Subsidies worth hundreds of billions fail to create a stir; food delivery wars don't solve e-commerce troubles

![]() 12/03 2025

12/03 2025

![]() 653

653

Image generated by Doubao AI

Synergy level stands at roughly 1%

Written by Zou Shan

Edited by Li Ji

Layout by Annalee

As winter draws near, the highly publicized food delivery wars appear to be nearing an end.

With Alibaba, JD.com, and Meituan releasing their Q3 2025 financial reports, the harsh realities of the subsidy wars are starkly evident in the data. Meituan reported a net loss of 16 billion yuan. Alibaba's operating profit plummeted by 85% year-on-year. JD.com's net profit attributable to common shareholders also dropped by 55%.

In the midst of fierce competition, while losses in battle may seem inevitable, what's been gained in exchange for real money varies. As '0-yuan milk tea' deals and 'discount frenzies' continue to drive up order volumes, the anxieties of e-commerce giants are becoming increasingly apparent. The tracks carved out through burning money are failing to create synergies with their core e-commerce businesses. Looking back at this arduous and unrewarding endeavor, it may seem more like a costly misstep in the short term.

After all, the food delivery track may look enticing, but it's tough to execute successfully.

What has been achieved with billions in subsidies?

Just how much real money has been poured into this massive food delivery war? Insights can finally be gleaned from the latest financial reports of the major players.

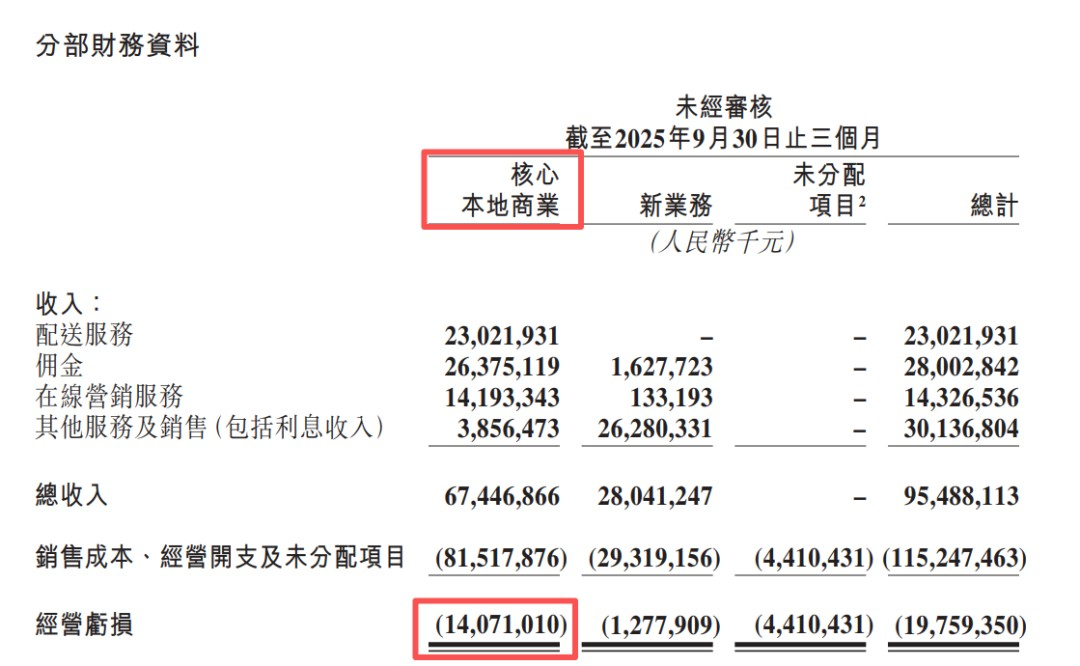

On November 28, Meituan's Q3 financial report revealed its largest quarterly loss since going public, with an adjusted net loss of 16 billion yuan, primarily due to a core local commerce operating loss of 14.1 billion yuan related to food delivery. The previously released Q2 financial report also indicated a significant profit decline in the second quarter.

