The second largest automobile producer in the EU opposes "being replaced"

![]() 06/11 2024

06/11 2024

![]() 680

680

Who would have thought that the "rebalancing" sought by the Renault-Nissan alliance amidst lengthy internal conflicts has, in a sense, propelled Spain's long-established automotive industry into action, striving to address the risk of "being replaced" brought about by industrial transformation and the upgrading of the electrical vehicle supply chain.

In July 2023, Renault and Nissan finally signed a new alliance cooperation agreement, clarifying their respective market boundaries. However, during the years of strained relations, as Renault resolved to gradually return to the European market, Nissan also chose to restructure its European operations, gradually concentrating resources on the Chinese, American, and Japanese domestic markets to avoid causing more conflicts within the "loose" alliance. In Spain, Nissan Iberia closed its plant located in the Barcelona Free Trade Industrial Zone since 2021, resulting in the cancellation of approximately 3,000 jobs. Subsequently, the production line for vans was also transferred from Barcelona to Renault's French plant, ceding the Spanish market and production layout to Renault.

Although Nissan's CEO Makoto Uchida admitted at the time that "closing the plant was a difficult decision," this move still elicited opposition from the Catalan local government and even the Spanish cabinet, who believed that this decision would have an impact on the region's manufacturing industry and employment. Ordinarily, business adjustments resulting from corporate strategic decisions should not provoke such a strong reaction. However, for Spain's secondary industry, which has been stable for many years, this is not only a gap that is difficult to fill in the short term but also a warning bell for deindustrialization, raising concerns about further waves of industrial enterprises relocating abroad.

After experiencing the debt crisis and the COVID-19 pandemic, Spain's economy has long had structural issues, with a disproportionately large share of unstable employment such as temporary jobs, leaving the country lacking sufficient resilience in the face of crises. Therefore, with the retreat of Nissan, the contraction of Renault, and indications from the Stellantis group of shifting production lines to lower-cost regions within the EU, Spain has had to start thinking: Can the "long-established" development of its automotive industry and the position of the automotive industry in the EU's industrial distribution continue to remain stable? And what measures should be taken to address this?

"Big but not strong" Spain

Compared to its illustrious reputation during the Age of Discovery, Spain is now more known as a major tourist destination. However, its manufacturing industry still cannot be underestimated. Over the past decade, Spain has gradually emerged from the shadow of the debt crisis, maintaining the healthy development of its manufacturing industry. Data shows that Spain's manufacturing PMI in April 2024 was 52.2, higher than the expected 50.8 and the previous value of 51.4. This figure is particularly noteworthy compared to the performance of manufacturing industries in many European countries hovering around the 50 boom-bust line. Additionally, the added value of the country's industrial products is also showing a rapid upward trend. Natixis, a French foreign trade bank, believes that Spain's industrial added value has surpassed Italy and France and is close to Germany.

Especially in the context of the energy crisis in recent years in the EU, which has led to power shortages in many countries, Spain has benefited from its abundant renewable energy resources, with photovoltaics and wind energy becoming important engines for its industrial development. Spain has even committed to achieving net-zero carbon emissions by 2050, with at least 74% of its power system powered by renewable energy by 2030.

In the automotive industry, according to data from the European Automobile Manufacturers Association (ACEA), Spain produced 1.87 million vehicles in 2023, making it the second largest automotive producer in Europe, second only to Germany's 3.96 million. Due to its long-standing role as an important production base for international giants such as Volkswagen and Renault, the automotive industry has also become one of Spain's main export industries, accounting for 9% of total exports annually, and related areas of auto parts also account for nearly 3%. Despite its energy advantages, Spain's labor costs are significantly cheaper compared to other major automotive hubs, and it possesses a significant automotive manufacturing history.

However, in stark contrast to its long history of automobile manufacturing, Spain does not currently have its own heavyweight automotive companies. According to incomplete statistics, there have been at least 50 brands in Spanish automotive history, most of which can only be described as "workshop-level" micro-brands that have mostly disappeared.

