European Electric Vehicles: Navigating Between Sunk Costs and Strategic Shifts

![]() 07/18 2025

07/18 2025

![]() 464

464

Introduction

How to reconcile sunk costs with strategic shifts?

The European Federation for Transport and Environment (T&E) recently published a research report titled "European Cars at a Crossroads." The report highlights that the European auto industry stands at a pivotal moment where success or failure hinges on whether the proposal to ban internal combustion engines (ICEs) progresses or stalls, each scenario dictating vastly different impacts and directions for the industry.

On one hand, there's a chain reaction of declining electric vehicle (EV) sales in Europe. According to the ACEA (European Automobile Manufacturers Association), EV sales in the EU fell by 5.9% in 2024, and this year, they face the additional threat of tariffs imposed by the Trump administration. The prolonged sluggish sales of pure EVs have cast a new shadow over the plan to ban the sale of fuel vehicles in the 27 EU member states by 2035.

On the other hand, if no remedial measures are taken and the EU abandons its goal of banning fuel vehicle sales by 2035, the entire European auto industry risks losing 1 million jobs. Much of the effort towards "zero emissions" would be in vain, resulting in investment losses of up to two-thirds in new energy sectors like batteries.

It's a dilemma of moving forward or backward.

In terms of the strategic shift towards electrification, the EU finds itself in an awkward position. Due to sluggish EV sales, many automakers have successively lowered their short- to medium-term sales targets, forcing the EU to have more room to relax its carbon dioxide emission targets. However, to date, the EU still insists on the established plan to ban the sale of fossil fuel vehicles by 2035.

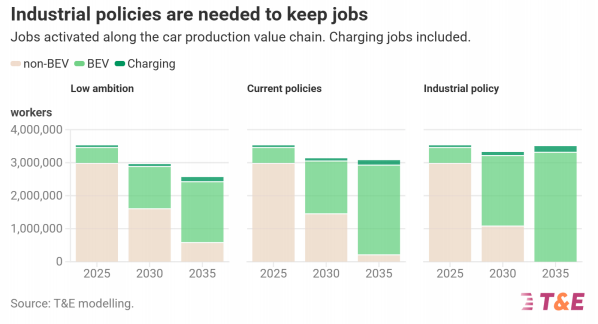

T&E's report clearly supports the continued advancement of the ICE ban. The report states that if the EU adheres to its 2035 clean energy target and implements policies during the transition period, the European auto industry is expected to return to producing 16.8 million new vehicles annually, reaching peak levels since the 2008 economic crisis.

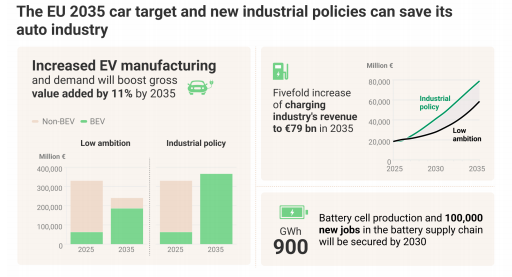

In summary, abandoning the ICE ban halfway would incur enormous sunk costs and risk large-scale unemployment. According to T&E data, if the EU maintains its 2035 ban target and implements a policy package to promote the development of emerging industrial chains, the automotive industry's contribution to the European economy will increase by 11% by 2035.

01 Employment and Industrial Chain Value

To support the continued advancement of the ICE ban, T&E's report provides several key data points:

If the EU implements the ICE ban until 2030, job losses in traditional automobile manufacturing may be offset by over 100,000 jobs created in new electrification areas such as batteries. By 2035, employment in the automotive industry's new energy sector will reach 120,000, mainly concentrated in the battery and electric drive industrial chains.

As long as Europe ensures a battery manufacturing capacity of over 900 GWh, it can create over 100,000 new jobs, with the number reaching 120,000 by 2035. Additionally, the economic output of the battery industrial chain will increase by about five times, reaching 79 billion euros.

The report notes that if the established ban target is weakened or EU policies waver, lacking a comprehensive industrial transformation plan, the automotive industry's economic contribution may decrease by 90 billion euros (approximately 758 billion yuan) by 2035, and the charging market's economic contribution will accumulate losses of 20 million euros (approximately 168 million yuan).

