Next Stop for AI Investment: Peeling Away the Hype and Uncovering Value in Established Industries

![]() 12/03 2025

12/03 2025

![]() 531

531

We are living in an era of innovation and new paradigms.

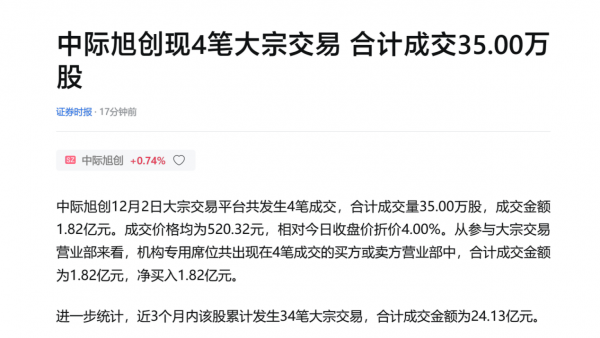

These paradigms, of course, revolve around emerging technologies like AI and semiconductors, which attract the lion's share of A-share liquidity. In contrast to the 'old economy stocks' linked with traditional sectors, the 'new economy stocks' imbued with these cutting-edge concepts have been repeatedly elevated to near-mythical status during bull markets. Core stocks like Zhongji Xunchuang frequently witness trading volumes in the tens of billions, with investor interest highly concentrated.

However, as AI leaders overseas engage in self-referential market hype and more institutions frequently discuss application prospects in research reports, the market tide is clearly shifting: AI applications have reached a make-or-break point where they must deliver tangible results, or else they remain just stories.

At this critical juncture, an unexpected development emerged—the acquisition of Zhenai Meijia by Tungee Technology, announced a month ago. The former is an AI unicorn primarily focused on intelligent agents, while the latter specializes in blankets and home textiles, representing a quintessential manufacturing business model. Thus, the era of 'AI + Manufacturing' has arrived.

'Unglamorous' Business, Glamorous AI

The AI industry faces an awkward dichotomy: model developers are vying for supremacy in the stratosphere of theoretical innovation, while traditional enterprises below are treading on thin ice in practical implementation.

Consulting firms like Gartner and McKinsey, ever at the vanguard of conceptual trends, have long been waving the flag, stating that 80% of future enterprises will adopt AI, with 78% of Chinese companies already dipping their toes in. However, in reality, most enterprises still use AI for writing copy, generating e-commerce images—valuable primarily in asset-light internet businesses but far removed from core operations.

Why? Because general-purpose large models fail to 'understand the industry': they do not grasp vertical industry needs, methods for screening and contacting clients, or what it truly means to 'do business'.

Unlike the internet, where a few clicks can complete business processes, manufacturing cannot afford inaccurate AI outputs—it would waste vast amounts of energy and resources.

What are manufacturing's pain points? Rising labor costs have rendered traditional 'mass army' tactics obsolete; the surge of concurrent tasks during promotions and peak seasons leaves manual processing stretched thin, with efficiency and quality at odds; and most frustratingly, highly skilled employees are bogged down in repetitive tasks like form-filling, screening, and initial reviews.

This is where Tungee's acquisition of Zhenai Meijia becomes intriguing. Tungee has developed a digital workforce system. Note the term: 'workforce,' not 'tools.'

Tools are used by humans, who need rest, have emotions, and vary in ability. Employees, however, are independent workers—they are productivity itself, capable of bearing KPIs. Tungee's large model intelligent agent platform, focused on digital productivity, along with its new generation of AI digital employees, boasts three irresistible traits for traditional bosses:

- Intelligent agents with planning, reasoning, and execution capabilities for complex tasks think and act like humans, operating 24/7 to achieve 'business never stops.'

- They enter the workforce as seasoned veterans, trained with industry know-how and business logic accumulated from serving over 50,000 enterprises, reaching expert-level business knowledge.

- Highly adaptable, they support customization and seamless integration into existing ERP and CRM processes, eliminating the need for costly system overhauls.

Such 'glamorous' industrial traits are only achievable through AI. So, how are these employees deployed? That relies on Tungee's Taiqing Platform and Kuanghu Data Foundation.