Today, people may still remember the existing Spanish brands, apart from Seat, perhaps Cupra, which is a spin-off of Seat's high-performance division by the Volkswagen Group. However, Seat has been in a state of chronic loss since its acquisition by Volkswagen in the 1980s, only recently starting to achieve initial profitability. Therefore, it can be argued that Spain is a typical large producer of automotive goods but not an industrial powerhouse, and its automotive industry's resilience to risks is very unstable compared to Germany and France.

In fact, since 2019, the Spanish Association of Automobile and Truck Manufacturers (ANFAC) has anticipated the risks that industrial transformation and new energy vehicles may bring to the local automotive industry. As the value of core components gradually shifts to batteries and the like, Spain's vast traditional parts manufacturing network cannot keep up with the changes in the electrical vehicle supply chain.

Meanwhile, countries in Central and Eastern Europe such as Poland, the Czech Republic, and Slovakia have become new destinations for many manufacturers due to their lower land and labor prices, posing a "risk" of replacing related industries in Spain. For the Spanish government, the stable tax revenue provided by the automotive industry cannot be allowed to decline. Therefore, the government is eager for large automotive companies to deeply participate in the country's industrial transformation process, similar to the strategy during the debt crisis in the 2010s, when companies like Volkswagen, Renault, Ford, and PSA at the time increased their investments, accelerating the self-healing process of Spain's automotive industry, which had been in decline for three years.

However, the increasing cost competition in the industry has objectively made European automakers with existing industrial layouts more inclined towards their own interests.

For example, the Stellantis group's decision to transfer production lines from Italy to non-EU countries and its choice to locate Zero Run International's T03 production line in Poland rather than Italy are both strategies to reduce costs through relocation rather than improving technology and supporting upgrades in the host country. These decisions have raised alarms for Spain's automotive industry: basic and cost advantages cannot last forever, and change must be sought with the trend.

Therefore, for Spain's automotive industry, which has a decent foundation, what is most urgently needed at present is "technology introduction" to upgrade its industrial base and maintain its position as the second largest automotive producer in the EU in the era of electric vehicles. At this stage, the feasible development path seems to be the introduction of new overseas automakers and mature electric vehicle technologies, thereby driving the development of upstream and downstream supporting industries.

Chery's entry and Ebro's revival

So, what conditions can Spain's automotive industry provide to attract new foreign enterprises at this moment? Firstly, as mentioned earlier, while the country's clean energy cost advantage is significant, issues related to the storage and transmission of photovoltaic and wind energy still need to be improved. However, when considering local labor costs, Xavier Ferre, a partner at Ernst & Young responsible for management consulting in Spain's automotive and transportation industries, recently stated that "Spain's energy costs are a quarter of Germany's, and Spain's labor costs are 40% lower than Germany's, making the manufacturing cost of electric vehicles much lower." Of course, if industrial infrastructure is not considered, regions with lower labor costs are not Spain's first choice, such as nearby Morocco and Serbia outside the EU system.

Geographical location is a unique advantage for Spain. In addition to supplying the European market, it is adjacent to the Strait of Gibraltar in the south, allowing it to radiate to the North African market, and relying on Mediterranean shipping in the west, it can radiate to the Middle East market. Furthermore, the Spanish government is currently friendly towards foreign investment and encourages foreign direct investment in the automotive industry. Elisa García, Executive Director of Spain's Export and Investment Promotion Agency, stated: "Spain is a country with an open attitude towards foreign investment. According to the OECD's Foreign Direct Investment Regulatory Index, Spain ranks ninth among countries with the least restrictions on foreign capital from a government regulatory perspective."

This view has also been confirmed in related research. For example, the "Chinese Direct Investment in Spain: Global Outlook 2023" report jointly released by Spain's Foreign Trade and Investment Promotion Agency and KPMG China showed that in a survey of 80 Chinese enterprises in Spain, respondents generally gave positive evaluations of Spain's investment and business environment.

