XR Weekly Highlights: Major Strategic Shifts by Giants, Chinese Players Secure Four Global Spots

![]() 12/23 2025

12/23 2025

![]() 444

444

Amidst the global surge of artificial intelligence reshaping the tech industry, the VR/AR sector, seen as a crucial direction for future human-computer interaction, is undergoing significant changes in its development trajectory and investment priorities. Over the past week, a series of moves from international tech giants to domestic innovators indicate that the XR industry has transitioned beyond its early stage of singular technological exploration and is entering a new era: the consumer market is clearly diversifying, technology is accelerating its integration with AI, and application deployments are increasingly focused on solving real-world problems.

The strategic choices of leading companies clearly guide the flow of capital and technology, while concrete market data faithfully reflects user needs and product performance.

01 Giants' Focus: AI and Lightweight Designs, Long-Term Plans Remain Unchanged

The strategic moves of tech giants serve as important windows into industry trends. This week, Meta's Chief Technology Officer Andrew Bosworth's response to external speculation is highly representative.

Previous reports suggested that Meta planned to cut its metaverse team budget by up to 30% and redirect resources toward AI glasses and wearables. In response, Bosworth firmly denied the claim that 'VR is dead,' emphasizing Meta's capacity as a large company to invest in multiple areas simultaneously, including VR, smart glasses, and artificial intelligence. The company's official statement confirmed that they are adjusting some investments from the metaverse sector to AI glasses and wearables based on business 'momentum.'

This adjustment does not signify abandoning the original direction but rather a reallocation of resources based on actual market feedback. It demonstrates the company's commitment to long-term VR investment while shifting its strategic focus toward the more immediately promising 'AI + lightweight glasses' track (track).

Meanwhile, another decision by Meta further illustrates its platform strategy adjustment. The company announced it has paused its cooperation plan to license its operating system, Meta Horizon OS, to third-party device manufacturers like ASUS and Lenovo, opting instead to focus on developing its own top-tier hardware and software products.

This change indicates that, at the current stage of XR ecosystem development, Meta has chosen to prioritize consolidating the user experience and market dominance of its Quest series products, temporarily slowing down the rapid expansion of its hardware ecosystem through operating system licensing. It reflects the company's current focus on refining its own products and building a closed-loop experience.

While Apple has not officially announced its moves, a rare code leak provided crucial clues.

Information extracted from an early development version of iOS 26 confirms that Apple is developing multiple unreleased products, including at least five XR-related devices: a lightweight, affordable 'Vision Air,' an abandoned prototype of lightweight AR glasses, discontinued AR glasses that could connect to Macs, a lower-priced second-generation Vision Pro, and an AI smart glasses model competing with Meta Ray-Bans.

This list showcases Apple's strategy of advancing multiple XR technology routes simultaneously and continuously adjusting its approach, with a product lineup covering various forms, from high-end, feature-rich headsets to everyday lightweight glasses.

Meanwhile, Google is also advancing its layout (layout). The company has not only deeply integrated its Gemini large model into applications like translation, enabling real-time translation via earphones, but has also placed its first AI glasses based on the Android XR platform on the development agenda.

The common choices of these tech giants reveal a clear trend: leveraging artificial intelligence as the core technological driver, focusing on lightweight, everyday-wearable smart glasses as a key product form, while maintaining long-term investment in immersive VR/AR experiences. Industry competition is expanding from a singular focus on hardware or concepts to a comprehensive contest of 'AI capabilities, wearable device forms, and ecological content development.'

Commentary: The strategic adjustments by these international giants are actually a response to market demands. They are shifting from their previous broad visions of the 'metaverse' toward seeking clearer, faster value-delivering product forms for users.

AI glasses have become the current focus due to their excellent integration with existing mobile networks and AI assistants. However, this does not mean VR technology has reached its limit; rather, companies are reallocating resources between long-term and short-term goals.

The strategy of pausing operating system licensing to other manufacturers indicates that, given the current market size, refining core proprietary products is more important than rapidly attracting more hardware partners.

02 Market Data Shows Rapid Growth

The strategic adjustments by tech giants are based on real market performance and user choices.

