Auto Industry 2025: No Winners in Price Wars, but Some Are Already Out of the Elimination Race

![]() 01/04 2026

01/04 2026

![]() 402

402

Automakers have moved beyond mere price competition, entering a new phase of “systematic” and “ecological warfare.”

©Original content from TMT Planet · Author|Huang Yanhua

As 2025 draws to a close, the automotive industry accelerates its transformation.

This year sees a continuous rise in the penetration of new energy vehicles and rapid implementation of intelligent technologies. Traditional fuel vehicle automakers face impacts from new energy vehicle companies, striving to maintain their footing.

Price wars, verbal battles, and marketing wars have become unavoidable keywords, with market competition intensifying.

Joint venture brands are hit hardest. Japanese brands significantly lag, with Nissan and Honda's sales in China slumping, relying only on Toyota for marginal support. The German trio of BBA (BMW, Mercedes-Benz, Audi) struggle, adopting a more pragmatic approach towards electrification and intelligence. Korean and French brands fade into obscurity.

In stark contrast, domestic brands surge ahead, with market shares continuing to climb. However, performance is uneven, with some achieving annual sales targets ahead of schedule and planning for 2026, while others struggle to maintain market relevance.

01

Domestic Brands Advance, Joint Ventures Retreat

The 2025 automotive market can be best described as “full of twists and turns.”

From the prolonged price wars to nationwide discussions on intelligent driving technologies, and then to the historic high in new energy penetration, these elements compose the grand development landscape of the automotive industry in 2025.

Firstly, the price wars. Initiated in 2023, the price wars continued into 2025, but this time led by domestic brands. BYD took the lead at the beginning of the year by launching the “Intelligent Driving for All” campaign, indirectly starting a price war by offering upgraded configurations without raising prices. Soon after, Geely, Chery, and other automakers followed suit.

However, harshly, this price war failed to help most automakers achieve their expected goals. Instead, it dragged down the industry's average profit margins, trapping them in a dilemma of “increased revenue but decreased profits,” leading relevant authorities to advocate against malignant (malignant) price wars explicitly.

Secondly, in terms of intelligent driving technologies, as automakers continue to invest heavily, intelligent driving has become a major selling point to attract consumers.

However, in the first half of the year, an explosion and fire accident occurred while a Xiaomi vehicle was traveling on the Tongling Expressway in Anhui Province, resulting in the deaths of three college students. This incident sparked intense discussions within and outside the industry on the safety, liability determination standards, and technological maturity of intelligent assisted driving.

Faced with the surging public opinion, companies, including the one involved in the incident, urgently adjusted their promotional messaging for intelligent driving features, while regulatory authorities accelerated the formulation of safety standards for intelligent connected vehicles.

This controversy made consumers keenly aware of the small word “assisted” hidden behind intelligent driving technologies. It also made the industry profoundly realize that attracting consumers solely through technological gimmicks is no longer viable.

While people discuss the safety of intelligent driving technologies, the power battery sector welcomes new standards.

In April 2025, the “Safety Requirements for Traction Batteries Used in Electric Vehicles” (GB38031-2025) was officially released and will be implemented on July 1, 2026.

Dubbed the “strictest battery safety mandate in history,” this standard upgrades thermal runaway test requirements from “providing alarm signals five minutes before fire or explosion” to “no fire or explosion.” It also introduces key new test items, such as bottom impact testing and safety testing after fast-charging cycles. The introduction of this standard forces the entire industry to upgrade battery technologies and accelerates the elimination of outdated production capacities.

With the continuous rise in new energy vehicle sales, penetration rates officially enter the 60% era.

According to data from the China Passenger Car Association, from December 1 to 7, the national passenger car new energy retail penetration rate reached 62.2%, a historic high. This indicates that in the domestic market, new energy vehicles have fully entered a stage of market recognition and consumer-driven growth, becoming the absolute mainstream of the domestic auto market.

It is particularly noteworthy that domestic brands are the core driving force behind this transformation. In November, the penetration rate of new energy passenger vehicles from domestic brands reached as high as 79.6%, meaning that approximately 8 out of every 10 vehicles sold by domestic brands are new energy models.

Corresponding to the rise of new energy vehicles is the “decline” of fuel vehicles. However, compared to declining sales, a more severe issue is excess production capacity.

In 2020, domestic automobile production and sales were around 25 million units, with new energy penetration just over 5%. In 2024, domestic automobile production and sales exceeded 30 million units, with new energy penetration around 40%. By 2025, exceeding 50% is a foregone conclusion.

Behind the advance of “new” and retreat of “fuel” lies a significant idle capacity of fuel vehicle production lines, with some companies already facing transfer, shutdown, and even bankruptcy.

