Subsidies Fully Withdrawn: Will the National Day Auto Market Panic?

![]() 09/29 2025

09/29 2025

![]() 642

642

Introduction

If subsidies are completely phased out, can the Chinese automotive market sustain its robust sales momentum?

Guided by policies and after years of fluctuations, the new energy vehicle (NEV) sector has emerged as the primary force propelling China's automotive industry from the periphery to the forefront. Entering 2025, despite the immense pressure from price wars across the automotive market faced by every automaker, the trend clearly shows that betting heavily on the new energy market remains the right move.

Moreover, with policies in place to support the replacement of traditional vehicles with new energy models, the entire Chinese automotive market has flourished amidst the new energy wave.

“As of September 10, the number of vehicle trade-in applications this year has reached 8.3 million.” On September 13, at the 2025 China Automotive Industry Development (TEDA) International Forum, the Ministry of Commerce announced these achievements and stated its commitment to further implementing decisions and deployments from higher authorities. The ministry aims to vigorously boost consumption, comprehensively expand domestic demand, and drive the high-quality development of the automotive industry.

It is foreseeable that, supported by these relief measures, the Chinese automotive market may witness another wave of enthusiasm.

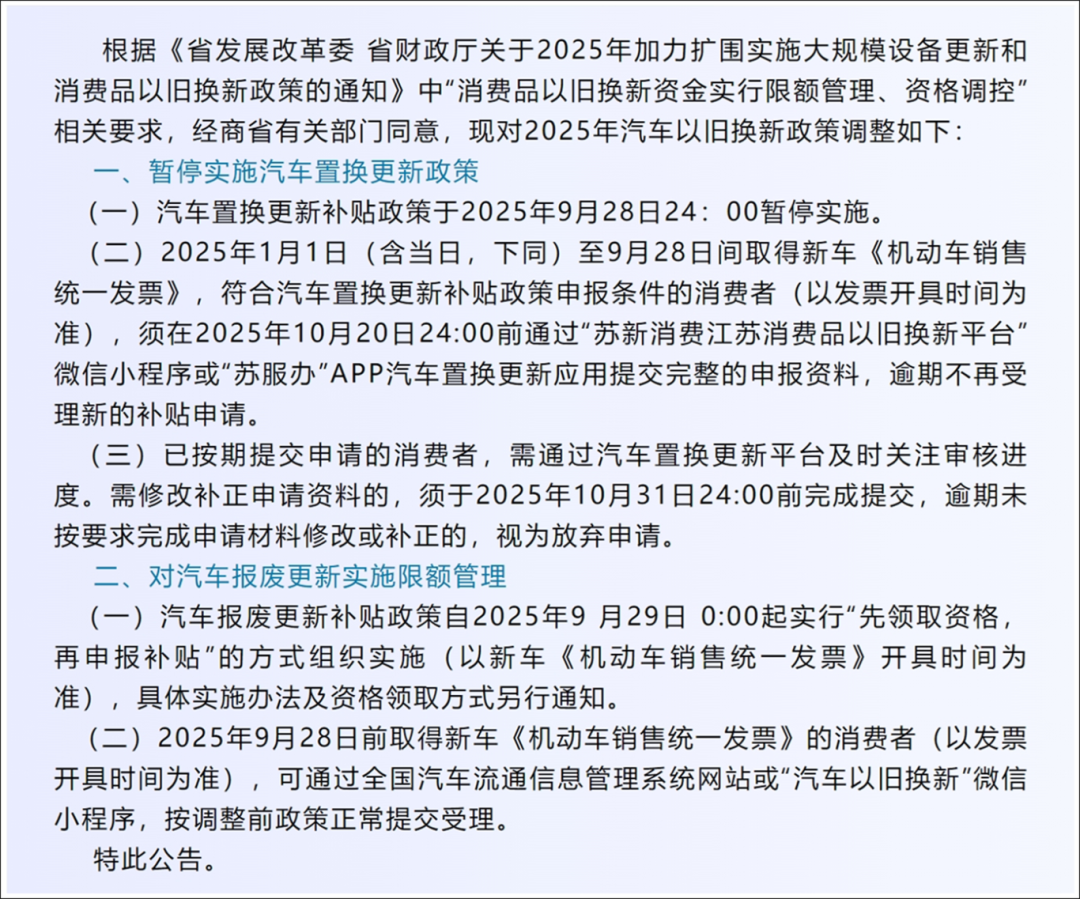

However, interestingly, as Jiangsu Province recently issued the “Announcement on Adjusting the 2025 Vehicle Trade-In Policy in Jiangsu Province,” announcing the suspension of the provincial vehicle replacement subsidy policy starting at 24:00 on September 28, 2025, and implementing quota management for vehicle scrapping and replacement, the automotive market's development trajectory seems to be taking an uncertain turn again.

As the policy hotbed gradually withdraws and the Chinese automotive market begins to face market challenges alone, can it still demonstrate unstoppable sales growth? Without policy incentives, can consumers maintain their enthusiasm for purchasing vehicles?

01 Significant Results, But an End is Inevitable

Since the real estate bubble burst due to unforeseen events, the automotive industry's importance to the national economy has become evident. In the early stages of new energy development, the state promoted industry growth through subsidies to automakers. However, when subsidies were directed at consumers, the core objective shifted from accelerating industrial progress to promoting consumption.