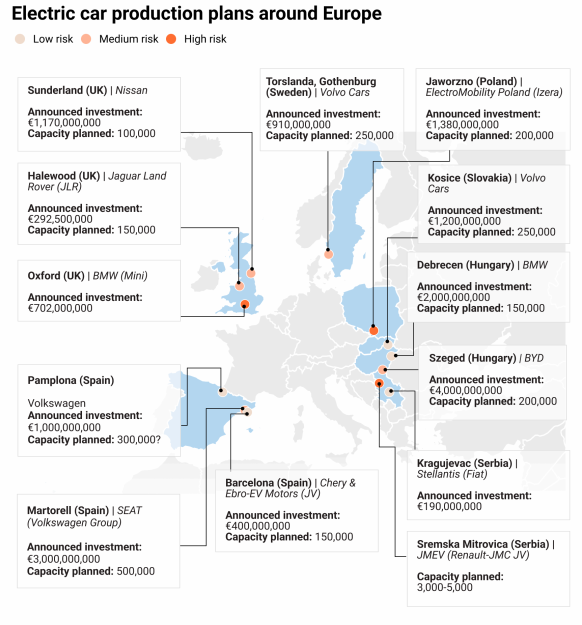

Regarding the sunk costs of the industrial chain, T&E conducted research on 13 new EV projects in Europe. Among them, five projects are brand-new EV factories, and the remaining eight involve conversions of existing fuel vehicle production lines.

If all projects are successfully implemented, Europe will add at least 2.1 million EV production capacities annually, with total production expected to reach 5.1 million vehicles by 2027, sufficient to meet growing market demand – this figure is based on the 2024 production volume of 1.8 million vehicles across Europe. According to T&E statistics, in 2024, pure EV sales in Europe (including the EU, the UK, EFTA countries, and Serbia) were approximately 2 million, while production was close to 1.8 million vehicles.

However, due to the uncertainty of future market prospects and policies, some projects face the risk of delay or even cancellation. T&E assessed all 13 projects based on four key criteria: project status (delayed/started/testing phase), construction progress (not started/under construction/completed), site determination, and government subsidy commitments. Based on the assessment, these projects were classified into low, medium, and high-risk levels to reflect the likelihood of investment implementation.

Low-risk projects include BMW's Hungarian factory and Volvo's Slovakian factory, both brand new. Also included are Stellantis' Serbian factory, Volkswagen and Chery's Spanish factories, which have converted existing fuel vehicle capacities into EV capacities. These projects will collectively form an annual production capacity of 550,000 vehicles, drive investments of approximately 4.8 billion euros, and create at least 5,550 jobs.

Medium-risk projects have a total planned annual production capacity of 1.2 million vehicles, involving 9.3 billion euros in investment and supporting 11,000 jobs. Among them, BYD's Szeged factory in Hungary, with an investment of 4 billion euros, accounts for nearly half of the total and is the largest project on the list. Next is the Seat-Volkswagen factory renovation project in Spain, with a cumulative investment of 3 billion euros. Also included are Jaguar Land Rover and Nissan's UK production bases being upgraded, which are expected to produce a combined 250,000 EVs annually, comparable to Volvo's Gothenburg factory plans.

High-risk projects include three projects that are either in the early development stage or have uncertainties regarding final investment decisions or commencement dates. These include BMW's suspended 700 million euro electrification project at its Oxford MINI factory and Renault's joint venture plan with China's Jiangling Motors to build a factory in Serbia.

02 Batteries and Supporting Facilities

In addition to vehicle manufacturing, significant investments are also being made in key components like batteries, requiring a balance between sunk costs and strategic shifts.

BloombergNEF (BNEF) previously reported that China currently supplies approximately 80% of the global lithium-ion batteries. Six of the top 10 EV battery manufacturers globally are from China. Europe has invested 36 billion dollars (approximately 232 billion yuan) in developing automotive power batteries, but 12 of its 16 local battery factories have experienced production delays or cancellations, and the situation is not optimistic.

Northvolt, once hailed as the "light of European batteries," filed for bankruptcy protection in Sweden after burning through 14 billion dollars (approximately 100 billion yuan), marking a significant setback for Europe's ambitions to challenge China in the dynamic battery sector. However, Northvolt is just a typical example of the huge investments made by Europe's battery industry. Besides this high-profile company, Europe has also spent heavily on other battery enterprises in the past few years, gradually establishing its battery energy storage industrial chain. Abandoning these efforts halfway through would impose heavier transformation shackles on the European automotive industry.