Therefore, although Spain's conditions and resource base are not the most abundant, it has still attracted the attention of Chinese automakers seeking to establish a European presence. On April 19th, Chery announced the establishment of a joint venture with Spanish company EBRO Motors in Barcelona to transform the production plant. The two parties will invest approximately 400 million euros and start producing pure electric and gasoline-powered Omoda 5 models from the fourth quarter of this year. Subsequently, they will also produce plug-in hybrid models like the Jaecoo 7, and new model development for the Ebro brand will also be synchronized.

"Ebro is the first Spanish company to establish a joint venture with a Chinese automaker," said Pedro Calef, CEO of Ebro. "The joint venture will study the establishment of a new R&D center in Barcelona to obtain certification in the European market in the future." Ebro was once a famous Spanish tractor and truck brand and was once a symbol of Spanish industrial vehicles, but disappeared from the automotive market after the Ebro brand was acquired by Nissan in 1987. In 2020, the Ebro brand returned to the public eye with the help of local business alliances but did not attract much attention. This collaboration has injected new vitality into the brand.

The Spanish cabinet and the Catalan local government have also provided support and view this cooperation as a symbol of the recovery of industrial employment in Spain. Prime Minister Pedro Sánchez and Minister of Industry and Tourism Jordi Hereu both attended the signing ceremony. Sánchez said at the signing ceremony that the project would "create wealth" and "jobs" and saw in the statements of Chery and Ebro "symbols of the reindustrialization process" taking effect "throughout Spain." Zhang Guibing, Deputy General Manager of Chery Automobile and General Manager of the International Company, emphasized the importance of the production base for electric vehicle production and assisting Chery in "going global" in Europe. He said that this joint venture and its plant, especially in the field of electric vehicles, would become one of Chery's "major automobile export bases" globally and hoped to use the Barcelona plant to export cars to other regions of Europe, emphasizing that this is a step for Chery to expand its global market presence.

It is worth mentioning that the renovated plant is precisely the one that was previously closed by Nissan. According to the plan, starting from 2027, this factory's new production line will produce 50,000 vehicles annually, and by 2029, annual capacity will be increased to 150,000 vehicles. Nowadays, Chinese automakers entering the European market are facing considerable obstacles from EU regulatory agencies or civil organizations. By choosing to partner with local companies and entering the market through joint ventures, Chery can quickly complete base construction by acquiring and transforming existing factories, allowing it to enter into substantial "localized" production locally as soon as possible.

Meanwhile, relying on the joint venture, Chery can also obtain Spanish government investment. According to Spanish newspaper El Economista, Chery can receive over 1.7 billion euros in financial support after setting up operations in Spain.

Ambitious spending

In 2021, the EU approved Spain's economic recovery plan formulated by the Spanish government, supporting the country's 140 billion euros of recovery funds (72.7 billion euros in grants) in phases. 40% of the funds will be invested in the green economy, while 28% will be used for economic digitization and a series of necessary reforms and investments. With this funding, the Spanish government has formulated ambitious industrial policies and investment plans - the Economic Recovery and Transformation Strategic Plan (PERTE), aiming to promote the implementation of any large projects that can promote economic growth, employment, and Spain's economic competitiveness.

Currently, 11 strategic subprojects under PERTE, including automobiles, renewable energy, green hydrogen and storage, and semiconductors, have been approved and launched, with a total investment of 30 billion euros.

In the automotive sector, the PERTE VEC subproject is a comprehensive initiative on the electric and connected automotive industrial value chain, aiming to create the necessary ecosystem for the manufacturing and development of electric and connected cars in Spain, encourage investment in industrial production capacity for electric vehicle batteries and their basic components, as well as the production or recycling of necessary critical raw materials, and benefit from the conditions approved in the temporary crisis and transition framework.

In the first phase from 2021 to 2023, the Spanish government actually invested 2.87 billion euros and expanded the plan, strengthening 250 million euros in transfer payments and an additional 1 billion euros in loans, for a total of 4.12 billion euros.

