The Hottest Track: Can Unicorns Weather the Storm?

![]() 12/30 2025

12/30 2025

![]() 504

504

The 'Fire and Ice' of the Intelligent Driving Industry: Head Consolidation and Tail Differentiation

'Full work suspension, unpaid wages and social insurance contributions, and an indefinite resumption date.' Recently, an employee's disclosure from intelligent driving unicorn Hwamo sent shockwaves throughout the industry.

This company, once valued at over $1 billion, has completely ceased operations in Beijing, Shanghai, Shenzhen, and Baoding. Its core management has remained tight-lipped amid inquiries from employees, leaving behind unpaid workers and an unfulfilled IPO dream.

Hwamo's predicament is not an isolated case. Prior to this, Zongmu Technology, with a valuation exceeding RMB 9 billion, entered judicial restructuring. Similarly, unicorns such as HoloMatic and Zhongzhixing have commenced bankruptcy liquidation proceedings.

In stark contrast, the intelligent driving market now boasts a 'Horizon-DJI-Huawei-Momenta' (Di Dahua Mo) elite tier, with these companies dominating smart driving solutions for mainstream best-selling models.

On one hand, former industry stars are crumbling; on the other, industry behemoths are surging ahead. The intelligent driving sector is witnessing a 'Song of Ice and Fire,' marked by 'head consolidation and tail differentiation.'

The Intelligent Driving Sector: A Tale of Two Extremes

As China's inaugural company to achieve mass production of intelligent driving systems, Hwamo was born with a 'silver spoon in its mouth.' Backed by the resources of Great Wall Motors, this AI firm specializing in autonomous driving technology early on garnered investments from Great Wall Motors, Meituan, Hillhouse Capital, and others, raising a total of RMB 2 billion. Following its Series A funding in 2021, Hwamo's valuation soared past $1 billion, joining the ranks of unicorns.

However, the spotlight soon dimmed. Commencing in 2023, Hwamo faced recurring layoff rumors, with functional departments experiencing cuts as high as 30-50%. By 2025, key executives had departed, and major shareholder Great Wall Motors had shifted its strategic focus—redirecting funds and orders previously earmarked for Hwamo to competitors like Rongxing Tech and DJI Automotive. This left Hwamo without its core client base.

Concurrently, Hwamo's bet on 'high-definition mapping + rule-based algorithms' lagged as the industry pivoted to 'mapless driving.' Under the weight of multiple pressures, Hwamo's cash flow tightened, its IPO plans stalled, and it ultimately suspended operations entirely.

Prior to Hwamo, several intelligent driving unicorns had already faced existential crises.

Zongmu Technology, once valued at over RMB 9 billion, entered judicial restructuring in April 2025. Despite raising over RMB 2.2 billion from investors like Xiaomi and Lenovo, the company relied on its top five automaker clients for 93% of its revenue. When these clients shifted to in-house development or alternative suppliers, orders plummeted. Coupled with three failed IPO attempts, Zongmu's cash reserves dwindled to RMB 199 million by early 2024, while short-term debt ballooned to RMB 462 million—a recipe for disaster. Meanwhile, HoloMatic and Zhongzhixing also faltered, hampered by outdated technology, client acquisition struggles, and weak revenue generation.

Behind the collapse of these unicorns lies a ruthless rewriting of survival rules in the intelligent driving sector following the retreat of capital. In reality, the industry is thriving. Companies like Horizon Robotics, DJI Automotive, Huawei ADS, and Momenta are expanding their market share, nearly monopolizing smart driving solutions for mainstream best-sellers.

