Additional tariffs ranging from 17.4% to 38.1%, who are the automakers targeted by the EU's trade sanctions?

![]() 06/14 2024

06/14 2024

![]() 538

538

Introduction | Lead

Although the EU has not been as harsh as the US in targeting Chinese electric vehicles, the imposition of temporary tariffs ranging from 17.4% to 38.1% is enough to suffocate Chinese automakers breaking into the European market and cast a shadow over China-EU economic and trade relations.

Produced by | Heyan Yueche Studio

Written by | Li Suwan

Edited by | Heyanzi

3536 words in full

4 minutes to read

The EU's trade sanctions have finally been imposed, disregarding repeated persuasions.

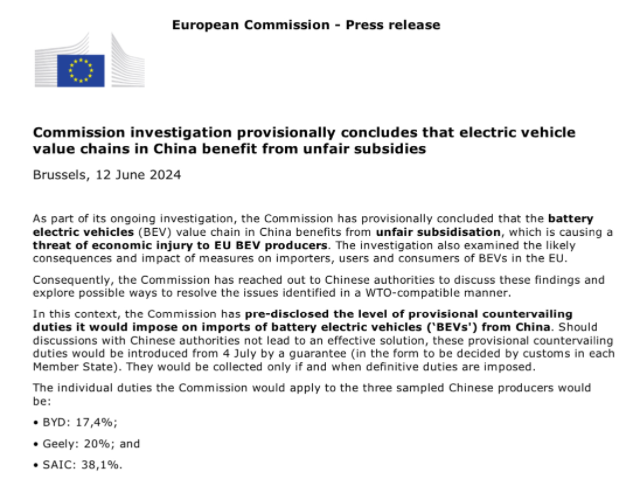

On June 12, the European Commission (hereinafter referred to as "EC") announced in a statement that it would impose additional tariffs of up to 38.1% on electric vehicles imported from China starting next month. Following the US's increase in tariffs on Chinese electric vehicles to 100%, the EU will also join the list of imposing high tax rates.

△EC announcing the preliminary ruling on the anti-subsidy investigation into Chinese electric vehicles

Regarding the EC's imposition of temporary anti-subsidy tariffs ranging from 17.4% to 38.1% on electric vehicles originating in China starting in early July, the Ministry of Commerce and other parties all voiced their opinions on June 12. A spokesperson for the Ministry of Commerce said that the EU disregarded the facts and WTO rules, ignored China's strong opposition on multiple occasions, and disregarded the appeals and dissuasion of multiple EU member governments and the industry. China is highly concerned and strongly dissatisfied with this, and the Chinese industry is deeply disappointed and resolutely opposed. China will closely monitor subsequent developments and will resolutely take all necessary measures to firmly defend the legitimate rights and interests of Chinese enterprises.

The European Union Chamber of Commerce in China believes that this measure will not only severely damage the legitimate rights and interests of Chinese and European automotive companies and automotive supply chain companies, distort the fair competitive environment for Chinese electric vehicle companies in the European market, but also impact the normal economic and trade exchanges between China and Europe in the automotive and related fields. Its "spillover effect" will further challenge China-EU economic and trade relations and bilateral relations.

Leading European automakers such as BMW, Volkswagen, and Mercedes-Benz have also expressed their positions on this matter. Oliver Zipse, the Chairman of BMW Group, said that the European Commission's decision to impose tariffs on Chinese electric vehicles is wrong. Imposing tariffs will hinder the development of European automakers and also damage Europe's own interests. Trade protectionism is bound to trigger a chain reaction: responding to tariffs with tariffs and replacing cooperation with isolation. For BMW Group, protectionist measures such as increasing import tariffs cannot help the company enhance its global competitiveness. BMW Group firmly supports free trade.

Which automakers are "hindered"

In its statement, the EC indicated that the tariffs imposed on the three sampled Chinese producers BYD, Geely Automobile, and SAIC Motor would be 17.4%, 20%, and 38.1%, respectively. Other battery electric vehicle producers participating in the investigation but not yet sampled will be subject to a weighted average tariff of 21%.