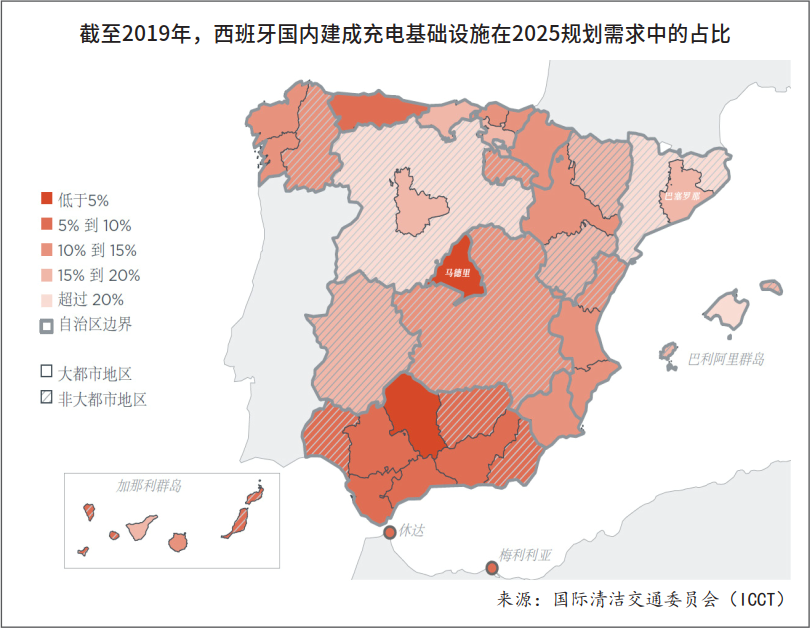

In 2023, the Spanish Ministry of Industry and Tourism released the objectives of the second phase of PERTE VEC, aiming to support investment plans targeting the industrial value chain for electric and connected vehicles and their systems, subsystems, and components, as well as some auxiliary infrastructure systems required for deployment. In addition to gradually implementing industrial investment plans, the Spanish government is also expanding government assistance for purchasing electric vehicles and building charging stations.

At the end of 2023, the Spanish Ministry of Energy Transition and Demographic Challenge announced an additional allocation of 1.2 billion euros to extend the electric vehicle industry incentive plan until mid-2024. Under this plan, most car buyers will receive discounts ranging from 1,100 euros to 9,000 euros. Individuals and companies installing charging stations will receive subsidies of 70% to 80%.

Meanwhile, considering the current uneven distribution of charging infrastructure in the country, Spain provides separate incentives for plug-in hybrid models priced below 45,000 euros. Multiple local tax policies also consider plug-in hybrid models, including 48V mild hybrids, as meeting "ecological" requirements and provide purchase subsidies. In the first quarter of 2024, plug-in hybrid models were more popular in the Spanish market, accounting for approximately 58% of the market share.

In a sense, Chinese electric vehicle manufacturers setting up factories in Europe are not a one-sided desire but often a two-way process. The demand for electric vehicles in the European market has led specific national governments to place high hopes on electric vehicle manufacturers. After all, globally, Chinese companies have become an important force in the field of electric vehicle production. After Nissan's withdrawal, the Spanish government has been searching for buyers who can restart large-scale production at the plant and finally found Chery.

In Spain, Chery's "landing" is not just an investment but also a symbol of the authorities' concern about missing out on the electric vehicle revolution and reviving Spain's automotive industry. Although Spain's market is not the most developed in Europe, it has certain specificities: local average salaries are not high compared to countries like the UK, France, and Germany, and with infrastructure construction on the agenda, there is still a significant demand in Spain's domestic automotive market. The government's continued investment in electric vehicles and intelligent connectivity projects will further promote industrial upgrading.

The PERTE plan is driving Spain to build a complete electric and connected vehicle ecosystem, providing the industry with the necessary infrastructure and policy support. Spain's geographical location makes it a hub connecting European, North African, and Middle Eastern markets. Leveraging this advantage, Spain can attract more international investment and further consolidate its position as a major automotive production base in Europe. Overall, driven by technological innovation, policy support, and market demand, Spain is expected to become an important player in the European electric vehicle sector in the coming years and one of the most promising and fastest-growing automotive markets in Europe by 2030.

Image: From the internet

Article: Auto Trends

Typesetting: Auto Trends