Will Tesla Reduce Prices If It Doesn't Cover the Purchase Tax?

![]() 12/03 2025

12/03 2025

![]() 475

475

The allure of RMB 15,000, but Tesla once again chooses not to follow.

With less than 30 days remaining until the end of 2025, sales consultants at Tesla stores are slightly busier than their 'neighbors' from many domestic brands. This is because they are frequently asked whether Tesla will follow the upcoming policy of halving the purchase tax subsidy for new energy vehicles. By 2026, buying a car may incur an additional RMB 15,000 in tax costs, and whether Tesla will follow suit or not is the question.

Of course, the sales consultants can only respond that there is currently no such plan or advise customers to wait for the new policy at the beginning of 2026. This is because, in 2023, when the national subsidy was reduced, Tesla also acted according to its own rhythm. At that time, many brands were telling consumers at the frontline of sales that car prices might rise in 2023, so it was better to buy now. However, in reality, when 2023 arrived, Tesla used an official price reduction to offset the price increase after the cancellation of the national subsidy.

Will Tesla Have a Great Opportunity by Replicating the Official Price Reduction from Three Years Ago?

Not following the trend is a common behavior of Tesla in the global market. For example, Tesla rarely participates in large-scale auto shows across the country. Furthermore, since Tesla first entered China several years ago, it has not placed any advertisements or established a traditional public relations department. Therefore, it is not particularly surprising that Tesla did not follow the new energy subsidy coverage policy this time.

Moreover, in 2023, Tesla made a price adjustment with a huge contrast, ultimately achieving a new sales record and rapidly expanding its recognition.

In 2023, the national subsidy policy for new energy vehicles expired at the end of 2022. The reduction in subsidies and the inability of vehicles priced above a certain standard (excluding battery swap models) to enjoy subsidies required automakers to bear the additional costs, prompting some automakers to generally raise car prices in 2023.

Under the 2022 national subsidy policy, plug-in hybrid vehicles received a subsidy of RMB 4,800, new energy vehicles with a range of 300-400 kilometers received a subsidy of RMB 9,100, and those with a range exceeding 400 kilometers received a subsidy of RMB 12,600.

For example, BYD announced price increases for its models ranging from RMB 2,000 to RMB 6,000, Aion announced price increases ranging from RMB 3,000 to RMB 8,000, and other brands such as Seres, Roewe, and Volkswagen's ID. series also quickly raised their prices at that time.

However, what followed was that Tesla, which did not announce a 'price increase' at the end of 2022, launched a wave of contrasting moves. In 2022, the price range of the Model 3 after subsidies was RMB 279,900-367,900, and the price range of the Model Y after subsidies was RMB 316,900-417,900. In early 2023, when major automakers began to announce price increases, Tesla significantly lowered its vehicle prices.

On January 6, 2023, the rear-wheel-drive version of the Model 3 was reduced to RMB 229,900, a decrease of RMB 36,000. The high-performance version of the Model 3 was reduced to RMB 329,900, a decrease of RMB 20,000.

It should be noted that throughout 2025 so far, Tesla has not made any price adjustments that break through the circle again. Around the Spring Festival in February this year, the rear-wheel-drive version of the Model 3 was reduced from RMB 235,500 to RMB 227,500, and the long-range all-wheel-drive version was reduced from RMB 275,500 to RMB 267,500, an amount of RMB 8,000. An insurance subsidy of RMB 8,000 was offered, and a 5-year 0% interest rate policy was introduced.

The above policies are basically the same as those in the second half of 2024. From April to June this year, Tesla's new offer in China was a subsidy for optional car paints. The subsidized prices for Quick Silver and Flame Red car paints were RMB 4,000. Since the fourth quarter of this year, Tesla's new official discounts have also been small, with a RMB 4,000 reduction in the final payment for specific Model 3 vehicles in stock.

In other words, throughout 2025, Tesla has hardly participated in the crazy price war. Currently, the refreshed version of the Model Y and the Model Y L, which account for the largest sales volume, have significant room for operation.

