Imposing Anti-Subsidy Duties on Chinese Electric Vehicles? The EU is Really in a Hurry!

![]() 06/14 2024

06/14 2024

![]() 561

561

Introduction

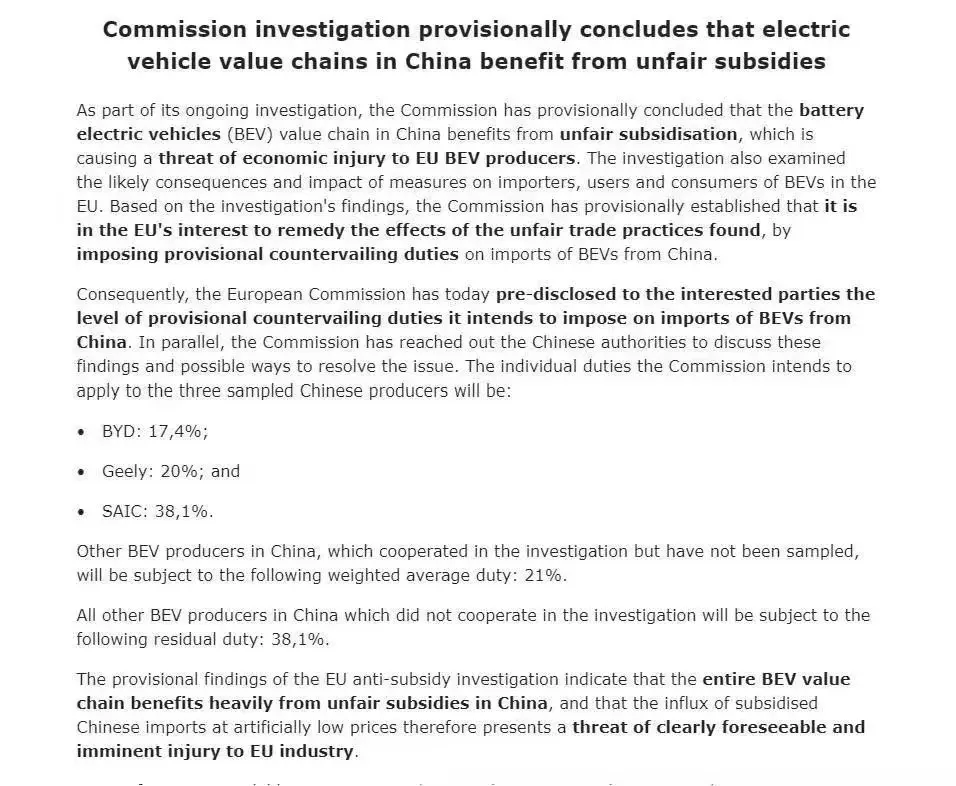

Just on June 12, the EU announced the news of imposing anti-subsidy duties on Chinese electric vehicles, which has caused a stir and is now widely known. The specific news is as follows:

The European Commission has stated that it will impose anti-subsidy duties of 17.4%, 20%, and 38.1% on the sampled three enterprises - BYD, Geely Automobile, and SAIC Motor respectively; a 21% average anti-subsidy duty will be imposed on electric vehicle manufacturers that participated in the investigation but were not sampled; and a 38.1% anti-subsidy duty will be imposed on electric vehicle manufacturers that did not cooperate with the investigation.

Not to mention that many people have never heard of this "anti-subsidy duty," the tax rate of up to 38.1% is truly outrageous!

Facing the aggressive exports of Chinese new energy vehicles this year, is Europe really in a hurry this time?!

Let's first give everyone a brief introduction to anti-subsidy duties.

The Origin and Development of Anti-Subsidy Duties

Upon investigation, it turns out that this anti-subsidy duty is truly unprecedented and created by the EU itself!

Anti-subsidy tariffs are actually a trade remedy measure under WTO rules, used to offset the unfair competitive advantage gained by foreign goods due to government subsidies.

To restrict the import of Chinese electric vehicles, the EU has created such a tax category as "anti-subsidy duty" out of thin air, truly showing disregard for its own reputation in pursuit of the development of its domestic automakers!

The origin of this incident dates back to the second half of last year.

