“Make the car bigger to survive”

![]() 11/24 2025

11/24 2025

![]() 541

541

Introduction

In the future Chinese auto market, those who dominate large cars will dominate the market.

No one could have imagined that the “Goat City” in November would be so chilly.

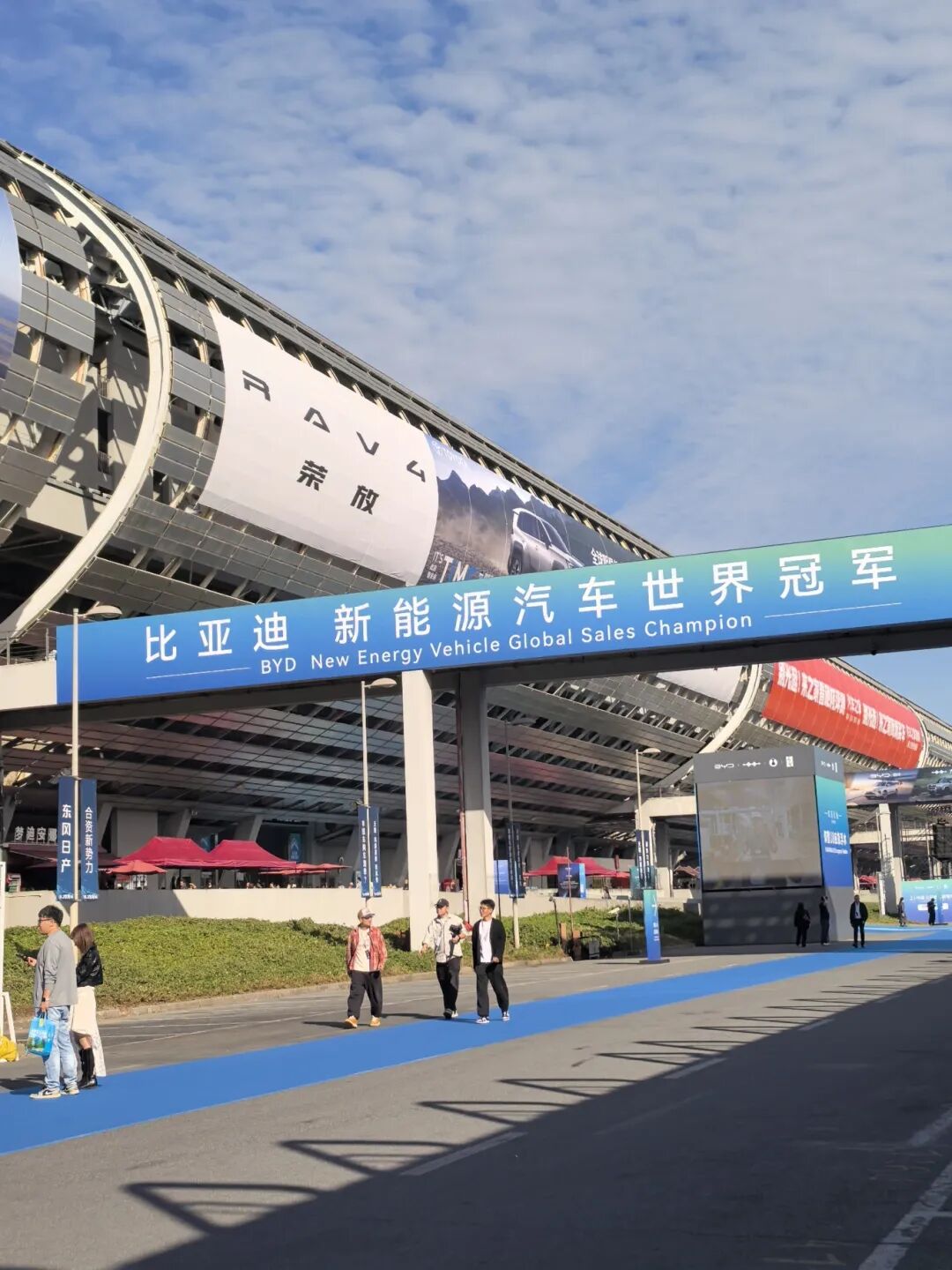

If my memory serves me right, after seven years in the industry, this is the “coldest” Guangzhou Auto Show I have attended. Of course, I am referring solely to the temperature, just the literal meaning. Because as soon as you step into the Pazhou International Convention and Exhibition Center, you can quickly sense the enthusiasm, intense competition, and even the ruthlessness of the Chinese auto market.

