They are all suffering, but Emma's situation is much worse than Yadea's

![]() 01/13 2026

01/13 2026

![]() 643

643

Source: YuanSight

Emma, the second-largest player in the electric bicycle market, has recently found itself at the center of a layoff controversy.

Recently, according to Economic Observer, multiple departments at Emma Technologies have undergone significant staff optimizations, with the high-end brand "SCOOX" and international business divisions seeing their workforce halved. After-sales, e-commerce, and other departments have also been affected. Additionally, the SCOOX business will relocate from Tianjin to Chongqing, but affected employees will not receive subsidies. The company has also required employees to sign contracts transferring their employment to third-party outsourcing firms.

In response, Emma stated that the claim of a 50% layoff is seriously inconsistent with the facts and is suspected of exaggeration and misdirection. The company noted that it conducts annual personnel adjustments at the end of each year as part of normal human resource management practices.

The timing of these layoff rumors does indeed contradict Emma's previous operational performance, especially considering that in the first three quarters of 2025, Emma achieved revenue and net profit growth exceeding 20%. Although the company officially denied the significant layoff claims, even as an industry leader, Emma must adjust its expectations in the new industry cycle following the implementation of the new national standards.

01

After reaping the benefits

Like Yadea, the industry leader, Emma was among the first electric bicycle companies to benefit from the "new national standards."

In December last year, the transition period for the "Safety Technical Specifications for Electric Bicycles" (the "new national standards") officially ended, allowing electric bicycles that comply with the new standards to enter the domestic market. Under these conditions, newly introduced electric bicycles face strict restrictions on speed, materials, and configurations.

As a result, during the transition period before the implementation of the new standards, a large number of consumers chose to purchase electric bicycles in advance, leading to a boom in the market. This trend boosted the performance of leading industry players.

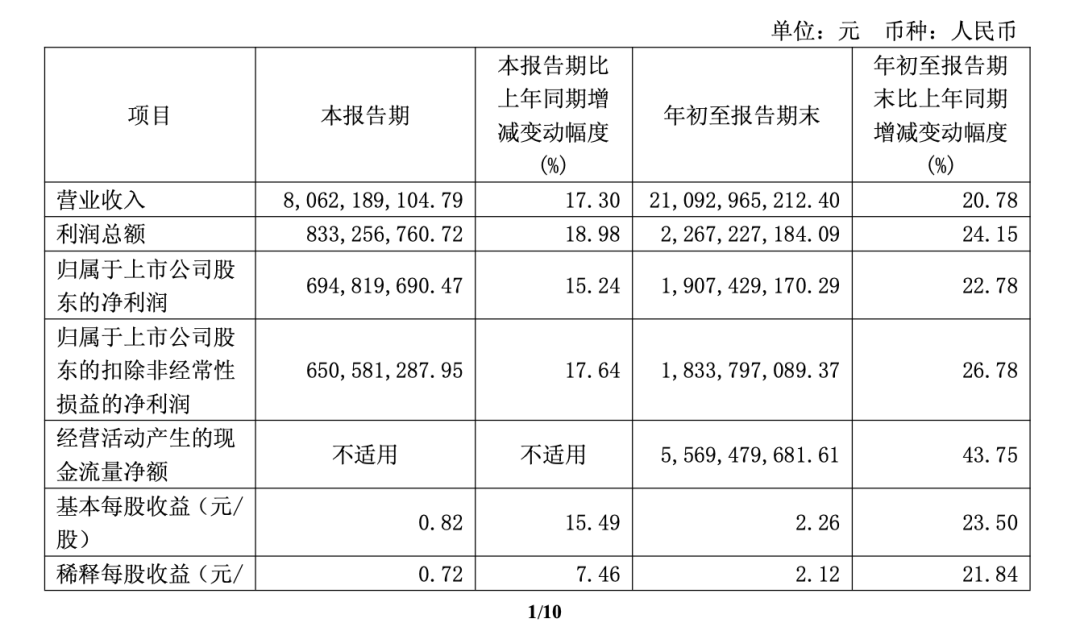

According to financial reports, in the first three quarters of 2025, Emma achieved total revenue of 21.093 billion yuan, a year-on-year increase of 20.78%, with net profit attributable to shareholders reaching 1.907 billion yuan, a year-on-year increase of 22.78%. In the third quarter, Emma reported revenue of 8.062 billion yuan, up 17.30% year-on-year, with net profit attributable to shareholders reaching 695 million yuan, a year-on-year increase of 15.24%.