△Chinese electric vehicle exports face many uncertainties

Chinese automakers are gradually emerging on the international stage with their increasing competitiveness, and Europe is one of the important markets for Chinese brands to "go global." Chinese automakers such as Geely, SAIC, and BYD are continuously striving to expand their European market share. Volvo, Polestar, Lynk & Co, and Lotus, multiple brands under Geely, form an "international team" and occupy a place in the European market. According to data from Dataforce Automotive Consulting, Geely Group sold a total of 348,000 vehicles in Europe in 2023, making it the tenth largest automaker in Europe. MG, a household name in Europe, is SAIC's trump card. In 2023, MG sold 231,300 vehicles in Europe alone, achieving triple-digit sales growth for three consecutive years. Although BYD lagged behind Geely and SAIC in sales in the European market in 2023, selling only 15,588 cars, its current momentum for electric vehicle exports is robust. Since September 2022, BYD has introduced multiple new energy models to 20 European countries including Germany, the UK, Spain, Italy, France, the Netherlands, Norway, and Hungary. Currently, BYD has opened over 250 stores in Europe.

However, facing the aggressive Chinese electric vehicles, European trade protectionism is on the rise and raising the trade stick. In addition to BYD, Geely, and SAIC on this list of increased tariffs, there are also many other Chinese automakers exporting electric vehicles to Europe, including FAW, Aichi, JAC, Chery, Xpeng, Dongfeng, and Zero Run. Industry insiders have pointed out that adding an additional tax rate of over 20% to a car on top of the existing 10% import tax will still have a significant impact on Chinese enterprises.

△Chinese electric vehicle exports to Europe will be impacted by high tax rates

According to foreign media reports, a new analysis suggests that if the EU imposes tariffs on Chinese electric vehicles, it could cost China nearly $4 billion in trade losses with the EU. Recently, the Kiel Institute for The World Economy cited its latest research report, stating that if the EU imposes a 20% import tariff on Chinese electric vehicles, the number of Chinese electric vehicles imported by the EU will decrease by a quarter, or about 125,000 vehicles. Meanwhile, sales of locally produced cars may increase by the same amount.

A survey conducted by the European Union Chamber of Commerce in China shows that for most Chinese automakers, the EU imposing tariffs of more than 10% would be a high range, which would have a direct negative impact on their exports to Europe. The current temporary tariff range of 17.4% to 38.1% represents a severe market access barrier. China is the largest market for electric vehicle production and sales globally, with domestic sales far exceeding the combined sales in Europe and the US. Exports of electric vehicles to Europe account for only about 5% of China's electric vehicle production, and most of them are European and American brands. The market share of Chinese independent electric vehicle brands in the European market is also far lower than that of European local enterprises.

It is worth noting that even European and American automakers in China cannot escape the EU's "severity." This list also includes specific manufacturing bases such as Asia Europe Automobile Manufacturing (Taizhou) Co., Ltd., Zhejiang Haoqing Automobile Manufacturing Co., Ltd., SAIC Volkswagen/SAIC GM Co., Ltd. This means that the temporary tax rate applies not only to Chinese brands but also to the export products of Volvo, smart, Volkswagen, and GM's locally produced pure electric vehicles in China. Meanwhile, the EC also stated that after the application is confirmed, Tesla, a BEV producer in China, may receive a separately calculated tax rate at the final stage.

How to face the blocked "exports"

Affected by factors such as trade frictions between China and the US and Europe, China's new energy vehicle exports have started to cool down. Data released by the China Passenger Car Association shows that in May, China exported 94,000 new energy vehicles, a year-on-year decrease of 4.0% and a month-on-month decrease of 18.8%. They accounted for 24.8% of passenger car exports, down 6.8 percentage points from the same period last year. Among them, BYD's export volume in May was 37,499 vehicles, a certain decline from its April export volume of 41,011 vehicles.

The US imposing tariffs of up to 100% on Chinese electric vehicles undoubtedly basically blocks Chinese electric vehicles from entering the US market. And the EU imposing high punitive tariffs next month will be even more devastating for Chinese electric vehicle exports. Since the EC officially launched an anti-subsidy investigation into imported passenger battery electric vehicles originating in China on October 4, 2023, although Chinese automakers do not recognize the original intention of the EU investigation, they have still fully cooperated with the EU investigation process, filling out questionnaires to the best of their ability, and cooperating with the EU's inspections of Chinese automakers' factories and business premises in China and Europe.

