Can Mercedes-Benz Break Free from the 'Non-Mainstream EV' Stigma?

![]() 11/19 2025

11/19 2025

![]() 465

465

Are BBA electric vehicles priced over 200,000 yuan truly a compelling choice?

"We boast a diverse lineup of electric vehicles, and while it might seem a bit intricate, we're far from being non-mainstream EVs," quipped Duan Jianjun, President and CEO of Beijing Mercedes-Benz Sales Service Co., Ltd., at the launch event of the all-new electric CLA. His self-deprecating opening remark was a direct response to market controversies.

This candid admission underscores the collective predicament faced by BBA (BMW, Benz, Audi) in their transition to new energy. Once firmly seated at the pinnacle of luxury during the fuel era, BBA now grapples with unprecedented challenges amidst the electrification wave, even being labeled by consumers as "traditional luxury brands that can't craft decent electric vehicles."

All-New Electric CLA (Photography/Liu Shanshan)

Facing fierce competition in China's burgeoning new energy market, BBA is collectively recalibrating its strategy: on one hand, it's actively lowering the price positioning of its luxury brand, bringing electrified product prices down to the mainstream range of 200,000-300,000 yuan; on the other, it's forging alliances with local tech firms like Momenta to address intelligence deficiencies.

Notably, on November 11, the Beijing Municipal Internet Information Office unveiled the notice on filed information regarding generative artificial intelligence services in Beijing. The 'Mercedes-Benz Virtual Assistant' large model, filed and recommended by Beijing and developed by Mercedes-Benz (China) Automotive Sales Co., Ltd., received approval from multiple national departments, including the Central Cyberspace Affairs Commission. It became one of the first batch of large model products from foreign enterprises approved for nationwide launch and the first in Beijing.

After a comprehensive overhaul in terms of pricing and product prowess, does BBA, with its stronger brand clout, emerge as a superior choice for consumers?

Isn't purchasing a Mercedes-Benz for over 200,000 yuan an enticing proposition?

If the previous query about 'non-mainstream EVs' mirrored the market's skepticism towards luxury brands' electrified offerings as 'falling short of expectations,' the debut of the all-new electric CLA can be seen as Mercedes-Benz's direct rebuttal to this feedback.

As the first mass-produced model from Mercedes-Benz's MMA pure electric platform, the vehicle's product strategy clearly exhibits a 'strengthening weaknesses' approach. Addressing past controversies over the range and charging efficiency of luxury brand EVs, it features an 800V high-voltage electrical architecture, an 866km range under CLTC conditions, low energy consumption of 10.9kWh/100km, and the ability to 'recharge for 10 minutes and gain 370km of range,' all aligning with the mainstream core demands of China's new energy market and narrowing the performance gap with domestic and emerging players.

In terms of pricing strategy, Mercedes-Benz's 'downward shift' this time carries significant industry implications. The 200,000-300,000 yuan range is a fiercely competitive 'red ocean' in China's new energy market, featuring bestsellers like BYD Han, XPeng P7i, and Tesla Model 3. Luxury brands previously focused mostly on the market segment above 300,000 yuan, but the starting price of 249,000 yuan for the all-electric CLA breaks this established boundary, and this price is even 10,000 yuan lower than the pre-sale price. Notably, the Mercedes-Benz all-electric CLA Champion Limited Edition, endorsed by Olympic champion Wang Chuqin and priced at 299,900 yuan with a global quota of only 100 units, sold out instantly upon its launch in the live streaming room, with even the accompanying charity little lion pendants being snapped up simultaneously.

All-New Electric CLA (Photography/Liu Shanshan)

The strategic pivot in the intelligence domain is one of the core highlights of Mercedes-Benz's transformation this time. Mercedes-Benz has opted to collaborate with Momenta, a Chinese local intelligent driving enterprise, to equip the all-electric CLA with standard features such as urban and highway pilot assist driving, intelligent assist parking, and other practical functions. Simultaneously, it has deepened its cooperation with ByteDance, leveraging its AI technological capabilities. These series of moves convey Mercedes-Benz's unequivocal stance of actively embracing China's local supply chain and technological ecosystem.

It's worth mentioning that the 'Mercedes-Benz Virtual Assistant' large model, which has just secured approval from the Central Cyberspace Affairs Commission, can support services such as voice dialogue, intelligent navigation, and cabin control for Mercedes-Benz's all-new electric CLA model by harnessing the AI generation capabilities of Douyin's (Chinese TikTok) 'Cloud Sparrow' large model. It is expected to serve 70,000 vehicles annually by 2026.

According to Mercedes-Benz, every component of this all-new electric CLA, except for its name, has undergone redevelopment and redesign. For instance, Mercedes-Benz invested 25 million yuan in researching and developing a single door handle, increasing the number of weld spot inspections to three times the industry standard; a seat underwent 1,460 days of refinement, meeting over 6,000 standards in a systematic engineering project, undergoing more than 1,800 digital simulation tests and 40,000 durability tests; chassis development commences from CAD design and necessitates completing global durability verification of 5 million kilometers, including 1.1 million kilometers in China.