On October 4, 2023, the EU initiated an anti-subsidy investigation into Chinese electric vehicles on the grounds of "overcapacity" to determine whether to impose tariffs.

The main targets of the investigation at that time were BYD, SAIC Motor, and Geely Automobile.

According to the process, the final ruling will be issued within 13 months of the investigation's initiation. Therefore, relevant experts analyzed last year that during the investigation period, the EU could impose temporary anti-subsidy duties.

Now, this shoe has finally dropped.

According to the EU's announcement, if a resolution cannot be reached through negotiations with China, then this "anti-subsidy duty" will come into effect on July 4.

It should be noted that the EU originally imposes a 10% tariff on all imported vehicles.

And this anti-subsidy duty is an additional increase on top of that 10%. This means that an electric vehicle from BYD exported to Europe will need to pay a total of 27.4% in tariffs; while a car under Geely will reach 30%; SAIC Motor is most affected, reaching as high as 48.1%.

These increased tax burdens will be borne by importers of products from relevant Chinese enterprises, which means that European car importers will inevitably reduce the import of Chinese electric vehicles in order to avoid risks.

The implementation of this policy indicates that the competitiveness of Chinese electric vehicles in the European market will face a test.

Why is it specifically imposed on China?

In recent years, developing a green economy, new energy vehicles are undoubtedly an excellent track. And it is a common practice worldwide to support emerging industries, not unique to us.

Currently, all countries have subsidy policies for new energy vehicles, so why is it that only China is subject to anti-subsidy tariffs?

China's current new energy subsidy policy is: exemption from purchase tax, with 100% exemption for car prices below 351,000 yuan, and only the excess portion being taxed for prices above this.

The latest electric vehicle subsidies in the United States are divided into two tiers of $3,750 and $7,500, with the difference in subsidy amounts mainly related to the source of vehicle manufacturing and components.

Frankly speaking, the fundamental reason for imposing tariffs on China is that the rapid growth of China's new energy vehicles and their significant influence in the European market have attracted the attention of the EU. In the past three years, China's new energy vehicle exports have increased fourfold, surpassing South Korea, Germany, and Japan successively, forcing the EU to treat China specially!

Meanwhile, the sales of European domestic automakers are not optimistic.

And such competitive protection is not unique to the EU. Not long ago, the Turkish Ministry of Trade just announced that it will impose an additional 40% tariff on cars imported from China; the US government announced in May that it would increase the tariff rate on electric vehicles imported from China from 25% to 100%.

The large-scale cross-border sales of Chinese electric vehicles, compared to other countries, have caused significant market distortion effects on the EU's domestic industries, which has become the main reason for the EU to impose anti-subsidy tariffs specifically on China.

In a recent statement, the European Union Chamber of Commerce in China pointed out that there are obvious signs of political manipulation and unilateral protectionism in the EU's investigation into Chinese electric vehicles, which is also an important reason.

Why is the tariff on SAIC the highest?

Different manufacturers face different anti-subsidy tax rates this time.

SAIC faces the maximum tax rate of 38.1% this time.

Why, among so many Chinese automakers, did SAIC become the biggest scapegoat that the EU severely abused?

One has to look at some data on the overseas sales of Chinese automakers in 2023.

In 2023, the overseas sales of Chinese automakers reached 4.68 million vehicles, of which SAIC alone sold 1.2 million vehicles, accounting for more than a quarter of the market.

In 2023, the total delivery volume of Chinese automakers in the European and British markets was 324,000 vehicles, while SAIC accounted for over 75% with 243,000 vehicles. The EU is not stupid, they shoot the bird that sticks out its head, who else would they sanction?

Therefore, the announced anti-subsidy tax rates are:

SAIC, 38.1%

Geely, 20%

BYD, 17.4%

The greater the ability, the greater the responsibility.

This electric vehicle tax rate is clearly positively correlated with the automaker's market share in the export market. As the leading exporter of electric vehicles to Europe and the UK, SAIC bears more responsibility, which is understandable.