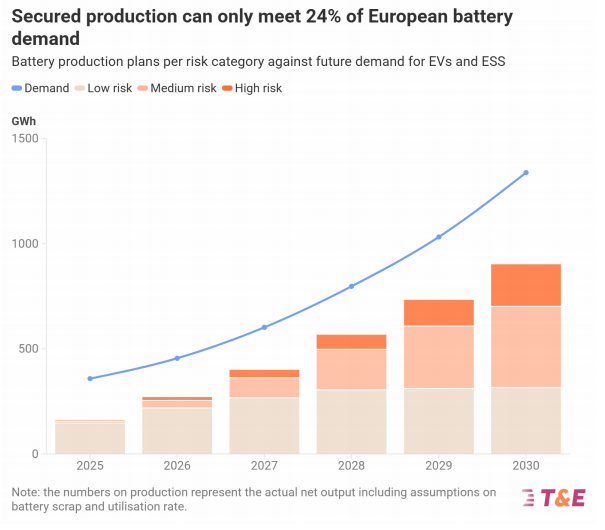

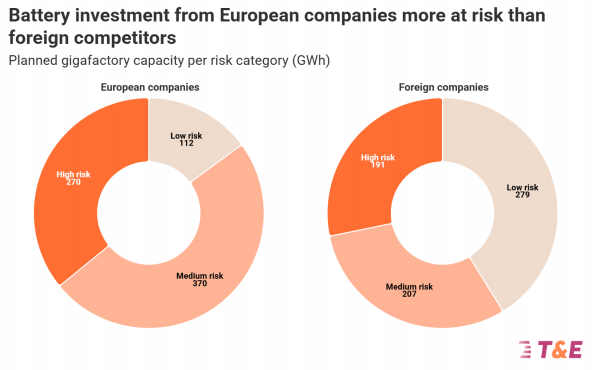

Similarly, T&E assessed battery factories in Europe based on multiple key criteria, and the data revealed that:

Low-risk battery factories have secured funding and commenced construction, with some already in production. They will bring 391 GWh of annual production capacity to Europe, backed by 39 billion euros in investment and the creation of up to 43,000 technical jobs. The ACC factory in Douvrin, France, and the Volkswagen PowerCo project in Salzgitter, Germany, fall into this category.

Medium-risk projects, mainly due to not having reached final investment decisions and thus not yet commenced construction, are currently the largest category in the European battery sector, involving 627 GWh of annual production capacity, 48 billion euros in investment, and 47,000 potential jobs. Compared to low-risk projects, these factories have many uncertainties. A representative project is Basquevolt in Spain, where most of the production capacity will be allocated to emerging areas such as solid-state batteries.

High-risk projects are still in the conceptual or approval stages. Although they will collectively include 410 GWh of annual production capacity, 21 billion euros in investment, and 37,000 job opportunities, their advancement entirely depends on subsequent industrial policies.

T&E analysis shows that, based on actual expected output (not theoretical capacity), local production capacity in Europe may meet two-thirds of the local battery demand by 2030.

However, if only low-risk projects are ultimately implemented, this proportion will plummet to 24%, far below the EU's 2030 target of 40% self-sufficiency. Including medium-risk projects, the self-sufficiency rate can reach 52%, but this figure is already lower than previous estimates by T&E and the EU. Due to adverse factors globally and within the EU (such as insufficient industry support), many battery projects are at risk of cancellation or delay.

Taking Spain as an example, from a policy support perspective, the country has shown great development potential, aiming to achieve an annual production capacity of 244 GWh by 2030. However, only 13% of this capacity belongs to low-risk projects, and the realization of most of the capacity still depends on future policy directions.

In contrast, the development prospects for Poland and Hungary are clearer, with low-risk production capacities of 115 GWh and 125 GWh, respectively. Although Poland has no plans for new factories, Hungary is expected to add another 90 GWh of capacity and may become a new center for the European EV industry in the future.

Major automotive economies such as France and Germany are in an intermediate position in battery manufacturing, with a combined production capacity of over 350 GWh, of which 130 GWh belongs to low-risk projects.

Since last year, an increasing number of European automakers have slowed down their electrification process. The EU's top priority is not only to re-examine its electrification strategy, finding a balance between industrial policies, infrastructure, and market demand but also to consider the input-output ratio of existing investments and how to account for sunk costs if policies are slowed down or halted.

This is indeed a challenging equation to solve, as it involves not only the huge investments of automakers but also the "money-burning" pitfalls of supporting facilities like batteries. Behind all this are millions of local jobs.

Responsible Editor: Yang Jing | Editor: He Zengrong