Electrification Brakes: Overseas Auto Giants Pivot to China

![]() 06/30 2025

06/30 2025

![]() 592

592

After an ambitious push towards electrification, several overseas automotive giants have successively hit the brakes.

Recently, Audi CEO Dietmar Voggenreiter announced the cancellation of the goal to phase out internal combustion engine (ICE) vehicles by 2033. Instead of setting a fixed timeline for the end of ICEs, the company will "flexibly adjust according to market differences."

Prior to this, Mercedes-Benz, Volvo, BMW, and other manufacturers have also adjusted their plans. Volvo revised its target of "selling only pure electric vehicles by 2030" to "having plug-in hybrid vehicles and pure electric models account for at least 90% of its sales by 2030." Mercedes-Benz stated that it would no longer adhere to the previously set goal of "fully transitioning to electric vehicle sales in major markets by 2030." Additionally, Volkswagen and Honda have also revised their respective electrification strategies.

These adjusted electrification plans reveal a unanimous strategy among the major manufacturers: synchronous development of gasoline and electric vehicles, tailored to local market demands and conditions.

From an external perspective, it is not surprising to see these giants recalibrate their electrification strategies.

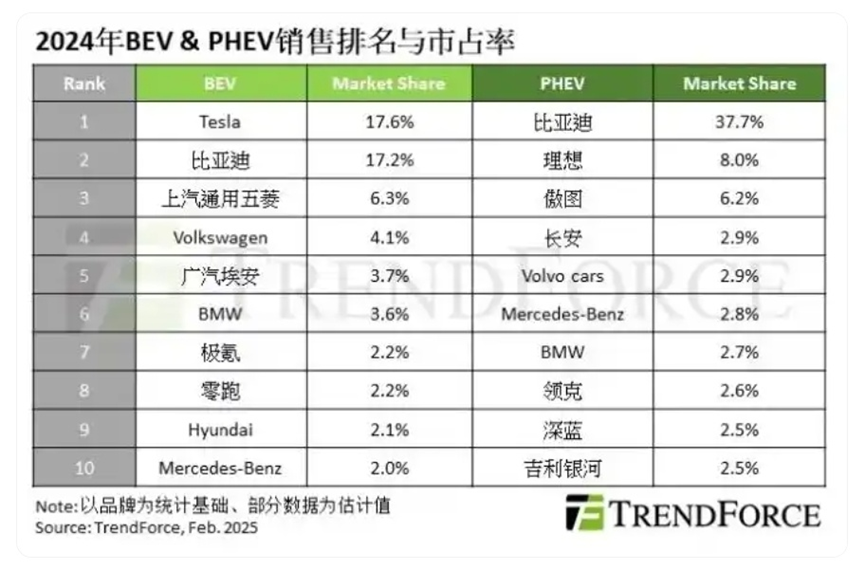

In recent years, electrified vehicles have shown a trend of balanced development across multiple paths. Data indicates that global sales of plug-in hybrid vehicles (PHEVs) increased by 53% year-on-year in 2024, while sales of pure electric vehicles (BEVs) only grew by 14% year-on-year. These figures suggest a growing popularity of electrified vehicles equipped with engines.

In this process, China has emerged as an absolute leader.

According to statistics from the China Passenger Car Association, China's global market share of PHEV models reached 74.2% in the first half of 2024, with the market share in the second quarter peaking at nearly 78%.

TrendForce data shows that seven Chinese brands ranked among the top 10 in PHEV market share in 2024, with BYD, Li Auto, AITO, and Changan occupying the top four spots. Notably, BYD alone accounted for 37.7% of the market share, while Li Auto and AITO combined exceeded 14%. Together, these three brands captured over half of the market.

Therefore, while implementing "flexible layouts," multiple giants have positioned China as a key player. In addition to gasoline and electric vehicles already on sale, plug-in hybrid models, including extended-range electric vehicles (EREVs), have become the development direction for overseas giants.

