Leapmotor: Navigating with Ideals, Charting a New Course for Overseas Expansion

![]() 06/30 2025

06/30 2025

![]() 804

804

Introduction | Lead

"New Force Transparent" and "Half-Price Ideal" are the most prevalent online assessments of Leapmotor. Amidst China's dynamic new energy vehicle landscape, Leapmotor often flies under the radar. However, whenever sales figures are compared, Leapmotor consistently features on the best-sellers list.

Produced by | Heyan Yueche Studio

Written by | Cai Jialun

Edited by | He Zi

Total words: 2604

Reading time: 4 minutes

The competition among new automakers is fierce, with sales rankings constantly in flux.

Recently, Leapmotor announced that its cumulative deliveries have surpassed 800,000 units (as of June 18, 2025). From March to May this year, Leapmotor ranked first in monthly sales among new carmaking forces for three consecutive months.

While Li Auto grapples with transformation, XPeng gambles on computational power, and NIO searches for the future, Leapmotor, with its understated approach, has been quietly making strides behind the scenes.

The Inspirational King Who Survived a Decade of Ups and Downs

Leapmotor was established in 2015 and released its first model, the S01, in 2017. Sales didn't commence until 2019, and the cumulative sales of 1,000 units in the first half of the launch year effectively set back four years of effort to zero.

Compared to the high-profile launches of NIO, XPeng, and Li Auto, Leapmotor's affordable and personalized route failed to gain significant market share or sales volume. The failure of the S01 accelerated Leapmotor's transformation to survive. In May 2020, the T03 was launched, capitalizing on the trend of pure electric small cars that year. With sales of 3,000 units in the first year and 61,000 units in the second, Leapmotor escaped the survival red line.

From 2021 to 2022, Leapmotor introduced the C11 and C01 models, complementing its product lineup in the mainstream market. In the same year, with the T03, C11, and C01 models, Leapmotor achieved annual sales of 111,000 units, propelling it to become the fourth new force automaker to go public after NIO, XPeng, and Li Auto.

The C series was pivotal for Leapmotor's transition from survival to becoming an inspirational leader. It not only helped Leapmotor navigate through the "beginning of intense competition" in 2023 but also became the second new force model to achieve positive net profit in the fourth quarter of 2024. As of the first quarter of this year, Leapmotor delivered a total of 87,552 units, a year-on-year surge of 162.1%. Among them, the C series models sold a cumulative 67,812 units, accounting for 77.5% of total sales and a year-on-year increase of 5.7%.

From the confusion of the SC01 in 2019 to the turnaround of the T03 in 2020, and then to the market recognition of the C series as the "Half-Price Ideal," Leapmotor's survival through several major industry reshuffles in China's decade of rapid new energy development is commendable, regardless of its achievements.

Has the "Half-Price Ideal" Route Been Successful?

Many attribute Leapmotor's resurgence to its "Half-Price Ideal" market positioning. If Geely follows BYD, then Leapmotor follows Li Auto.

In reality, Leapmotor holds BYD in one hand and Li Auto in the other, earning profits by firmly standing on in-house R&D and market anchoring.

Since its inception in 2015, Leapmotor has adhered to all-domain in-house R&D, which can be specifically divided into two aspects: the in-house R&D and production of the central integrated electronic and electrical architecture, and the vertical integration of core components.

In terms of the central integrated electronic and electrical architecture, Leapmotor focuses on in-house R&D and production of electric drive assemblies, battery packs, and smart cabins. It has successively launched the industry's first eight-in-one electric drive, CTC battery chassis integration, and the "four-domain integration" central integrated electronic and electrical architecture. Leapmotor's R&D costs per vehicle are reduced by 40% compared to the outsourcing model. Additionally, 60% of Leapmotor's components are also in-house R&D and produced, saving an additional 6% in cost space.

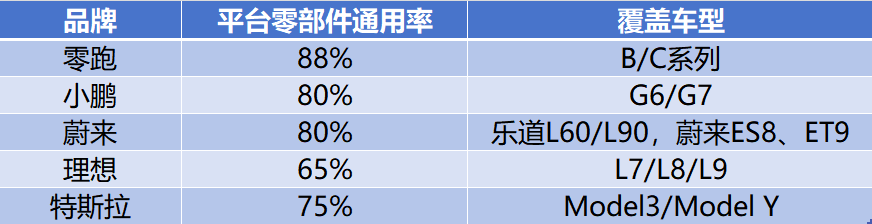

Regarding vertical integration, it boils down to the commonality rate of core components on the development platform and supply chain management capabilities. Under Leapmotor's LEAP3.5 architecture, the component commonality rate of C/B series models reaches 80%~88%, making it one of the automakers with the highest vertical integration of components among domestic new carmaking forces. To illustrate, here are a few examples of platform commonality among new energy automakers.

In terms of supply chain management, with Zhu Jiangming's background in supply chain and Huada Shares' support, Leapmotor has a natural advantage in supply chain integration. By bypassing traditional tier-one suppliers and reducing profit sharing in intermediate links, Leapmotor's operating expenses dropped to 19.22% in 2024, which is relatively low in the industry.