It's no exaggeration to say that I've never seen such a “crazy” battlefield in any major global market segment. Here, everyone has to fight for their share in a thorny forest.

Currently, the wave of electrification transformation is irreversible, and new energy vehicles have become the absolute trendsetter and protagonist. This year's Guangzhou Auto Show has reinforced this feeling even more.

As I walked past each brand's booth, new energy vehicles almost firmly occupied the center stage. From the volume of publicity to the number of new products, from comprehensive sales to strategic significance, new energy vehicles undoubtedly hold an absolute advantage.

As the saying goes, “It's clear who is shaping the future.”

Precisely because of this backdrop, many of the game rules established during the era of traditional fuel vehicles are being thoroughly overturned and reshaped. For instance, the classification of product levels and pricing.

In the past, sedans, SUVs, and MPVs were generally categorized into A00 micro passenger vehicles, A0 small passenger vehicles, A compact passenger vehicles, B mid-size passenger vehicles, C large passenger vehicles, and D full-size passenger vehicles based on their overall dimensions. Each vehicle class also tended to fall within a relatively stable price range.

But now, everything has started to blur. Take this year's Guangzhou Auto Show as an example, and you'll notice a prominent phenomenon. The “size” of new energy vehicles is becoming increasingly exaggerated.

Especially SUVs, with models boasting lengths exceeding 5.2 meters and wheelbases surpassing 3.1 meters becoming commonplace. Moreover, their pricing is very aggressive, with some directly entering the sub-200,000-yuan range.

The underlying message seems to be, “Make the car bigger to survive.”

01 Chinese People Love Big Cars

Why, in the era of electrification, are cars being made bigger and bigger?

The most fundamental reason lies in consumer preference. By chance, I came across a viewpoint stating, “With rising income levels, gradually relaxed fertility policies, and China's vast land area, Chinese car-buying habits will increasingly resemble those of the North American market.”

In other words, large cars, especially large SUVs, will gradually take center stage. Indeed, in recent times, I've clearly noticed that many friends around me have started purchasing or trading in for such products.

The reasons they gave align with the aforementioned viewpoint. “We need a car that can accommodate the whole family, carry luggage, drive well and look imposing, save money, and have power.”

From a product development perspective, if making large cars was challenging in the era of traditional fuel vehicles due to powertrain limitations and thresholds, it's now relatively easy.

Currently, with Chinese automakers fully mastering the entire new energy supply chain and various core technologies, making large cars has become straightforward.

Whether it's plug-in hybrids, extended-range electric vehicles, or pure electric vehicles, relying on these three power forms perfectly solves the issues of high energy consumption and usage costs.

Moreover, in my view, the essence of electrification is to disrupt the past rigid landscape with stronger configurations, better experiences, and lower prices, providing a more fertile ground for new energy large cars to enter thousands of households.

In any case, the entire process resembles a mutual pursuit between users and automakers.

At this year's Guangzhou Auto Show, after communicating with numerous brands, a consensus emerged: “New energy vehicles will continue to grow in size.” Taking large three-row SUVs as an example, next year, there will be more than one product with a length exceeding 5.3 meters, a wheelbase approaching 3.2 meters, and an even more exaggerated sense of scale.

When it comes to making large cars, never underestimate the determination and ambition of Chinese automakers.

Reading this far, some might worry about the cars being cumbersome to drive and difficult to maneuver. To that, I can only say, “The widespread adoption of rear-wheel steering can fully address your concerns.”

Some might question whether standard parking spaces will be sufficient, let alone multi-story car parks. To that, I can only say, “On the one hand, assisted parking can resolve some extreme scenarios. On the other hand, as the number of vehicles increases, it will inevitably drive the renewal and upgrading of supporting facilities.”

Some might criticize the increasing size and weight, suggesting road maintenance fees should be paid. To that, I can only say, “Next year, the subsidy for new energy vehicle purchases will be halved. Subsequently, the Chinese auto market will achieve complete parity between fuel and electric vehicles, so there's no need to rush.”

Of course, if you ask whether there's an upper limit to making large cars, personally, I believe there will be size limitations due to regulatory requirements, but almost none in terms of demand. After all, the “cake” corresponding to the Chinese auto market is incredibly enticing and vast.

For many consumers, the mindset of pursuing large cars is similar to that of pursuing large houses. Moreover, the threshold for acquiring the former is much lower than the latter.

Therefore, for various automakers attempting to stay in the game, making cars bigger is essential to qualify for the final competition. Failing to understand this, the market will surely deliver a harsh lesson.