Source: Corporate Financial Reports

Data from AVC Revo shows that in the first half of 2025, domestic sales of electric two-wheelers reached 32.325 million units, a year-on-year increase of 29.5%. In the third quarter, domestic shipments of electric two-wheelers reached 21.505 million units, a year-on-year increase of 23.4%.

However, as the transition period ended, sales of relevant companies began to be affected by the new national standards. According to the new standards, electric bicycles must not exceed a speed of 25 km/h, and the inclusion of new features such as Beidou satellite positioning systems has increased costs, leading manufacturers to raise prices. This adjustment has, to some extent, suppressed market demand.

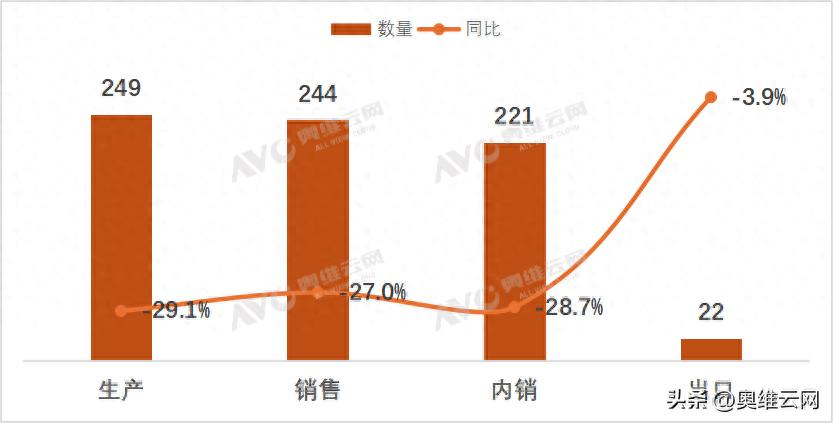

For example, in November last year, AVC Revo data showed that domestic production of electric two-wheelers was approximately 2.49 million units, a year-on-year decline of 29.1%. Total sales were approximately 2.44 million units, a year-on-year decline of 27%. Among these, domestic sales reached 2.21 million units, a year-on-year decline of 28.7%, while exports reached 220,000 units, a year-on-year decline of 3.9%.