Meituan's Q3 2025 financial report

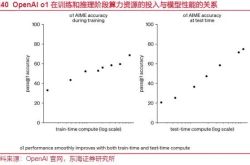

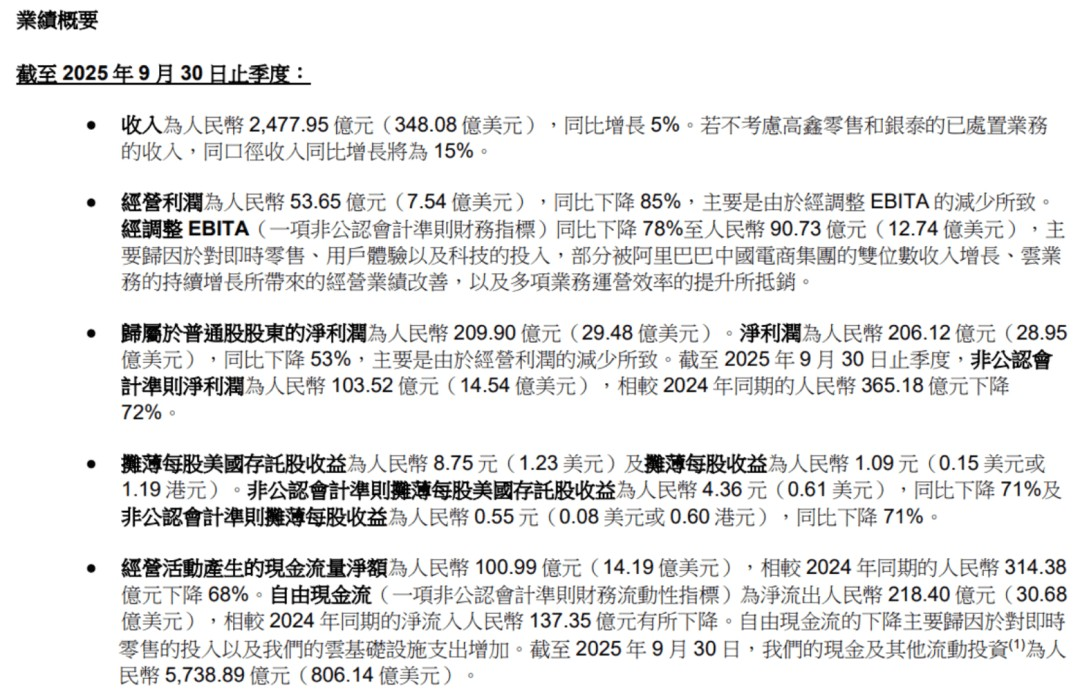

However, losses in battle aren't exclusive to the defender; the two major e-commerce giants also suffered heavily. According to previously disclosed financial reports, Alibaba's China e-commerce group reported an adjusted EBITA of 44.3 billion yuan in the third quarter of the previous year, which dropped to only 10.5 billion yuan in the third quarter of this year, a decrease of 33.8 billion yuan. Considering the 10% growth in e-commerce business in the third quarter of this year and assuming a synchronous 10% profit growth, it implies that Alibaba's adjusted EBITA for this segment decreased by approximately 38 billion yuan in the third quarter. The report also hints at this, mentioning that the profit decline is related to 'investments in instant retail, user experience, and technology'.

JD.com's financial report showed a new business loss of 15.74 billion yuan in Q3 2025, compared to a loss of 620 million yuan in the same period last year. JD.com's net profit attributable to common shareholders declined by 55% year-on-year.

Closely tied to these losses is a surge in sales expenses. Marketing expenditures for Meituan, Alibaba, and JD.com increased by 90.9%, 104.8%, and 110.5% year-on-year, respectively. The additional costs were primarily invested in subsidies and promotions for the food delivery battlefield.

Alibaba's quarterly financial report

Furthermore, if we consider the second and third quarters of 2025 as a whole, amid tough and fierce offensive and defensive maneuvers, the three giants collectively burned through nearly 80 billion yuan.

What has been gained from such massive investments?

It can't be denied that there has been significant growth in order volume and user base. Financial reports show that over the past 12 months, the number of transaction users on the Meituan platform has surpassed 800 million, with daily active users of the Meituan app increasing by over 20% year-on-year. JD.com's annual active users exceeded 700 million in October. During Alibaba's Q3 financial report conference call, Alibaba CEO Wu Yongming stated, 'The growth of instant retail has promoted rapid growth in monthly active consumers on the Taobao app and supported the expansion of customer management revenue.'

