Final Verdict | Special Annual Feature I: Achievements and Challenges Coexist—A Holistic Perspective on China's Auto Industry in 2025

![]() 01/04 2026

01/04 2026

![]() 461

461

During the New Year holiday, numerous domestic automakers unveiled their auto sales performance for 2025. The released data generally indicates positive growth, with some instances of substantial increases. Several automakers even reported record-breaking sales figures. In 2025, propelled by a series of national policies aimed at boosting auto consumption, China set new historical benchmarks for annual auto production and sales, retaining its status as the world's largest auto producer and consumer for the 17th consecutive year. Sales of new energy vehicles (NEVs) continued their rapid ascent, with China maintaining its position as the world's largest producer and consumer of NEVs for the 11th straight year. Auto exports are projected to reach 7 million units, marking China as the world's largest auto exporter for the third consecutive year. However, it is vital to acknowledge that despite these accomplishments, significant challenges persist. An industry authority aptly summarized the situation with 16 words: 'Numerous issues remain, scale has expanded, problems are mounting, and moral integrity is lacking.'

Only through a thorough and objective examination of China's auto industry can we discern the right path for future development and ultimately realize the transformation from a major auto producer to a formidable auto power.

Notable Achievements in the 2025 Auto Industry: China's auto industry has secured a series of triumphs in 2025, primarily evident in the following five domains:

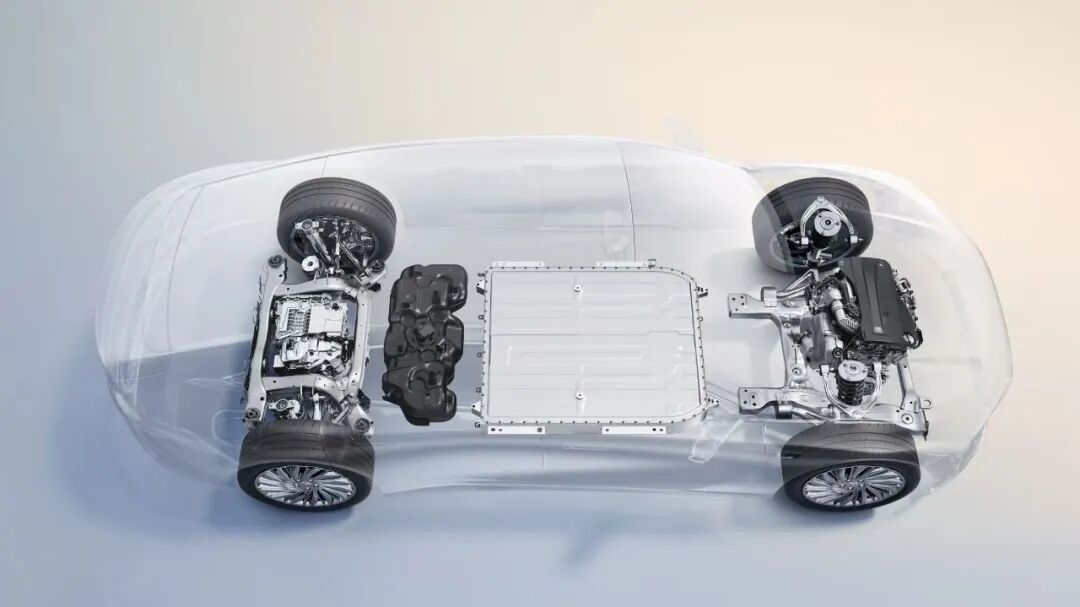

Firstly, China's auto industry has made unwavering efforts in technological research and development, yielding a series of remarkable outcomes. In terms of core NEV technologies, battery technology has witnessed continuous advancements, significantly extending driving range, with many models now catering to consumer demands for long-distance travel. Automobile intelligence technology has progressed rapidly, with an increasing number of models incorporating Level 2 driving assistance functions. Notable strides have also been made in technologies such as intelligent chassis and intelligent cockpits.

Secondly, the market share of indigenous brand passenger vehicles has steadily climbed. With ongoing enhancements in product quality and brand influence, the market share of Chinese indigenous brand vehicles in the domestic market has risen annually, reaching approximately 60% in 2025, according to relevant statistics. In the NEV passenger vehicle segment, Chinese indigenous brands command the market.

Thirdly, Chinese automobiles have made their mark in the international arena, with expanding export scales. Export destinations span multiple regions, including Europe, Asia, and Africa, further amplifying the international influence of China's auto industry.