02 Selling Big Cars Is Not Easy

At this year's Guangzhou Auto Show, NIO's booth featured the “hero”—the all-new ES8.

At the neighboring booth, Leading Ideal's L90 took center stage. It must be acknowledged that the popularity of these two large three-row SUVs has temporarily pulled this new energy vehicle manufacturer back from the brink.

A few days ago, I read an article analyzing the all-new ES8, which contained several interesting details that resonated with today's topic.

Firstly, the second-generation ES8's failure was largely attributed to its awkward size—too small for Chinese consumers and too large for Europeans.

Secondly, when planning the all-new ES8, although NIO decided to make a large car, there were internal disagreements over the specific size. One faction believed in going all-out with a length of 5.3 meters, while another thought that although Chinese consumers prefer large cars, an excessively large size might affect purchasing decisions, suggesting a length of around 5.2 meters.

Thirdly, from a user's perspective, making a car bigger might seem straightforward, but in reality, the larger the car, the higher the expectations for interior space, and the greater the technical and engineering challenges.

The central message I gathered was, “Making large cars is undoubtedly the trend, but the intricacies involved are far more complex than imagined.”

Focusing on this year's large six-seater SUV market, with the launch of the LanTu Taishan, all players have essentially revealed their cards. A rough estimate shows that no fewer than 20 “gamblers” have entered the fray, to the point where almost every automaker is venturing into this category.

However, judging by the current performance, apart from a few leaders who have stood out, most participants have become what can be described as “cannon fodder.”

What have I deduced from this? The answer lies in the subtitle of this section.

Further elaborating, taking large six-seater SUVs as an example, to sell them successfully at a premium, besides having no significant flaws or shortcomings at the product level, corresponding support must be provided in marketing, service, charging infrastructure, and delivery. Meanwhile, the brand's image often influences consumers' final decisions.

In comparison, if there's no significant advantage in these areas, then another approach must be taken: lowering expectations and adopting a low-price, low-margin strategy to drive sales.

In any case, selling large cars might seem easy, but it's full of challenges. Many automakers, eyeing others' success, believe they can do it too, only to find it's not that simple.

Next year, as mentioned earlier, more large cars will flood the Chinese auto market, intensifying the already fierce competition in this red ocean and further escalating the battle in the large six-seater SUV market.

Take Li Auto, for example.

It will undoubtedly strive to regain as much ground as possible lost this year with the all-new L9. From the currently available information, a larger body size, self-developed intelligent driving chips, 5C ultra-fast charging large battery, active suspension, and a brand new interior design will all be featured.

This new energy vehicle manufacturer understands that only with the return of the all-new L9 can it break free from the current predicament. Otherwise, the vicious cycle will only worsen.

Take Xiaomi, for example.

After firmly establishing itself in the pure electric vehicle sector with the SU7 and YU7, leveraging the extended-range electric vehicle sector to initiate a second growth curve has become the most urgent task for Lei Jun.

It's foreseeable that the much-anticipated large six-seater SUV will launch a relentless offensive to secure a leading position.

Take Huawei, for example.

According to leaks, next year, HarmonyOS Intelligent Connected Vehicle will launch various large cars, including models from AITO, Luxeed, STELATO, SHANGJIE, and MAEXTRO.

Few automakers in the Chinese auto market can withstand such a dimensional strike.

Brands like NIO, XPENG, ZEEKR, Avatr, and IM Motors will also vigorously compete in the large car market, including large six-seater SUVs, pushing the competition to a white-hot stage.

At this year's Guangzhou Auto Show, the intense rivalry was already palpable.

Everyone is quietly strategizing and openly preparing, fully aware that in the future Chinese auto market, “those who dominate large cars will dominate the market.” Regardless of who they are, they must have one or several flagship large cars to serve as a foundation, around which other lower-tier products can be developed.

At this juncture, making cars bigger is not just about survival but also about achieving better results.

The same logic applies—for Chinese consumers, the mindset of pursuing large cars is identical to that of pursuing large houses. It's both a form of self-validation and a means to meet demands, representing consumption upgrading. The only difference is that the threshold is much lower, and the demand is much stronger.

During NIO's exclusive interview, Li Bin emphasized more than once, “The golden age of extended-range large three-row vehicles has passed, and the golden age of pure electric large three-row SUVs has arrived.” In my view, the underlying logic is akin to, “The showdown for large cars in the Chinese auto market has slowly begun.”

By 2026, the winners and losers will become clear.

Editor-in-Chief: Li Sijia Editor: Wang Yue

THE END