However, when e-commerce platforms pour money into the food delivery track, it's somewhat 'missing the mark'. From Alibaba management's mention during the financial report conference call that 'as of October 31, approximately 3,500 Tmall brands have connected their offline stores to our instant retail business', it's not hard to see that e-commerce platforms are more hopeful that the traffic attracted through food delivery subsidies can be effectively converted into growth momentum for traditional e-commerce, the so-called 'synergistic effect'. Previously, Alibaba partner Jiang Fan also stated, 'We are now more focused on integrating existing businesses, connecting various operations, and achieving synergies'.

As early as November 13, CITIC Securities released a research report predicting a 10%-12% growth rate in retail sales for the Double 11 e-commerce event in 2025, roughly in line with the growth rate of the 2024 promotion. Among platforms, Douyin E-commerce is expected to have the highest growth rate at 20%-25%. Pinduoduo follows at 15%. JD.com at 5%-10%. And Taobao and Tmall's GMV growth rate is above 5%.

The research report analysis, citing previously disclosed data from Taobao Flash Sales, states that new users brought in by instant retail placed over 100 million e-commerce orders during Double 11. However, after estimation, the GMV accounts for only about 1% of the total e-commerce GMV during the same period, indicating that 'the cross-selling ratio of instant retail to e-commerce is still at a low level'.

Image source: Xiaohongshu

Consumer feedback is even more telling. Previously, many users mentioned on social platforms like Xiaohongshu and Weibo that during the initial launch of Taobao Flash Sales, 'flash sale orders appearing in Taobao order records always give the feeling of opening a wardrobe and seeing a bowl of spicy hotpot.' This seems to be a microcosm of how, on the consumer side, flash sales and e-commerce remain two separate matters. In short, a consumer might use Taobao Flash Sales for a '0-yuan milk tea,' but when needing to purchase a piece of clothing or a home appliance, their first choice might still be regular delivery. This is a 'consumer inertia' that is hard to break.

A thankless task

Of course, the significant investments by e-commerce giants yielding minimal returns may be due to the food delivery track being different from what the e-commerce giants imagined. Especially if it's seen as a channel for 'draining traffic,' it's destined to be a thankless task.

Wang Puzhong, CEO of Meituan's core local commerce, also admitted in an interview with 'LatePost' that food delivery is a delicate and low-margin business model, requiring scientific methods for subsidies. Otherwise, it's extremely prone to losses.

Data supports this point. Taking Meituan as an example, its net profit for 2024 was 35.8 billion yuan, considered a reference for the profit ceiling that the food delivery industry can achieve under stable market conditions. Roughly estimated, the total annual profit for the entire food delivery industry is around 30 billion yuan. On average, during periods of easing competition, platforms may only earn a profit of slightly over 1 yuan per food delivery order. Assuming an average order value of 30 yuan, the profit margin is only around 3%-4%.

Clearly, this is a 'tough business' that typically relies on scale effects and extreme operational efficiency to survive. It's not hard to understand why this food delivery war has been dubbed 'bending over to pick up pennies' by outsiders.

Image source: QuestMobile

More importantly, as Wang Puzhong emphasized, order volume and valuable GTV are two different things. 'If you only use order volume as the sole metric, you'll find it easier than imagined. You can always achieve it by aggressively subsidizing milk tea and coffee orders and distributing coupons.' However, 'no matter how fierce the commercial war, if it fails to drive progress or even goes against commercial logic, there will be no winners in this battlefield'.

The war initiated by e-commerce platforms has precisely adopted the 'simple and crude' subsidy approach that most violates industry norms. Therefore, when subsidy wars distort the true market landscape and attract a large number of 'price-sensitive elastic consumption bargain hunters,' the focus of competition becomes abnormally centered on low-priced milk tea orders. However, the market structure of the core food delivery segment, which consists of relatively high-profit main meals, remains fundamentally unshaken.

Meituan revealed during its financial report conference call that among orders with an average order value of over 15 yuan, its market share accounts for approximately two-thirds. In the higher-priced order segment of over 30 yuan, its share even reaches about 70%.

In Morgan Stanley's latest report, based on order volume statistics, Meituan handles 71 million daily orders, accounting for 50% of the market share, followed by Alibaba with 42% and JD.com with 8%. Goldman Sachs believes that in the long run, the market share of food delivery and instant e-commerce businesses will form a 5:4:1 ratio among Meituan, Alibaba, and JD.com.

