Post-Anti-Involution Era: A 'Manifest Strategy' Emerges in the Auto Industry

![]() 09/10 2025

09/10 2025

![]() 458

458

The Matthew Effect Intensifies in the Auto Sector: Can Anti-Involution and Equal Rights for Fuel and Electric Vehicles Break the Deadlock?

Recently, several mainstream automakers have unveiled their financial results for the first half of the year.

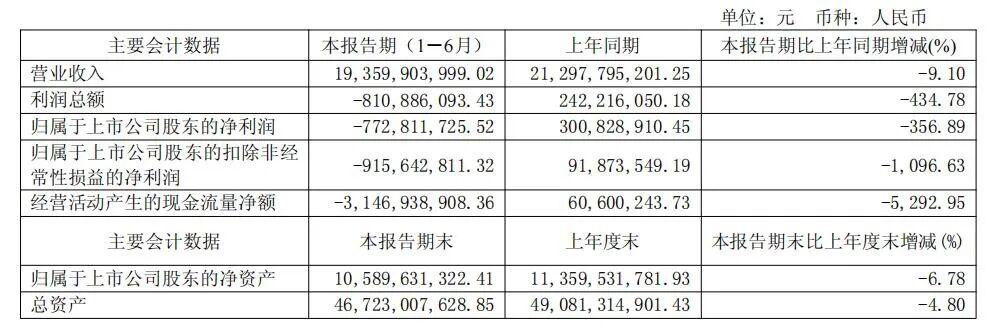

BYD maintained its leading position, with revenue soaring to RMB 371.3 billion and net profit reaching RMB 15.51 billion. Its overseas performance was particularly outstanding, with a year-on-year surge of 130%. Great Wall Motors reported stable revenue, showing signs of a second-quarter recovery, while JAC Motors incurred losses, with a net profit of -RMB 773 million.

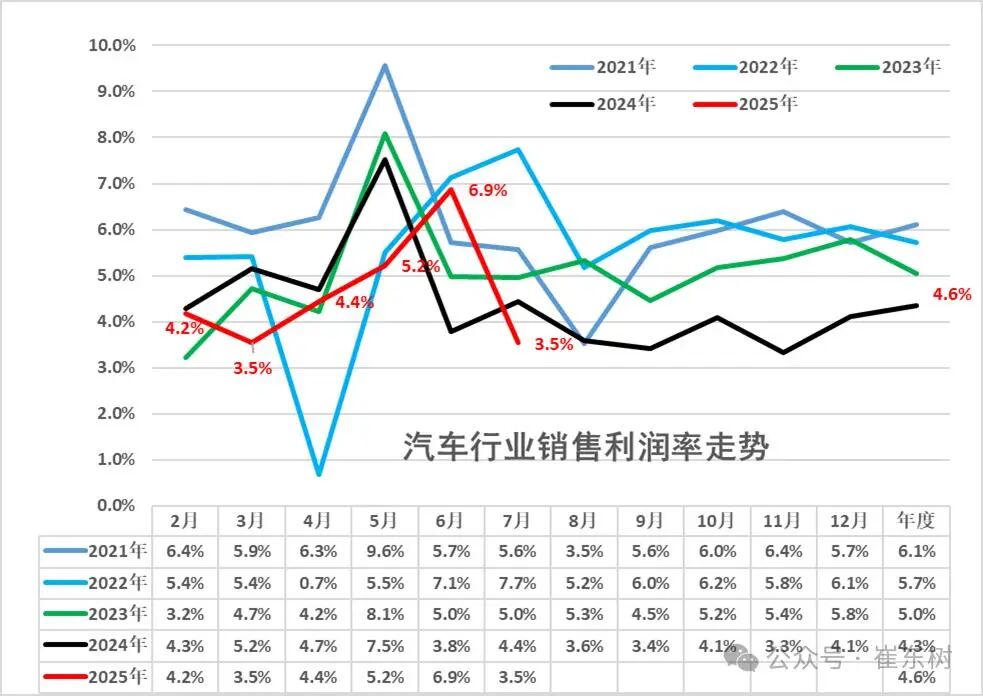

It is clear that leading automakers are expanding their market share through economies of scale, technological advancements, and global expansion. In contrast, many others are mired in price wars and profitability struggles. Meanwhile, the industry-wide profit margin remains low at 4.6%, with most automakers teetering on the brink of growth and loss.

Since the beginning of the year, an industry-wide self-rescue campaign centered on 'anti-involution' has been in full swing, spanning from policy initiatives to market practices. Multiple departments have jointly called for an end to cutthroat price competition, prompting automakers to shift their focus from relentless price cuts to building product and technological prowess. However, breaking free from the low-profit trap requires more than just resisting involution. The 'equal rights for fuel and electric vehicles' mechanism, which promotes fair competition between internal combustion engine vehicles and new energy vehicles, is widely regarded as crucial for the sustainable health of the industry. Driven by both market forces and policy support, China's auto industry is striving to transition from inefficient competition to high-quality growth.

Leading Enterprises Forge Ahead as the Matthew Effect Deepens

As the industry leader, BYD has demonstrated robust growth. In the first half of 2025, its total revenue reached RMB 371.3 billion, up 23.3% year-on-year, with net profit rising 13.8% to RMB 15.51 billion. Its overseas performance was particularly noteworthy, with revenue surging 130% year-on-year to RMB 135.4 billion and overseas sales exceeding 550,000 units, already surpassing last year's total. Some high-end models in markets like Germany and Brazil were priced competitively with traditional luxury brands such as Mercedes-Benz and BMW, significantly boosting profitability. In terms of R&D, BYD maintained high investment, with spending up 53% year-on-year to RMB 30.88 billion in the first half, driving innovations such as the 'Tian Shen Zhi Yan' advanced driver-assistance system and megawatt-level flash charging.