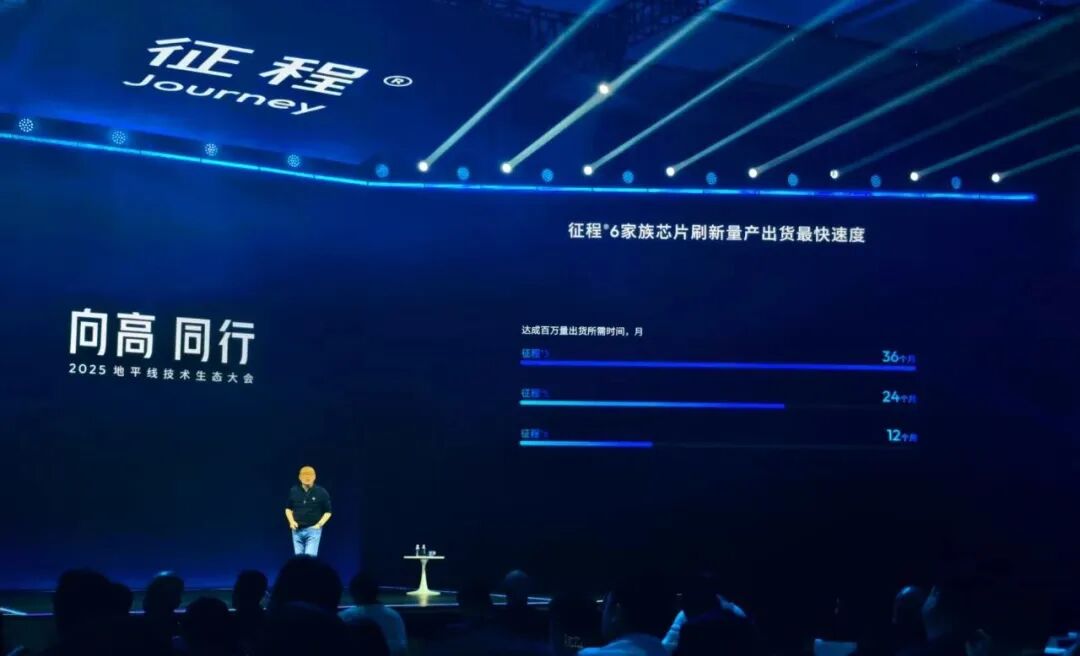

Horizon Robotics' First Technology Ecosystem Conference (Photo/Liu Shanshan)

Horizon Robotics' inaugural Technology Ecosystem Conference on December 8 drew executives from global automotive giants like Volkswagen, BYD, and Chery, alongside supply chain titans such as Bosch. Data reveals that Horizon's Journey series chips have shipped over 10 million units, with one in every three smart cars in China powered by these chips.

'For the past 20 years, we've relied on engines; for the next 20, it'll be intelligence—or rather, Yu Kai's technology!' declared Yin Tongyue, Chairman of Chery Holding Group, emphasizing that future competition will hinge on intelligence, akin to the role of engines in the era of fuel-powered vehicles (internal combustion vehicles).

Huawei ADS has also excelled in the realm of intelligent driving. According to Jin Yuzhi, CEO of Huawei's Intelligent Automotive Solutions BU, Huawei ADS had accumulated over 6.38 billion kilometers of assisted driving miles by late November, with usage surging from 300,000 to over 5 million instances annually. By year-end, the number of parking lots supporting 'park-to-park' functionality is expected to double from 500,000 in mid-2025 to 1 million nationwide. Leveraging its strengths in AI, chips, and communications, Huawei has emerged as a top smart driving solution provider for automakers.

Meanwhile, the rise of 'mapless driving' solutions has positioned Momenta favorably in the competitive market. The company now partners with global automakers like Toyota, Nissan, Mercedes-Benz, and BMW.

The emergence of the 'Horizon-DJI-Huawei-Momenta' elite tier signals a sharp rise in industry concentration. Head companies, armed with technological, financial, and ecological advantages, are steering the sector's direction, while tail firms face elimination—a classic manifestation of the 'Matthew Effect.'

The Inevitable Arrival of Intelligent Driving Democratization

Amidst the industry's reshuffling, the penetration of smart driving technology continues to soar.

Data from the Ministry of Industry and Information Technology reveals that L2-equipped passenger vehicle sales surged 21.2% year-on-year in the first three quarters of 2025, reaching a 64% penetration rate—up from 47.3% in 2023 and 55.8% in 2024.

According to Horizon Robotics founder and CEO Yu Kai, vehicles priced under RMB 130,000 accounted for over 50% of China's passenger car market in the first three quarters of 2025, while those above RMB 200,000 made up 30%. 'Shouldn't affordable national cars priced around RMB 100,000 have access to reliable urban assisted driving?' Yu asserted, predicting that urban assisted driving will become standard in RMB 100,000 models within 3-5 years, achieving mass production in the millions.

Indeed, signs of democratization are emerging. BYD's 2025 Qin L Smart Driving Edition, priced between RMB 99,800-139,800, features Horizon's 'Divine Eye C-Advanced Tri-Camera Smart Driving' system, supporting full-speed adaptive cruise, urban navigation, and smart parking (L2+ functions). Models like XPENG M03 and GAC Aion RT (RMB 100,000-150,000) also offer advanced smart driving systems, with some top variants supporting full-scenario NGP (Navigation Guided Pilot) on highways and cities.

Horizon VP and Chief Architect Su Qing noted that Tesla FSD and Huawei HSD have propelled Urban L2 into a 'golden age.' 'This means systems will perform well across vehicles priced from hundreds of thousands to RMB 200,000 and even RMB 100,000,' he said, confident that affordable smart driving for all is inevitable.

As technology matures and costs decline, smart driving features are transitioning from 'premium options' to 'standard equipment.' The industry reshuffle will persist, but companies that focus on core technologies, market alignment, and cost-performance balance will ultimately dominate the intelligent driving blue ocean.