△If the EU imposes tariffs, the cost of local consumers purchasing Chinese-made electric vehicles will also increase

Multiple companies and stakeholders have反映that the EU abused its investigative powers during the investigation and engaged in improper investigative actions, including some investigative directions and areas exceeding the scope of the anti-subsidy investigation, making unreasonable and excessive demands on companies beyond their ability to provide evidence, and not giving companies and various stakeholders sufficient time to respond and provide evidence. In addition, there are inaccuracies in many of the EU's "subsidy" allegations. At several hearings held in Brussels, Chinese automakers and relevant parties raised questions about the issues that emerged during the investigation, but the EU did not respond.

The European Union Chamber of Commerce in China has always believed that the advantage of China's electric vehicle industry lies in technological innovation and cost management. Through continuous technological iteration and fierce market competition, relying on China's overall supply chain advantages, it has developed strong market competitiveness, helping to transform electric vehicles, a green product and technology, into a public good that is conducive to global green transformation. The advantages of China's electric vehicle industry are definitely not formed by subsidies. The chamber is concerned that the EU's insistence on promoting the investigation and imposing temporary anti-subsidy taxes, a trade protectionist approach, may lead to an escalation of trade frictions between China and Europe, destabilizing economic, trade, and business relations between the two sides, and calling on China and Europe to jointly seek solutions through dialogue and consultation.

The EC stated this time that the sampled companies have received information about their own calculations and have the possibility to comment on their accuracy. If these final comments provide sufficient rebuttal evidence, the EC can modify its calculations in accordance with EU law. Any other Chinese production enterprises that are not selected for the final sample and wish to investigate their specific circumstances may request an accelerated review under the basic anti-subsidy regulations after the implementation of the final measures (i.e., 13 months after the initiation).

The EC has only announced the tax rates this time and has not yet announced the specific composition of the tax rates. Chinese automakers are considered to still have some room for defense. On July 4, the temporary anti-subsidy tariffs will be imposed in the form of guarantees (the form will be determined by the customs of each member state). The EC will make a final ruling on the anti-subsidy investigation into pure electric vehicles imported from China before November 2.

In addition to continuing to actively respond to the lawsuit and argue based on reason, relevant automakers also need to make more adequate preparations on the path to internationalization. Market diversification is one of the effective ways for enterprises to avoid trade barriers. BYD is working towards this aspect and has entered more than 400 cities in over 80 countries and regions worldwide.

△BYD accelerates its pace of international market diversification

Moreover, setting up factories overseas can also help circumvent trade barriers such as high tax rates. Automakers such as BYD, SAIC, and Chery are actively planning factories in Europe. BYD, which has already invested in factories in overseas markets such as Brazil and Thailand, is preparing for large-scale investment plans in Europe, with an investment amount that may reach several billion euros, covering areas such as factories, sales network construction, and brand marketing. Currently, BYD's first European automotive plant is scheduled to go into production next year in Hungary, and plans to start studying the location of a second plant in the coming months. BYD plans to surpass Volkswagen, Tesla, and Stellantis to become the largest electric vehicle seller in the European market by 2030.

However, building factories in Europe will face higher costs and complex issues such as industrial chain construction. Compared to building factories, future technology licensing will become a new way for Chinese automakers to go global. Some Chinese automakers that are leading in electrification and intelligent technology can expand their revenue by cooperating with European local automakers and adopting technology licensing or permitting methods, which is also an effective way to avoid trade frictions. However, many Chinese automakers are currently not technologically leading globally, mainly relying on high processing and assembly efficiency. This path may not be feasible for most Chinese automakers for the time being.

Commentary

The EU's decision to impose taxes on Chinese electric vehicles is a double-edged sword. Once the temporary tariffs are implemented, although it can block many Chinese-made electric vehicles in the short term, it will significantly increase the cost of purchasing electric vehicles for European consumers. In addition, it will also have a negative impact on Chinese and European companies in areas such as electric vehicle supply chains, innovative research and development, and market cooperation. For Chinese electric vehicles, the high trade barriers in the two major auto markets of Europe and the US have significantly increased the difficulty of "going global." However, facing trade barriers is an inevitable path to internationalization. Chinese automakers, in addition to continuously improving their internal capabilities, can also draw on the practices of leading multinational automakers that have preceded them on the path to internationalization to a certain extent.

(This article is original content from "Heyan Yueche" and may not be reproduced without authorization.)