Fourthly, significant progress has been achieved in the coordinated development of the industrial chain. After years of development, China's auto industry has forged a relatively complete industrial chain system. From upstream component supply to downstream sales services, all sectors collaborate closely and develop harmoniously. The automotive aftermarket is also thriving, encompassing areas such as maintenance, financial services, and used car transactions, providing comprehensive service assurances for consumers and fostering the sustainable development of the entire industry.

Fifthly, the scale of Chinese automakers has continued to expand, with several enterprises achieving annual sales exceeding 2 million units. Based on data and projections released by various automakers (including exports, joint ventures, and overseas-controlled enterprises), among domestic auto enterprise groups in 2025, BYD led with 4.6 million units sold; SAIC Motor followed closely with 4.5 million units (projected); Geely Holding Group ranked third with 4 million units (projected); FAW Group ranked fourth with 3.3 million units; Changan Automobile ranked fifth with 2.913 million units; Chery Group ranked sixth with 2.806 million units; and Dongfeng Motor ranked seventh with 2.5 million units (projected).

Multiple Issues Behind the 2025 Sales Achievements of Automakers Selling Over 2 Million Units: Firstly, there are still deficiencies in core auto technologies.

Despite substantial progress in technological innovation, Chinese automakers still rely on imports or lag behind international advanced levels in certain key core technologies. High-end chips, crucial for automobile intelligence, are predominantly sourced from abroad, posing supply chain security risks. There is also a disparity in engine thermal efficiency and transmission shift smoothness compared to international top levels, which to some extent restricts the performance enhancement and energy-saving effects of fuel vehicles.

Secondly, brand building has a long road ahead.

Brands represent intangible assets of enterprises and hold significant weight in market competition.

China boasts numerous auto brands, yet truly internationally influential and renowned brands are scarce. Chinese indigenous brands exhibit shortcomings in brand image building and brand culture construction, resulting in low consumer recognition and loyalty. In the luxury auto segment, China currently lacks a globally recognized luxury auto brand. Strengthening brand building and enhancing brand value is a paramount task for Chinese automakers.

Thirdly, market competition has intensified, increasing pressure.

The influx of new auto-making enterprises has exacerbated the severe overcapacity issue in China's auto industry. The competition in China's auto market is exceptionally fierce, bordering on cutthroat rivalry. Price wars have erupted frequently and have not been entirely curbed. Automakers' profit margins have been squeezed, increasing business difficulties. Some enterprises have incurred losses not seen in years, and most NEV automakers, barring a few, are operating at a loss. Auto suppliers are also facing trying times, and auto dealers are experiencing widespread losses. If this situation of increasing output without improving efficiency is not fundamentally altered, it will pose a serious threat to the sustainable development of China's auto industry.

Fourthly, 'involution' has permeated overseas markets, threatening China's auto exports.

In some overseas markets, Chinese auto brands have flooded in and engaged in price wars, leading to self-destruction. The consequence is damage to the image of Chinese autos locally and the potential for eventual market withdrawal. The Key Lies in Enhancing Quality and Efficiency to Achieve High-Quality Development: In response to the issues in the auto industry's development, under the guidance of central leadership, relevant government departments have implemented a series of measures to regulate corporate market behavior. Efforts to rectify 'involutionary' vicious competition in the auto industry have yielded some results, with auto price wars easing and online auto market disorders improving.

Commencing this year, the state has instituted license management for the export of electric passenger vehicles and used vehicles, which will aid in improving the auto export environment. Faced with a scenario where achievements coexist with challenges, China's auto industry must adopt proactive and effective measures to enhance quality and efficiency and achieve high-quality development. Firstly, it is imperative to increase investment in core technology research and development, encourage industry-university-research collaboration, break through key technological bottlenecks, and acquire independent intellectual property rights. The government should introduce relevant policies to guide and support enterprises in conducting technological innovation activities.

Secondly, automakers must genuinely embrace long-termism, focusing on brand cultivation and management, establishing a positive brand image, telling compelling brand stories, and enhancing brand reputation and competitiveness.

Thirdly, optimize the industrial structure, strengthen resource integration and collaboration within the industry, avoid vicious competition, and jointly create a healthy market environment.

Looking ahead, China's auto industry holds vast prospects. With the deep integration of new energy, intelligence, and connectivity technologies, more opportunities will emerge for industrial development. With unwavering confidence, a willingness to confront issues, and a commitment to innovation, China's auto industry is certain to secure a prominent position in global auto industry competition and pen a brilliant chapter for itself. (End)