The reconstruction of the fuel vehicle industry ecosystem is clearly imminent.

02

Top Performers Reach the Finish Line, Stragglers Struggle

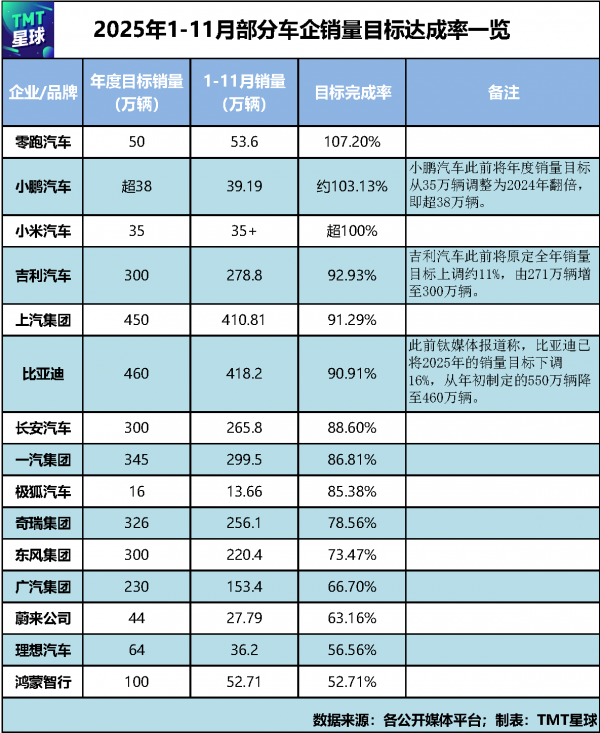

As 2025 nears its end, the completion status of annual sales targets for major automakers gradually becomes clear, with significant differentiation among different camps. Some automakers have already “crossed the finish line,” while others are still sprinting with all their might, and some have basically determined they will not meet their targets.

From the perspective of annual target completion rates, leading new automotive forces have undoubtedly become the “top performers.”

XPENG Motors delivered a cumulative 392,000 vehicles from January to November 2025, a year-on-year increase of 156%, successfully achieving its revised annual sales target of over 380,000 vehicles, with an annual target completion rate as high as 103.13%.

Leapmotor, with cumulative sales reaching 536,000 vehicles in the first 11 months, a year-on-year increase of over 113%, prematurely accomplished its annual sales target of 500,000 vehicles.

Among traditional domestic brands, most automakers maintain stability. Geely Automobile adjusted its annual sales target from 2.71 million units to 3 million units, achieving a target completion rate of over 90%, with cumulative sales reaching 2.788 million units in the first 11 months. Notably, Geely's new energy sector performed exceptionally well, with new energy sales reaching 1.534 million units from January to November, a year-on-year increase of 97%, and penetration exceeding 50%.

BYD and Changan Automobile closely followed, with sales in the first 11 months reaching 4.182 million units and 2.658 million units, respectively, year-on-year increases of 11.3% and 9.25%. Their annual target completion rates were 90.91% and 88.60%, respectively, making it highly likely they will achieve their full-year targets.

In contrast, some new forces and joint venture brands face a different situation. NIO set a full-year target of 440,000 vehicles but only delivered approximately 280,000 vehicles from January to November, achieving 63.16% of its target. It is almost impossible to deliver 160,000 vehicles in December. Some enterprises, such as Li Auto, have target completion rates below 60%.

The situation for joint venture brands is even more challenging. Whether it is first-tier luxury brands represented by BBA or joint venture vehicles with a wide range of models represented by Honda, Nissan, and Volkswagen, the completion rates of their 2025 annual targets look bleak based on cumulative sales in the first 11 months. Especially among the three Japanese giants, Nissan and Honda's sales in China continue to slump, with only Toyota barely maintaining its sales scale.

Industry analysts believe that automakers that have prematurely achieved their targets generally possess advantages such as products that meet market demand, leading intelligent configurations, and high supply chain efficiency. In contrast, enterprises with low target completion rates either set unrealistic targets or lag in their new energy transformation, lacking core product competitiveness.

Additionally, securities firms predict that industry differentiation will further intensify in the future, with automakers possessing systematic capabilities and core technological advantages occupying more market share.

It is worth noting that under sales pressure, some automakers engage in “underwater operations” in marketing and order quantities to make their sales data look better. However, the actual delivery falls far short of the initially promoted order quantities. Some automakers even achieved the “miracle” of “nearly 290,000 orders in one hour” for their new vehicle launches, but the actual delivery situation was vastly different.

