 335 million yuan, a year-on-year decrease of 26.76%.

In the first half of 2024, Actions Semiconductor's procurement from its top five suppliers accounted for 92.48% of the total procurement amount for the period. Among them, Huahong Group remained the largest supplier, with a procurement amount accounting for 66%.

RDA Microelectronics: In 2024, the company achieved operating revenue of 1.819 billion yuan, a year-on-year increase of 25.72%; operating profit of 310 million yuan, a year-on-year increase of 23.35%; total profit of 310 million yuan, a year-on-year increase of 23.34%; and net profit attributable to shareholders of listed companies of 300 million yuan, a year-on-year increase of 19.38%. The announcement attributed the growth in net profit to emerging market layout and brand expansion, noting that the reduction in government subsidies led to a decrease in non-recurring gains and losses.

RDA Microelectronics' first-quarter report for 2025 showed an operating income of 367 million yuan, an increase of 1.2% year-on-year; net profit attributable to shareholders of listed companies was 44.8902 million yuan, a decrease of 18.21% year-on-year; non-recurring net profit was 36.6718 million yuan, a decrease of 19.93% year-on-year; debt ratio was 12.52%; investment income was 11.607 million yuan; financial expenses were -10.1658 million yuan; and gross profit margin was 22.86%.

Telink Semiconductor: Telink Semiconductor released its performance forecast, with preliminary accounting results for 2024 showing total operating revenue of 844 million yuan, a year-on-year increase of 32.71%; operating profit of 93.31 million yuan, a year-on-year increase of 89.22%; total profit of 91.6 million yuan, a year-on-year increase of 82.45%; and net profit attributable to shareholders of listed companies of 96.49 million yuan, a year-on-year increase of 93.87%. After deducting non-recurring gains and losses, net profit attributable to shareholders of listed companies was 90.61 million yuan, a year-on-year increase of 295.57%. Basic earnings per share were 0.41 yuan, a year-on-year increase of 64%.

The report noted that amid recovering demand in the IoT market, the company's major customers increased shipments. R&D investment also increased, with expenses rising by 27.04% year-on-year. As of the end of the reporting period, the company's total assets were 2.489 billion yuan, an increase of 2.43% from the beginning of the period, and shareholders' equity attributable to the parent company was 2.342 billion yuan, an increase of 0.05% from the beginning of the period.

Telink Semiconductor's announcement estimated that operating revenue for the first quarter of 2025 would be approximately 230 million yuan, an increase of approximately 43% year-on-year. It is estimated that net profit attributable to shareholders of the parent company for the first quarter of 2025 will be approximately 35 million yuan, an increase of approximately 39.41 million yuan, or approximately 894%, marking a turnaround from a loss to a profit.

The report emphasized that despite being the company's traditional sales off-season, the first quarter of 2025 saw its best-ever financial performance for that quarter, with both sales and net profit reaching record highs. Sales achieved high year-on-year growth, while the growth rate of net profit far exceeded that of revenue. This sales growth benefited from the continuous improvement in the digitalization and intelligence penetration rate of downstream industries. Telink Semiconductor's shipments to major and new customers in the IoT connectivity market (smart homes, ESL, offices, etc.) and the audio market have increased significantly. Additionally, some newly explored vertical markets such as smart energy storage BMS and smart gateways also contributed to new sales growth. Several of the company's new products, including edge AI chips, have begun mass shipments.

Actions Semiconductor: In 2024, the company's operating revenue was 652 million yuan, an increase of 25.3% year-on-year; net profit attributable to shareholders of listed companies was 107 million yuan, an increase of 63.8% year-on-year; non-recurring net profit attributable to shareholders of listed companies was 78.55 million yuan, an increase of 53.6% year-on-year; net operating cash flow was 154 million yuan, a decrease of 0.6% year-on-year; and EPS (fully diluted) was 0.7293 yuan.

In the fourth quarter, the company's operating revenue was 185 million yuan, an increase of 28.7% year-on-year; net profit attributable to shareholders of listed companies was 35.67 million yuan, an increase of 96.7% year-on-year; non-recurring net profit attributable to shareholders of listed companies was 30.53 million yuan, an increase of 110.1% year-on-year; and EPS was 0.2441 yuan.

As of the end of the fourth quarter, total assets were 2.162 billion yuan, an increase of 12.2% from the end of the previous year; and shareholders' equity attributable to the parent company was 1.879 billion yuan, an increase of 3.9% from the end of the previous year. In terms of R&D investment, expenses reached 215 million yuan, accounting for 33.00% of operating revenue.