Source: AVC Revo

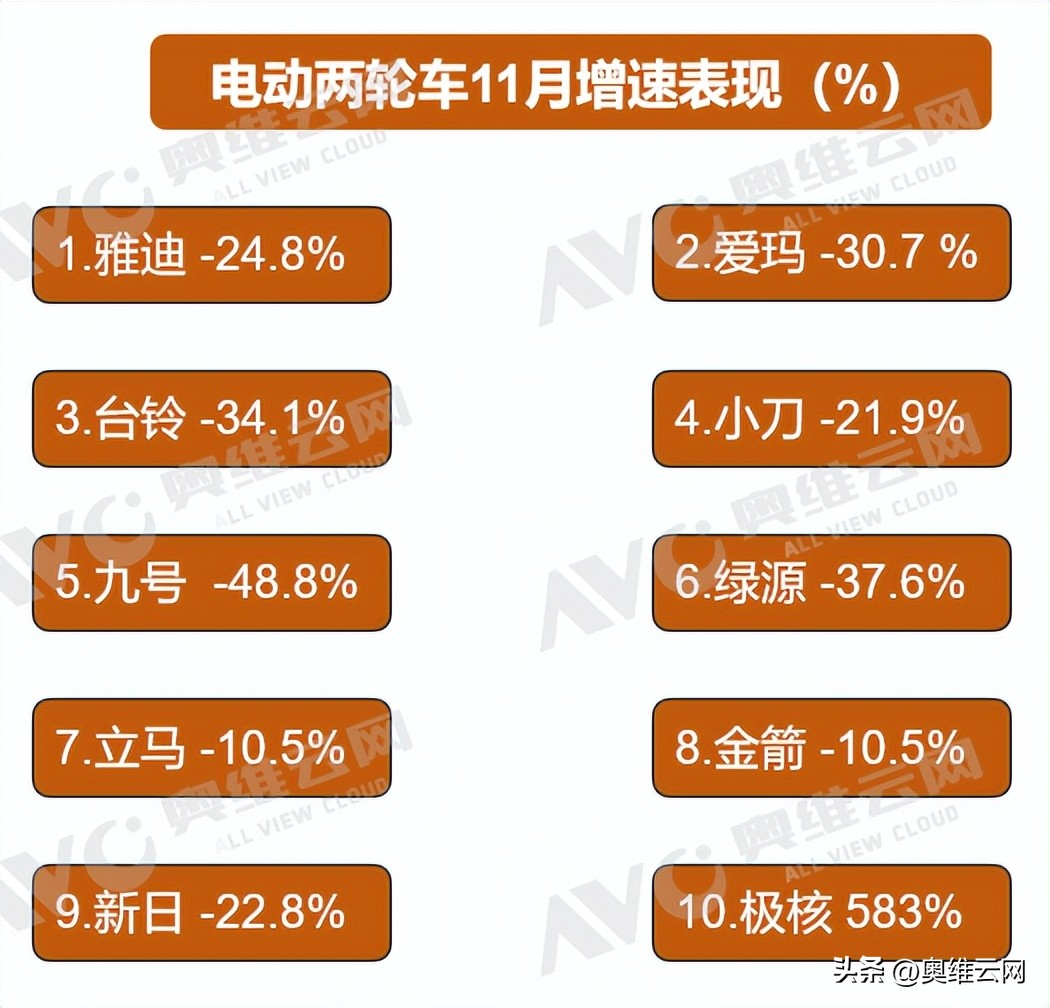

Given this broader environment, even leading companies could not remain unaffected. Yadea, for instance, saw a 25% year-on-year decline in domestic shipments in November last year. AVC Revo noted that while Yadea also faced pressure, its relatively stable performance was attributed to its extensive channel network, brand reputation, and early product line layout (which means "layout" in Chinese, but kept as is for context), allowing it to maintain its market position amid the turmoil.

Source: AVC Revo

During the same period, Tailg experienced a year-on-year decline of approximately 34%. Its long-standing "energy-saving" technology label saw reduced immediate appeal under the new standards, which emphasize lightweight design and speed limits, resulting in a more pronounced transition pain. Emma, meanwhile, saw a year-on-year decline of approximately 30.7%. Its design-focused models have yet to fully leverage their advantages under the new standards, and the company faces significant pressure to digest its old inventory.

02

Advancing premiumization

Emma has traditionally focused on the mid-range electric bicycle market in China, with its brand carrying a distinct "high cost-performance" label. Under current trends, however, its premiumization efforts are accelerating.

In October 2025, Emma held a global launch event in Beijing, introducing the high-end electric motorcycle brand "SCOOX." The brand is widely seen as a key component of Emma's premiumization strategy, positioning it against new competitors such as Ninebot, Niu Technologies, and ZEEHO.

It is understood that the SCOOX brand targets urban consumers aged 25-35, emphasizing personalized style and intelligent experiences. The product line is divided into three series: X (Performance Flagship), S (Sport Fashion), and C (Urban Commuting), with the first model, the X7, unveiled at the launch event.

Currently, the Emma SCOOX X7 is in the pre-sale stage, with formal delivery expected in the first quarter of 2026. Market analysis suggests that the pricing for this series is expected to range between 12,000 and 15,000 yuan.

At the same time, Emma is accelerating the layout (layout) of its high-end flagship models. In April 2025, Emma launched the A7Ultra Extreme All-Terrain Edition electric motorcycle, capable of reaching speeds up to 80 km/h, priced at 5,999 yuan. In November, it introduced mid-to-high-end products such as the Mach S1 and other luxury light electric scooters, enhancing intelligentization (which means "intelligent" or "smart" features, but kept as is for context) configurations to increase product appeal.

Additionally, Emma is targeting female users and the electric tricycle market, introducing differentiated designs in product appearance to attract niche high-end users and increase product unit prices.

