Reuniting with Huawei After Parting: GAC's Decade-Long Alliance with CATL and Past Support for CALB as a Strategic Move | Mirror Pro

![]() 11/13 2025

11/13 2025

![]() 435

435

If it's conducive to growth, even if it entails a bit of awkwardness, it must be pursued wholeheartedly—this is the prevailing mindset at GAC now.

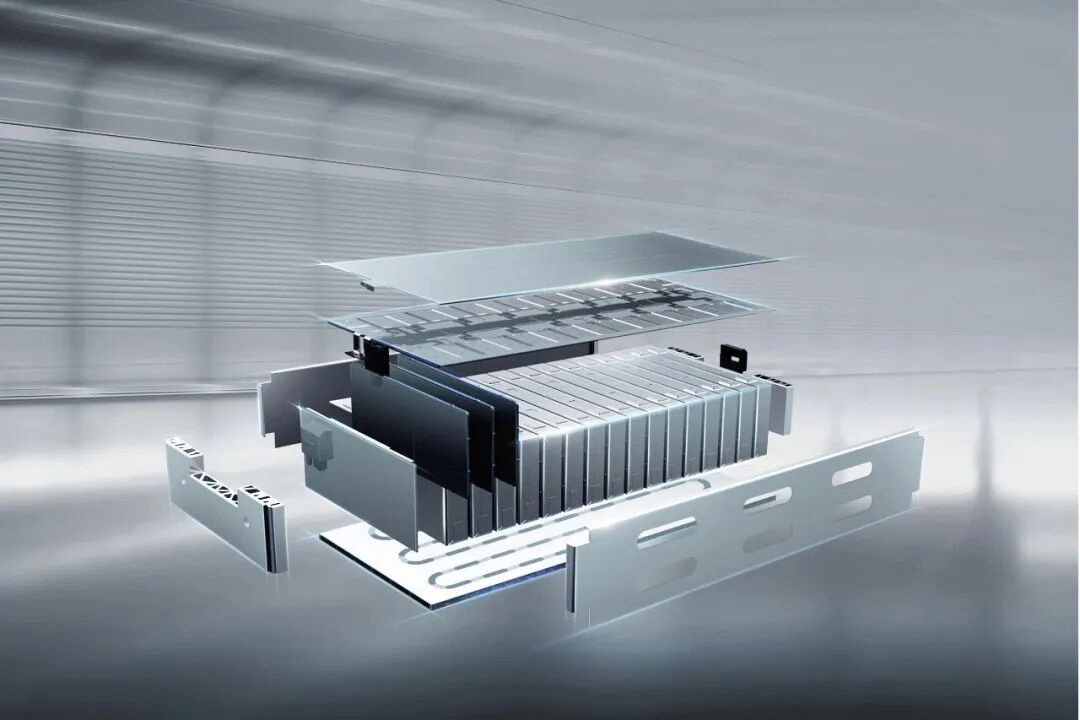

Why do we make such a statement? Let's delve into GAC's recent actions. On the evening of November 10th, GAC officially unveiled a new cooperation pact with CATL. The company announced that both entities had formally inked a 10-year comprehensive strategic cooperation agreement in Panyu, Guangdong. GAC underscored that this partnership transcends mere supply chain collaboration; it encompasses a full-spectrum co-creation spanning from technology research and development to energy ecology, with the aim of jointly laying the technological groundwork and enhancing user experience for the next generation of intelligent electric vehicles, thereby setting a new industry benchmark for long-term cooperation.

The signing ceremony, attended by GAC Chairman Feng Xingya, CATL Chairman Zeng Yuqun, and other dignitaries, underscored the significance of the event. Moreover, the direct signing of a 'ten-year' agreement by GAC and CATL signals a long-term commitment from both sides. Amidst a cordial atmosphere, both parties exchanged smiles, though many might have overlooked the fact that GAC was the first automaker to 'part ways' with CATL. Not only that, but GAC also threw its full weight behind a second-tier battery manufacturer, CALB, allocating over half of its orders to this emerging player. Currently, CALB is embroiled in a patent dispute with CATL, with the two sides locked in fierce opposition.

What led to this scenario? The roots of the story trace back to 2018. During the second half of that year, amidst a surge in new energy vehicle demand, CATL's production capacity proved insufficient to meet the burgeoning orders, severely impacting deliveries. At that juncture, GAC Aion was among the top sellers of domestic electric vehicles, and the lack of batteries meant vehicles couldn't be delivered, causing immense frustration for GAC. To mitigate reliance on CATL for battery supply, GAC sought a secondary supplier and, in this context, opted for the rising CALB.

Subsequently, GAC swiftly transitioned almost all of its battery supply to CALB. This rapid and decisive shift is understandable. In 2017, GAC's first-generation GS8 was launched and became an instant hit. However, shortly thereafter, GAC Trumpchi encountered a gearbox supply bottleneck. That year, GAC announced in a statement that due to insufficient gearbox supply capacity for the GS8, it had to curtail production volume from May to September of that year to approximately 7,000 units per month. GAC Trumpchi pledged to actively engage with gearbox suppliers and make every effort to augment gearbox supply and boost GS8 production volume. It was anticipated that normal supply would resume by October.

