After Bankruptcy Reorganization, WM Motor Announces Production Resumption: Can It Achieve a 'Miracle' Without a Precedent for Success?

![]() 09/10 2025

09/10 2025

![]() 466

466

Once on par with NIO, XPeng, and Li Auto, WM Motor found itself in a dire situation, having accumulated debts exceeding 26 billion yuan and remaining inactive for two and a half years. Suddenly, it unveiled a revival plan, aiming to make a remarkable comeback in China's highly competitive new energy vehicle market.

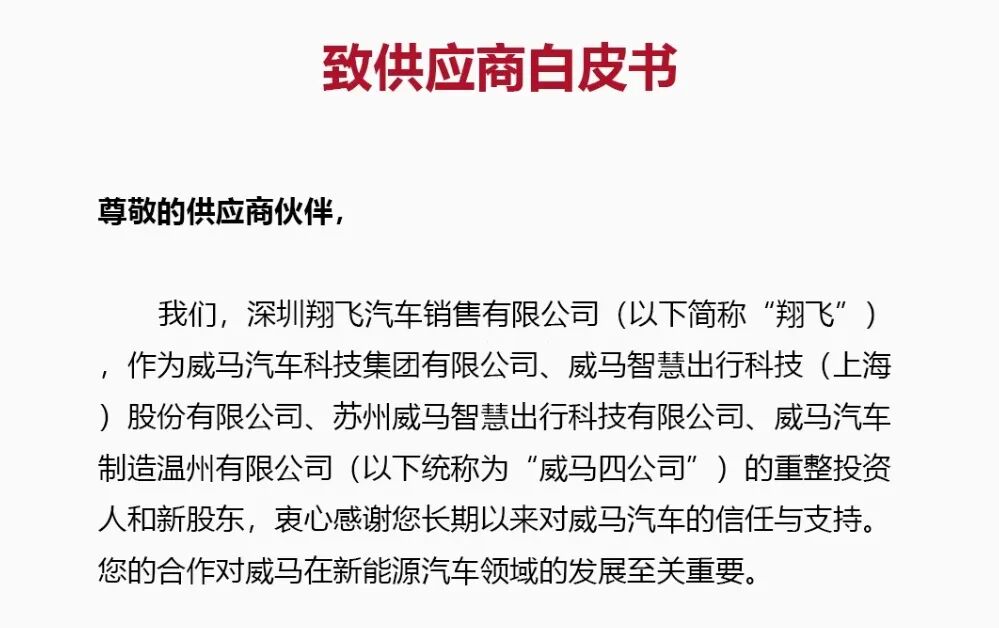

On September 6th, WM Motor, through its long - dormant official account, issued a 'White Paper to Suppliers'. It announced that Shenzhen Xiangfei Automobile Sales Co., Ltd. has officially taken over the company. WM Motor plans to restart mass production of the EX5 and E.5 models at its Wenzhou base this month.

The white paper provides in - depth details about the company's restructuring progress, the court's rulings on its historical debts, and the 'New WM Motor's' five - year development blueprint. WM Motor has pledged that ordinary creditors with claims of 150,000 yuan or less will receive full cash settlement within six months after the court approves the restructuring plan.

Mysterious 'Acquirer'

Established in 2015, WM Motor was once hailed as one of the leading representatives of China's new automotive forces. In 2018, it ranked second in the industry in terms of delivery volume. By 2020, it still held its position as the fourth - best - selling new force, alongside NIO, XPeng, and Li Auto, collectively known as the 'Four Little Dragons' of new forces. During this period, there were also repeated rumors about its pursuit of an IPO.

However, starting in 2022, WM Motor encountered a series of operational issues, including production halts and store closures. Eventually, in October 2023, it applied for bankruptcy review. Its total debts had soared to 26 billion yuan, while its book assets were valued at only about 4 billion yuan, leaving it severely insolvent.

According to the white paper released on WM Motor's official account, the restructuring investor and new shareholder of WM Motor is Shenzhen Xiangfei Automobile Sales Co., Ltd. Tianyancha data reveals that Xiangfei was established in September 2023 with a registered capital of 100 million yuan. Its legal representative and actual controller is Huang Jing. Xiangfei's main business is the retail of new automobiles, rather than the capital - intensive manufacturing of complete vehicles. Its 2024 corporate annual report shows that the company has zero insured employees. Notably, Huang Jing is also the actual controller of Kunshan Baoneng Automobile Co., Ltd.

In terms of funding, the white paper states that Xiangfei initially plans to invest 1 billion yuan in equipment upgrades, supply chain restoration, and product development. This investment, combined with government financing support, is expected to ensure the sustained and stable operation of the new WM Motor.