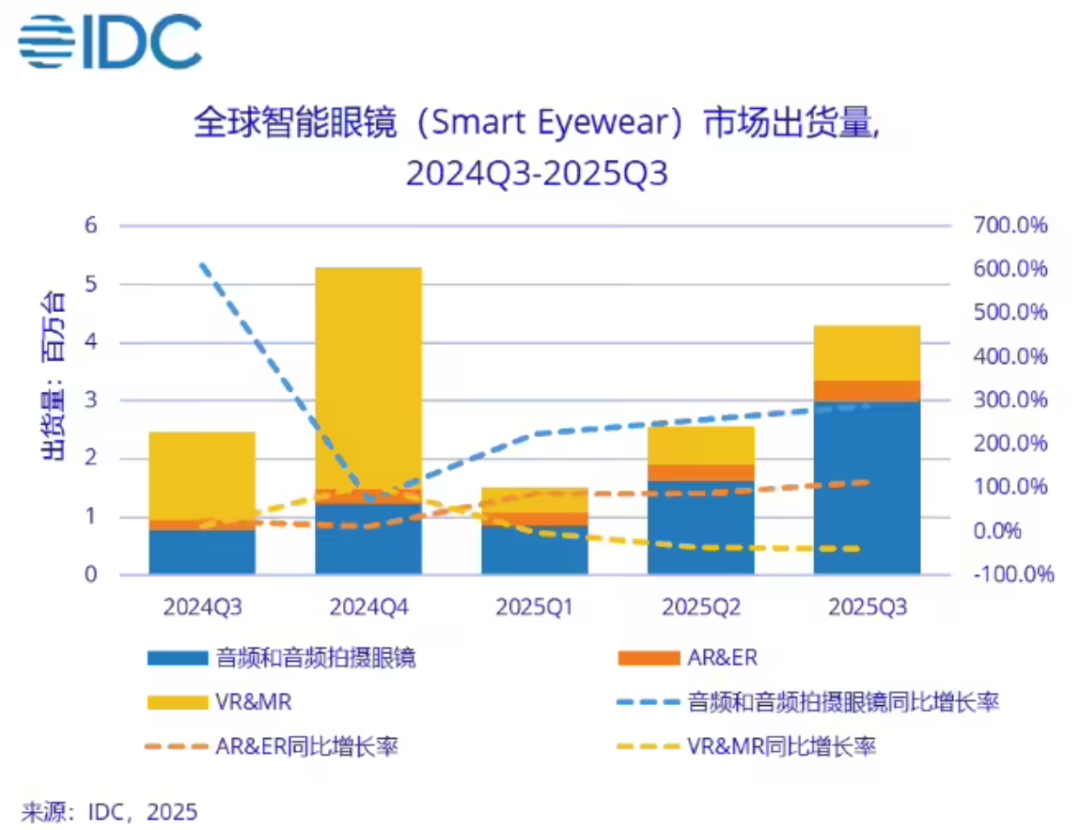

The latest report from International Data Corporation (IDC) clearly illustrates the global market situation in the third quarter of 2025. It shows that global smart glasses shipments reached 4.296 million units in the quarter, a substantial year-on-year increase of 74.1%. However, behind this overall growth, market segmentation is evident: shipments of simpler 'audio and camera glasses,' primarily focused on audio and photography, reached 2.994 million units, soaring by 287.5% year-on-year; in contrast, shipments of more complex, immersive 'AR/VR devices' stood at 1.302 million units, actually declining by 23.2% year-on-year.

This 'two-tiered' scenario is also present in the Chinese market. Smart glasses shipments in China reached 623,000 units in the quarter, a year-on-year increase of 62.3%. Among them, audio and camera glasses grew by 79.2%, while AR/VR devices increased by only 29.4%. These figures clearly indicate that the primary products driving market growth are lightweight devices that seamlessly integrate into daily life, meeting high-frequency needs such as music listening, calling, and first-person video recording.

Meta captured 75.7% of the global market share with its newly launched Ray-Ban Meta second-generation series, accurately capitalizing on this trend.

