Japanese Cars Lose Ground in Southeast Asia, Retreat to India

![]() 11/13 2025

11/13 2025

![]() 568

568

"Chinese Electric Vehicles Launch Fierce Offensive"

Compiled by | Yang Yuke

Edited by | Li Guozheng

Produced by | Bangning Studio (gbngzs)

Japanese automakers such as Toyota, Honda, and Nissan are beginning to shift their focus to the Southeast Asian and Indian markets.

On November 7, 2025, Honda lowered its full-year forecast by 20%, citing U.S. tariffs and a shortage of Amperes chips. However, for Honda and other Japanese automakers, an even greater threat comes from Chinese electric vehicle manufacturers.

The Southeast Asian market is a prime example. There, Japanese automakers have long held a dominant position, unrivaled by any others. Until recently, Japan firmly believed it could protect its Asian operations outside of China from the downturn experienced in the world's largest market.

Now, that assumption no longer holds.

Noriya Kaihara, Executive Vice President of Honda Motor, stated at a November 7 press conference: "The Thai market is fiercely competitive, and we have lost our pricing edge against Chinese automakers."

Declining sales are just the beginning. Kaihara noted that as automakers attract buyers through increased incentives and price reductions, profits will be even slimmer.

An industry insider, who spoke on condition of anonymity, said that competition from Chinese electric vehicle manufacturers such as BYD in regions like Thailand and Indonesia is making it increasingly difficult for Japanese automakers.

Speaking before Honda released its results, the source said, "Southeast Asia has been significantly impacted by Chinese companies. Over the past two years, the growth of Chinese electric vehicles in Thailand has been astonishing."

According to Honda, from January to September this year, its sales in Indonesia fell nearly 30% year-on-year, while sales in Malaysia and Thailand dropped by 18% and 12%, respectively.

More unfavorably, from the current fiscal year to the next, Honda has no plans to introduce new models in Southeast Asia beyond updating the City sedan—potentially risking further market share loss to Chinese manufacturers.

Data released by Voice of Indonesia (VOI) shows that from January to October 2025, total vehicle sales in Indonesia reached 635,844 units, down 10.6% from 711,064 units in the same period last year. Toyota once again led with 202,376 units sold, capturing a 31.8% market share. BYD from China sold 30,670 units, ranking sixth.

As challenges intensify in Southeast Asia, Honda is shifting its strategy to India—a market nearly closed to China—as a key manufacturing hub and export base.

Japanese automakers are investing billions of dollars in new facilities and expanding operations in India. The country is transforming into a vital hub for Japanese automotive exports.

In recent years, Japanese automakers, once highly influential in China, have begun scaling back or closing their Chinese operations. Nissan announced it would shut down its Dongfeng Nissan plant in Wuhan, China, by the end of March 2026. In July, Mitsubishi Motors exited the Chinese market.

▍01 Southeast Asia's Backyard Ablaze

The surge in sales of affordable Chinese electric vehicles is breaking Japanese automakers' decades-long monopoly in Southeast Asia.