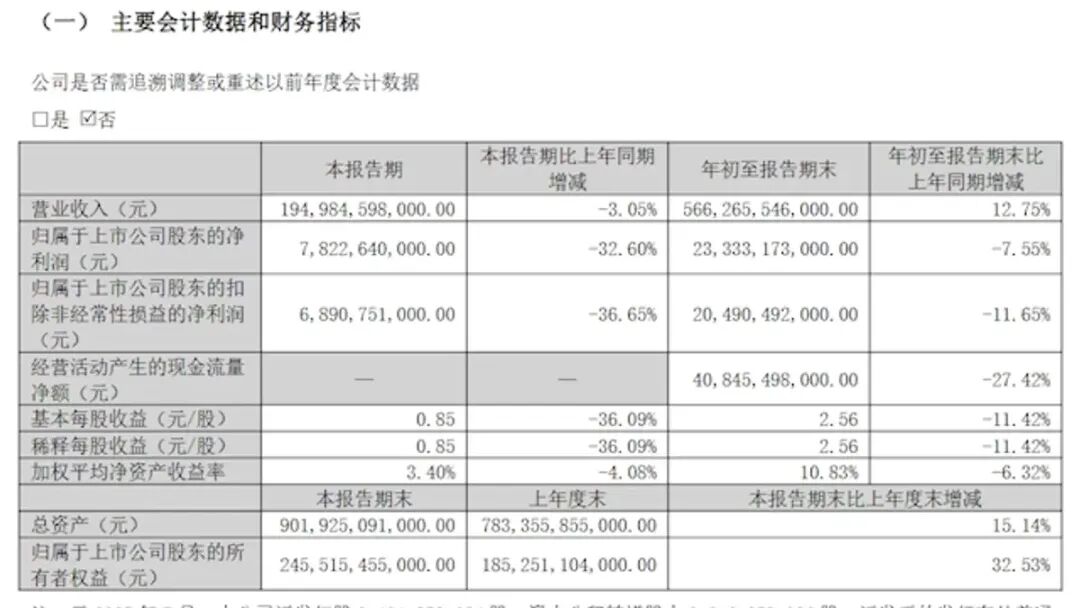

From a financial perspective, in the first quarter financial report, the total revenue was USD 19.335 billion, a year-on-year decrease of 9%, and the net profit was USD 409 million, a year-on-year plunge of 71%. In the second quarter, the revenue was USD 22.496 billion, a year-on-year decrease of 12%, and the net profit was USD 1.172 billion, a year-on-year decrease of 16%. In the third quarter, the revenue was USD 28.1 billion, a year-on-year increase of 12%, and the net profit was USD 1.37 billion, a year-on-year decrease of 37%.

Although the main trend is a decrease, the value of this set of financial data is actually not low. In BYD's 2025 financial report, the profits for the first three quarters were approximately USD 1.294 billion, USD 897 million, and USD 1.106 billion respectively, totaling USD 3.297 billion, with sales volume of 3.26 million units.

Tesla's total profit for the first three quarters was USD 2.951 billion, and the delivery volume for the first three quarters was 1.218 million units. Therefore, although Tesla's sales volume is only 37.3% of BYD's, its profit is actually 89.5% of BYD's.

In other words, even without considering Musk's wealth, Tesla itself has sufficient financial resources, so as long as it is willing, the room for operation is large enough.

Price Reductions Are Not Fearful Because Profits Can Be Earned Back

Furthermore, from a certain perspective, there is no need for Tesla to participate in the current coverage PK.

This is because the logic and focus of each company's policy announcements are different. Some are for creating an atmosphere, some are marketing moves, some are for grabbing orders, and still others are for users.