The 'Taiqing' enterprise-grade large model intelligent agent development platform supports industry expert models, multi-capability engines, and cross-platform data interaction, enabling 'professional competence and rapid deployment.' Meanwhile, the 'Kuanghu' data cloud foundation aggregates vast, deeply curated commercial data, providing AI with the decision-making support it needs. Thus, Tungee's agent team can truly grasp businesses' real needs.

For instance, B2B sales is a highly challenging business area, often plagued by 'elites being too expensive, novices being too ineffective.' Tungee's sales agents can intelligently assess downstream needs based on keywords, screen high-quality leads from vast data, and make opportunities clear at a glance. Subsequently, AI handles initial outreach and screening, with human sales stepping in only at the critical deal-closing stage, dramatically boosting conversion rates.

In the B2C realm, Tungee's customer service agents understand context like humans, instantly grasping needs while remaining indefatigable, operating 24/7 with exceptional capabilities. The cost-saving and efficiency gains are unimaginable under traditional models.

Like multiplying productivity, AI's theoretical and practical effects far exceed expectations.

Finding Incremental Growth in 'Invisible' Areas

In fact, Tungee's complete agent applications extend far beyond this. Its AI agent platform covers core scenarios in B2B (sales, marketing, outreach, analysis) and B2C (customer service, marketing, operations, private domains), meeting most manufacturing service demands.

Thus, Tungee's acquisition of Zhenai Meijia is highly likely aimed at establishing a benchmark case for 'AI + Manufacturing.'

Many manufacturing bosses' pain points do not lie in production itself but in 'invisibility': not seeing where clients are, not spotting new demands, not knowing what sales do out in the field. However, after adopting AI and digital employees to share the workload, this logic completely changes. Let's examine a few cases:

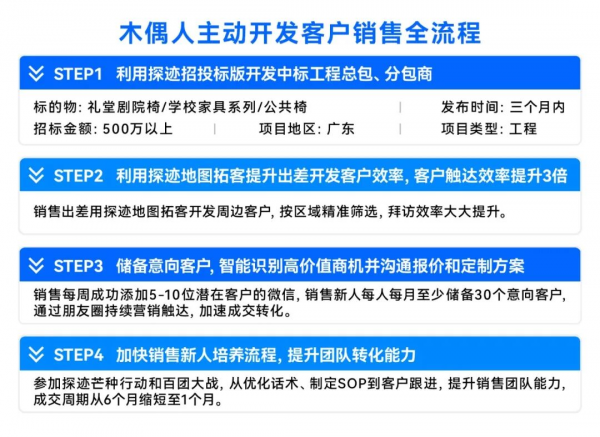

Muorouren Furniture in Gaoming, Foshan: Founder Mr. Jiang, a veteran of Alibaba's elite sales force, demanded strict product quality but initially relied on intensive marketing: salespeople used primitive door-to-door methods to find clients, often spending three days without encountering a single valid customer with engineering projects. Information asymmetry left them in the dark.

The situation only reversed qualitatively after integrating Tungee's AI sales agents. Sales needed only to input criteria like 'won gym projects in the past year' or 'within a 50-kilometer radius,' and the system instantly locked in target enterprises with clear bidding details. Daily effective visits by salespeople soared from 1.2 to 4.7.

In 2024, while peers were retrenching, Muorouren's performance surged 48.6% year-on-year, achieving 13 million in sales within a month using Tungee, with the signing conversion rate tripling. Data, driven by AI, ultimately surpassed experience.

If the furniture industry still has design differences, the steel trade industry is a pure red ocean. Mr. Hua of Jinan Hengshunyuan previously faced severe headaches: with steel prices so transparent that a single phone call revealed the floor price, and rebar prices down 15% from last year, customer acquisition costs in this industry were exorbitant. Exhibitions costing 200,000 over three days might yield only three prospective clients; newcomers on ground outreach could go three months without closing a deal.