Launch Event of the All-New Electric CLA (Photography/Liu Shanshan)

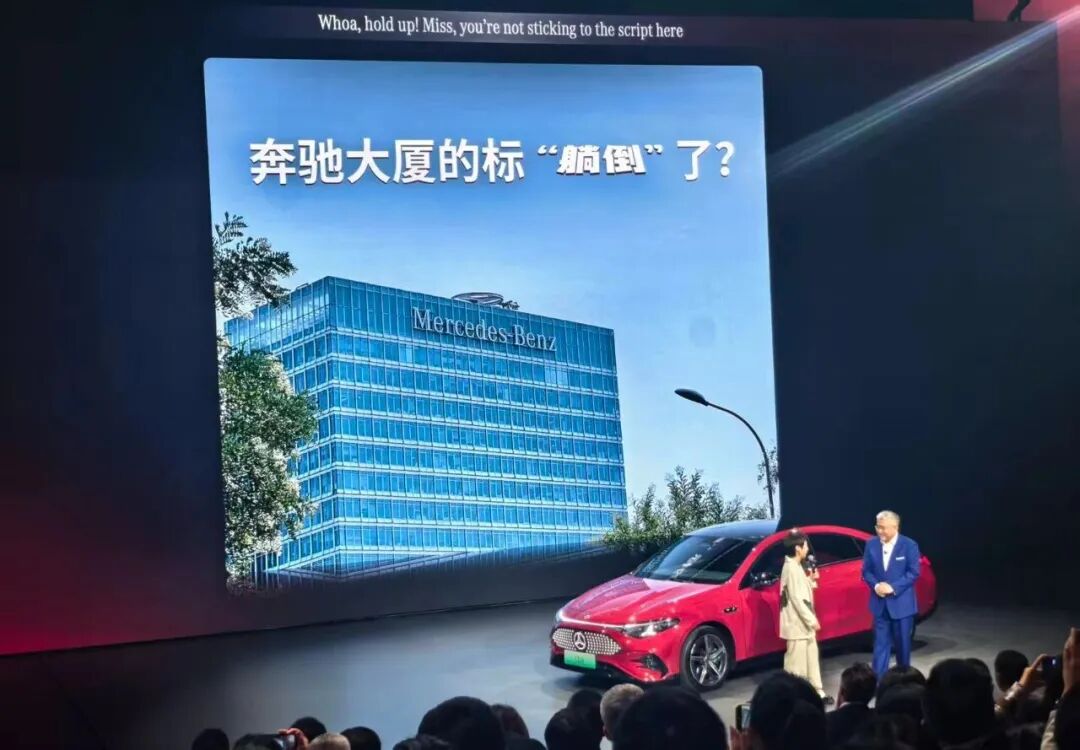

This technological confidence also imbues Mercedes-Benz with a sense of 'ease.' At the launch event, Duan Jianjun joked about the incident where the LOGO on the rooftop of Mercedes-Benz China's headquarters 'strategically laid flat' due to strong winds: 'The LOGO didn't topple; this is called strategic lying flat—it can lay flat when stability is needed and rise again when ascension is required.'

Can the new energy market rebound from its slump?

Prior to this, traditional luxury brands represented by German BBA, including the EQ series, i series, and e-tron series, lagged behind domestic high-end electric vehicles in terms of both technological accumulation and product influence, with market performance far less dominant than their fuel vehicle counterparts.

Amidst market transitions, BBA delivered its 'worst' financial results in recent years in the first half of 2025: Mercedes-Benz's revenue declined by 8.6% year-on-year, with net profit plummeting from 6.087 billion euros to 2.688 billion euros; BMW's revenue dropped by 8%, and after-tax net profit decreased by 29%; Audi's revenue increased by 5.3%, but net profit fell by 37.5%, falling into a dilemma of 'increased revenue but decreased profit.' All three companies admitted in their financial reports that intense competition in the Chinese market was the core influencing factor, with some brands even lowering their full-year performance expectations.

The dual pressure of sales volume and profit stems from a complete overhaul of the market landscape. Before 2021, BBA held over 60% of the domestic luxury car market share, with Mercedes-Benz selling 759,000 vehicles in China in 2021, BMW 846,000, and Audi 696,400, an unassailable position.

However, this landscape was disrupted by the new energy wave. According to data released by the third-party market research company 'Jielanlu,' in 2024, Mercedes-Benz's average transaction price per vehicle was 431,000 yuan, down 7.2% from 2023. BMW and Audi also saw declines in their average transaction prices in 2024, to 340,000 yuan and 297,000 yuan, respectively.

Previously, the market above 300,000 yuan was the main battleground for BBA's fuel vehicles. However, entering a new cycle, after BBA ventures into the 200,000-300,000 yuan electric vehicle market, it needs to adjust not just its strategy but also its mindset. After all, this price range is teeming with competitors, including several new car-making forces established just a few years ago.

Nevertheless, unlike the fuel vehicle era when consumers often prioritized entry-level configurations for cost-effectiveness and tended to add other features later, the intelligence driving level has now become a core indicator for consumers to consider cost-effectiveness, and they no longer blindly favor the lowest configuration version. In this context, embracing China's local supply chain and technological ecosystem has become a common choice for BBA. Currently, Audi is deepening its cooperation with Huawei, focusing on intelligent cockpits and autonomous driving; Mercedes-Benz and BMW, on the other hand, are partnering with local tech companies like Momenta to accelerate the localization and iteration of intelligent technologies.

Currently, Mercedes-Benz remains the 'preferred brand for users in the 1 million yuan and above and 1.5 million yuan and above segments.' This also indicates that among consumers at the top of the pyramid, traditional luxury brands still wield significant influence. Moreover, their century-old accumulated manufacturing processes and after-sales services remain key factors attracting rational consumers.

In any case, BBA's 'strategic adjustment' has already unveiled new possibilities to the market. When BBA's century-old luxury genes deeply integrate with China's local intelligent technologies and user insights, they may not be able to recreate the absolute dominance of the fuel era, but they will undoubtedly inject new competitive vitality into the new energy market. And ultimately, the consumers wielding the power of choice will be the beneficiaries.