Actions Semiconductor expects a significant increase in performance for the first quarter of 2025, with a net profit attributable to shareholders of listed companies of 41.3 million yuan, a year-on-year increase of 383.91%, and an expected operating revenue of 191 million yuan. The company stated that it achieved the best performance in a single quarter in its history, even surpassing the company's traditional sales peak season.

This growth is not coincidental. As the 'nerve endings' of smart devices, Bluetooth chips are penetrating scenarios from traditional headphones and speakers to smart homes, wearable devices, industrial control, and beyond. For instance, desktop computers, residential gate access controls, household appliances, and other areas that previously lacked Bluetooth have now become new growth points. The underlying logic of the market has shifted from a single consumer demand to full-scenario intelligence, and Bluetooth technology's low power consumption and high compatibility make it a key technology for connecting everything.

The 'Bluetooth Market Trends Report 2024' released by the Bluetooth SIG announced future trends for LE Audio and Bluetooth LE technology: larger transmission bandwidth, support for 5GHz or 6GHz frequency bands, and more accurate location information.

Moreover, SIG has collaborated with Sony, Bose, OPPO, Qualcomm, NXP, Ericsson, and other companies to create the Gaming Audio Profile 1.0 (GAP 1.0) technical standard for gaming applications, providing faster sound output and shorter latency during live streaming, significantly enhancing the user experience. Intel already has Bluetooth LE audio-compatible products and has conducted a proof of concept (POC) for Auracast broadcast audio.

In fact, the Bluetooth 5.2 version introduced three major technological updates. The first is the Enhanced Attribute Protocol (EATT), allowing for denser Bluetooth signal transmission while further reducing overall latency, strengthening signal encryption, and improving transmission signal security. The second is LE Isochronous Channels, ensuring music synchronization between each receiving device during one-to-many audio transmission through Bluetooth Low Energy (LE Audio) signal transmission and time synchronization. The third is LE Power Control, which can improve device power efficiency and connection stability through dynamic adjustment.

Technological breakthroughs not only bring parameter improvements but also qualitative changes in application scenarios. In automotive electronics, the Periodic Advertising with Responses (PAwR) mode supported by the Bluetooth 5.4 standard enables bidirectional secure communication between vehicle keys and vehicles, reducing the response delay of traditional keyless entry systems from 500 milliseconds to 30 milliseconds. This millisecond-level evolution is redefining the boundaries of human-computer interaction.

More noteworthy is the evolution of Bluetooth chips from mere connectors to edge computing nodes. In industrial IoT scenarios, Bluetooth SoCs with AI acceleration capabilities can process sensor data in real-time, reducing the time for generating early warning information from 2.3 seconds for cloud computing to 80 milliseconds for local processing. This 'terminal intelligence' awakening has increased the value of a single Bluetooth chip from $0.5 to the $3-5 range, completely overturning the old perception that 'low-end chips are unprofitable'.

With the rise of emerging technologies such as the metaverse and digital twins, Bluetooth technology's application scenarios in AR/VR devices, smart wearables, industrial automation, and other fields continue to expand. In the AR/VR market, the low-latency characteristics of the Bluetooth 5.4 standard provide stable audio and video transmission for wireless head-mounted displays. It is estimated that by 2028, Bluetooth AR/VR device shipments will exceed 100 million units, with a compound annual growth rate of 45%. In industrial automation, Bluetooth Mesh network technology enables multi-hop communication between devices, significantly enhancing the deployment flexibility and reliability of the Industrial Internet of Things, helping smart manufacturing enterprises increase production efficiency by more than 30%.

Personalized demand in the consumer market also presents new opportunities for Bluetooth chip companies. Consumers have higher requirements for the interactive experience of smart devices, and Bluetooth chips supporting functions such as gesture recognition, health monitoring, and spatial audio have become new favorites in the market. By integrating technologies such as sensors and AI algorithms, companies have developed SoC chips with higher integration and lower power consumption, meeting users' needs for device intelligence and portability, and driving a 20%-30% increase in average selling prices.

At the confluence of technological evolution and market expansion, the Bluetooth chip industry is entering an unparalleled golden era of growth. Evolving from a mere 'standard component' in consumer electronics to the 'nerve center' of the Internet of Everything, Bluetooth chips are poised to emerge as the pivotal 'intelligent nodes' in this new era, fueled by the maturation of cutting-edge technologies like edge AI and edge computing.