Reports indicate that behind these “inflated orders” are marketing ploys orchestrated by automakers in collaboration with public relations firms, creating a false impression of popularity through collective “small deposits” by employees, low-price brush orders, and repurchases. However, they are ultimately contradicted by reality.

03

From Price Competition to Ecosystem Building

By examining the annual target completion rates of automakers, it becomes evident that after years of internal price competition, the competitive logic of the Chinese automotive market in 2025 is undergoing profound changes: shifting from mere product comparison and price competition to a comprehensive battle of systematic capabilities and ecological layouts.

The strong breakthrough of domestic brands, the accelerated adaptation of multinational automakers, and the centrality of intelligence in competition are prominent features of this stage. Major automakers are adjusting their strategies to seek new growth paths.

Hongmeng Intelligent Automotive Solution continues to strengthen ecosystem construction, expanding market coverage through a “tiered penetration” strategy and striving to build the world's largest in-vehicle ecosystem.

Leapmotor leverages its “value-for-money” advantage and full-stack self-research capabilities to further enhance cost control while improving its product matrix, laying the foundation for its subsequent goal of annual sales of one million vehicles.

XPENG Motors achieves simultaneous improvements in sales and brand value through new model iterations and intelligent technology upgrades. Its in-depth cultivation of overseas markets also brings new growth opportunities.

Faced with the wave of intelligence in the Chinese market, joint venture brands have no choice but to set aside their “technological superiority” and accelerate localization adaptation. The transformation strategies of the German trio of BBA are particularly typical, shifting from insisting on self-research to partnering with domestic intelligent driving technology companies.

According to reports, Audi announced this year that all its models will be equipped with Huawei's intelligent driving system. BMW China officially announced a strategic cooperation with Huawei Consumer Business Group to develop core functions such as digital keys and HiCar in-vehicle connectivity based on the HarmonyOS ecosystem.

This transformation by BBA stems from the realistic dilemma of sales pressure and shortcomings in intelligent technologies. BMW's sales in China declined by 13.4% in 2024. Audi's main models were suppressed by competitors due to insufficient intelligence. The technological advantages of Huawei's ADS system and the user base of the HarmonyOS ecosystem became their “shortcut” to break through.

This cooperation model not only shortens the research and development cycles of multinational automakers but also rewrites the competitive logic of traditional luxury vehicles, making software capabilities such as intelligent cockpits and autonomous driving the core competitiveness.

Furthermore, technological innovation has become the core focus of automakers' competition, with increased research and development investments to seek new growth points. For example, Li Auto bets on AI technology, focusing on AI interaction in intelligent cockpits and AI algorithm optimization for autonomous driving as key research and development directions, attempting to build differentiated advantages through AI technology.

In terms of the intelligent driving ecosystem, relevant companies are also accelerating their layouts. In late November 2025, Huawei held the Qiankun Intelligent Ecosystem Conference, showcasing its breakthrough achievements in intelligent driving, intelligent cockpits, and other fields. It also released the Huawei Qiankun APP, attempting to create an official hub connecting users, vehicles, and ecological services.

Following this, Horizon Robotics, dedicated to creating intelligent driving solutions for passenger vehicles, held its first Technology Ecosystem Conference in ten years. While showcasing its strengths, it collaborated with complete vehicle (complete vehicle) and industry chain enterprises such as BYD, Chery, Great Wall Motors, Volkswagen, and Bosch to explore commercial paths for autonomous driving planning and build an intelligent driving ecosystem.

04

Conclusion

As the scroll of 2025 slowly closes, what the Chinese automotive industry presents is not a simple “final outcome of victory or defeat,” but rather a snapshot of a profound transformation in progress.

The achievement of sales targets is merely the tip of the iceberg above the surface. The true structural transformation is occurring in the deep waters of market perception, technological integration, and global competition rules.

Because the future development of the automotive industry is no longer monopolized by a single path but is woven by an ecological network of diversified power technologies, deeply intelligent experiences, and global market operations.

For automakers, the rules of market competition have been rewritten. The true test is no longer whether they can bet on the sole “technological lottery ticket” but whether they possess the systemic resilience to quickly integrate resources across multiple technological routes and continuously create unique value for users.

The market will reward those “amphibious” enterprises that not only have profound manufacturing heritage but also keenly embrace the software revolution, standing firmly in China while embracing the world.

The differentiation and breakthroughs in 2025 are a necessary path for the Chinese automotive industry to move towards global leadership. The future competition will ultimately be a comprehensive battle of ecosystems and systems.

*The featured image in the article is from the official website of Hongmeng Intelligent Automotive Solution.