Therefore, despite the surge in subsidies, as Meituan maintains its core market, a significant portion of the subsidies from e-commerce platforms is exhausted on competing for low-value, low-loyalty orders. In this game, the simple and crude subsidy approach has proven ineffective.

Anxious e-commerce: Desperate times call for desperate measures?

So, why are e-commerce giants rushing into this low-margin track and initiating a seemingly 'uneconomical' war? The deeper reason lies less in the profitability of the food delivery track and more in the unprecedented growth anxieties faced by the traditional e-commerce industry, which has entered a consolidation phase of homogeneous supply excess and begun to shift from incremental competition to stock competition.

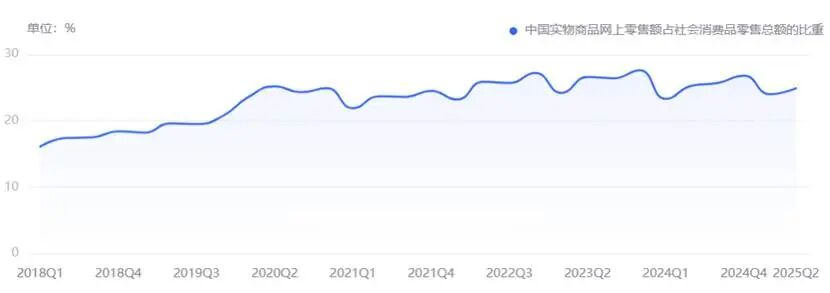

According to 'China Economic Data', since 2021, the proportion of online retail sales of physical goods in total retail sales of consumer goods has long been stable in the 24%-27% range, with online penetration growth reaching its ceiling. In the first three quarters of 2025, driven by subsidy policies, online retail sales of physical goods grew by 6.5% overall, higher than the growth rate of total retail sales of consumer goods. However, the increment was mainly concentrated in the first quarter when national subsidies were distributed. From a trend perspective, year-on-year growth rates in the second and third quarters both declined to varying degrees, with a 2.5% drop in the third quarter.

Image source: China Economic Data

At the same time, competition among major platforms continues to intensify, especially with Douyin, Kuaishou, and Pinduoduo vigorously catching up, and Xiaohongshu and Bilibili accelerating their layouts, making it even harder for top players to alleviate their anxieties. After Double 11, CITIC Securities released a research report predicting a +10% to +12% year-on-year GMV growth rate for the e-commerce sector during Double 11 (October 9 to November 11). Among platforms, Taobao and Tmall's GMV growth rate is expected to be around +5%, JD.com at +5% to +10%, Pinduoduo at around +15%, and Douyin E-commerce at +20% to +25%.

According to Guosen Securities' data, the domestic e-commerce CR2 (concentration ratio of the top two) dropped from 60% in 2022 to 57% in early 2025, while the CR5 (concentration ratio of the top five) surged from 84% to 93%, forming a 'hammer-shaped' pattern with more top players and intensified competition.

All of this is reflected in the giants' financial reports as the common dilemma of 'increasing revenue without increasing profit'. Therefore, when the original growth narrative becomes unsustainable, finding new traffic entry points and growth curves becomes a top priority. The food delivery and instant retail markets have thus become the new continents lying right before their eyes.

However, as discussed above, at least in the short term, this food delivery war aimed at resolving e-commerce growth woes seems to have missed the mark. It has used nearly 80 billion yuan in profit to verify the complexity of cross-border synergies and once again reminded the market that the essence of business is creating value rather than simply burning money for scale.

As winter winds approach, the food delivery war is gradually cooling down. Besides Meituan repeatedly stating its opposition to low-level price wars, recently, Alibaba executives also indicated at an earnings conference that they expect significant reductions in investments in Taobao Flash Sales next quarter. JD.com also emphasized balancing input and output from a more long-term perspective.

This may already be the best outcome. After all, in the long run, the anxieties of the e-commerce industry are real, but the cure may not lie in a frantic arms race outside their own boundaries. Whether it's instant retail or other new businesses, how to form genuine strategic synergies with the core business and build differentiated competitive barriers is the key to navigating industry cycles.

As the smoke of subsidies clears, e-commerce platforms must ultimately confront the essential question of growth, seeking a sustainable future in head-on confrontations of deepening industry expertise and improving efficiency. The 'pennies' picked up by bending over may quench temporary thirst but are hard to fill the growth chasm.