In contrast, JAC Motors faced significant challenges. Its interim report showed revenue of RMB 19.36 billion, down 9.1% year-on-year, with a net loss of RMB 773 million. Overall sales dropped 7.54%, including a 16.12% decline in passenger vehicle sales. Despite receiving over 12,000 orders for its luxury Zunjie S800 model, co-developed with Huawei, it struggled to reverse its weak performance. JAC attributed its losses to intensified global competition affecting exports and its new energy projects still ramping up production without achieving economies of scale. Meanwhile, Great Wall Motors occupied a middle ground, with first-half revenue edging up 0.99% to RMB 92.3 billion, although net profit fell 10.21%. However, its second quarter showed improvement, with both revenue and profit growing year-on-year.

These performance disparities clearly reflect a polarized Chinese auto market, where resources and market share are increasingly concentrated among top players, while companies lacking scale and technological barriers face the risk of elimination. Since 2017, over 400 automakers have exited the market, suggesting a shift from a diverse landscape to dominance by industry giants.

Industry Profit Margins Remain Low Despite Anti-Involution Efforts

While some automakers have seen revenue growth, the industry's overall profitability has failed to keep pace. Data shared by Cui Dongshu, Secretary-General of the China Passenger Car Association, revealed that from January to July 2025, automotive industry revenue rose 8% year-on-year, but profits increased by just 0.9%, resulting in a profit margin of only 4.6%. Although slightly higher than the 4.3% in the same period of 2024, it remains historically low. Notably, the profit margin dropped to 3.5% in July, marking a significant year-on-year decline. Compared to the average 5.9% profit margin of downstream industrial enterprises, the auto sector faces acute profit pressure.

Image Source: Cui Dongshu's WeChat Official Account

Several factors have contributed to the depressed profit margins. The new energy vehicle (NEV) market has seen intensifying 'price involution,' as mainstream automakers have slashed prices to capture market share, severely eroding per-unit profits. Meanwhile, although low commodity prices have eased some raw material costs, structural issues such as volatile battery prices and unstable chip supplies have posed control challenges. Inefficiencies and double-counting across the supply chain have further impacted final profits.

Uncertainties in overseas markets have added extra pressure on industry profits. For instance, Mexico's plan to raise tariffs on Chinese imports, if implemented, would directly affect the competitiveness and profitability of Chinese vehicles in that market. Such shifts in the international trade environment require automakers to adjust their global strategies and cost management accordingly.

In response to the industry's struggles from disorderly price wars, policy measures have intensified since the second half of 2024. The Central Political Bureau meeting explicitly opposed 'involution-style cutthroat competition' for the first time. In 2025, multiple departments jointly enhanced price monitoring, compliance inspections, and banned high-interest financial models. The Ministry of Industry and Information Technology, China Association of Automobile Manufacturers, and other bodies have also spoken out against involution, urging a return to rational competition. The All-China Federation of Industry and Commerce Automobile Dealers Chamber has issued an initiative, calling on automakers to set reasonable sales targets, reduce inventory pressures, and establish profit-sharing mechanisms with dealers to improve their viability.

These policies have started to show results. From January to July 2025, the number of price-cut models fell to 106, down from 147 in the same period of 2024, indicating weaker promotional intensity. Terminal prices rebounded in June and stabilized in July, while dealer inventory indices dropped to a healthy 1.78 months. Competition is gradually shifting from pure price battles to a focus on comprehensive strengths in products, technology, and services.

Equal Rights for Fuel and Electric Vehicles: The Key to Fair Competition?

While anti-involution policies have provided short-term relief, fundamentally improving the auto industry's profitability requires a fair market competition environment. Here, 'equal rights for fuel and electric vehicles' has become a focal point. This concept advocates for equal treatment of internal combustion engine vehicles and new energy vehicles in terms of market access, tax policies, purchase incentives, and usage environments, avoiding one-sided policy biases and enabling consumers to make choices based on genuine needs.

Currently, NEVs have achieved rapid growth under policy support, but most automakers remain unprofitable, creating a stark contrast with the relatively higher profits of battery companies and the struggling profitability of vehicle manufacturers. Meanwhile, although the internal combustion engine vehicle market is shrinking, it remains the primary profit source for many companies. This imbalance hinders the industry's overall healthy development. Cui Dongshu has repeatedly emphasized the need to promote fair competition between fuel and electric vehicles, aiming for 'equal strength' through 'equal rights.' Zeng Qinghong, Chairman of GAC Group, has also suggested studying equal rights policies once pure electric vehicles account for 50% of the market.

In reality, equal rights for fuel and electric vehicles do not aim to hinder NEV development but to foster fair competition among multiple technology routes, allowing the market to truly evaluate product strength. Long-term, NEVs have entered a market-driven development phase with self-sustaining capabilities. Eliminating policy discrimination and establishing an open competitive landscape will encourage companies to rely on technological innovation rather than subsidies, ultimately enhancing the global competitiveness of China's auto industry.

Conclusion

It is projected that by 2030, the penetration rate of new energy passenger vehicles could reach 80%, with independent brands potentially exceeding 80% market share. In this process, implementing anti-involution policies and advancing equal rights for fuel and electric vehicles will jointly help the industry escape the low-profit trap. Only by achieving coordinated growth in scale and efficiency can China truly transition from a major auto producer to a global auto powerhouse.