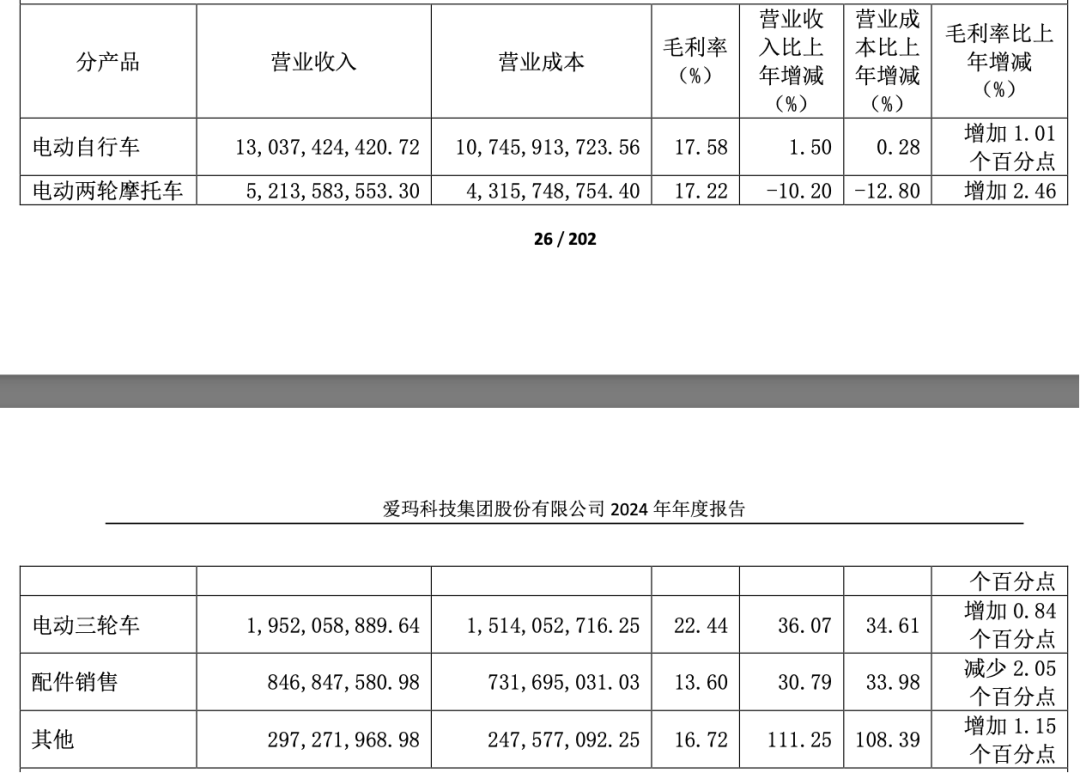

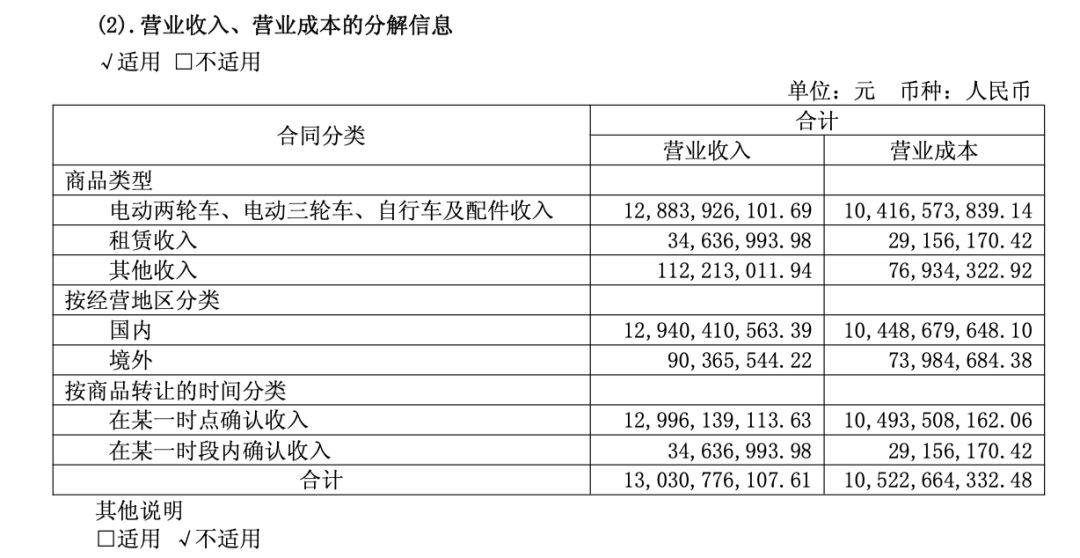

According to Southwest Securities, in 2024, Emma sold 7.5361 million electric bicycles and 2.3693 million electric motorcycles, representing year-on-year declines of 0.88% and 11.81%, respectively. Corresponding revenues were 13.037 billion yuan and 5.214 billion yuan, up 1.50% and down 10.20%, respectively. The average unit prices were 1,729.99 yuan per electric bicycle and 2,200.4 yuan per electric motorcycle, representing year-on-year increases of 2.4% and 1.8%, respectively.