In the new energy era, BYD was the first automaker to turn itself into a supplier, followed by Leapmotor. In-house R&D and cost control translate into product confidence and pricing power. Leapmotor's approach is straightforward – get to work.

First is the volume-driving marvel, the Leapmotor B10, which comes standard with high-level intelligent driving across all trim levels and has a starting price of RMB 99,800. For an additional RMB 20,000, customers can upgrade to the LiDAR intelligent driving version with Qualcomm's dual flagship chips (8295+8650). Most importantly, Leapmotor directly offers free access to high-speed intelligent pilot assistance features.

From hardware to computing power to applications, the Leapmotor B10 outclasses all compact new energy SUVs, especially those that charge extra for LiDAR and offer high-level intelligent driving for a limited free period of two years.

As the only model in its class equipped with Qualcomm's 8295+8650 dual chips and LiDAR, the Leapmotor B10 has no competition in the market in terms of higher configuration and lower price. Hence, it's understandable that after the April launch event, Leapmotor B10 received over 10,000 orders within one hour.

This momentum continued. In May, as BYD led a price war, Leapmotor, which already offered great value with its C16 EREV and C11 EREV, introduced a limited-time fixed-price policy with a maximum discount of RMB 45,000. With these discounts, Leapmotor transcended being just a "Half-Price Ideal" to become a "Triple Ideal".

By following BYD's path, competing with Li Auto for orders, and becoming the Uniqlo of the automotive industry, Leapmotor has formed a positive cycle of resources, technology, and confidence through market exploration of the C/B series. Consumers like "affordable substitutes," so Leapmotor creates "half-price or even triple ideal" products. Consumers like SUVs, so Leapmotor segments the 100,000-200,000 yuan new energy SUV market. Consumers like high-end features at low prices, so Leapmotor piles on the specifications.

It's undeniable that during its rapid development, Leapmotor, which emphasizes pragmatism, may not have an advantage in vehicle attributes such as chassis, handling, and quietness. However, from actual sales results, Leapmotor has clearly identified its brand consumer group.

How to Transform from a Substitute to the Main Character

With one hand on in-house R&D and the other on market positioning, Leapmotor has successfully implemented the "Half-Price Ideal" model. Judging by the battle reports, both sales and gross profit margins have seen significant improvements. In particular, Leapmotor's gross profit margin was only 0.5% in 2023 but directly increased to 8.4% in 2024, and in the first quarter of this year, it reached 14.9%.

However, the reality is that Leapmotor's current gross profit margin still cannot support the brand's long-term healthy development. Taking the first quarter of this year as an example, Leapmotor's sales volume of 87,000 units is very close to Li Auto's 93,000 units, but its profitability situation has shifted from a profit of RMB 80 million in the fourth quarter of 2024 to a loss of RMB 130 million. Leapmotor is once again scrambling to turn a profit. To address the issue of low gross profit margins, Leapmotor is focusing on product upgrades and brand globalization.

In terms of product upgrades, during the 2025 Shanghai Auto Show, Cao Li, Senior Vice President of Leapmotor, revealed that the brand will launch the high-end D series models during its 10th anniversary, priced in the RMB 250,000-300,000 range. Additionally, an MPV model will also be introduced, primarily to attract young users.

Regarding Leapmotor's ambition to target the high-end market, considering its long-standing image as a "price slayer" and "pragmatist," the future launch of high-end models will undoubtedly face significant challenges. Especially as product prices rise, the marginal effect of product configurations will become increasingly apparent. After all, what makes a brand or model "high-end" is not just a simple accumulation of features but more about brand premium, service, emotional value, and a sense of ceremony.

In terms of brand globalization, as early as 2023, Leapmotor had already established a cooperative relationship with the Stellantis Group. From January to April, Leapmotor exported 13,632 units, becoming the new carmaking force with the largest export volume.

Obviously, Leapmotor can quickly tap into overseas markets by leveraging the mature sales channels and market reputation of the Stellantis Group. However, judging from the shareholding ratio of "Leapmotor International," jointly established by Leapmotor and the Stellantis Group, the Stellantis Group owns 51% of the shares. This means that Leapmotor may not have a say in product positioning, pricing, and other aspects in overseas markets in the future. When opinions differ, Leapmotor may need to make concessions and adjustments.

Commentary

Simply put, Leapmotor and the Stellantis Group each have their own objectives. Leapmotor covets the sales channels of the Stellantis Group, while the Stellantis Group covets Leapmotor's products. However, it's difficult to predict whether the two will continue to collaborate in the future. Leapmotor's "rational and pragmatic" development tone has indeed helped pull the brand back from the brink of danger, but the rapid self-rescue has raised issues of "brand positioning" and "brand discourse power," which are clearly challenges that Leapmotor urgently needs to address in the future.

(This article is originally created by "Heyan Yueche" and may not be reproduced without authorization)