Is Integrated Die-Casting a Mirage or a Major Trend? Intense Debate Rages On

![]() 12/30 2025

12/30 2025

![]() 638

638

Lead

Introduction

The road to the future is never singular.

Recently, the automotive sector has witnessed a heated debate surrounding 'integrated die-casting' technology.

On one side stands Wei Jianjun, Chairman of Great Wall Motors, renowned for his candid remarks. He直言不讳(kept it blunt)stated that the cost of integrated die-casting bodies in China is not low, and their repairability is extremely poor. Aluminum materials become 'brittle' upon impact, leading to soaring repair and insurance costs. He further asserted, 'Global established automakers avoid this technology, prompting Great Wall Motors to abandon it as well.'

These comments not only thrust the topic of integrated die-casting into the consumer limelight but also triggered 'counterattacks.' The head of materials technology at Li Auto responded on social media, refuting the 'demonization' of repairability. He underscored that the benefits of integrated die-casting lie in its 'lighter weight and higher integration,' which can effectively enhance production efficiency, body rigidity, and energy consumption performance. He also highlighted that overseas brands like Volvo (EX90) are already utilizing this technology, and the primary reason most automakers shun it is 'cost,' not repairability.

On one hand, traditional automakers prioritize the total lifecycle cost for users; on the other, new entrants pursue manufacturing efficiency and product performance. Although this debate lacks absolute right or wrong, it has laid bare the industry's divergences over future manufacturing routes before the public eye.

So, is integrated die-casting a major trend leading the automotive manufacturing revolution, or merely a 'mirage' inflated by capital and marketing?

01 A Manufacturing Revolution Sparked by Cost Reduction and Efficiency Enhancement

To ascertain whether integrated die-casting is a mirage or an industry trend, we must delve into its origins.

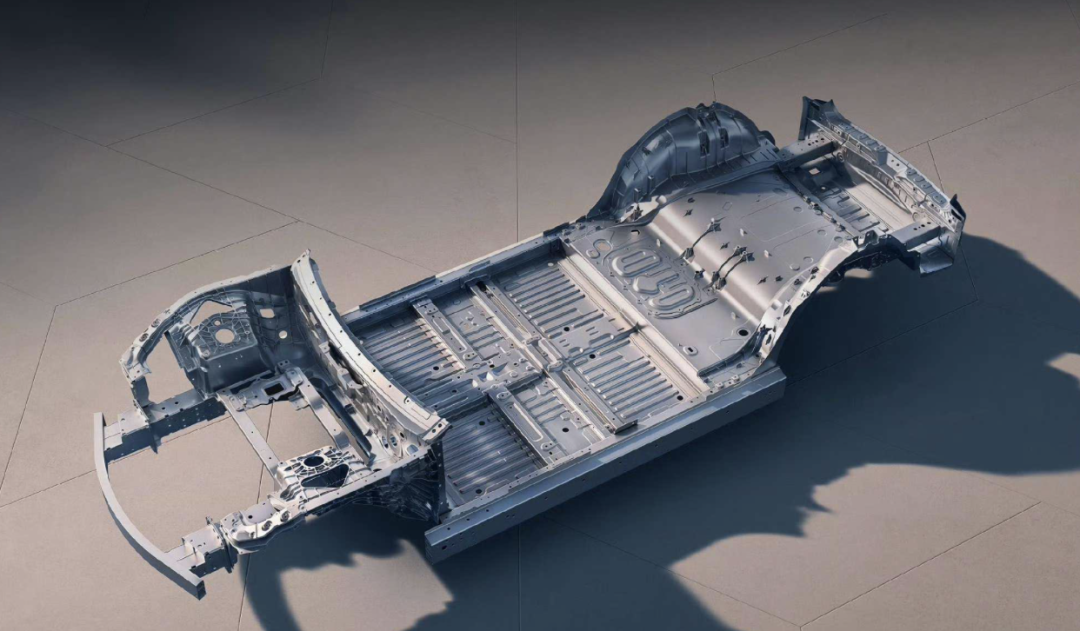

Integrated die-casting technology did not emerge spontaneously. Its turning point can be precisely traced back to September 2020. At that time, Tesla CEO Elon Musk officially announced that the Model Y would adopt an integrated die-casting method for producing the rear body floor assembly. This process, dubbed 'Gigacasting' by Tesla, aims to replace over 370 stamping and welding parts on traditional body floors with just 2-3 large die-castings.

Musk's calculation was astute. According to him, this transformation reduced the number of rear floor parts from over 70 to just 1, lowering manufacturing costs by approximately 40%.

Behind this lies a clear efficiency advantage. A drastic reduction in parts means a significant decrease in the number of stamping machines, molds, and welding robots required on the production line, compressing factory floor space and construction costs. An extremely streamlined production process condenses dozens of steps, such as stamping, welding, and gluing, into just two or three minutes of 'aluminum in, casting out,' greatly accelerating production rhythm. Higher material utilization means precise molding of liquid metal, with far less waste from scraps than traditional stamping.

For Tesla, which prioritizes economies of scale, integrated die-casting is a potent tool for cost reduction and efficiency enhancement. And its benefits extend well beyond the manufacturing end.

Among these, lightweighting stands out as a core advantage. Aluminum alloy castings replace steel, significantly reducing vehicle weight. Data shows that the integrated die-cast rear floor of the Tesla Model Y reduces body weight by over 10%. For electric vehicles, weight reduction directly translates to improved range. Additionally, the leap in body rigidity and safety is another major gain. An integrated structure avoids stress concentration and strength degradation that may occur at numerous welding points, significantly enhancing body torsional rigidity and providing a solid foundation for handling stability and collision safety.