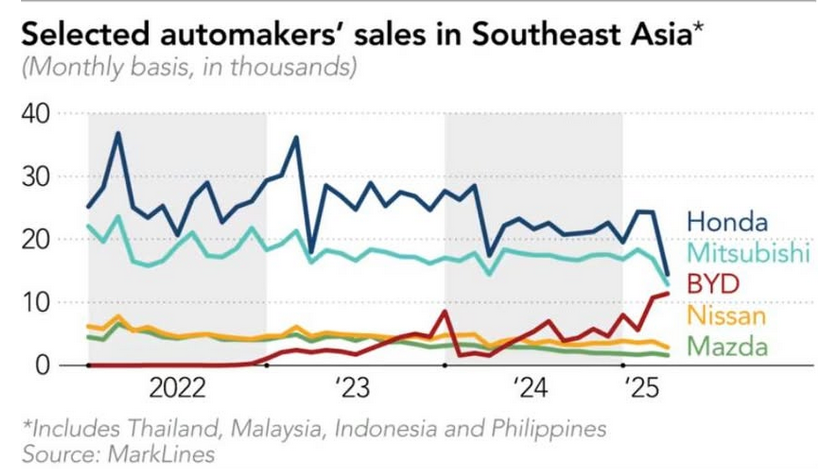

PwC data shows that in the first half of 2025, the market share of Japanese automakers—led by Toyota, Honda, and Nissan—in the six largest Southeast Asian markets dropped from 73% in 2021 to 62%. In this market with annual sales of 3.3 million units, Chinese automakers' share has grown from negligible to over 5%.

Facing fierce domestic price wars, Chinese electric vehicle manufacturers are setting their sights on Southeast Asia. Meanwhile, a free trade agreement allows their vehicles to enter the market duty-free.

Patrick Ziechmann, a PwC partner in Malaysia, believes the arrival of Chinese electric vehicle manufacturers signals the end of Japan's unchallenged dominance in Southeast Asia.

Ramesh Narasimhan, former head of Nissan's Thai operations, said that with China launching an offensive in Japan's "backyard," Japanese automakers will continue to lose market share. Previously, they were almost "a sure bet" in Southeast Asia.

In Narasimhan's view, Chinese automakers can easily adopt pricing strategies to boost sales and market share. "Soon, you'll see this across the entire Southeast Asian market," he said.

Indonesia, Southeast Asia's largest consumer market with a population of approximately 280 million, has seen exponential growth in Chinese vehicle sales, despite a decline in overall local sales due to economic challenges.

Japanese automotive brands remain market leaders, but their sales are declining month by month. From January to August this year, Toyota's sedan and truck sales in Indonesia fell 12% to 161,079 units. During the same period, BYD's local sales reached 18,989 units.

The key to Chinese companies' success lies in their affordably priced electric vehicles. Chinese cars in Indonesia start at as low as 200 million Indonesian rupiah (approximately $12,000).

"This is the decisive factor," said Jongkie Sugiarto, Vice Chairman of the Indonesian Automotive Industry Association. "The Japanese must act, or they will lose more and more market share."

Indonesia is home to 15 Chinese brands, with five more expected to enter the market. Sugiarto added that at least three companies have established local production facilities, while the rest assemble vehicles through local partners, including his own company.

Chinese companies also benefit from incentives provided by the Indonesian government, including exemptions from electric vehicle import tariffs. However, these preferences will end next year, with manufacturers required to produce locally to receive subsidies.

For smaller Chinese automakers, qualifying for subsidies poses a challenge. Thailand's Finance Ministry warned Chinese electric vehicle brand Neta that if the ratio of locally produced vehicles to imports does not reach 2:3 by the end of this year, the government may have to withdraw subsidies.

In Singapore, the offensive by Chinese automotive brands is becoming even more pronounced. BYD has become this year's best-selling brand, surpassing long-time market leader Toyota, which held a 25% market share in 2023.

Government efforts to improve electric vehicle infrastructure, combined with the entry of Chinese automotive brands, have led more Singaporeans to switch to electric vehicles. BYD seized this opportunity by partnering with bars and restaurants to establish lavish showrooms in malls and downtown areas.

"There have been some changes in the Singapore market," said Adam Mirza, Managing Director of Prestige Auto Export, which distributes Japanese vehicles. Japanese brands "have accepted the fact that they cannot compete with Chinese brands in the electric vehicle sector."

Chinese electric vehicle manufacturers also hope to leverage their leading position in automotive software technology, an area where traditional Japanese automakers have been slow to develop. In February, Chinese startup XPeng began shipping its X9 model to Singapore, a vehicle capable of smartphone-controlled parking.

"Southeast Asia is a market full of potential," said Gu Hongdi, Vice Chairman and Co-President of XPeng.

Jessada Thongpak, Deputy Head of S&P Global Mobility's ASEAN division, believes China's progress in Southeast Asia could be replicated elsewhere.