The GS8's gearbox was an Aisin 6-speed automatic transmission. This predicament wasn't unique to GAC; the subsequent GAC Emzoom also faced similar constraints. This resulted in GAC missing out on the prime opportunity for two potentially blockbuster products. Besides GAC, brands like Changan also felt the impact. Given this backdrop, having been stung once, GAC learned its lesson and promptly inked a cooperation agreement with CALB.

In fact, in 2024, then-GAC Chairman Zeng Qinghong even indirectly castigated CATL at a forum. Zeng remarked that automakers were essentially working for CATL. This statement, though not overtly insulting, was highly damaging, effectively placing CATL in the spotlight.

The ensuing narrative unfolded naturally. With GAC's backing, CALB's performance soared. From 2019 to 2022, GAC Group consistently ranked among CALB's top five customers, ascending from second place in 2019 to first place in 2020 and retaining that position thereafter. Seventy percent of GAC Group's mainstream electric vehicle Aion series utilized CALB batteries. Over the next three years, GAC Group signed strategic procurement agreements with CALB. Financially, GAC Group contributed 26.6% of CALB's revenue in 2019, a figure that surged to 55.1% in 2020 and slightly dipped to 51.9% in the same year.

Subsequently, XPeng, which had also abandoned CATL for similar reasons, emerged as another key customer for CALB. Through large-scale procurement, these automakers collectively nurtured CALB into a formidable force in China's battery industry. So, why did GAC opt to reconcile with CATL at this juncture? The primary reason is that GAC now seeks transformation to capture the market. Adopting the stance of 'uniting all possible forces,' GAC not only reconciled with CATL but even renewed its partnership with Huawei.

GAC and Huawei have actually maintained a longstanding cooperation. The collaboration between Aion and Huawei commenced in 2021 when Huawei was a highly coveted partner in the automotive sector. However, a contentious issue arose: whether to entrust the core 'soul' of autonomous driving to another enterprise. Amidst this debate, three automakers in the industry took the lead in partnering with Huawei. Among them, BAIC Arcfox directly adopted Huawei Inside, while Changan only vaguely promoted itself as a 'joint brand.' However, Aion and Huawei's clear definition of 'co-defining and jointly building vehicles' was deemed the most in-depth partnership.

Contrary to expectations, on the evening of March 27th, 2023, GAC Group abruptly announced that its controlled subsidiary, GAC Aion's AH8 project, would shift from joint development with Huawei to independent development. Following this change, Huawei would continue to participate as a key supplier in the development and cooperation of the company's autonomous brand vehicle models. The total investment in the project was revised from 925 million yuan to 1.233 billion yuan, with funds raised independently. This marked the official termination of the joint development model between Aion and Huawei.

The AH8 model represented the inaugural cooperation project between GAC Aion and Huawei, a mid-to-large-sized intelligent pure electric SUV. The total investment in the project stood at 780 million yuan, with the vehicle slated for mass production by the end of 2023. Calculating from the timeline, this implies the AH8 model is now on the verge of mass production. Why did this project abruptly conclude? Mirror Pro exclusively revealed in 2023 that the core reason was GAC's difficulty in integrating with Huawei during cooperation. Huawei was relatively dominant, seeking to participate in and decide on every aspect. Additionally, an irreconcilable contradiction existed: Huawei's products were prohibitively expensive and were forcefully imposed on automakers, rendering negotiations futile.

This scenario bore resemblance to the previous one with CATL. Hence, in the face of dominant component suppliers, GAC was unwilling to be subjugated. Previously, GAC could afford to assert its dominance due to its confidence in saying no, whether in terms of electric vehicle sales or operating performance. However, GAC now confronts the most challenging moment in its decades-long existence.

GAC's financial report indicates that on October 24th, GAC Group disclosed its third-quarter report for 2025. The report reveals that in the first three quarters, revenue reached 66.272 billion yuan, marking a year-on-year decrease of 10.49%. The net profit attributable to shareholders of the listed company stood at -4.312 billion yuan, reflecting a year-on-year decrease of 3691.33%. In the third quarter, revenue was 24.106 billion yuan, a year-on-year decrease of 14.63%. The net profit attributable to shareholders of the listed company was -1.774 billion yuan, a year-on-year decrease of 27.02%.

In response to this performance, GAC's transformation has already commenced and is now deemed a period of reform pain. Last year, GAC Group sounded the horn of the 'Panyu Action,' initiating a self-reform that cuts to the core. Last year, GAC Group's headquarters relocated from Guangzhou CBD to Hualong, Panyu, enabling decision-makers to 'hear the gunfire.' It launched a three-year 'Panyu Action' to drive the enterprise's transformation from a 'strategic control type' to an 'operational management type,' achieving higher decision-making efficiency, faster market response speed, and lower operational costs.

During this transformation, GAC requires more partners to bolster its development, especially in the realm of high-end models, where Huawei and CATL have become indispensable standards. GAC's development necessitates the support of these leading component suppliers. From this vantage point, GAC's choice is undeniably correct.