Tesla's successful demonstration, akin to a stone thrown into a lake, has created massive ripples in China's fiercely competitive new energy vehicle market. Quick to follow suit are Chinese new entrants labeled by 'efficiency' and 'technology.'

Li Auto has embraced it as the 'technological foundation' of its flagship models, emphasizing its value in improving rigidity and production efficiency. Xiaomi Motors has proudly unveiled its 9,100-ton super die-casting technology, 'Xiaomi HyperCasting,' and highlighted the 20-in-1 integrated die-cast aluminum triangular beam as a core selling point of the SU7, claiming it brings class-leading torsional stiffness to the entire vehicle.

Additionally, brands like Zeekr, NIO, and AITO have joined the integrated die-casting ranks. From Tesla to Chinese new entrants, integrated die-casting is showing a trend of widespread adoption. Under the waves of electrification and intelligence, they are achieving ultimate cost control, performance enhancement, and production efficiency through a highly integrated manufacturing revolution. This is not mere marketing rhetoric but a tangible path for industrial upgrading.

02 Route Divergences

However, any revolutionary technology comes with significant controversies and real challenges. When Wei Jianjun raised the 'integrated die-casting is useless' argument, he touched upon the pain points of this technology regarding user wallets and automaker strategies.

The most immediate pain point for consumers is the high repair costs and poor repair economy. Unlike traditional steel bodies that can undergo local sheet metal repair, aluminum parts from integrated die-casting tend to tear or experience ductile fracture upon significant impact, making them almost irreparable and necessitating complete replacement. A seemingly minor collision could result in replacing an integrated rear body worth hundreds of thousands of yuan.

Insurers are well aware of this, so premiums for models equipped with this technology generally rise, with these costs ultimately passed on to consumers. Although proponents emphasize protective designs for die-castings in general collisions, the potential high costs when damage occurs are very real.

Secondly, the daunting initial investment and technical barriers pose another challenge. Integrated die-casting is not a decision to be made lightly. The core equipment, super large die-casting machines, can cost over 50 million yuan or even exceed 100 million yuan each. Moreover, mold development is time-consuming and costly, with each mold dedicated to a specific vehicle model.

This not only entails significant capital expenditure but also presents formidable difficulties in production processes and quality control. Tesla spent nearly a year to raise the yield rate of the Model Y's rear floor from 30% to 70%-85%. For vehicle models with annual sales not reaching a certain scale (at least in the hundred-thousand unit range), this huge investment cannot be amortized, leading to an increase in per-unit costs instead.

Based on these realities, the automotive industry has shown clear divergences in attitudes toward integrated die-casting.

The opposition, or cautious camp, is represented by Great Wall Motors. Wei Jianjun calculates the 'total cost of ownership' over a user's entire lifecycle, believing that integrated die-casting does not add up in terms of repair convenience, insurance costs, and initial investment. He argues that instead of chasing hot trends, it is better to adhere to reliable, low-maintenance technology routes. This pragmatic attitude also exists among some traditional automakers, which are more conservative about heavy asset investments and supply chain flexibility.

On the other hand, the support, or aggressive camp, is growing: in addition to Tesla and Chinese new entrants mentioned earlier, more and more international traditional giants are entering the field. Volvo has announced that all future electric vehicles, starting with the EX90, will adopt large integrated die-casting technology. Volkswagen in its Trinity project, Toyota, Ford, Hyundai, and others are also deploying or applying this technology. Their participation effectively refutes the argument that 'foreign established automakers do not use it,' indicating that integrated die-casting has become a key part of the technological reserves of global leading automakers.

The essence of this divergence lies in the route choices made by different automakers based on their positioning, product strategies, and cost structures. For automakers with diverse product lines and rapid iteration cycles, the rigidity of integrated die-casting molds may be a burden. However, for brands pursuing blockbuster models and ultimate efficiency, it is a potent tool.

03 There Is Never Just One Path to the Future

After weighing the pros and cons, we return to the original question: Is integrated die-casting a trend or a mirage?

In many people's views, the answer is the former—it is a major trend. However, industry insiders also state that it is a 'potent remedy' rather than a 'panacea.'

From Tesla igniting the spark to global mainstream automakers flocking to deploy, the manufacturing direction represented by integrated die-casting, characterized by high integration and ultimate efficiency, is expected to become a major trend in the evolution of the automotive industry. It profoundly meets the rigid demand for lightweighting in electric vehicles and the eternal pursuit of cost reduction and efficiency enhancement in global manufacturing.

However, a potential major trend does not equate to universal applicability. The issues Wei Jianjun pointed out, such as poor repair economy, high insurance costs, and enormous initial investments, are real pain points for users and technological barriers.

This reminds us that technological advancement must be balanced with market acceptance and the actual interests of users.

Therefore, a more accurate description is: Integrated die-casting is becoming a mainstream and important technological route in the automotive industry, particularly in the mid-to-high-end electric vehicle sector. It will be the 'arena' for automakers with strong financial strength, pursuing economies of scale, and a technological brand image. However, diversified technological routes (such as multi-material bodies and modular platforms) will continue to coexist for a long time, serving different market positions and user needs.

The value of this debate sparked by Wei Jianjun and Li Auto lies not in determining a winner or loser but in completing an in-depth industry popularization and consumer education. It shows us that progress in the automotive industry is a complex balancing act, with no single technology able to dominate the market. The ultimate beneficiaries are consumers who gain more diverse and mature choices through this full competition and transparent discussion.

The wheels of the times roll forward, but there is never just one path to the future.

Editor-in-Chief: Li Sijia Editor: He Zengrong

THE END