Thailand is also undergoing transformation. Last year, Subaru closed its plant, and Suzuki plans to shut down its factory by the end of 2025. In August, BYD exported its first vehicle from Thailand to Europe.

Liu Xueliang, General Manager of BYD's Asia-Pacific Automotive Sales Division, said that while Japanese automakers have helped drive economic growth in the region, "we will let consumers decide who the ultimate winner is."

▍02 India Emerges as a Temporary Safe Haven

Japanese automakers are turning to India, a market largely closed to Chinese electric vehicle manufacturers.

As Japanese automakers continue to restructure their supply chains to reduce reliance on China, manufacturers such as Toyota, Honda, and Suzuki are investing billions of dollars to build new vehicles and factories in India. This marks the growing importance of India as a manufacturing hub.

Toyota, the world's largest automaker, announced it would spend over $3 billion to expand its plant in southern India and build a new factory in Maharashtra, western India. Production is expected to begin before 2030. Once completed, its Indian capacity will exceed 1 million units.

Suzuki leads India with a nearly 40% market share. The company plans to invest $8 billion to increase annual production from 2.5 million to 4 million units. Its local subsidiary, Maruti Suzuki, has become India's best-selling brand and largest exporter.

Honda has just designated India as a production and export hub for one of its upcoming "Zero Series" electric vehicles. These electric vehicles will be shipped to Japan and other Asian markets starting in 2027. CEO Toshihiro Mibe ranks India as the world's second most important automotive market, after the United States but ahead of Japan.

Japanese direct investment in India's transportation sector grew sevenfold from 2021 to 2024, reaching 294 billion yen (approximately $2 billion) last year. In contrast, Japanese investment in China's transportation sector fell 83% during the same period to 46 billion yen.

In the last fiscal year, India produced approximately 5 million passenger vehicles, with exports growing by 15% and domestic sales by 2%. Over the past three fiscal years, the country's economy has grown at an average rate of 8%. The Narendra Modi government actively provides incentives and protectionist policies to foreign manufacturers.

These protective measures have been particularly advantageous for Japan. India has effectively blocked Chinese investment, prevented the entry of new Chinese brands, and limited the expansion of existing companies such as SAIC's MG and BYD.

In India, Japanese automakers face no competition from Chinese electric vehicle manufacturers, at least for now. Therefore, India can be considered a temporary safe haven for Japanese automakers.

Julie Boote, a London-based automotive analyst at Pelham Smithers Associates, believes India is a good alternative to the Chinese market. "For now, the Japanese see this as a better market because they don't have to face Chinese competitors," Boote said.

Toyota and Suzuki each hold majority stakes in their Indian subsidiaries. Honda owns 100% of its Indian operations.

Currently, Toyota is collaborating with Japanese and Indian suppliers to maintain low costs while expanding hybrid component production. This year, India faced a supply shortage of hybrid components amid soaring demand.

A senior executive at a major Toyota supplier said, "Toyota has localized its products, focusing less on global specifications and more on local ones."

Last week, Reuters reported that Toyota plans to launch 15 new and updated models in India by 2030 and deepen its rural network. Its goal is to capture a 10% share of the passenger vehicle market by 2030, up from the current 8%.

Toyota President Koji Sato said at last week's Japan Mobility Show, "The Indian market is extremely important and will certainly grow in the future."

"India's protectionist stance toward its neighbors is a bittersweet blessing for Japanese automakers," said Gaurav Vangaal of S&P Global Mobility, describing this unique opportunity for Japanese automakers in India.

The outflow of Japanese automobiles from China seems irreversible, and India's appeal extends far beyond its protectionist stance. India offers the low costs, vast labor force, and government support that China once provided. For Toyota, Honda, and Suzuki, India is not just an option—it is becoming the core of their global manufacturing strategies.

(This article combines reports from Automotive News, Reuters, Outlook Business, VOI, and Technology ORG. The featured image is sourced from Nikkei Asia, with some images from the internet.)