Mr. Hua's bold choice: let sales 'go AI.' Tungee's AI agents showcased their terrifying capabilities in B2B. Inputting keywords, they generated 2,000 precise client lists in three seconds based on knowledge graphs, including names, scales, production capacities, and annual revenues. They could even trace connections, such as recommending a machinery manufacturer in a park and then analyzing similar demands within the same park.

Under traditional sales models, this would rely on luck. Now, sales visit records and client data are perfectly stored in the backend. Mr. Hua calculated: at least 30% of this year's additional 50,000-ton sales volume could be attributed to such refined management.

Global manufacturing giant 3M China, with product lines spanning industrial, medical, consumer goods, and more, faced diverse challenges: a vast and complex client base made efficient information integration difficult through traditional means, leaving sales teams mired in fragmented data and unable to spot genuine opportunities.

After partnering with Tungee, the situation transformed. Through big data and AI capabilities, 3M systematically completed and integrated vast client information, constructing precise dynamic client views. Sales teams could now swiftly identify high-value targets, shifting from 'broad coverage' to 'precision outreach.' Driven by data intelligence, customer acquisition efficiency and precision significantly improved, opening a sustainable and efficient precision growth path for this diversified enterprise.

Returning to the original question, AI's path to implementation in manufacturing is clear: finding clients, managing sales, and discovering new markets. Tungee AI's knowledge graphs and intelligent agents represent a paradigm shift attacking traditional experience-driven and labor-driven models. This is especially true for Zhenai Meijia.

Speculations on Zhenai Meijia's 'AI Transformation'

Returning to this acquisition: Tungee's takeover of Zhenai Meijia is a deliberate move toward deep 'AI + Manufacturing' integration. The latter already possesses a certain digital foundation, with its 'Zhenai Industrial Internet Platform' connecting R&D, production, supply, sales, and services. Introducing Tungee's AI empowerment means three aspects of Zhenai Meijia's business will undergo disruptive transformation.

First, AI intelligent agents will transform—or even take over—marketing, especially overseas operations.

If you're familiar with foreign trade, you'll know that for a company with 80% of its business overseas, traditional approaches involve expanding channels and participating in exhibitions—costly and inefficient, not to mention exhibition fees.

However, with Tungee's B2C agents and overseas sales intelligent agent Futern, Zhenai Meijia can deploy digital marketing employees as needed. They generate marketing materials automatically using AIGC based on different countries' languages, cultures, and aesthetic preferences, scooping up potential clients from public traffic 24/7.

Meanwhile, leveraging Futern's global knowledge graph covering 800 million contacts and 190 million enterprises, Zhenai Meijia can precisely locate potential overseas distributors and large retailers without relying on personal connections for customer acquisition.

Second, traditional enterprises' most troublesome R&D design issues will undergo a predictive revolution.

The home textile industry's lack of imagination stems directly from its weak ability to adapt to client needs. Previously reliant on designers' inspiration and buyers' experience, R&D can now leverage AI.

Tungee's large models can monitor global fashion trends, social media hotspots, and search keywords in real-time—be it INS style or TikTok trends. AI continuously identifies design signals with potential to go viral, assisting designers in rapidly generating schemes that might take only days to create new styles.

If needed, tracing upstream is also feasible. In new material and formula R&D, AI expert large models can efficiently analyze vast chemical formulas and material performance data to explore material formulation R&D solutions. Whether seeking warmth and breathability or antibacterial and eco-friendly properties, data provides comprehensive support—a progress traditional manufacturing dared not imagine.

Finally, Tungee AI's empowerment will inevitably transform Zhenai Meijia's business model.

From now on, everything will be based on data-driven predictions rather than experience-based gambles. AI will assist management in making the toughest decisions, with results likely reflected in future financial reports. The true value of this AI unicorn will soon be put to the test.

This is why Tungee Technology's holding of Zhenai Meijia creates a trackable, verifiable, and replicable 'AI-transformed manufacturing' sample. With vertical scenarios and deep integration, no other A-share company seems to offer a similar case. Perhaps this is the correct approach for AI investment in the second half.

The content and views in the article are for reference only and do not constitute investment advice. Investing involves risks; decisions should be made cautiously.