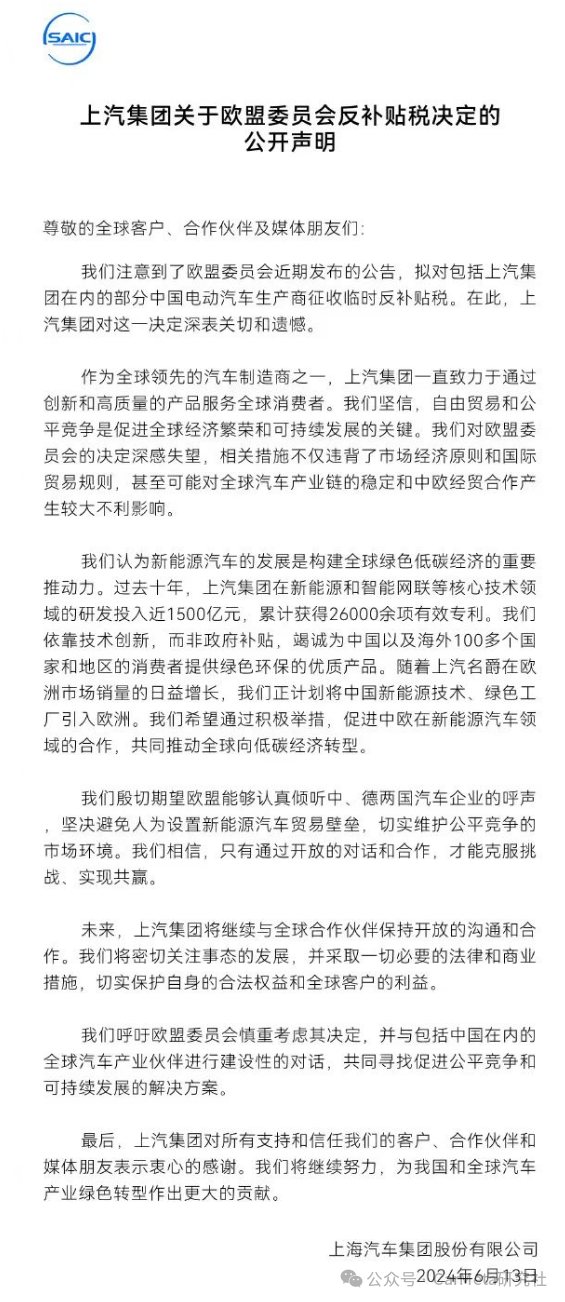

Let's take a look at how SAIC responded:

Between the lines, there is deep helplessness and sighs.

Where is the path for Chinese automakers to go overseas?

A spokesperson for China's Ministry of Commerce clearly stated that the EU's ruling on China's electric vehicle industry lacks sufficient factual and legal basis. The European Commission ignored the fact that the competitive advantage of China's electric vehicle industry is based on market openness and fair competition, disregarded the rules of the World Trade Organization, and disregarded the active cooperation of Chinese enterprises.

The EU is considered to have artificially constructed and exaggerated the so-called subsidy issue, abused the investigation rules, leading to an unfair high subsidy margin ruling, which is seen as blatant protectionism. Such behavior not only creates and intensifies trade frictions but also destroys fair competition in the name of maintaining it, which is extremely unfair.

Moreover, the EU's approach not only infringes on the legitimate rights and interests of China's electric vehicle industry but may also cause interference and distortion to the global automotive industry chain and supply chain, including within the EU.

For the EU's approach of disregarding WTO rules, disregarding the dissuasion of member states, disregarding industry appeals, and acting unilaterally, China is strongly dissatisfied, firmly opposed, and has issued a warning.

However, apart from opposition, there are currently no substantive measures against this. So where is the path for Chinese automakers to go overseas?

The EU's anti-subsidy tariff policy will pose even greater challenges to the export of China's new energy vehicles, with costs increasing visibly.

If subsidies fade away and oil and electricity have equal rights, how much competitiveness will our electric vehicles still have?

The journey of electric vehicles going overseas is a long and arduous one.

In addition to strengthening independent innovation, enhancing product competitiveness, and actively expanding diversified markets, we must also find ways to reduce dependence on policy changes in a single market.

Facing existing and potential tariff barriers, perhaps Chinese electric vehicle companies going overseas can explore new ways to reduce trade frictions and enhance competitiveness by investing locally to achieve localized production.