Aggressive Development Plan

Xiangfei has formulated an ambitious 'three - step' development strategy for WM Motor:

Revival Phase (2025 - 2026): Restart production of the EX5/E.5 models in September 2025, aiming for an annual production and sales volume of 10,000 units and striving to reach 20,000 units. Simultaneously, establish a KD factory in Thailand to explore markets in Southeast Asia and the Middle East. Achieve full production capacity of 100,000 units in 2026.

Development Phase (2027 - 2028): Expand annual sales to 250,000 - 400,000 units, commence mass production of high - level assisted driving models, and initiate IPO preparations.

Leap Phase (2029 - 2030): Challenge production of 1 million units by 2030, achieve revenue of 120 billion yuan, construct a smart mobility ecosystem, and become a new industry benchmark.

WM Motor's attempt to restart is closely linked to its plan for handling historical debts.

In the 'White Paper,' the new WM Motor proposes a specific debt settlement plan: Ordinary creditors with claims of 150,000 yuan or less will receive full cash settlement within six months after the court approves the restructuring plan.

For ordinary creditors with claims exceeding 150,000 yuan, each will receive 150,000 yuan in cash settlement, with the remaining amount settled through trust beneficiary rights.

This plan is clearly designed to swiftly restore supply chain relationships and pave the way for production resumption. Some suppliers have already shown enthusiasm upon receiving the repayment plan, with one stating, 'Everyone in the group is thrilled.'

Product and Market Challenges

It is reported that production has resumed at WM Motor's Wenzhou base, with the first batch of over ten EX5 and E.5 models already rolling off the line, mainly for market promotion. Currently, over 400 employees have returned to the Wenzhou base, and production lines have been restarted. The company is recalling former employees and renegotiating salaries while conducting large - scale recruitment across various positions.

However, some former employees have expressed concerns about stability and have not considered returning to work. A friend working in the factory revealed that the base salary is now 30% lower than before, but bonuses may compensate if production increases next year.

The EX5 and E.5 models that WM Motor plans to resume production are several years old and lag significantly behind mainstream products in core metrics such as intelligent driving and range. Industry insiders point out that the WM EX5/E.5 models, after being dormant for two to three years, now have a generational gap compared to current new energy vehicles and can only re - enter the market through a low - price strategy.

One consumer directly stated, 'I was deceived by the false range claims last time, and now replacing the battery is extremely expensive. I'd rather buy a BYD.' Regarding pricing, sources indicate that the price may be around 150,000 yuan. Additionally, WM Motor has launched a trade - in program, allowing old vehicles to be traded in for new ones at a discount of tens of thousands of yuan.

After WM Motor released the 'White Paper to Suppliers,' many vehicle owners left comments in the review section. One owner said, 'I've been using my 2020 WM EX5 - Z for five years. The quality is excellent, with no issues. It drives comfortably. I support the new WM Motor.' Another owner commented, 'I blind - ordered in 2018 and have been driving it ever since. It still has no issues.'

However, more long - time users expressed expectations: 'I hope the vehicle's infotainment system is restored first.' 'The car's quality is really good. I hope it survives, but the quality must not decline. Also, please restore the internet connectivity for my vehicle's infotainment system.' 'The most important thing is to restore the internet for long - time WM users. I don't care about anything else.'

WM Motor's solid market reputation has given it the confidence to regroup. However, it must be acknowledged that there is still a long and arduous road ahead to truly win over consumers.

Will There Be a 'Miracle'?

Xiangfei initially plans to invest 1 billion yuan in equipment upgrades, supply chain restoration, and product development. However, compared to WM Motor's debts exceeding 26 billion yuan, this 1 billion yuan investment seems like a mere drop in the ocean.

In terms of technology, while current new energy vehicles are focusing on intelligence, WM Motor still relies mainly on selling hardware. Regarding product planning, it intends to launch over ten new products in the next five years to meet diverse global market demands. The model lineup includes refreshed versions of the EX5 and E.5, covering a wide range of vehicles from A00 - class to C - class sedans, SUVs, MPVs, and crossovers. However, the research and development team appears to be significantly understaffed. Currently, the average automaker allocates 30% of its employees to R&D, whereas WM Motor has to rebuild its team from scratch. Launching such a large number of new products in a short time is highly unrealistic.

Industry experts are skeptical of WM Motor's revival plan, believing it is extremely difficult to achieve. They point out that WM Motor has been plagued by negative information and will struggle to quickly regain the trust of consumers and dealers. Industry insiders bluntly state, 'Going from annual production of 10,000 to 1 million units is equivalent to achieving in five years what other brands take ten years to accumulate. This requires three miracles to happen simultaneously: technological breakthroughs, product iterations, and supply chain restructuring.'

The battlefield for new energy vehicles is already fiercely competitive. Revival cannot rely solely on repayment sincerity; it requires a comprehensive breakthrough in product strength, funding, and technology. There is no precedent for a new energy vehicle company to revive after going bankrupt. Can WM Motor create a 'miracle'? We will have to wait and see!