Indian Electric Vehicle Market: MG Closes in on Tata as Premium SUVs and Long-Range Models Dominate Competition

![]() 10/17 2025

10/17 2025

![]() 543

543

Amid the global automotive industry's shift toward electrification, the Indian market is revealing unique strategic potential. In the first half of 2025, overall passenger vehicle sales remained steady, while electric vehicles (EVs) achieved a 65.6% year-on-year surge and a near 5% monthly penetration rate. This market, once dominated by cost-effectiveness, is now entering a critical phase of accelerated EV adoption and consumption upgrade.

A recent study on India's EV market by automotive data and consulting provider JATO Dynamics revealed that in the first half of 2025, total passenger vehicle sales reached 2.9 million units, up 1.45% year-on-year. EV sales exceeded 87,000 units during the same period, soaring 65.6% year-on-year and capturing a 3.2% market share. June's monthly penetration rate rose to 4.9%, a record high, signaling that the EV wave is reshaping India's automotive landscape.

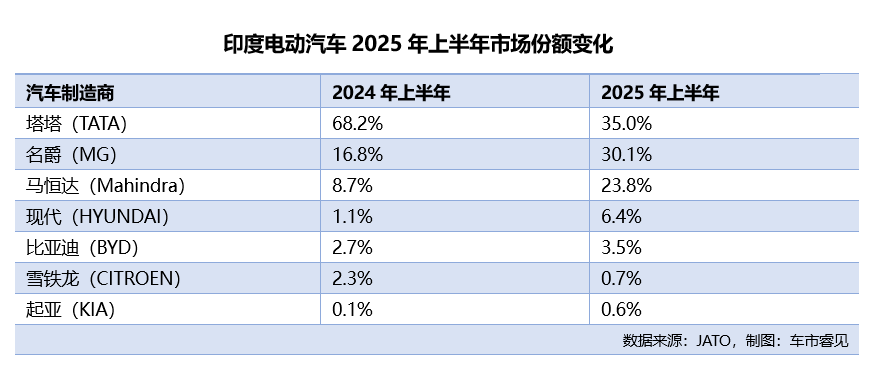

Shifting Brand Dynamics: A "Three-Way Battle" Replaces Dominance

The growth dividends of India's EV market have not been evenly distributed. While Tata Motors remains the leader with a 35% share, its dominance has significantly declined compared to the previous year. This is not solely due to Tata's sales decline but also a result of intensified market competition.

MG Motor India's market share surged from 16.8% to 30%, thanks to the strong performance of the MG Windsor, narrowing the gap with Tata. Indian automaker Mahindra secured third place with a 23.8% share, leveraging its SUV lineup to attract both lifestyle-focused users and premium buyers.

Among other brands, Hyundai's market share jumped from 1.1% to 6.4% with the launch of the Creta EV. BYD achieved rapid growth from a smaller base with models like the Seal 7/eMAX7, demonstrating potential in the premium and niche segments.

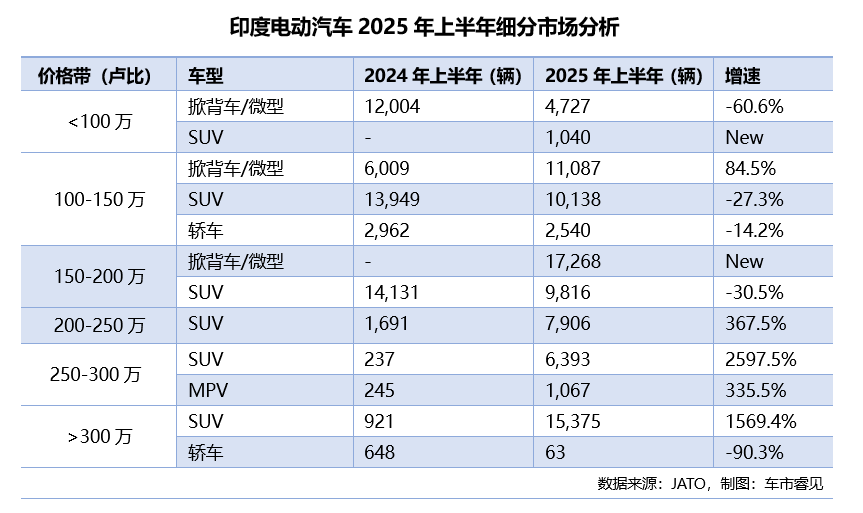

Consumer Trend Shift: Price Sensitivity Gives Way to "Range Anxiety"

The report highlights that in the first half of 2025, Indian EV consumers shifted their focus from "low prices" to "long range" and "high performance." The premium SUV segment experienced exponential growth, with sales of models priced between 2.5 million and 3 million rupees surging over 2,500%. The top-tier market, priced above 3 million rupees, also saw a 1,500% increase. In stark contrast, the mid-range SUV market (1.5 million to 2 million rupees) declined by double digits, while the micro/small EV market (below 1 million rupees) contracted sharply by over 60%.

Meanwhile, mid-to-high-end hatchbacks boosted sales in the 1.5 million to 2 million rupee segment, and MPVs achieved triple-digit growth, indicating a diversifying range of EV styles in India.

These structural changes stem from consumers' urgent demand for longer driving ranges. The study found that EVs with ranges exceeding 500 kilometers are highly sought after, driving up average prices. The market share for vehicles priced at 2 million rupees and above soared from just 3% last year to 27% in the first half of this year.

Conversely, entry-level EVs with ranges below 300 kilometers and prices under 1 million rupees saw their market share plummet from 22% to 7%. This reflects Indian consumers' growing preference for extended range capabilities, which are becoming a critical differentiator in EV purchasing decisions. The alleviation of "range anxiety" now prioritizes far above "price sensitivity," driving growth in the premium segment.

Intensifying Model Competition: Top Five Models Account for 68% of Sales

Beyond range preferences, the market is witnessing significant model consolidation, with a clear shift toward the premium price segment. Sales in the 2.5 million to 3 million rupee range surged over 1,400%, while the top-tier market (above 3 million rupees) jumped nearly 884%. In contrast, the mid-to-low-end market (below 1.5 million rupees) contracted sharply, with the sub-1 million rupee segment seeing sales halve, dropping by over 50%. This structural transformation reveals a consumer shift from merely seeking low prices to favoring products with fuller features and longer ranges.

This trend is equally evident at the model level, where market concentration has significantly increased. The top five best-selling models now account for 68% of total sales. New premium models like the MG Windsor and Mahindra XEV 9E rapidly gained market share, while most older models, except for the Tata Nexon.ev, saw sales decline. This underscores the market's demand for products that integrate innovative technology, superior performance, and outstanding user experience, rather than relying solely on established reputation.

India's EV market is undergoing a profound consumption upgrade. Market drivers have shifted from meeting basic transportation needs to pursuing longer range, better performance, and superior experience. Looking ahead, with expanded charging infrastructure, declining battery costs, and government incentives, India's EV market is poised for sustained growth.

However, the mass market still faces severe challenges, including price sensitivity, import tariffs, geopolitical risks, and uneven charging network coverage. Competition in the EV market will intensify further. International brands like Tesla and VinFast are expected to enter the fray in the second half of the year, competing head-on with BYD in the premium segment. For all market players, continuous innovation in product capabilities, balancing technology, user experience, and performance, will be essential to securing a competitive edge.

Layout 丨 Zheng Li

Source 丨 JATO Dynamics

Image Source 丨 588ku.com