Audi stated, "This volatility and diversity in the market require us to provide a differentiated product portfolio in as flexible and stable a manner as possible in the coming years, covering battery electric vehicles (BEVs), plug-in hybrid vehicles (PHEVs), and internal combustion engine (ICE) models."

Notably, the recently launched third-generation Audi Q3 also offers a plug-in hybrid version with a larger battery and longer pure electric range, which may become its primary sales variant. Additionally, plug-in hybrid versions of the Audi Q5 and Audi A6 will be introduced, with previous news indicating their arrival in the Chinese market.

Recently, foreign media reported a significant development: in response to market changes, BMW is internally discussing plans for the future application of EREV technology.

According to British automotive magazine Autocar, BMW is collaborating with major component supplier ZF to develop EREV technology. This system has already been tested on the iX5 and will be named iX5 Rex in the future. BMW internally expects the iX5 REx to launch as early as 2026.

A source revealed that given the high likelihood of China becoming the largest market for EREVs, BMW is evaluating the feasibility of extended-range vehicles in key markets like China as the preferred option for launching this technology.

Recent media reports claimed that Mercedes-Benz is preparing a plug-in hybrid product with "simultaneous gasoline and electric drive and ultra-long range" for the Chinese market. The project has already received directional approval, and relevant pre-research work is underway. Although Mercedes-Benz China denied the "news," industry insiders said it was not baseless.

Volkswagen has long announced plans to launch over 30 electrified models in the Chinese market. According to the plan, starting from 2026, FAW-Volkswagen will introduce 2 plug-in hybrid models and 2 extended-range models, while SAIC Volkswagen will launch 3 plug-in hybrid models and 2 extended-range models.

It is worth mentioning that to better align with consumer demand in the Chinese market, multiple automakers are also betting on localized development.

In the past two years, Audi has established cooperation with multiple domestic automakers and intelligent driving suppliers. The sub-brand AUDI, specifically created for China, adopts the China-exclusive Advanced Digitized Platform. FAW Audi and SAIC Audi have access to Huawei's Kunlun intelligent driving solution, while the AUDI brand accesses the Momenta intelligent driving solution. Additionally, Audi has cooperated with DJI's subsidiary Zhuoyu, and it is expected that two models will introduce their pure vision intelligent driving solutions.

Volkswagen's efforts are even more comprehensive. Currently, Volkswagen has developed the CMP platform, an A-segment electrified vehicle platform specifically for the Chinese market. The Volkswagen China team has also collaborated with XPeng Motors to develop the CEA architecture. Furthermore, Volkswagen is working with Chinese companies, centered around Horizon Robotics, to develop driving assistance technology.

Toyota has directly handed over the leadership of the Chinese market's development to the Chinese.

"Toyota will take a crucial step in the Chinese market—in the future, the decision-making power for the development of Chinese models will be transferred from the Japanese headquarters to China," revealed Yoshiki Konishi, General Manager of Toyota Smart Electric Vehicle R&D Center (China) Co., Ltd., at the second GAC Toyota Technology Day held on June 12th.

Previously, GAC Toyota announced the establishment of the RCE (Regional-Chief Engineer) system, appointing local personnel most familiar with China's situation as R&D leaders, allowing Chinese engineers to define Chinese vehicles. It is reported that products such as the all-new Sienna, Highlander, and Camry will be locally developed with Chinese engineers at the helm.

Some analysts have stated that this "join if you can't beat" approach can quickly compensate for current intelligence shortcomings, but in the long run, relying solely on external cooperation is insufficient. Nonetheless, the aforementioned localized development practices clearly demonstrate that China has become a top priority for these giants.

Currently, major automakers are adopting a more cautious approach to electrification. For now, the widespread adoption of pure electric vehicles is still some time away, and electrification remains intertwined with engines. In this process, China, as the global leader in electrification, has become a pivotal fulcrum for the electrification efforts of these major giants.

(Images sourced from the internet. Please delete if infringing.)