Meanwhile, in the more niche AR glasses segment, Chinese brands have demonstrated strong international competitiveness. Counterpoint Research's report notes that RayNeo (Thunderbird Innovation) maintained its position as the global leader in AR smart glasses sales for the second consecutive quarter with a 24% market share, and its overseas sales surged by 3.8 times year-on-year.

IDC's report also reveals that among the global top five, apart from Meta, the other four are Chinese manufacturers: Xiaomi, RayNeo, Xreal, and Viture. This collective rise of multiple companies benefits from China's mature supply chain, rapid product iteration capabilities, and deep understanding of the consumer electronics market.

XREAL's newly released XREAL 1S glasses, featuring a '500-inch portable giant screen' and stable spatial display, aim to deepen the value of AR in core scenarios like movie watching. Competition in the consumer market is intensifying.

Commentary: Market data most authentically reflects the gap between technological ideals and actual demands. The explosive growth of audio glasses demonstrates that products accurately addressing 'a specific need' are far more likely to gain mass-market acceptance than concepts attempting to 'build a grand virtual world.'

The short-term decline in AR/VR device shipments indicates that these high-end products still face obstacles in terms of pricing, content ecosystems, and portability, and have not yet crossed the threshold of widespread adoption.

Chinese manufacturers securing four of the top five global market positions clearly shows that the manufacturing hub and part of the innovation momentum in the XR industry are shifting toward China. These companies have successfully found their development space through more flexible market strategies, focusing on lightweight device design and display optimization.

03 Significant Progress in the Industrial Chain

This week, multiple segments of the industrial chain have reported positive developments.

In the core optical display field (field) that determines device experience, OmniVision released the industry's first ultra-low-power single-chip LCOS microdisplay for smart glasses. This product delivers higher-definition visuals and a wider field of view in a smaller form factor, serving as a key component for making smart glasses thinner, lighter, and more stylish.

AAC Technologies' AR device, specifically designed for a core client in the North American market, has successfully passed mass production validation and begun large-scale deliveries.

Mojie Technology won the 'Deloitte China Technology Fast 500' award for its independently developed resin diffractive waveguide technology, showcasing the innovative capabilities of domestic companies in core technology R&D.

Meanwhile, other supply chain players are rapidly responding to market demands. For example, Conant Optical, the exclusive lens supplier for Kuake AI glasses, saw its stock price rise due to significant order growth; Sunword, an antenna supplier, stated it has established deep collaborations with multiple AR/AI glasses clients and achieved mass production.

Commentary: These advancements are crucial foundations for the maturation of XR devices. Innovations in core display and optical components directly determine whether end products can become thinner and offer better experiences; validating mass production capabilities and rapid supply chain responses are key steps for the industry to move from design to market and from niche to scaling (scale).

This demonstrates that China's supply chain is evolving from a past role of 'manufacturing' to deeper involvement in 'core component innovation' and 'collaborative R&D,' providing solid support for the industry's accelerated development.

Summary

Combining the week's developments, the future landscape of the XR industry is gradually becoming clearer, though challenges remain.

The primary challenge lies in how consumer-grade AR/VR can overcome the 'killer application' hurdle. While the growth of audio glasses proves the market potential of lightweight, high-frequency-demand products, more immersive AR/VR devices still await a breakthrough application that resonates with the masses, whether in gaming, social interaction, or work scenarios. Meta's decision to pause Horizon OS licensing is, to some extent, due to the current third-party hardware ecosystem and content scale not yet reaching a tipping point.

Looking ahead, global competition will intensify. While Chinese manufacturers have secured advantages in hardware shipments and cost control, they still face long-term competition with giants like Apple, Google, and Meta in underlying operating systems, top-tier AI models, and global content ecosystems.

Chinese companies' opportunities lie in leveraging their deep understanding of vertical scenarios in domestic and specific overseas markets (such as education, cultural tourism, and industry) for rapid innovation iteration.

In this all-encompassing competition of 'hardware + AI + content + scenarios,' participants capable of continuous technological innovation, profound user demand understanding, and building open, win-win ecosystems are most likely to define the next computing platform.

These are some of the notable XR industry highlights and commentaries from the past week. VRAR Planet will continue to bring you the latest industry hotspots in a timely manner.