Furthermore, in 2024, Emma sold 549,900 electric tricycles, a year-on-year increase of 28.87%, outpacing the growth of its two-wheeler products. Corresponding revenues from electric tricycles reached 1.952 billion yuan, a year-on-year increase of 36.07%, with an average unit price of 3,549.79 yuan, up 5.6% year-on-year.

However, in terms of revenue contribution, electric tricycles still account for a relatively small portion of Emma's total revenue.

In the first half of 2025, Emma's gross profit margin was 19.25%, up 1.42 percentage points year-on-year. However, it is important to note that as premiumization efforts progress, Emma faces increasing challenges.

On one hand, Emma's current brand perception is relatively fixed, with its long-standing reputation for affordability and approachability proving difficult to shake. Additionally, electric bicycles still dominate Emma's revenue, and these products typically fall within a lower price range.

For example, in 2024, the electric bicycle business contributed 13.037 billion yuan in revenue, making it the absolute mainstay.

Source: Emma's 2024 Financial Report

On the other hand, the high-end market features significant competitive barriers, particularly in the segment above 7,000 yuan, which is dominated by Ninebot and Niu Technologies. Without effective product and brand differentiation, Emma's high-end products risk being perceived as "overpriced Emma models" rather than standalone premium brands.

Furthermore, following the implementation of the new national standards, domestic electric bicycle products have generally become more expensive due to improvements in safety and materials. Market acceptance of these higher prices remains to be seen.

03

Lack of breakthroughs in internationalization

In addition to premiumization as a strategy to increase unit prices, internationalization is another key breakthrough for Emma.

In 2015, Emma initiated its international expansion, obtaining EU certification and opening its first European flagship store in Switzerland. In 2021, the company established an International Business Division, focusing on Southeast Asia, Europe, and the Americas as key markets.

Emma has also expanded its supply chain overseas. According to its 2025 semi-annual report, production facilities in Indonesia and Vietnam are now operational.

Overall, Emma's strategy in Southeast Asia emphasizes cost-effectiveness and localization, while targeting the high-end electric-assist bicycle market in Europe and the Americas. Markets in Latin America and the Middle East are being gradually penetrated as potential growth areas.

However, currently, revenue from overseas markets accounts for only about 1% of Emma's total revenue. Given the significant depreciation and operational costs associated with its factories in Indonesia and Vietnam, failure to achieve breakthroughs in overseas markets could become a financial drain for the company.

In 2024, Emma's overseas business revenue was 235 million yuan, up 0.57 percentage points year-on-year. In the first half of 2025, overseas revenue was 90.3655 million yuan, a year-on-year decline of 24.99%.

Source: Emma's 2025 Semi-Annual Financial Report

Currently, Chinese electric bicycle companies face common challenges in overseas expansion, including supply chain layout (layout), market promotion, and infrastructure development. Additionally, sustained channel investment is crucial. If market demand has not yet reached a stable scale, manufacturers lacking sufficient funds to continuously subsidize overseas distributors may experience reduced dealer loyalty and promotion efforts, leading to higher customer acquisition costs.

Currently, the impact of the new national standards has not fully dissipated, and Emma must continue to invest to stabilize market demand.

According to a research report by Guojin Securities, in terms of expenses, in the third quarter of 2025, Emma's sales, management, research and development, and financial expense ratios were 3.6%, 2.6%, 2.4%, and -0.6%, respectively, representing year-on-year increases of 0.7, 0.3, 0.0, and 0.3 percentage points. The significant rise in expense ratios was primarily attributed to increased promotional efforts due to the new national standards and the launch of the high-end SCOOX brand.

On a positive note, the implementation of the new national standards is driving industry benefits toward leading companies. Guojin Securities noted that the fourth quarter of 2025 is expected to see the rollout of new national standard products and inventory liquidation, with overall new models and sales resources likely to be determined in 2026. However, in the long run, the implementation of the new standards will benefit the competitive landscape of leading companies, as the exit of smaller brands will contribute to incremental sales for larger players.

Some images are sourced from the internet. Please notify us for removal if any infringement is identified.