In other words, as the new energy industry became the cornerstone of China's automotive sector, automobile consumption naturally played a pivotal role.

Driven by policies, in the first eight months of this year, China's automobile production and sales reached 21.051 million and 21.128 million units, respectively, representing year-on-year increases of 12.7% and 12.6%. Among them, NEV production and sales reached 9.625 million and 9.62 million units, respectively, with year-on-year increases of 37.3% and 36.7%. NEV sales accounted for 45.5% of total new automobile sales.

While it cannot be said that 100% of consumers' vehicle purchases are now driven by subsidies, it is evident that when buying a car becomes a non-essential matter, unexpected subsidies play a crucial role.

This year, we have all witnessed the sales performance of the entire automotive market. Continuing with the development model from the automotive market's heyday will make it challenging to mobilize potential users' enthusiasm. Therefore, even without subsidies, automakers have employed comprehensive strategies.

Throughout the year, we have constantly discussed how certain new models released by automakers are incredibly affordable and how their product competitiveness represents a significant advantage, which, in essence, is a variation of price wars.

Regarding the escalating price wars in 2025, they appear to be market competition initiated by a few automakers on the surface. However, the overall trend of the consumer market seems to have been set long ago.

Compared to the past, affordability is now the primary consideration for anyone considering buying a car. Regardless of brand or class, automobiles on the market are distinguished solely by their price. As this perception spreads, any new model launched now can only gain exposure on social platforms if its price is lower than that of similar products.

It is difficult to say whether this current situation aligns with the automotive industry's evolution logic. After all, given the current environment, it is impossible to return to the era when automakers could easily make profits, and consumers would buy cars without much thought.

However, in the long run, can such a state truly enable the positive operation of the Chinese automotive market's internal circulation?

Now, just before the National Day holiday, with vehicle purchase subsidies continuously tightening and even being canceled in coastal developed provinces, it has indeed caught everyone off guard.

To put it bluntly, when replacement subsidies disappear, the cost of purchasing a vehicle for consumers directly increases. Previously, vehicle replacements that met policy requirements could enjoy cash subsidies of up to 20,000 yuan. With the suspension of subsidies, this cost must be borne by consumers themselves, inevitably leading budget-sensitive consumers to postpone their purchase plans. Given the current consumption environment, most people are likely to be budget-sensitive.

What lies ahead for the Chinese automotive market? No one can provide a specific answer. However, we should be clear that no industry in history has grown by relying solely on external forces to stimulate consumer sentiment. While automotive subsidies are beneficial, ultimately, automakers must rely on themselves to attract users.

02 Policy Withdrawal: A Turning Point for the Automotive Market

In fact, even before Jiangsu, regions such as Hubei, Hunan, Anhui, and Guangzhou had successively suspended applications for vehicle replacement subsidies. Some areas even shifted from “unconditional application” to a “coupon grab mode” and strictly restricted the location for new vehicle registration. In some places, subsidy programs originally planned to continue until the end of the year were terminated as early as the second quarter due to rapid fund depletion.

The threshold for vehicle purchase subsidies has significantly increased, and future policy uncertainty has grown. Clearly, the window for consumers to enjoy preferential vehicle purchases has been narrowing. However, when Jiangsu made a similar decision, it became even clearer that the withdrawal of policies will not only have an immediate impact on the market but also an unprecedentedly profound one.

Affected by policy adjustments, the lives of automotive dealers will become more challenging; with sales suffering setbacks, automakers will hesitate in promoting subsequent products; and suppliers bound to automakers will find their development precarious under the premise of tightened funds for automakers.

Now, this situation has made everyone in the industry nervous. If, in the future, the reduction of purchase tax exemptions for new energy vehicles is also tightened, it is unimaginable how those enterprises that have long relied on external support will survive.

Of course, just like the market scenarios after the cancellation of national-level policies such as the “Automobiles to the Countryside” and the halving of purchase taxes in the past, the reduction or adjustment of subsidy policies is, after all, a crucial step in driving the automotive industry's transition from “policy-driven” to “market-driven” and “experience-driven.”

Viewed positively, this move represents a new starting point for forcing automakers to build core competitiveness. After the subsidies are gone, automakers can no longer rely solely on price advantages and must shift their focus back to product competitiveness itself.

On the other hand, it will inevitably accelerate industry consolidation. Leading automakers, with advantages in technology, capital, and supply chains, can better adapt to an environment without subsidies. In contrast, tail-end enterprises heavily reliant on subsidies may face the risk of being eliminated by the market, thereby facilitating industry integration and healthy development.

Admittedly, the suspension of vehicle replacement subsidies will bring short-term pain to the market. However, in the long run, it is a necessary step for the industry to mature. Currently, given that subsidies will still be distributed in batches and orderly in the fourth quarter, this means that policies are not exiting with a “one-size-fits-all” approach but entering a phase of optimization and adjustment that emphasizes precision and efficiency to prevent the recurrence of fraudulent activities such as “zero-kilometer used cars” seen in previous policy implementations.

As observers, we hope that the future healthy development of the automotive market will rely more on technological innovation by automakers, enhanced product experiences, and a fair competitive environment in the market. As for consumers, when all the glamour fades away, their purchasing decisions may need to consider the long-term value of products more comprehensively, rather than just short-term price discounts and subsidies.

Editor-in-Chief: Cao Jiadong, Editor: He Zengrong

THE END