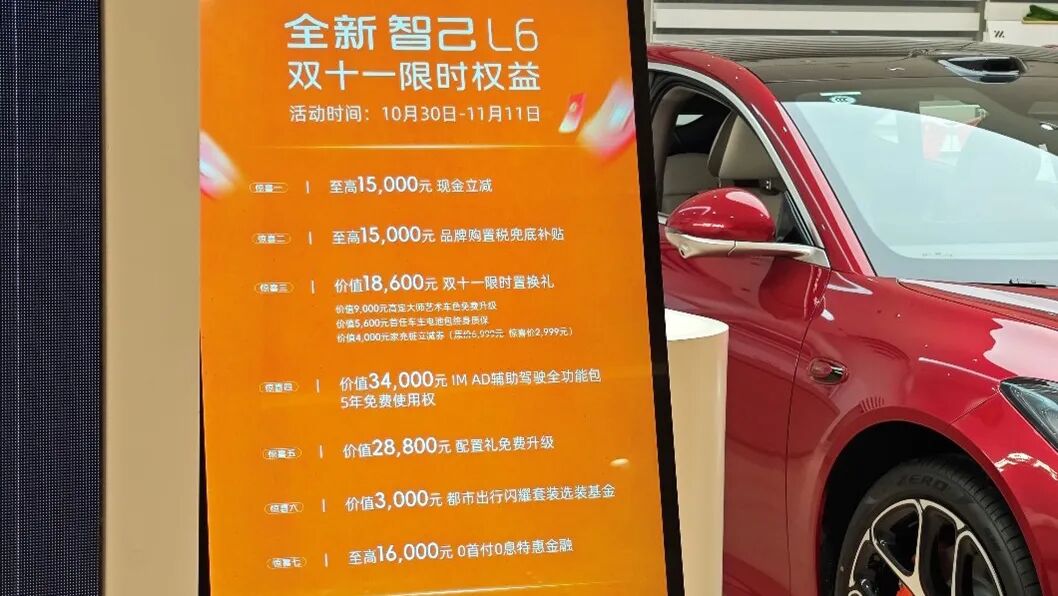

The so-called 'atmosphere group' refers to follow-up coverage. That is, when the industry is popularizing coverage policies, some companies follow suit to avoid falling behind. A notable feature of such coverage policies is that the covered models are neither hot models in short supply on the market nor do they have a deadline beyond November 30th.

The latest round of policy coverage is divided into two types: one with a deadline around December 15th and another with a real deadline of December 31st for order locking. For the former, such as the latest Roewe M7 DMH, its order locking deadline is 24:00 on December 14th. Essentially, this is equivalent to automakers trying to protect themselves as much as possible during the coverage process. In other words, it is about minimizing risks or maximizing cost-effectiveness.

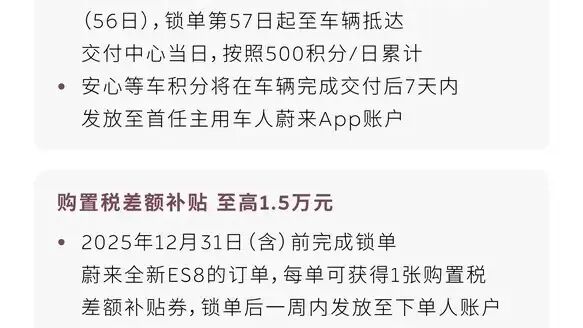

Therefore, only a few automakers choose to provide as much coverage as possible. For example, NIO's third-generation ES8 offers that if the order is locked before December 31, 2025 (inclusive), and the vehicle is invoiced and delivered in 2026 due to NIO's reasons, a 'purchase tax difference subsidy coupon' will be provided to offset part of the car price, up to a maximum of RMB 15,000. Additionally, at the Guangzhou Auto Show, Shen Fei also stated that Leapmotor will definitely have relevant coverage policies.

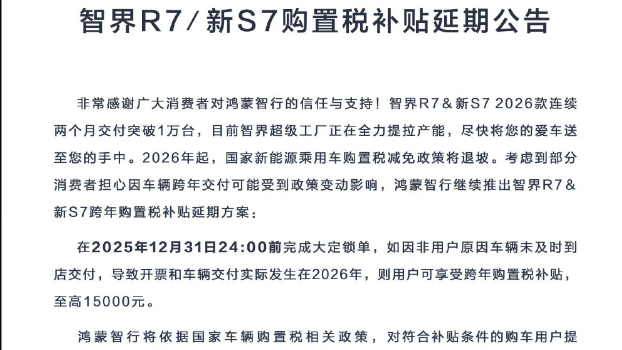

For another example, Luxeed suddenly extended and increased the coverage information for the S7 and R7 to enhance brand goodwill and truly consider consumers' perspectives.

Furthermore, from the current market sales situation, many mainstream automakers, like Tesla, choose not to participate in the coverage battle.

A summary is as follows: Besides Tesla, there are BYD, BMW, Mercedes-Benz, Porsche, Geely, XPENG, and Leapmotor. The commonality among them is that they either have sufficient production capacity or have a relatively abundant supply of vehicles in stock, so they can basically enjoy the current purchase tax subsidy policy for purchases made within 2025. However, there are also differences among them. For example, XPENG launched the extended-range version of the X9 before the Guangzhou Auto Show, and its vehicle delivery time is continuously lengthening, with some models now extended to 6-8 weeks, basically meaning they cannot be registered with 0 purchase tax.

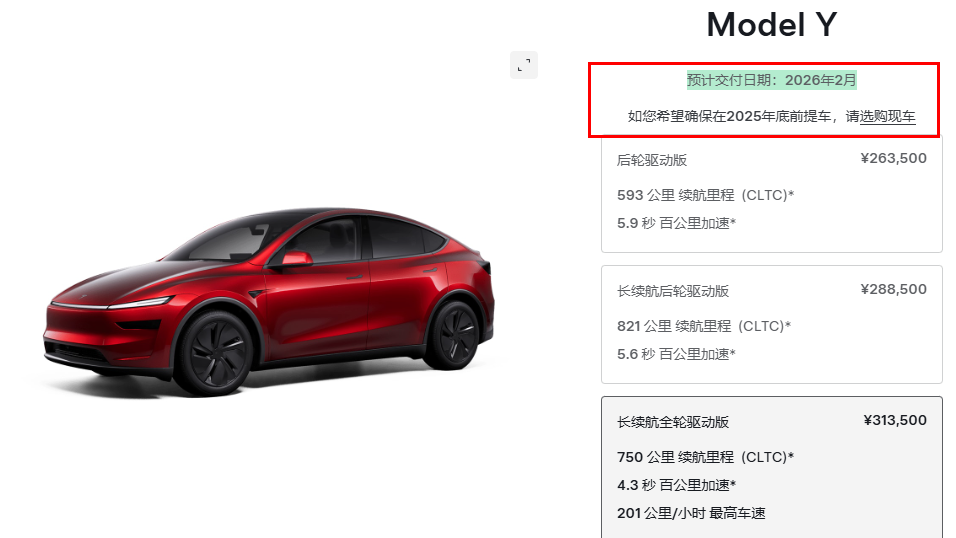

However, Tesla is somewhat different from the above companies. On December 1st, Tesla's official website was updated, indicating that the rear-wheel-drive version of the Model Y will be delivered in January 2026, and the long-range version will be delivered in February 2026. The currently most popular Model Y L will have a delivery time of 4-8 weeks.

In other words, Tesla makes no secret of its stance and does not intervene in the countdown to the new policy of halving the purchase tax. This is also traceable from a sales perspective. The latest November data shows that Tesla's Shanghai Super Factory delivered 86,700 vehicles, a month-on-month increase of over 40% and a year-on-year increase of nearly 10%. Furthermore, according to data from the China Passenger Car Association, it is estimated that Tesla China's wholesale sales volume in November was 82,432 vehicles, with 65,504 vehicles sold in the Chinese market and 16,928 vehicles exported.

In other words, this figure is slightly lower than the sum of NIO, XPENG, and LI Auto, or on par with the five brands under Harmony Intelligent Mobility Alliance. Moreover, from another perspective, Tesla has more strategies and response methods, such as the long-awaited FSD. Musk publicly stated at Tesla's annual shareholder meeting in November this year that 'partial approval has been obtained in China, and full approval is expected around February or March next year.'

This is already public information, but there are also significant variables. This is because, on July 25, 2024, during the financial report conference call, Musk also publicly stated that Tesla might obtain FSD approval in some markets, such as Europe and China, by the end of 2024. Of course, the final result did not go as smoothly as expected.

If it can be approved and launched in China, the latest progress of FSD can also be divided into two lines. Firstly, the latest version of AI5 hardware is highly likely to emerge in 2025. Secondly, its subscription price will definitely decrease, and the reduction may also exceed previous expectations.

Recently, Tesla seems to be planning a new round of upgrades for camera perception, namely the Sony IMX00N. The model currently used on the AI4/HW4 platform is the IMX963, with 5 million pixels, offering significant improvements in low-light performance and dynamic range compared to AI3. According to Musk's previous statements, AI5 is expected to undergo a minor update in 2026 and a large-scale deployment in 2027.

Regarding the price of FSD, the current price in the Chinese market is an exorbitant 64,000 yuan. Given that Tesla's sales consultants have undergone significant systemic changes since October this year, including asking all test-driving customers whether they are interested in FSD and what price they consider reasonable for FSD, among other inquiries.

In other words, if Tesla sets the price at the same level as Huawei ADS4, after accounting for subsidies from various automakers, it would currently be around 12,000 yuan. This would easily offset the impact of the policy halving the purchase tax.

Epilogue

Actually, from the current perspective, the most noteworthy aspect is not who will be providing relevant support in 2025. Instead, it is important to observe how automakers will respond starting from January 1, 2026, in order to seize the small golden period before the annual Spring Festival.

The overall situation is to prevent chaotic price wars and eliminate cutthroat competition. However, the practical need for automakers is that each company wants to secure more orders. Moreover, with the rapid popularization of Huawei's technology, the essence of the technology in more and more new cars is extremely similar. They all have ADS4 and HarmonyOS Cockpit 5. Therefore, to gain more prominent influence and user recognition, there will definitely be more variables in terms of pricing.